Reimagining Classic Strategies (Part 13): Minimizing The Lag in Moving Average Cross-Overs

Moving average cross-overs are widely known by traders in our community, and yet the core of the strategy has changed very little since its inception. In this discussion, we will present you with a slight adjustment to the original strategy, that aims to minimize the lag present in the trading strategy. All fans of the original strategy, could consider revising the strategy in accordance with the insights we will discuss today. By using 2 moving averages with the same period, we reduce the lag in the trading strategy considerably, without violating the foundational principles of the strategy.

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

Data Science and Machine Learning (Part 12): Can Self-Training Neural Networks Help You Outsmart the Stock Market?

Are you tired of constantly trying to predict the stock market? Do you wish you had a crystal ball to help you make more informed investment decisions? Self-trained neural networks might be the solution you've been looking for. In this article, we explore whether these powerful algorithms can help you "ride the wave" and outsmart the stock market. By analyzing vast amounts of data and identifying patterns, self-trained neural networks can make predictions that are often more accurate than human traders. Discover how you can use this cutting-edge technology to maximize your profits and make smarter investment decisions.

MQL5 Wizard techniques you should know (Part 03): Shannon's Entropy

Todays trader is a philomath who is almost always looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders.

Experiments with neural networks (Part 5): Normalizing inputs for passing to a neural network

Neural networks are an ultimate tool in traders' toolkit. Let's check if this assumption is true. MetaTrader 5 is approached as a self-sufficient medium for using neural networks in trading. A simple explanation is provided.

Using Assertions in MQL5 Programs

This article covers the use of assertions in MQL5 language. It provides two examples of the assertion mechanism and some general guidance for implementing assertions.

Multiple indicators on one chart (Part 03): Developing definitions for users

Today we will update the functionality of the indicator system for the first time. In the previous article within the "Multiple indicators on one chart" we considered the basic code which allows using more than one indicator in a chart subwindow. But what was presented was just the starting base of a much larger system.

Ready-made templates for including indicators to Expert Advisors (Part 1): Oscillators

The article considers standard indicators from the oscillator category. We will create ready-to-use templates for their use in EAs - declaring and setting parameters, indicator initialization and deinitialization, as well as receiving data and signals from indicator buffers in EAs.

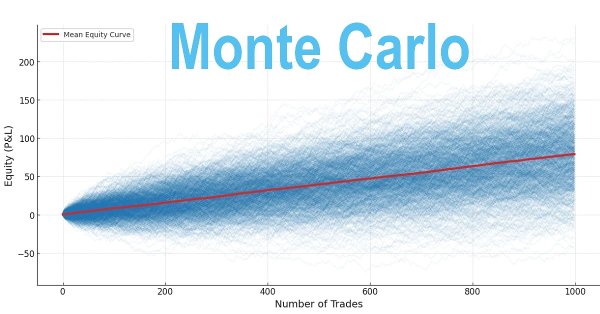

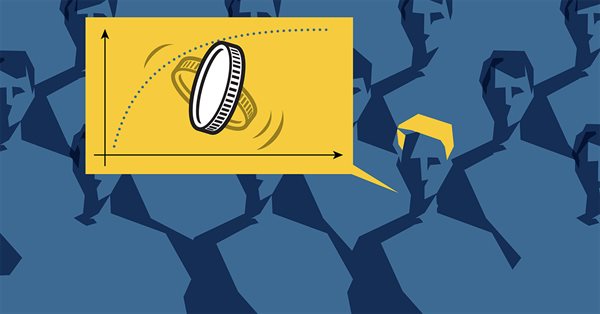

Building a Trading System (Part 1): A Quantitative Approach

Many traders evaluate strategies based on short-term performance, often abandoning profitable systems too early. Long-term profitability, however, depends on positive expectancy through optimized win rate and risk-reward ratio, along with disciplined position sizing. These principles can be validated using Monte Carlo simulation in Python with back-tested metrics to assess whether a strategy is robust or likely to fail over time.

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Developing a Replay System — Market simulation (Part 02): First experiments (II)

This time, let's try a different approach to achieve the 1 minute goal. However, this task is not as simple as one might think.

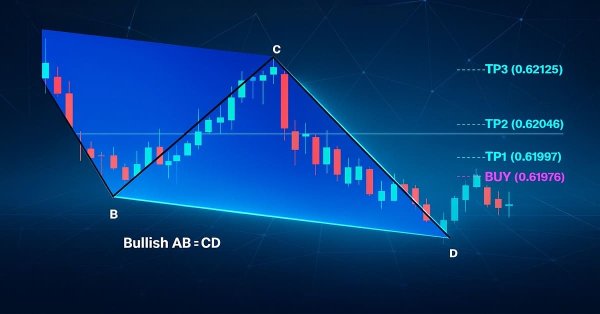

Automating Trading Strategies in MQL5 (Part 30): Creating a Price Action AB-CD Harmonic Pattern with Visual Feedback

In this article, we develop an AB=CD Pattern EA in MQL5 that identifies bullish and bearish AB=CD harmonic patterns using pivot points and Fibonacci ratios, executing trades with precise entry, stop loss, and take-profit levels. We enhance trader insight with visual feedback through chart objects.

Better Programmer (Part 03): Give Up doing these 5 things to become a successful MQL5 Programmer

This is the must-read article for anyone wanting to improve their programming career. This article series is aimed at making you the best programmer you can possibly be, no matter how experienced you are. The discussed ideas work for MQL5 programming newbies as well as professionals.

Data Science and Machine Learning (Part 07): Polynomial Regression

Unlike linear regression, polynomial regression is a flexible model aimed to perform better at tasks the linear regression model could not handle, Let's find out how to make polynomial models in MQL5 and make something positive out of it.

Deep Learning GRU model with Python to ONNX with EA, and GRU vs LSTM models

We will guide you through the entire process of DL with python to make a GRU ONNX model, culminating in the creation of an Expert Advisor (EA) designed for trading, and subsequently comparing GRU model with LSTM model.

Implementing the Deus EA: Automated Trading with RSI and Moving Averages in MQL5

This article outlines the steps to implement the Deus EA based on the RSI and Moving Average indicators for guiding automated trading.

Price Action Analysis Toolkit Development (Part 13): RSI Sentinel Tool

Price action can be effectively analyzed by identifying divergences, with technical indicators such as the RSI providing crucial confirmation signals. In the article below, we explain how automated RSI divergence analysis can identify trend continuations and reversals, thereby offering valuable insights into market sentiment.

Neural networks made easy (Part 16): Practical use of clustering

In the previous article, we have created a class for data clustering. In this article, I want to share variants of the possible application of obtained results in solving practical trading tasks.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 2): Adding Button Responsiveness

In this article, we focus on transforming our static MQL5 dashboard panel into an interactive tool by enabling button responsiveness. We explore how to automate the functionality of the GUI components, ensuring they react appropriately to user clicks. By the end of the article, we establish a dynamic interface that enhances user engagement and trading experience.

Prices in DoEasy library (part 59): Object to store data of one tick

From this article on, start creating library functionality to work with price data. Today, create an object class which will store all price data which arrived with yet another tick.

Moral expectation in trading

This article is about moral expectation. We will look at several examples of its use in trading, as well as the results that can be achieved with its help.

Neural networks made easy (Part 67): Using past experience to solve new tasks

In this article, we continue discussing methods for collecting data into a training set. Obviously, the learning process requires constant interaction with the environment. However, situations can be different.

Data label for time series mining(Part 1):Make a dataset with trend markers through the EA operation chart

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Advanced resampling and selection of CatBoost models by brute-force method

This article describes one of the possible approaches to data transformation aimed at improving the generalizability of the model, and also discusses sampling and selection of CatBoost models.

Developing a trading Expert Advisor from scratch (Part 28): Towards the future (III)

There is still one task which our order system is not up to, but we will FINALLY figure it out. The MetaTrader 5 provides a system of tickets which allows creating and correcting order values. The idea is to have an Expert Advisor that would make the same ticket system faster and more efficient.

Neural networks made easy (Part 21): Variational autoencoders (VAE)

In the last article, we got acquainted with the Autoencoder algorithm. Like any other algorithm, it has its advantages and disadvantages. In its original implementation, the autoenctoder is used to separate the objects from the training sample as much as possible. This time we will talk about how to deal with some of its disadvantages.

Trend strength and direction indicator on 3D bars

We will consider a new approach to market trend analysis based on three-dimensional visualization and tensor analysis of the market microstructure.

DoEasy. Controls (Part 3): Creating bound controls

In this article, I will create subordinate controls bound to the base element. The development will be performed using the base control functionality. In addition, I will tinker with the graphical element shadow object a bit since it still suffers from some logic errors when applied to any of the objects capable of having a shadow.

Parallel Particle Swarm Optimization

The article describes a method of fast optimization using the particle swarm algorithm. It also presents the method implementation in MQL, which is ready for use both in single-threaded mode inside an Expert Advisor and in a parallel multi-threaded mode as an add-on that runs on local tester agents.

Experiments with neural networks (Part 2): Smart neural network optimization

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders. MetaTrader 5 as a self-sufficient tool for using neural networks in trading.

Developing an Expert Advisor from scratch (Part 30): CHART TRADE as an indicator?

Today we are going to use Chart Trade again, but this time it will be an on-chart indicator which may or may not be present on the chart.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 5): Sending Commands from Telegram to MQL5 and Receiving Real-Time Responses

In this article, we create several classes to facilitate real-time communication between MQL5 and Telegram. We focus on retrieving commands from Telegram, decoding and interpreting them, and sending appropriate responses back. By the end, we ensure that these interactions are effectively tested and operational within the trading environment

Build Self Optimizing Expert Advisors With MQL5 And Python

In this article, we will discuss how we can build Expert Advisors capable of autonomously selecting and changing trading strategies based on prevailing market conditions. We will learn about Markov Chains and how they can be helpful to us as algorithmic traders.

Data Science and Machine Learning (Part 06): Gradient Descent

The gradient descent plays a significant role in training neural networks and many machine learning algorithms. It is a quick and intelligent algorithm despite its impressive work it is still misunderstood by a lot of data scientists let's see what it is all about.

New Opportunities with MetaTrader 5

MetaTrader 4 gained its popularity with traders from all over the world, and it seemed like nothing more could be wished for. With its high processing speed, stability, wide array of possibilities for writing indicators, Expert Advisors, and informatory-trading systems, and the ability to chose from over a hundred different brokers, - the terminal greatly distinguished itself from the rest. But time doesn’t stand still, and we find ourselves facing a choice of MetaTrade 4 or MetaTrade 5. In this article, we will describe the main differences of the 5th generation terminal from our current favor.

Creating a ticker tape panel: Basic version

Here I will show how to create screens with price tickers which are usually used to display quotes on the exchange. I will do it by only using MQL5, without using complex external programming.

Parafrac Oscillator: Combination of Parabolic and Fractal Indicator

We will explore how the Parabolic SAR and the Fractal indicator can be combined to create a new oscillator-based indicator. By integrating the unique strengths of both tools, traders can aim at developing a more refined and effective trading strategy.

Neural networks made easy (Part 15): Data clustering using MQL5

We continue to consider the clustering method. In this article, we will create a new CKmeans class to implement one of the most common k-means clustering methods. During tests, the model managed to identify about 500 patterns.

Technical Analysis: What Do We Analyze?

This article tries to analyze several peculiarities of representation of quotes available in the MetaTrader client terminal. The article is general, it doesn't concern programming.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part I): Movable GUI (I)

Unleash the power of dynamic data representation in your trading strategies or utilities with our comprehensive guide on creating movable GUI in MQL5. Dive into the core concept of chart events and learn how to design and implement simple and multiple movable GUI on the same chart. This article also explores the process of adding elements to your GUI, enhancing their functionality and aesthetic appeal.