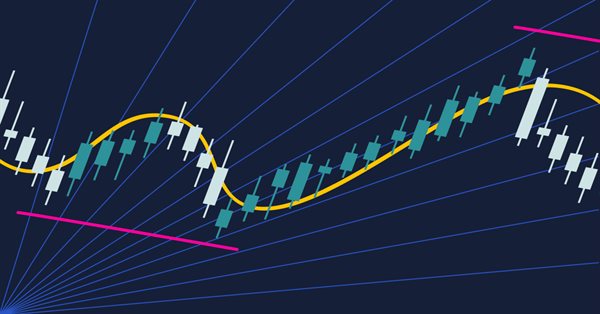

Indicator for Spindles Charting

The article regards spindle chart plotting and its usage in trading strategies and experts. First let's discuss the chart's appearance, plotting and connection with japanese candlestick chart. Next we analyze the indicator's implementation in the source code in the MQL5 language. Let's test the expert based on indicator and formulate the trading strategy.

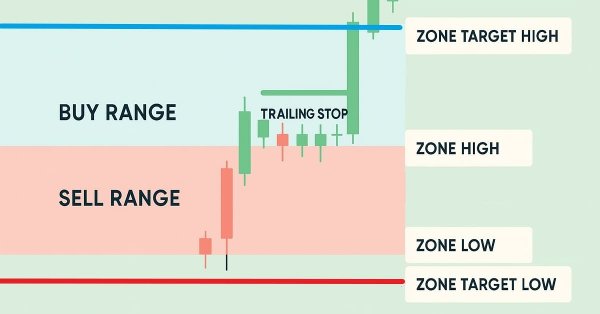

Automating Trading Strategies in MQL5 (Part 4): Building a Multi-Level Zone Recovery System

In this article, we develop a Multi-Level Zone Recovery System in MQL5 that utilizes RSI to generate trading signals. Each signal instance is dynamically added to an array structure, allowing the system to manage multiple signals simultaneously within the Zone Recovery logic. Through this approach, we demonstrate how to handle complex trade management scenarios effectively while maintaining a scalable and robust code design.

Revisiting an Old Trend Trading Strategy: Two Stochastic oscillators, a MA and Fibonacci

Old trading strategies. This article presents one of the strategies used to follow the trend in a purely technical way. The strategy is purely technical and uses a few technical indicators and tools to deliver signals and targets. The components of the strategy are as follows: A 14-period stochastic oscillator. A 5-period stochastic oscillator. A 200-period moving average. A Fibonacci projection tool (for target setting).

Magic of time trading intervals with Frames Analyzer tool

What is Frames Analyzer? This is a plug-in module for any Expert Advisor for analyzing optimization frames during parameter optimization in the strategy tester, as well as outside the tester, by reading an MQD file or a database that is created immediately after parameter optimization. You will be able to share these optimization results with other users who have the Frames Analyzer tool to discuss the results together.

Graphical Interfaces XI: Refactoring the Library code (build 14.1)

As the library grows, its code must be optimized again in order to reduce its size. The version of the library described in this article has become even more object-oriented. This made the code easier to learn. A detailed description of the latest changes will allow the readers to develop the library independently based on their own needs.

Creating an EA that works automatically (Part 12): Automation (IV)

If you think automated systems are simple, then you probably don't fully understand what it takes to create them. In this article, we will talk about the problem that kills a lot of Expert Advisors. The indiscriminate triggering of orders is a possible solution to this problem.

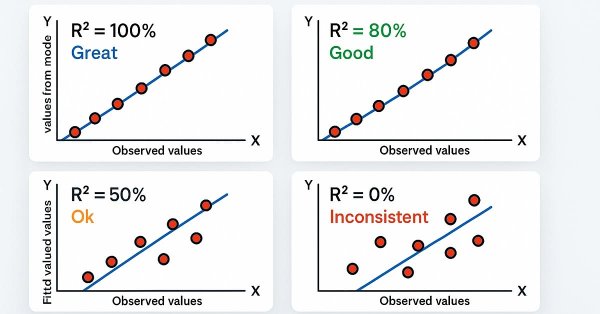

Automating Trading Strategies in MQL5 (Part 34): Trendline Breakout System with R-Squared Goodness of Fit

In this article, we develop a Trendline Breakout System in MQL5 that identifies support and resistance trendlines using swing points, validated by R-squared goodness of fit and angle constraints, to automate breakout trades. Our plan is to detect swing highs and lows within a specified lookback period, construct trendlines with a minimum number of touch points, and validate them using R-squared metrics and angle constraints to ensure reliability.

Trailing stop in trading

In this article, we will look at the use of a trailing stop in trading. We will assess how useful and effective it is, and how it can be used. The efficiency of a trailing stop largely depends on price volatility and the selection of the stop loss level. A variety of approaches can be used to set a stop loss.

Automating Trading Strategies in MQL5 (Part 14): Trade Layering Strategy with MACD-RSI Statistical Methods

In this article, we introduce a trade layering strategy that combines MACD and RSI indicators with statistical methods to automate dynamic trading in MQL5. We explore the architecture of this cascading approach, detail its implementation through key code segments, and guide readers on backtesting to optimize performance. Finally, we conclude by highlighting the strategy’s potential and setting the stage for further enhancements in automated trading.

Graphical Interfaces VIII: The Tree View Control (Chapter 2)

The previous chapter of part VIII on graphical interfaces has focused on the elements of static and drop-down calendar. The second chapter will be dedicated to an equally complex element — a tree view, that is included in every complete library used for creating graphical interfaces. A tree view implemented in this article contains multiple flexible settings and modes, thus allowing to adjust this element of control to your needs.

Building a Professional Trading System with Heikin Ashi (Part 2): Developing an EA

This article explains how to develop a professional Heikin Ashi-based Expert Advisor (EA) in MQL5. You will learn how to set up input parameters, enumerations, indicators, global variables, and implement the core trading logic. You will also be able to run a backtest on gold to validate your work.

Advanced Order Execution Algorithms in MQL5: TWAP, VWAP, and Iceberg Orders

An MQL5 framework that brings institutional-grade execution algorithms (TWAP, VWAP, Iceberg) to retail traders through a unified execution manager and performance analyzer for smoother, more precise order slicing and analytics.

Creating an EA that works automatically (Part 06): Account types (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. Our EA in its current state can work in any situation but it is not yet ready for automation. We still have to work on a few points.

Neural networks made easy (Part 13): Batch Normalization

In the previous article, we started considering methods aimed at improving neural network training quality. In this article, we will continue this topic and will consider another approach — batch data normalization.

Neural networks made easy (Part 30): Genetic algorithms

Today I want to introduce you to a slightly different learning method. We can say that it is borrowed from Darwin's theory of evolution. It is probably less controllable than the previously discussed methods but it allows training non-differentiable models.

Automating Trading Strategies in MQL5 (Part 17): Mastering the Grid-Mart Scalping Strategy with a Dynamic Dashboard

In this article, we explore the Grid-Mart Scalping Strategy, automating it in MQL5 with a dynamic dashboard for real-time trading insights. We detail its grid-based Martingale logic and risk management features. We also guide backtesting and deployment for robust performance.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 6): Two RSI indicators cross each other's lines

The multi-currency expert advisor in this article is an expert advisor or trading robot that uses two RSI indicators with crossing lines, the Fast RSI which crosses with the Slow RSI.

Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast

The article provides an example of using a perceptron as a self-sufficient price prediction tool by showcasing general concepts and the simplest ready-made Expert Advisor followed by the results of its optimization.

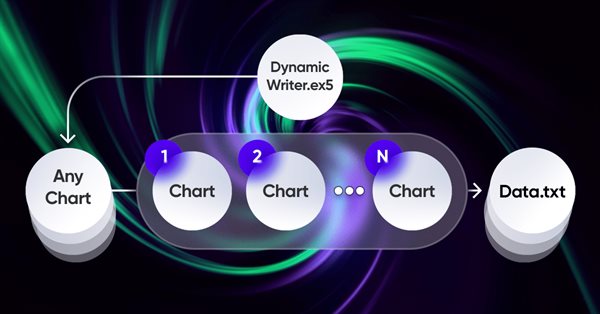

How to Implement Auto Optimization in MQL5 Expert Advisors

Step by step guide for auto optimization in MQL5 for Expert Advisors. We will cover robust optimization logic, best practices for parameter selection, and how to reconstruct strategies with back-testing. Additionally, higher-level methods like walk-forward optimization will be discussed to enhance your trading approach.

Algorithmic trading based on 3D reversal patterns

Discovering a new world of automated trading on 3D bars. What does a trading robot look like on multidimensional price bars? Are "yellow" clusters of 3D bars able to predict trend reversals? What does multidimensional trading look like?

Building an Interactive Application to Display RSS Feeds in MetaTrader 5

In this article we look at the possibility of creating an application for the display of RSS feeds. The article will show how aspects of the Standard Library can be used to create interactive programs for MetaTrader 5.

Creating an EA that works automatically (Part 03): New functions

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we started to develop an order system that we will use in our automated EA. However, we have created only one of the necessary functions.

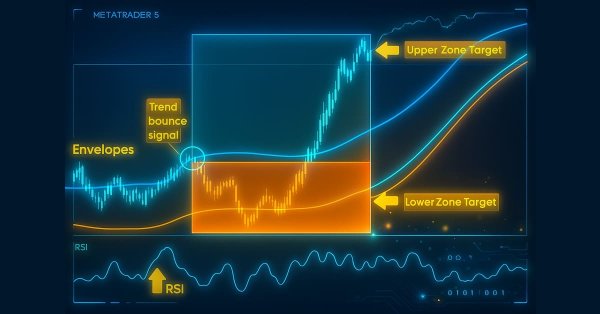

Automating Trading Strategies in MQL5 (Part 19): Envelopes Trend Bounce Scalping — Trade Execution and Risk Management (Part II)

In this article, we implement trade execution and risk management for the Envelopes Trend Bounce Scalping Strategy in MQL5. We implement order placement and risk controls like stop-loss and position sizing. We conclude with backtesting and optimization, building on Part 18’s foundation.

Automating Trading Strategies in MQL5 (Part 22): Creating a Zone Recovery System for Envelopes Trend Trading

In this article, we develop a Zone Recovery System integrated with an Envelopes trend-trading strategy in MQL5. We outline the architecture for using RSI and Envelopes indicators to trigger trades and manage recovery zones to mitigate losses. Through implementation and backtesting, we show how to build an effective automated trading system for dynamic markets

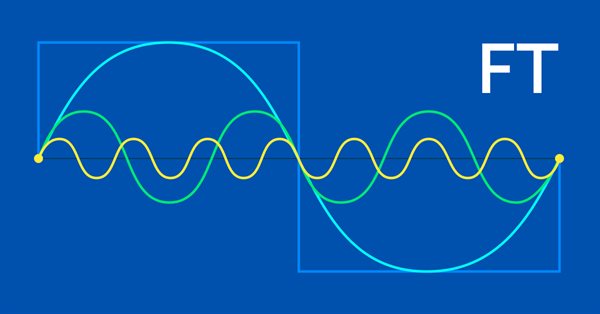

MQL5 Wizard techniques you should know (Part 06): Fourier Transform

The Fourier transform introduced by Joseph Fourier is a means of deconstructing complex data wave points into simple constituent waves. This feature could be resourceful to traders and this article takes a look at that.

Prices in DoEasy library (part 60): Series list of symbol tick data

In this article, I will create the list for storing tick data of a single symbol and check its creation and retrieval of required data in an EA. Tick data lists that are individual for each used symbol will further constitute a collection of tick data.

Neural networks made easy (Part 14): Data clustering

It has been more than a year since I published my last article. This is quite a lot time to revise ideas and to develop new approaches. In the new article, I would like to divert from the previously used supervised learning method. This time we will dip into unsupervised learning algorithms. In particular, we will consider one of the clustering algorithms—k-means.

Neural networks made easy (Part 36): Relational Reinforcement Learning

In the reinforcement learning models we discussed in previous article, we used various variants of convolutional networks that are able to identify various objects in the original data. The main advantage of convolutional networks is the ability to identify objects regardless of their location. At the same time, convolutional networks do not always perform well when there are various deformations of objects and noise. These are the issues which the relational model can solve.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 1): Setting Up the Panel

In this article, we create an interactive trading dashboard using the Controls class in MQL5, designed to streamline trading operations. The panel features a title, navigation buttons for Trade, Close, and Information, and specialized action buttons for executing trades and managing positions. By the end of the article, you will have a foundational panel ready for further enhancements in future installments.

How to create a trading journal with MetaTrader and Google Sheets

Create a trading journal using MetaTrader and Google Sheets! You will learn how to sync your trading data via HTTP POST and retrieve it using HTTP requests. In the end, You have a trading journal that will help you keep track of your trades effectively and efficiently.

Graphical interfaces X: New features for the Rendered table (build 9)

Until today, the CTable was the most advanced type of tables among all presented in the library. This table is assembled from edit boxes of the OBJ_EDIT type, and its further development becomes problematic. Therefore, in terms of maximum capabilities, it is better to develop rendered tables of the CCanvasTable type even at the current development stage of the library. Its current version is completely lifeless, but starting from this article, we will try to fix the situation.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Implementing a Rapid-Fire Trading Strategy Algorithm with Parabolic SAR and Simple Moving Average (SMA) in MQL5

In this article, we develop a Rapid-Fire Trading Expert Advisor in MQL5, leveraging the Parabolic SAR and Simple Moving Average (SMA) indicators to create a responsive trading strategy. We detail the strategy’s implementation, including indicator usage, signal generation, and the testing and optimization process.

Other classes in DoEasy library (Part 67): Chart object class

In this article, I will create the chart object class (of a single trading instrument chart) and improve the collection class of MQL5 signal objects so that each signal object stored in the collection updates all its parameters when updating the list.

Automating Trading Strategies in MQL5 (Part 23): Zone Recovery with Trailing and Basket Logic

In this article, we enhance our Zone Recovery System by introducing trailing stops and multi-basket trading capabilities. We explore how the improved architecture uses dynamic trailing stops to lock in profits and a basket management system to handle multiple trade signals efficiently. Through implementation and backtesting, we demonstrate a more robust trading system tailored for adaptive market performance.

Creating multi-symbol, multi-period indicators

In this article, we will look at the principles of creating multi-symbol, multi-period indicators. We will also see how to access the data of such indicators from Expert Advisors and other indicators. We will consider the main features of using multi-indicators in Expert Advisors and indicators and will see how to plot them through custom indicator buffers.

Developing a trading Expert Advisor from scratch (Part 12): Times and Trade (I)

Today we will create Times & Trade with fast interpretation to read the order flow. It is the first part in which we will build the system. In the next article, we will complete the system with the missing information. To implement this new functionality, we will need to add several new things to the code of our Expert Advisor.

Creating an MQL5 Expert Advisor Based on the PIRANHA Strategy by Utilizing Bollinger Bands

In this article, we create an Expert Advisor (EA) in MQL5 based on the PIRANHA strategy, utilizing Bollinger Bands to enhance trading effectiveness. We discuss the key principles of the strategy, the coding implementation, and methods for testing and optimization. This knowledge will enable you to deploy the EA in your trading scenarios effectively

Brute force approach to patterns search (Part VI): Cyclic optimization

In this article I will show the first part of the improvements that allowed me not only to close the entire automation chain for MetaTrader 4 and 5 trading, but also to do something much more interesting. From now on, this solution allows me to fully automate both creating EAs and optimization, as well as to minimize labor costs for finding effective trading configurations.

Creating an EA that works automatically (Part 04): Manual triggers (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode.