Vladislav Berestenko / 个人资料

- 信息

|

11+ 年

经验

|

1

产品

|

937

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

Vladislav Berestenko

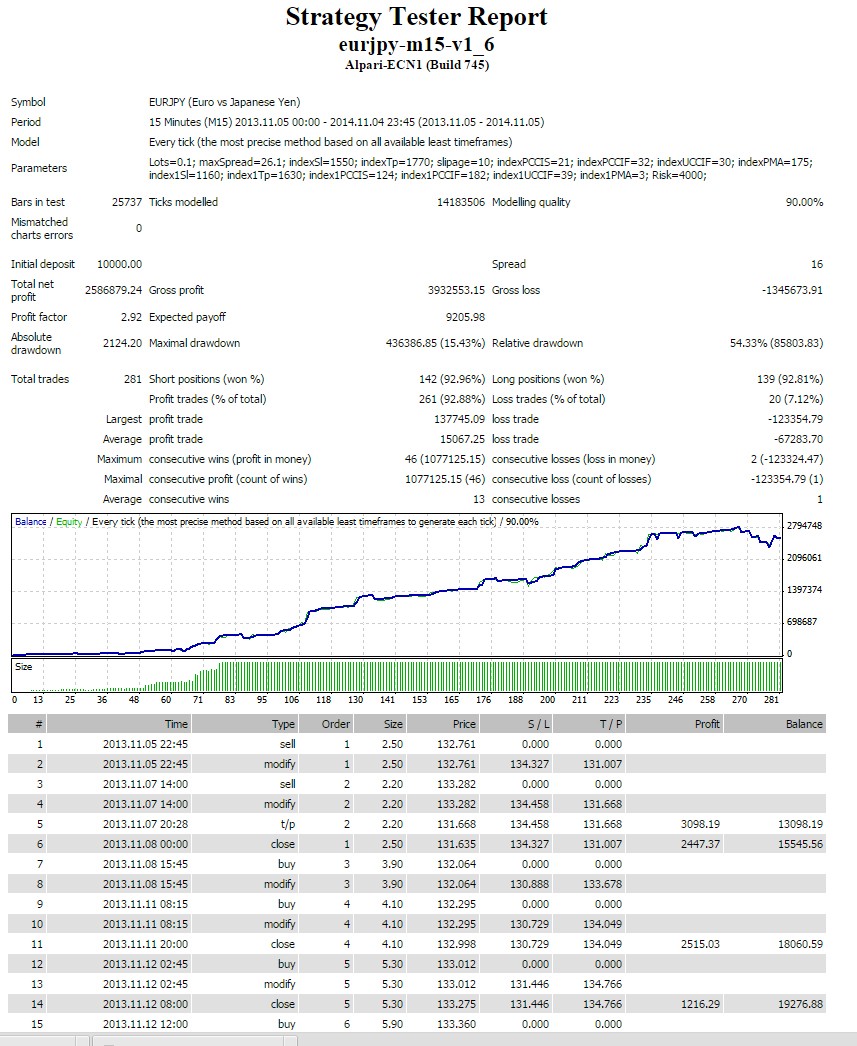

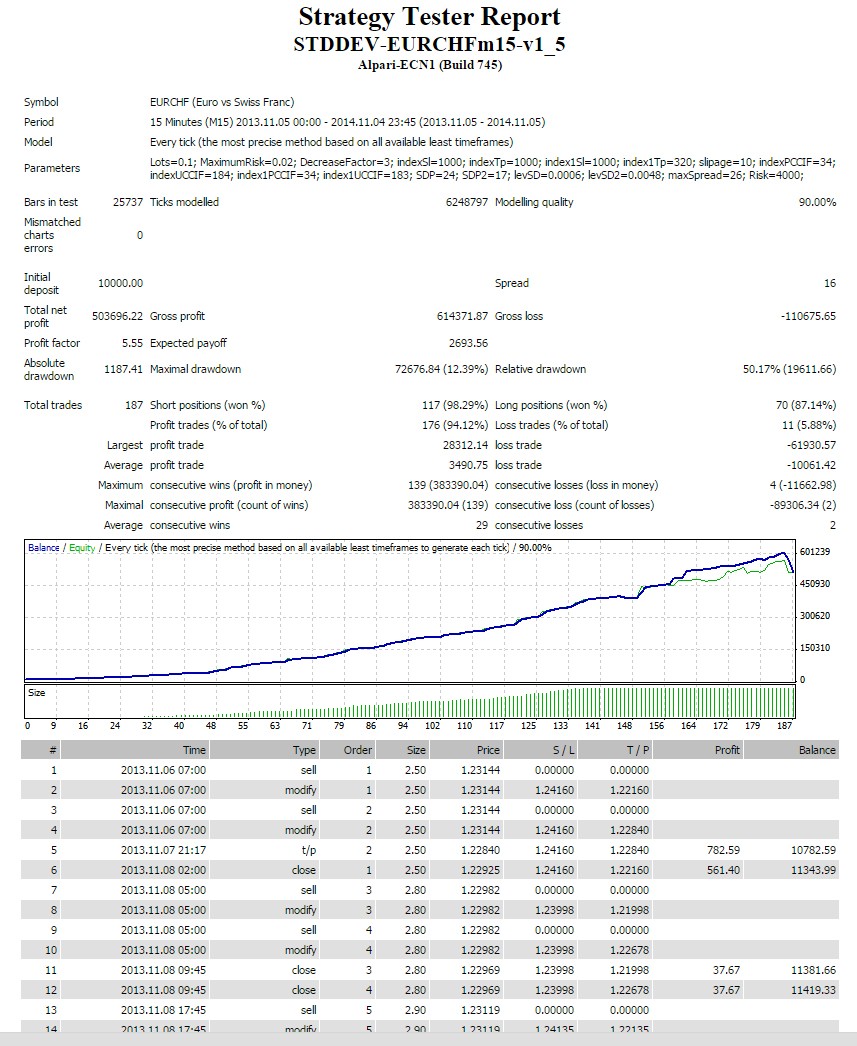

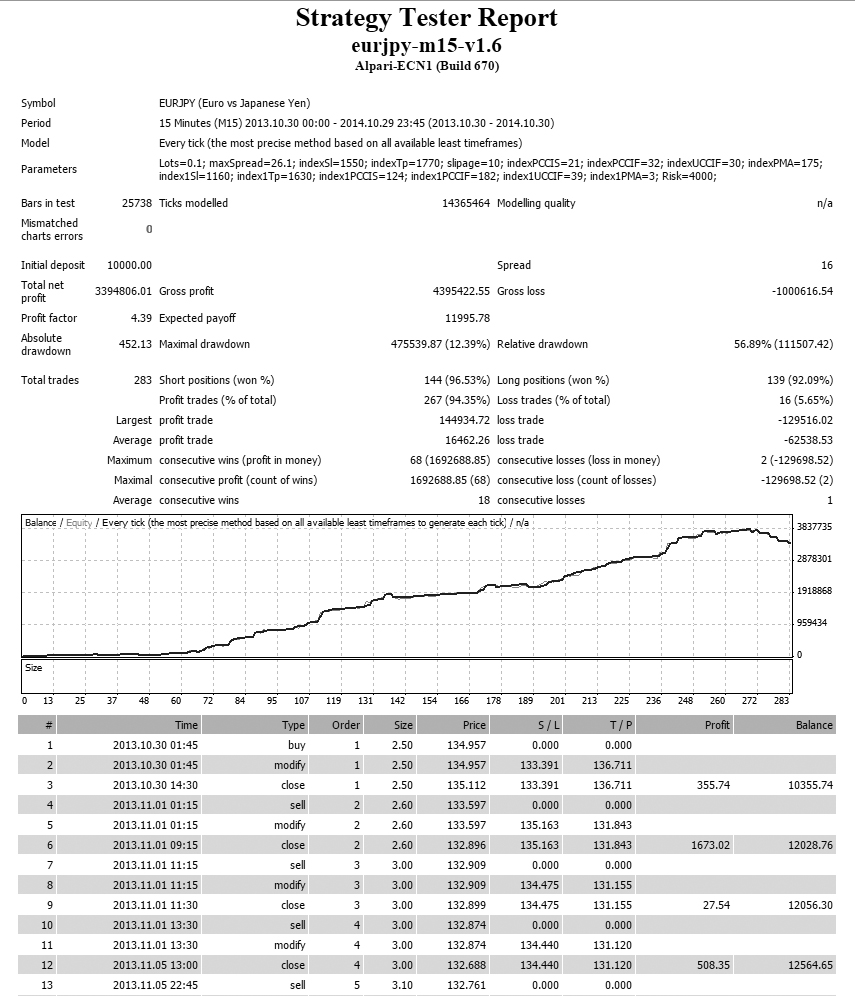

The new versions (Eurjpym15 & StdDev EurCHF m15) 1.4 is available! Optimized for the period 2013.10.03-2014.10.03

eurjpy-m15-v1_4

Alpari-ECN1 (Build 711)

Symbol EURJPY (Euro vs Japanese Yen)

Period 15 Minutes (M15) 2013.10.03 00:00 - 2014.10.02 23:45 (2013.10.03 - 2014.10.03)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1550; indexTp=1770; slipage=10; index1Sl=1160; index1Tp=1630; Risk=4000;

Bars in test 25602 Ticks modelled 13924799 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 300.00 Spread 16

Total net profit 1640876.82 Gross profit 2274857.19 Gross loss -633980.37

Profit factor 3.59 Expected payoff 5839.42

Absolute drawdown 252.69 Maximal drawdown 225458.88 (31.21%) Relative drawdown 88.43% (361.70)

Total trades 281 Short positions (won %) 138 (94.20%) Long positions (won %) 143 (94.41%)

Profit trades (% of total) 265 (94.31%) Loss trades (% of total) 16 (5.69%)

Largest profit trade 144800.45 loss trade -129512.06

Average profit trade 8584.37 loss trade -39623.77

Maximum consecutive wins (profit in money) 46 (1137111.91) consecutive losses (loss in money) 1 (-129512.06)

Maximal consecutive profit (count of wins) 1137111.91 (46) consecutive loss (count of losses) -129512.06 (1)

Average consecutive wins 16 consecutive losses 1

STDDEV-EURCHF-m15-v1_4

Alpari-ECN1 (Build 711)

Symbol EURCHF (Euro vs Swiss Franc)

Period 15 Minutes (M15) 2013.10.03 00:00 - 2014.10.02 23:45 (2013.10.03 - 2014.10.03)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1000; indexTp=1000; index1Sl=1000; index1Tp=320; slipage=10; Risk=4000;

Bars in test 25602 Ticks modelled 6293204 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 10000.00 Spread 16

Total net profit 176944.25 Gross profit 264822.50 Gross loss -87878.26

Profit factor 3.01 Expected payoff 782.94

Absolute drawdown 1386.99 Maximal drawdown 97687.57 (51.22%) Relative drawdown 54.37% (23660.32)

Total trades 226 Short positions (won %) 124 (96.77%) Long positions (won %) 102 (92.16%)

Profit trades (% of total) 214 (94.69%) Loss trades (% of total) 12 (5.31%)

Largest profit trade 8604.52 loss trade -20120.71

Average profit trade 1237.49 loss trade -7323.19

Maximum consecutive wins (profit in money) 60 (53159.27) consecutive losses (loss in money) 2 (-32000.96)

Maximal consecutive profit (count of wins) 53159.27 (60) consecutive loss (count of losses) -32000.96 (2)

Average consecutive wins 24 consecutive losses 1

eurjpy-m15-v1_4

Alpari-ECN1 (Build 711)

Symbol EURJPY (Euro vs Japanese Yen)

Period 15 Minutes (M15) 2013.10.03 00:00 - 2014.10.02 23:45 (2013.10.03 - 2014.10.03)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1550; indexTp=1770; slipage=10; index1Sl=1160; index1Tp=1630; Risk=4000;

Bars in test 25602 Ticks modelled 13924799 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 300.00 Spread 16

Total net profit 1640876.82 Gross profit 2274857.19 Gross loss -633980.37

Profit factor 3.59 Expected payoff 5839.42

Absolute drawdown 252.69 Maximal drawdown 225458.88 (31.21%) Relative drawdown 88.43% (361.70)

Total trades 281 Short positions (won %) 138 (94.20%) Long positions (won %) 143 (94.41%)

Profit trades (% of total) 265 (94.31%) Loss trades (% of total) 16 (5.69%)

Largest profit trade 144800.45 loss trade -129512.06

Average profit trade 8584.37 loss trade -39623.77

Maximum consecutive wins (profit in money) 46 (1137111.91) consecutive losses (loss in money) 1 (-129512.06)

Maximal consecutive profit (count of wins) 1137111.91 (46) consecutive loss (count of losses) -129512.06 (1)

Average consecutive wins 16 consecutive losses 1

STDDEV-EURCHF-m15-v1_4

Alpari-ECN1 (Build 711)

Symbol EURCHF (Euro vs Swiss Franc)

Period 15 Minutes (M15) 2013.10.03 00:00 - 2014.10.02 23:45 (2013.10.03 - 2014.10.03)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1000; indexTp=1000; index1Sl=1000; index1Tp=320; slipage=10; Risk=4000;

Bars in test 25602 Ticks modelled 6293204 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 10000.00 Spread 16

Total net profit 176944.25 Gross profit 264822.50 Gross loss -87878.26

Profit factor 3.01 Expected payoff 782.94

Absolute drawdown 1386.99 Maximal drawdown 97687.57 (51.22%) Relative drawdown 54.37% (23660.32)

Total trades 226 Short positions (won %) 124 (96.77%) Long positions (won %) 102 (92.16%)

Profit trades (% of total) 214 (94.69%) Loss trades (% of total) 12 (5.31%)

Largest profit trade 8604.52 loss trade -20120.71

Average profit trade 1237.49 loss trade -7323.19

Maximum consecutive wins (profit in money) 60 (53159.27) consecutive losses (loss in money) 2 (-32000.96)

Maximal consecutive profit (count of wins) 53159.27 (60) consecutive loss (count of losses) -32000.96 (2)

Average consecutive wins 24 consecutive losses 1

分享社交网络 · 3

显示全部评论 (4)

Azad Ahmd Yasr

2014.10.17

i bought this but speard error (speard must be 26) my account spread 26.00000001046

Vladislav Berestenko

I see stock quotes like a probabilistic process without laws on all the time, so my EA works only in the time of optimization. and it may be another month under the conditions (the server settings) he will give positive results. what is your attitude to the process of forecasting a stock quote?

分享社交网络 · 1

Vladislav Berestenko

С 30 июня 2014 года Альпари изменяет торговые условия для счетов типа Standard, ECN, ECN-new, PAMM и счета fx.option.

С этой даты для указанных типов счетов вводится минимальный депозит, необходимый для активации торгового счета.

Источник: alpari.ru, «Изменение торговых условий с 30 июня 2014 года»

cn.mt4, ecn-new.mt4, pamm.ecn.mt4, pamm.ecn-new.mt4,

ecn-new.swapfree.mt4, ecn-new.weekendfee.mt4

300 USD / 300 EUR / 10 000 RUR / 300 GLD

Также для счетов типа ECN и ECN-new значение минимального объема сделки увеличивается до 0.1 лота. Шаг увеличения при этом остается прежним — 0.01 лот.

Источник: alpari.ru, «Изменение торговых условий с 30 июня 2014 года»

так что минимальная сумма 500 $ для моих EA

С этой даты для указанных типов счетов вводится минимальный депозит, необходимый для активации торгового счета.

Источник: alpari.ru, «Изменение торговых условий с 30 июня 2014 года»

cn.mt4, ecn-new.mt4, pamm.ecn.mt4, pamm.ecn-new.mt4,

ecn-new.swapfree.mt4, ecn-new.weekendfee.mt4

300 USD / 300 EUR / 10 000 RUR / 300 GLD

Также для счетов типа ECN и ECN-new значение минимального объема сделки увеличивается до 0.1 лота. Шаг увеличения при этом остается прежним — 0.01 лот.

Источник: alpari.ru, «Изменение торговых условий с 30 июня 2014 года»

так что минимальная сумма 500 $ для моих EA

分享社交网络 · 1

Vladislav Berestenko

comments to my EA: - minimum lot size of 0.01 and a leverage 1:500 minimum Deposit 200$

if the parameter Risk=4000 that is, the lot size of the order will be 200/4000=0,05 (balance account=200$)

if the parameter Risk=5000 that is, the lot size of the order will be 200/5000=0,04

server Alpari-ESN-new

if the parameter Risk=4000 that is, the lot size of the order will be 200/4000=0,05 (balance account=200$)

if the parameter Risk=5000 that is, the lot size of the order will be 200/5000=0,04

server Alpari-ESN-new

分享社交网络 · 2

Vladislav Berestenko

分享社交网络 · 4

[删除]

2014.06.25

scalper?

[删除]

2014.06.25

Can't wait to see this ea:]

Vladislav Berestenko

The new version 1.3 is available!

Strategy Tester Report (2014.01.01 - 2014.06.23)

eurjpy-m15-v1_03-a

Alpari-ECN-New (Build 646)

Symbol EURJPY (Euro vs Japanese Yen)

Period 15 Minutes (M15) 2014.01.02 09:00 - 2014.06.20 23:45 (2014.01.01 - 2014.06.23)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1370; indexTp=1700; slipage=10; index1Sl=1860; index1Tp=1640; Risk=4000;

Bars in test 12666 Ticks modelled 7112882 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 300.00 Spread 20

Total net profit 740489.92 Gross profit 772331.08 Gross loss -31841.16

Profit factor 24.26 Expected payoff 10284.58

Absolute drawdown 3.45 Maximal drawdown 121706.10 (25.23%) Relative drawdown 65.29% (8193.38)

Total trades 72 Short positions (won %) 42 (97.62%) Long positions (won %) 30 (100.00%)

Profit trades (% of total) 71 (98.61%) Loss trades (% of total) 1 (1.39%)

Largest profit trade 148383.01 loss trade -31841.16

Average profit trade 10877.90 loss trade -31841.16

Maximum consecutive wins (profit in money) 71 (772331.08) consecutive losses (loss in money) 1 (-31841.16)

Maximal consecutive profit (count of wins) 772331.08 (71) consecutive loss (count of losses) -31841.16 (1)

Average consecutive wins 71 consecutive losses 1

Strategy Tester Report (2014.01.01 - 2014.06.23)

eurjpy-m15-v1_03-a

Alpari-ECN-New (Build 646)

Symbol EURJPY (Euro vs Japanese Yen)

Period 15 Minutes (M15) 2014.01.02 09:00 - 2014.06.20 23:45 (2014.01.01 - 2014.06.23)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1370; indexTp=1700; slipage=10; index1Sl=1860; index1Tp=1640; Risk=4000;

Bars in test 12666 Ticks modelled 7112882 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 300.00 Spread 20

Total net profit 740489.92 Gross profit 772331.08 Gross loss -31841.16

Profit factor 24.26 Expected payoff 10284.58

Absolute drawdown 3.45 Maximal drawdown 121706.10 (25.23%) Relative drawdown 65.29% (8193.38)

Total trades 72 Short positions (won %) 42 (97.62%) Long positions (won %) 30 (100.00%)

Profit trades (% of total) 71 (98.61%) Loss trades (% of total) 1 (1.39%)

Largest profit trade 148383.01 loss trade -31841.16

Average profit trade 10877.90 loss trade -31841.16

Maximum consecutive wins (profit in money) 71 (772331.08) consecutive losses (loss in money) 1 (-31841.16)

Maximal consecutive profit (count of wins) 772331.08 (71) consecutive loss (count of losses) -31841.16 (1)

Average consecutive wins 71 consecutive losses 1

分享社交网络 · 3

Vladislav Berestenko

the new revised version EA eurjpy-m15 is checked by the moderator of the site. coming soon...

Vladislav Berestenko

NEW VERSION 1.01 !!!

Strategy Tester Report

eurjpy-m15-v1_01

Alpari-ECN-New (Build 560)

Symbol EURJPY (Euro vs Japanese Yen)

Period 15 Minutes (M15) 2013.01.02 09:00 - 2014.02.17 23:45 (2013.01.01 - 2014.02.18)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1430; indexTp=2150; slipage=10; index1Sl=2520; index1Tp=1780; Risk=4000;

Bars in test 28736 Ticks modelled 19714914 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 300.00 Spread 10

Total net profit 6707136.84 Gross profit 11098162.82 Gross loss -4391025.98

Profit factor 2.53 Expected payoff 22736.06

Absolute drawdown 119.34

Maximal drawdown 894271.25 (11.81%) Relative drawdown 74.36% (280482.25)

Total trades 295 Short positions (won %) 154 (84.42%) Long positions (won %) 141 (92.20%)

Profit trades (% of total) 260 (88.14%) Loss trades (% of total) 35 (11.86%)

Largest profit trade 188634.90 loss trade -224999.74

Average profit trade 42685.24 loss trade -125457.89

Maximum consecutive wins (profit in money) 33 (1672447.89) consecutive losses (loss in money) 3 (-349995.86)

Maximal consecutive profit (count of wins) 1672447.89 (33) consecutive loss (count of losses) -353034.74 (2)

Average consecutive wins 9 consecutive losses 1

Graph

Strategy Tester Report

eurjpy-m15-v1_01

Alpari-ECN-New (Build 560)

Symbol EURJPY (Euro vs Japanese Yen)

Period 15 Minutes (M15) 2013.01.02 09:00 - 2014.02.17 23:45 (2013.01.01 - 2014.02.18)

Model Every tick (the most precise method based on all available least timeframes)

Parameters Lots=0.1; MaximumRisk=0.02; DecreaseFactor=3; indexSl=1430; indexTp=2150; slipage=10; index1Sl=2520; index1Tp=1780; Risk=4000;

Bars in test 28736 Ticks modelled 19714914 Modelling quality 90.00%

Mismatched charts errors 0

Initial deposit 300.00 Spread 10

Total net profit 6707136.84 Gross profit 11098162.82 Gross loss -4391025.98

Profit factor 2.53 Expected payoff 22736.06

Absolute drawdown 119.34

Maximal drawdown 894271.25 (11.81%) Relative drawdown 74.36% (280482.25)

Total trades 295 Short positions (won %) 154 (84.42%) Long positions (won %) 141 (92.20%)

Profit trades (% of total) 260 (88.14%) Loss trades (% of total) 35 (11.86%)

Largest profit trade 188634.90 loss trade -224999.74

Average profit trade 42685.24 loss trade -125457.89

Maximum consecutive wins (profit in money) 33 (1672447.89) consecutive losses (loss in money) 3 (-349995.86)

Maximal consecutive profit (count of wins) 1672447.89 (33) consecutive loss (count of losses) -353034.74 (2)

Average consecutive wins 9 consecutive losses 1

Graph

分享社交网络 · 1

[删除]

2014.02.19

hi..can post or send me full strategy tester repor

: