Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

Connexus Observer (Part 8): Adding a Request Observer

In this final installment of our Connexus library series, we explored the implementation of the Observer pattern, as well as essential refactorings to file paths and method names. This series covered the entire development of Connexus, designed to simplify HTTP communication in complex applications.

MQL5 Wizard Techniques you should know (Part 48): Bill Williams Alligator

The Alligator Indicator, which was the brain child of Bill Williams, is a versatile trend identification indicator that yields clear signals and is often combined with other indicators. The MQL5 wizard classes and assembly allow us to test a variety of signals on a pattern basis, and so we consider this indicator as well.

Developing a multi-currency Expert Advisor (Part 13): Automating the second stage — selection into groups

We have already implemented the first stage of the automated optimization. We perform optimization for different symbols and timeframes according to several criteria and store information about the results of each pass in the database. Now we are going to select the best groups of parameter sets from those found at the first stage.

MQL5 Wizard Techniques you should know (Part 47): Reinforcement Learning with Temporal Difference

Temporal Difference is another algorithm in reinforcement learning that updates Q-Values basing on the difference between predicted and actual rewards during agent training. It specifically dwells on updating Q-Values without minding their state-action pairing. We therefore look to see how to apply this, as we have with previous articles, in a wizard assembled Expert Advisor.

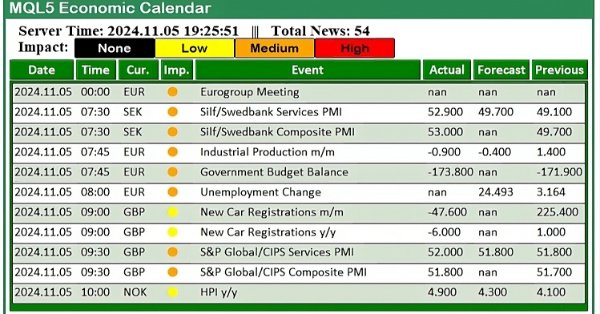

Trading with the MQL5 Economic Calendar (Part 2): Creating a News Dashboard Panel

In this article, we create a practical news dashboard panel using the MQL5 Economic Calendar to enhance our trading strategy. We begin by designing the layout, focusing on key elements like event names, importance, and timing, before moving into the setup within MQL5. Finally, we implement a filtering system to display only the most relevant news, giving traders quick access to impactful economic events.

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

Feature Engineering With Python And MQL5 (Part II): Angle Of Price

There are many posts in the MQL5 Forum asking for help calculating the slope of price changes. This article will demonstrate one possible way of calculating the angle formed by the changes in price in any market you wish to trade. Additionally, we will answer if engineering this new feature is worth the extra effort and time invested. We will explore if the slope of the price can improve any of our AI model's accuracy when forecasting the USDZAR pair on the M1.

MQL5 Wizard Techniques you should know (Part 46): Ichimoku

The Ichimuko Kinko Hyo is a renown Japanese indicator that serves as a trend identification system. We examine this, on a pattern by pattern basis, as has been the case in previous similar articles, and also assess its strategies & test reports with the help of the MQL5 wizard library classes and assembly.

Requesting in Connexus (Part 6): Creating an HTTP Request and Response

In this sixth article of the Connexus library series, we will focus on a complete HTTP request, covering each component that makes up a request. We will create a class that represents the request as a whole, which will help us bring together the previously created classes.

Neural Networks Made Easy (Part 91): Frequency Domain Forecasting (FreDF)

We continue to explore the analysis and forecasting of time series in the frequency domain. In this article, we will get acquainted with a new method to forecast data in the frequency domain, which can be added to many of the algorithms we have studied previously.

MQL5 Wizard Techniques you should know (Part 45): Reinforcement Learning with Monte-Carlo

Monte-Carlo is the fourth different algorithm in reinforcement learning that we are considering with the aim of exploring its implementation in wizard assembled Expert Advisors. Though anchored in random sampling, it does present vast ways of simulation which we can look to exploit.

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (II)

The number of strategies that can be integrated into an Expert Advisor is virtually limitless. However, each additional strategy increases the complexity of the algorithm. By incorporating multiple strategies, an Expert Advisor can better adapt to varying market conditions, potentially enhancing its profitability. Today, we will explore how to implement MQL5 for one of the prominent strategies developed by Richard Donchian, as we continue to enhance the functionality of our Trend Constraint Expert.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

News Trading Made Easy (Part 4): Performance Enhancement

This article will dive into methods to improve the expert's runtime in the strategy tester, the code will be written to divide news event times into hourly categories. These news event times will be accessed within their specified hour. This ensures that the EA can efficiently manage event-driven trades in both high and low-volatility environments.

Neural Networks Made Easy (Part 90): Frequency Interpolation of Time Series (FITS)

By studying the FEDformer method, we opened the door to the frequency domain of time series representation. In this new article, we will continue the topic we started. We will consider a method with which we can not only conduct an analysis, but also predict subsequent states in a particular area.

Connexus Helper (Part 5): HTTP Methods and Status Codes

In this article, we will understand HTTP methods and status codes, two very important pieces of communication between client and server on the web. Understanding what each method does gives you the control to make requests more precisely, informing the server what action you want to perform and making it more efficient.

MQL5 Wizard Techniques you should know (Part 44): Average True Range (ATR) technical indicator

The ATR oscillator is a very popular indicator for acting as a volatility proxy, especially in the forex markets where volume data is scarce. We examine this, on a pattern basis as we have with prior indicators, and share strategies & test reports thanks to the MQL5 wizard library classes and assembly.

Creating a Trading Administrator Panel in MQL5 (Part V): Two-Factor Authentication (2FA)

Today, we will discuss enhancing security for the Trading Administrator Panel currently under development. We will explore how to implement MQL5 in a new security strategy, integrating the Telegram API for two-factor authentication (2FA). This discussion will provide valuable insights into the application of MQL5 in reinforcing security measures. Additionally, we will examine the MathRand function, focusing on its functionality and how it can be effectively utilized within our security framework. Continue reading to discover more!

Neural networks made easy (Part 89): Frequency Enhanced Decomposition Transformer (FEDformer)

All the models we have considered so far analyze the state of the environment as a time sequence. However, the time series can also be represented in the form of frequency features. In this article, I introduce you to an algorithm that uses frequency components of a time sequence to predict future states.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 2): Adding Button Responsiveness

In this article, we focus on transforming our static MQL5 dashboard panel into an interactive tool by enabling button responsiveness. We explore how to automate the functionality of the GUI components, ensuring they react appropriately to user clicks. By the end of the article, we establish a dynamic interface that enhances user engagement and trading experience.

How to integrate Smart Money Concepts (OB) coupled with Fibonacci indicator for Optimal Trade Entry

The SMC (Order Block) are key areas where institutional traders initiate significant buying or selling. After a significant price move, fibonacci helps to identify potential retracement from a recent swing high to a swing low to identify optimal trade entry.

Creating an MQL5 Expert Advisor Based on the Daily Range Breakout Strategy

In this article, we create an MQL5 Expert Advisor based on the Daily Range Breakout strategy. We cover the strategy’s key concepts, design the EA blueprint, and implement the breakout logic in MQL5. In the end, we explore techniques for backtesting and optimizing the EA to maximize its effectiveness.

MQL5 Wizard Techniques you should know (Part 43): Reinforcement Learning with SARSA

SARSA, which is an abbreviation for State-Action-Reward-State-Action is another algorithm that can be used when implementing reinforcement learning. So, as we saw with Q-Learning and DQN, we look into how this could be explored and implemented as an independent model rather than just a training mechanism, in wizard assembled Expert Advisors.

MQL5 Trading Toolkit (Part 3): Developing a Pending Orders Management EX5 Library

Learn how to develop and implement a comprehensive pending orders EX5 library in your MQL5 code or projects. This article will show you how to create an extensive pending orders management EX5 library and guide you through importing and implementing it by building a trading panel or graphical user interface (GUI). The expert advisor orders panel will allow users to open, monitor, and delete pending orders associated with a specified magic number directly from the graphical interface on the chart window.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 1): Setting Up the Panel

In this article, we create an interactive trading dashboard using the Controls class in MQL5, designed to streamline trading operations. The panel features a title, navigation buttons for Trade, Close, and Information, and specialized action buttons for executing trades and managing positions. By the end of the article, you will have a foundational panel ready for further enhancements in future installments.

Body in Connexus (Part 4): Adding HTTP body support

In this article, we explored the concept of body in HTTP requests, which is essential for sending data such as JSON and plain text. We discussed and explained how to use it correctly with the appropriate headers. We also introduced the ChttpBody class, part of the Connexus library, which will simplify working with the body of requests.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (II)-LoRA-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

MQL5 Wizard Techniques you should know (Part 42): ADX Oscillator

The ADX is another relatively popular technical indicator used by some traders to gauge the strength of a prevalent trend. Acting as a combination of two other indicators, it presents as an oscillator whose patterns we explore in this article with the help of MQL5 wizard assembly and its support classes.

Creating an MQL5 Expert Advisor Based on the PIRANHA Strategy by Utilizing Bollinger Bands

In this article, we create an Expert Advisor (EA) in MQL5 based on the PIRANHA strategy, utilizing Bollinger Bands to enhance trading effectiveness. We discuss the key principles of the strategy, the coding implementation, and methods for testing and optimization. This knowledge will enable you to deploy the EA in your trading scenarios effectively

Developing a multi-currency Expert Advisor (Part 12): Developing prop trading level risk manager

In the EA being developed, we already have a certain mechanism for controlling drawdown. But it is probabilistic in nature, as it is based on the results of testing on historical price data. Therefore, the drawdown can sometimes exceed the maximum expected values (although with a small probability). Let's try to add a mechanism that ensures guaranteed compliance with the specified drawdown level.

Header in the Connexus (Part 3): Mastering the Use of HTTP Headers for Requests

We continue developing the Connexus library. In this chapter, we explore the concept of headers in the HTTP protocol, explaining what they are, what they are for, and how to use them in requests. We cover the main headers used in communications with APIs, and show practical examples of how to configure them in the library.

How to create a trading journal with MetaTrader and Google Sheets

Create a trading journal using MetaTrader and Google Sheets! You will learn how to sync your trading data via HTTP POST and retrieve it using HTTP requests. In the end, You have a trading journal that will help you keep track of your trades effectively and efficiently.

MQL5 Wizard Techniques you should know (Part 41): Deep-Q-Networks

The Deep-Q-Network is a reinforcement learning algorithm that engages neural networks in projecting the next Q-value and ideal action during the training process of a machine learning module. We have already considered an alternative reinforcement learning algorithm, Q-Learning. This article therefore presents another example of how an MLP trained with reinforcement learning, can be used within a custom signal class.

Developing a multi-currency Expert Advisor (Part 11): Automating the optimization (first steps)

To get a good EA, we need to select multiple good sets of parameters of trading strategy instances for it. This can be done manually by running optimization on different symbols and then selecting the best results. But it is better to delegate this work to the program and engage in more productive activities.

Risk manager for algorithmic trading

The objectives of this article are to prove the necessity of using a risk manager and to implement the principles of controlled risk in algorithmic trading in a separate class, so that everyone can verify the effectiveness of the risk standardization approach in intraday trading and investing in financial markets. In this article, we will create a risk manager class for algorithmic trading. This is a logical continuation of the previous article in which we discussed the creation of a risk manager for manual trading.

HTTP and Connexus (Part 2): Understanding HTTP Architecture and Library Design

This article explores the fundamentals of the HTTP protocol, covering the main methods (GET, POST, PUT, DELETE), status codes and the structure of URLs. In addition, it presents the beginning of the construction of the Conexus library with the CQueryParam and CURL classes, which facilitate the manipulation of URLs and query parameters in HTTP requests.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 7): Command Analysis for Indicator Automation on Charts

In this article, we explore how to integrate Telegram commands with MQL5 to automate the addition of indicators on trading charts. We cover the process of parsing user commands, executing them in MQL5, and testing the system to ensure smooth indicator-based trading

Neural Networks Made Easy (Part 88): Time-Series Dense Encoder (TiDE)

In an attempt to obtain the most accurate forecasts, researchers often complicate forecasting models. Which in turn leads to increased model training and maintenance costs. Is such an increase always justified? This article introduces an algorithm that uses the simplicity and speed of linear models and demonstrates results on par with the best models with a more complex architecture.

MQL5 Wizard Techniques you should know (Part 40): Parabolic SAR

The Parabolic Stop-and-Reversal (SAR) is an indicator for trend confirmation and trend termination points. Because it is a laggard in identifying trends its primary purpose has been in positioning trailing stop losses on open positions. We, however, explore if indeed it could be used as an Expert Advisor signal, thanks to custom signal classes of wizard assembled Expert Advisors.