Sarowar Jahan / 个人资料

- 信息

|

4 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

1

信号

|

2

订阅者

|

CEO

在

Let's Trade

Personal Contacts:

WhatsApp: +8801617276927

Email: sarowarjahan@outlook.com

WhatsApp: +8801617276927

Email: sarowarjahan@outlook.com

Sarowar Jahan

**EUR/USD Surges: Key Reasons Behind Last Week’s Rally**

The EUR/USD currency pair experienced a strong rally last week, reaching its highest level in four months. Traders and investors were caught off guard as the euro surged against the U.S. dollar, marking its largest three-day gain since November 2022. Let’s break down the key reasons behind this significant movement.

### 1. The ECB’s Interest Rate Cut & Forward Guidance

On March 6, 2025, the European Central Bank (ECB) reduced its benchmark interest rate by 0.25% to 2.5%. While rate cuts typically weaken a currency, the ECB simultaneously upgraded its inflation forecast. This shift led investors to believe that further rate reductions may not come as quickly as previously expected, which strengthened the euro in the forex market.

### 2. Increased Fiscal Spending in the Eurozone

Several major economic developments in the eurozone also contributed to the rally:

- Germany announced plans to reform its debt rules and establish a major infrastructure investment fund.

- The European Commission proposed borrowing €150 billion to boost defense spending across the region.

These fiscal initiatives are expected to stimulate economic growth, making the euro more attractive to investors.

### 3. U.S. Dollar Weakness Amid Trade Concerns

Another major factor driving EUR/USD higher was the weakness in the U.S. dollar. The U.S. administration introduced new tariffs on Canada, Mexico, and China, raising concerns about potential trade conflicts. Unlike previous trade wars, where the U.S. dollar strengthened as a safe-haven asset, this time investors are wary of prolonged economic disruptions and inflationary pressures. Additionally, expectations of future Federal Reserve rate cuts have dampened the dollar's appeal, leading to its relative weakness and allowing the euro to gain strength in comparison.

### What’s Next for EUR/USD?

With these recent developments, traders will be closely watching upcoming economic data, central bank decisions, and geopolitical events that could further impact EUR/USD. If the ECB maintains a cautious approach to rate cuts while European economies show resilience, the euro may continue to hold its gains.

**Stay updated with the latest forex insights and market trends!**

The EUR/USD currency pair experienced a strong rally last week, reaching its highest level in four months. Traders and investors were caught off guard as the euro surged against the U.S. dollar, marking its largest three-day gain since November 2022. Let’s break down the key reasons behind this significant movement.

### 1. The ECB’s Interest Rate Cut & Forward Guidance

On March 6, 2025, the European Central Bank (ECB) reduced its benchmark interest rate by 0.25% to 2.5%. While rate cuts typically weaken a currency, the ECB simultaneously upgraded its inflation forecast. This shift led investors to believe that further rate reductions may not come as quickly as previously expected, which strengthened the euro in the forex market.

### 2. Increased Fiscal Spending in the Eurozone

Several major economic developments in the eurozone also contributed to the rally:

- Germany announced plans to reform its debt rules and establish a major infrastructure investment fund.

- The European Commission proposed borrowing €150 billion to boost defense spending across the region.

These fiscal initiatives are expected to stimulate economic growth, making the euro more attractive to investors.

### 3. U.S. Dollar Weakness Amid Trade Concerns

Another major factor driving EUR/USD higher was the weakness in the U.S. dollar. The U.S. administration introduced new tariffs on Canada, Mexico, and China, raising concerns about potential trade conflicts. Unlike previous trade wars, where the U.S. dollar strengthened as a safe-haven asset, this time investors are wary of prolonged economic disruptions and inflationary pressures. Additionally, expectations of future Federal Reserve rate cuts have dampened the dollar's appeal, leading to its relative weakness and allowing the euro to gain strength in comparison.

### What’s Next for EUR/USD?

With these recent developments, traders will be closely watching upcoming economic data, central bank decisions, and geopolitical events that could further impact EUR/USD. If the ECB maintains a cautious approach to rate cuts while European economies show resilience, the euro may continue to hold its gains.

**Stay updated with the latest forex insights and market trends!**

分享社交网络 · 1

[删除]

2025.03.11

[删除]

Eri Nurdiyanto

2025.04.04

keep fighting

Sarowar Jahan

发布MetaTrader 4信号

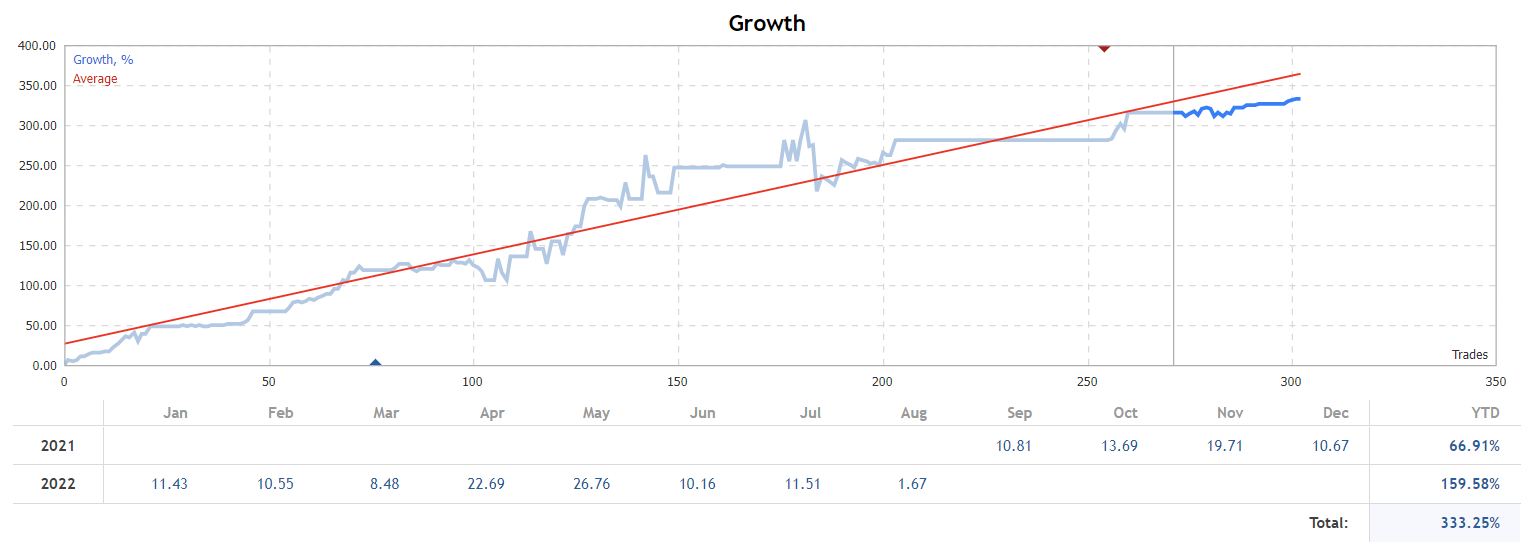

Yearly 30%-40% growth target. Do not invest below $5000 Warning: You can lose your funds too.

分享社交网络 · 1

1

Damilare Femi Akinsanya

2025.03.04

Hello i don’t have a good experience about withdrawal, I have not been able to withdraw my funds while selling signal, they are rejecting my card. That why i closed my signal account. My funds just stay there in my mql5 account. Please help me out if you can. Thanks.

Sarowar Jahan

🚀 **Exciting News!** 🚀

I’m thrilled to announce that my new personal website is now live! 🎉

Visit my website (https://www.sarowarjahan.com) to explore a range of resources, including:

Forex Trading Insights: Get the latest market analysis and strategies.

News Analysis: Stay informed with up-to-date news impacting the forex market.

Educational Posts: Enhance your trading skills with valuable insights.

Bank Signals: Get an update about latest my signals.

Fund Management Services: Learn about my personalized account management options for investors.

Your support means a lot to me, and I can’t wait to share this journey with all of you. Check it out and feel free to share your thoughts!

Thank you for being a part of this community! 🙌

I’m thrilled to announce that my new personal website is now live! 🎉

Visit my website (https://www.sarowarjahan.com) to explore a range of resources, including:

Forex Trading Insights: Get the latest market analysis and strategies.

News Analysis: Stay informed with up-to-date news impacting the forex market.

Educational Posts: Enhance your trading skills with valuable insights.

Bank Signals: Get an update about latest my signals.

Fund Management Services: Learn about my personalized account management options for investors.

Your support means a lot to me, and I can’t wait to share this journey with all of you. Check it out and feel free to share your thoughts!

Thank you for being a part of this community! 🙌

分享社交网络 · 3

Sarowar Jahan

XAU/USD to see strength back to $1,968, then $2,063/2,075 record highs – Credit Suisse

Gold has achieved Credit Suise’s target/support zone at $1,900/1,890, and the bank looks for a floor here.

A weekly close below $1,862 would be seen to reinforce the longer-term sideways range.

Gold has achieved our target of price support and the 38.2% retracement of the 2022/2023 uptrend at $1,900/1,890. With the key rising 200-DMA seen not far below $1,862, our bias remains for a major floor to be found here.

We thus look for $1,862 to hold on a closing basis for strength back to the 55-DMA at $1,968 initially, then a retest of major resistance at the $2,063/2,075 record highs. We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move above $2,300.

A weekly close below $1,862 though would be seen to reinforce the longer-term sideways range, and a fall to support next at $1,810/05.

Gold has achieved Credit Suise’s target/support zone at $1,900/1,890, and the bank looks for a floor here.

A weekly close below $1,862 would be seen to reinforce the longer-term sideways range.

Gold has achieved our target of price support and the 38.2% retracement of the 2022/2023 uptrend at $1,900/1,890. With the key rising 200-DMA seen not far below $1,862, our bias remains for a major floor to be found here.

We thus look for $1,862 to hold on a closing basis for strength back to the 55-DMA at $1,968 initially, then a retest of major resistance at the $2,063/2,075 record highs. We still stay biased to an eventual break to new record highs later in the year, which would then be seen to open the door to a move above $2,300.

A weekly close below $1,862 though would be seen to reinforce the longer-term sideways range, and a fall to support next at $1,810/05.

分享社交网络 · 9

显示全部评论 (4)

Yan Qing Zhao

2024.04.09

Your analysis is very correct, but it is a pity that you did not take risk control, which led to the loss of the whole game. I really feel sorry for you. I hope you can cheer up, continue to start, and believe in your strength

Sarowar Jahan

Three reasons to buy Gold now – UBS

Gold remains 8.2% higher since the start of this year, and economists at UBS think it is likely to break its all-time high later this year with multiple mid- to longer-term drivers.

1. Central bank demand should remain robust

“Central banks are on track to buy around 700 metric tons of Gold this year, much higher than the average since 2010 of below 500 metric tons. We think this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation.”

2. Broad US Dollar weakness supports Gold

“The direction of a weakening USD is clear, we believe the reduction in US yield carry will continue to weigh on the greenback. Gold has historically performed well when the US Dollar softens due to their strong negative correlation, and we see another round of USD weakness over the next 6-12 months.”

3. Rising US recession risks may prompt safe-haven flows

“Recent data coming out of the US showed the country’s growth is slowing. Tighter credit conditions, evidenced by the Fed’s latest Senior Loan Officer Opinion Survey, are also likely to weigh on growth and corporate profits. Based on data since 1980, Gold’s relative performance versus the S&P 500 improved significantly during US recessions.”

Gold remains 8.2% higher since the start of this year, and economists at UBS think it is likely to break its all-time high later this year with multiple mid- to longer-term drivers.

1. Central bank demand should remain robust

“Central banks are on track to buy around 700 metric tons of Gold this year, much higher than the average since 2010 of below 500 metric tons. We think this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation.”

2. Broad US Dollar weakness supports Gold

“The direction of a weakening USD is clear, we believe the reduction in US yield carry will continue to weigh on the greenback. Gold has historically performed well when the US Dollar softens due to their strong negative correlation, and we see another round of USD weakness over the next 6-12 months.”

3. Rising US recession risks may prompt safe-haven flows

“Recent data coming out of the US showed the country’s growth is slowing. Tighter credit conditions, evidenced by the Fed’s latest Senior Loan Officer Opinion Survey, are also likely to weigh on growth and corporate profits. Based on data since 1980, Gold’s relative performance versus the S&P 500 improved significantly during US recessions.”

分享社交网络 · 7

[删除]

2023.09.26

[删除]

Yan Qing Zhao

2024.04.09

Your analysis is very correct, but it is a pity that you did not take risk control, which led to the loss of the whole game. I really feel sorry for you. I hope you can cheer up, continue to start, and believe in your strength

Sarowar Jahan

USD: 3 Narratives Supporting A Stronger USD Into Year-End - ING

ING Research maintains a bullish bias on the USD over the coming weeks.

"Last week’s action in the FX market conveyed a clear message that it is too early to turn more structurally bearish on the dollar or bullish on pro-cyclical currencies. This week, markets may find further confirmation that this is the case, with a few key threads to follow.

First, US CPI figures on Thursday should show a decline (we estimate from 8.3% to 8.1%) in headline inflation caused primarily by lower gasoline prices, but at the same time an acceleration in the core rate (we estimate from 6.3% to 6.5%), mainly driven by housing costs and recreation prices," ING notes.

"Second, Fed communication. A 75bp hike for November and a 4.60-4.70% peak rate are now in the price, but additional hawkish comments – if backed by an inflation surprise for example – could encourage markets to speculate on larger hikes or a more prolonged tightening cycle.

Third, geopolitical and energy market developments. There have been signs over the weekend that any optimism over an imminent de-escalation in the Ukraine conflict may be misplaced.

A re-test of the 114.76 September high in DXY is our base case over the next few days," ING adds.

WhatsApp: +8801617276927

Telegram: https://t.me/SarowarJahan

ING Research maintains a bullish bias on the USD over the coming weeks.

"Last week’s action in the FX market conveyed a clear message that it is too early to turn more structurally bearish on the dollar or bullish on pro-cyclical currencies. This week, markets may find further confirmation that this is the case, with a few key threads to follow.

First, US CPI figures on Thursday should show a decline (we estimate from 8.3% to 8.1%) in headline inflation caused primarily by lower gasoline prices, but at the same time an acceleration in the core rate (we estimate from 6.3% to 6.5%), mainly driven by housing costs and recreation prices," ING notes.

"Second, Fed communication. A 75bp hike for November and a 4.60-4.70% peak rate are now in the price, but additional hawkish comments – if backed by an inflation surprise for example – could encourage markets to speculate on larger hikes or a more prolonged tightening cycle.

Third, geopolitical and energy market developments. There have been signs over the weekend that any optimism over an imminent de-escalation in the Ukraine conflict may be misplaced.

A re-test of the 114.76 September high in DXY is our base case over the next few days," ING adds.

WhatsApp: +8801617276927

Telegram: https://t.me/SarowarJahan

分享社交网络 · 5

Sarowar Jahan

新闻关于Peace 信号

I will increase my subscription fee from $30 to $40 after 15 days. Then it will stay at $40 for a long period of time

分享社交网络 · 2

Sarowar Jahan

EUR/USD: The Winter Is Coming; Expecting EUR/USD To Fall Towards 0.90 This Winter - Nomura

Nomura Research maintains a core bearish bias on EUR/USD into year-end.

"The inflation figures will take full focus in Europe next week. We expect a further rise in euro area HICP inflation in August, but expect the rise to be less sharp than previous increases. Naturally, for the market watching energy prices soar higher the question is how quickly will this feed through to CPI inflation with government subsidies making CPI inflaton artificially low for now. This is why euro area producer prices may stand out more as a true reflection of price pressures and are also our preferred metric for calculating EUR’s fair value," Nomura notes.

"We expect EUR/USD to fall to 0.90 this winter, inflation to climb further to multi-decade highs before peaking, GDP to decline over the coming year and the ECB first to raise rates in response to higher inflation, and then cut next year as the energy-induced recession continues," Nomura adds.

Nomura Research maintains a core bearish bias on EUR/USD into year-end.

"The inflation figures will take full focus in Europe next week. We expect a further rise in euro area HICP inflation in August, but expect the rise to be less sharp than previous increases. Naturally, for the market watching energy prices soar higher the question is how quickly will this feed through to CPI inflation with government subsidies making CPI inflaton artificially low for now. This is why euro area producer prices may stand out more as a true reflection of price pressures and are also our preferred metric for calculating EUR’s fair value," Nomura notes.

"We expect EUR/USD to fall to 0.90 this winter, inflation to climb further to multi-decade highs before peaking, GDP to decline over the coming year and the ECB first to raise rates in response to higher inflation, and then cut next year as the energy-induced recession continues," Nomura adds.

分享社交网络 · 3

Sarowar Jahan

EUR: Any Uptick On An Upward Surprise In EA CPI This Week Should Be Viewed As Opportunities To Sell - Barclays

Barclays Research discusses the EUR outlook and maintains a bearish bias over the coming weeks.

"This week, we expect Euro Area CPI (Wed) to grind further higher, with headline printing at 9.1% y/y (cf 9.0%, prev 8.9%) and core at 4.2% y/y (cf 4.1%, prev 4.0%), driven mainly by resilient consumer demand and the ongoing surge in food and energy prices. Markets are now pricing 50% chance of a 75bp hike by the ECB at its September meeting, following news that some GC members want to discuss a 75bp hike at the meeting. 1 Speaker, including Lane (Mon, dove), Vasle (Tue, hawk), Holzmann (Tue, hawk) et al, and Centeno (Thu, dove), could shed more light on the September decision before the ECB enters its blackout period after Friday," Barclays notes.

"An upward surprise in EA CPI, or hawkish comments from ECB doves, would likely push rates pricing up. But any resultant rallies in EUR are likely to be temporary, and should be viewed as opportunities to fade, in our view," Barclays adds.

Barclays Research discusses the EUR outlook and maintains a bearish bias over the coming weeks.

"This week, we expect Euro Area CPI (Wed) to grind further higher, with headline printing at 9.1% y/y (cf 9.0%, prev 8.9%) and core at 4.2% y/y (cf 4.1%, prev 4.0%), driven mainly by resilient consumer demand and the ongoing surge in food and energy prices. Markets are now pricing 50% chance of a 75bp hike by the ECB at its September meeting, following news that some GC members want to discuss a 75bp hike at the meeting. 1 Speaker, including Lane (Mon, dove), Vasle (Tue, hawk), Holzmann (Tue, hawk) et al, and Centeno (Thu, dove), could shed more light on the September decision before the ECB enters its blackout period after Friday," Barclays notes.

"An upward surprise in EA CPI, or hawkish comments from ECB doves, would likely push rates pricing up. But any resultant rallies in EUR are likely to be temporary, and should be viewed as opportunities to fade, in our view," Barclays adds.

分享社交网络 · 2

Sarowar Jahan

CAD: Chances Of USD/CAD Reaching 1.25 By Year-End Have Risen After BoC's 100bps Hike - ING

ING Research discusses USD/CAD outlook and maintains a core bearish bias into year-end targeting a move towards 1.25.

"Looking at the FX implications, we think that the BoC’s faster hiking could help the currency in the longer run but for now, external factors (eg, global risk sentiment, oil prices) continue to play a much bigger role and may keep CAD gains capped in the near-term.

"However, with CAD now sharing the highest policy rate in the G10 (2.50%) with the New Zealand dollar, and still counting on a decent economic outlook thanks to positive commodity exposure, the chances of USD/CAD moving back below 1.25 by year-end (barring a prolonged USD strength) have risen – in our view," ING adds.

ING Research discusses USD/CAD outlook and maintains a core bearish bias into year-end targeting a move towards 1.25.

"Looking at the FX implications, we think that the BoC’s faster hiking could help the currency in the longer run but for now, external factors (eg, global risk sentiment, oil prices) continue to play a much bigger role and may keep CAD gains capped in the near-term.

"However, with CAD now sharing the highest policy rate in the G10 (2.50%) with the New Zealand dollar, and still counting on a decent economic outlook thanks to positive commodity exposure, the chances of USD/CAD moving back below 1.25 by year-end (barring a prolonged USD strength) have risen – in our view," ING adds.

分享社交网络 · 6

Sarowar Jahan

USD: US CPI: Inflation Stunned Again In June; Clearly Supports A 75bp Hike From The Fed This Month - CIBC

CIBC Research discusses its reaction to today's US CPI print for the month of June.

"Inflation stunned again in the US in June, adding urgency to the Fed's rate hiking path. The 1.3% monthly advance in total CPI (vs. 1.1% consensus) left the annual rate of inflation at 9.1%, five ticks above the prior month, and above the consensus expectation of 8.8%. Gasoline and food prices were the main drivers of the acceleration in headline prices, but even excluding those categories showed that core inflation gained momentum, as it rose by 0.7% on the month (vs. 0.5% consensus). Shelter prices were a major contributor to that advance, adding to pressure from used cars amongst other categories. That left the annual rate a tick slower than the prior month at 5.9% (vs. 5.7% expected), with the deceleration reflecting base effects," CIBC notes.

"Although gasoline prices have fallen into July, suggesting an easing in headline inflation ahead, core annual inflation could accelerate ahead as base effects will no longer be biasing that measure down, while higher shelter prices will continue to feed through to that index. Overall, this data clearly supports a 75bp hike from the Fed later this month," CIBC adds.

CIBC Research discusses its reaction to today's US CPI print for the month of June.

"Inflation stunned again in the US in June, adding urgency to the Fed's rate hiking path. The 1.3% monthly advance in total CPI (vs. 1.1% consensus) left the annual rate of inflation at 9.1%, five ticks above the prior month, and above the consensus expectation of 8.8%. Gasoline and food prices were the main drivers of the acceleration in headline prices, but even excluding those categories showed that core inflation gained momentum, as it rose by 0.7% on the month (vs. 0.5% consensus). Shelter prices were a major contributor to that advance, adding to pressure from used cars amongst other categories. That left the annual rate a tick slower than the prior month at 5.9% (vs. 5.7% expected), with the deceleration reflecting base effects," CIBC notes.

"Although gasoline prices have fallen into July, suggesting an easing in headline inflation ahead, core annual inflation could accelerate ahead as base effects will no longer be biasing that measure down, while higher shelter prices will continue to feed through to that index. Overall, this data clearly supports a 75bp hike from the Fed later this month," CIBC adds.

分享社交网络 · 5

Sarowar Jahan

JPY: BoJ Not Signaling A Lack Of Tolerance Of JPY Weakness; USD/JPY To Remain Elevated - CIBC

CIBC Research discusses USD/JPY outlook and sees the pair remains elevated in the near term.

"It was notable that the recent BoJ policy statement included a rare FX reference. The BoJ detailed that “It is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan’s economic activity and prices.” The currency reference underlines that the BoJ is not totally immune to JPY weakness," CIBC notes.

"Although the monetary authorities are paying attention to the JPY, they are not necessarily signaling a lack of tolerance for JPY weakness, rather they are looking to avoid disorderly moves. As the BoJ signaled that 10-year JGB yields will continue to be capped UST-JGB spreads point towards USD/JPY remaining elevated," CIBC adds.

CIBC Research discusses USD/JPY outlook and sees the pair remains elevated in the near term.

"It was notable that the recent BoJ policy statement included a rare FX reference. The BoJ detailed that “It is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan’s economic activity and prices.” The currency reference underlines that the BoJ is not totally immune to JPY weakness," CIBC notes.

"Although the monetary authorities are paying attention to the JPY, they are not necessarily signaling a lack of tolerance for JPY weakness, rather they are looking to avoid disorderly moves. As the BoJ signaled that 10-year JGB yields will continue to be capped UST-JGB spreads point towards USD/JPY remaining elevated," CIBC adds.

分享社交网络 · 5

Sarowar Jahan

USD: Expecting A Brief Pause In The USD Rally Before Next High CPI Print - Danske

Danske Research discusses the USD outlook in light of yesterday's FOMC policy meeting.

"At the FOMC press conference, Fed Chair Jerome Powell had a lot of focus on 'dangers', 'data dependency', 'clouded outlook', and so forth. To us, this is playing a bit of both side and a more clear (hawkish) message could have been delivered, if he so wanted. At present, high-frequency indicators point towards one more 1% m/m print on the headline CPI and there is mostly tentative evidence that CPI has peaked. That said, markets sold (broad) USD and bought risk on the back of this somewhat ambiguous message. However, looking ahead, we see inflation prints as remaining high amid a cyclical slowdown. If data confirms this, then we also expect Fed to underpin our forecast for seeing EUR/USD towards parity in 12M," Danske notes.

"Our view is that Fed on the margin could have chosen to do more to underline hawkishness - and that we might see a brief pause in the USD rally before we see the next data print/evidence of high CPI and cyclical slowdown but that Fed did not push markets to add to such defensive pricing during the press conference," Danske adds.

Danske Research discusses the USD outlook in light of yesterday's FOMC policy meeting.

"At the FOMC press conference, Fed Chair Jerome Powell had a lot of focus on 'dangers', 'data dependency', 'clouded outlook', and so forth. To us, this is playing a bit of both side and a more clear (hawkish) message could have been delivered, if he so wanted. At present, high-frequency indicators point towards one more 1% m/m print on the headline CPI and there is mostly tentative evidence that CPI has peaked. That said, markets sold (broad) USD and bought risk on the back of this somewhat ambiguous message. However, looking ahead, we see inflation prints as remaining high amid a cyclical slowdown. If data confirms this, then we also expect Fed to underpin our forecast for seeing EUR/USD towards parity in 12M," Danske notes.

"Our view is that Fed on the margin could have chosen to do more to underline hawkishness - and that we might see a brief pause in the USD rally before we see the next data print/evidence of high CPI and cyclical slowdown but that Fed did not push markets to add to such defensive pricing during the press conference," Danske adds.

分享社交网络 · 5

Sarowar Jahan

USD: June FOMC: "Faster, Higher, Stronger' - CIBC

CIBC Research discusses its reaction to today's FOMC June policy decision.

"Too many inflation reports that tested the Fed’s patience have it adopting the Olympics slogan of “faster, higher, stronger” for its stance on rate hikes. Today’s 75bp hike to a range of 1.50-1.75% was hinted at through media contacts on Monday, so the market was well prepared, and with that mega-step came an appropriately hawkish statement. There was one dissenting voice in favor of a somewhat smaller 50bp hike.

The forecast underscores the higher starting point for inflation, and the willingness to take a larger bite out of growth ahead to bring price pressures down. GDP is now expected to be up only 1.7% Q4/Q4 this year and next (previously 2.8% and 2.2%), and the unemployment rate is also now expected to have to move up (to 4.1% by 2024) in order to achieve a core PCE reading close to target by the end of the forecast horizon," CIBC notes.

"The median dots show rates rising to 3.4% this year and 3.8% in 2023, which would be well above the 2.5% longer-run neutral projection. While we see that as overkill and unlikely to materialize, another 75bp move at the next FOMC, and a peak of 3.25% for the fed funds ceiling attained this year, now seems likely before Powell’s team sees enough signs of a slowing to stop at that level. With the Fed having normalized a 75bp move, we see the BoC also hiking by that amount in July, and the Bank getting to 2.75% this year before also seeing enough of a deceleration in growth and inflation to call it quits at that level.

Markets were braced for a big move today and a hawkish tilt to the dot plot projections, and as such reaction has been relatively limited so far," CIBC adds.

CIBC Research discusses its reaction to today's FOMC June policy decision.

"Too many inflation reports that tested the Fed’s patience have it adopting the Olympics slogan of “faster, higher, stronger” for its stance on rate hikes. Today’s 75bp hike to a range of 1.50-1.75% was hinted at through media contacts on Monday, so the market was well prepared, and with that mega-step came an appropriately hawkish statement. There was one dissenting voice in favor of a somewhat smaller 50bp hike.

The forecast underscores the higher starting point for inflation, and the willingness to take a larger bite out of growth ahead to bring price pressures down. GDP is now expected to be up only 1.7% Q4/Q4 this year and next (previously 2.8% and 2.2%), and the unemployment rate is also now expected to have to move up (to 4.1% by 2024) in order to achieve a core PCE reading close to target by the end of the forecast horizon," CIBC notes.

"The median dots show rates rising to 3.4% this year and 3.8% in 2023, which would be well above the 2.5% longer-run neutral projection. While we see that as overkill and unlikely to materialize, another 75bp move at the next FOMC, and a peak of 3.25% for the fed funds ceiling attained this year, now seems likely before Powell’s team sees enough signs of a slowing to stop at that level. With the Fed having normalized a 75bp move, we see the BoC also hiking by that amount in July, and the Bank getting to 2.75% this year before also seeing enough of a deceleration in growth and inflation to call it quits at that level.

Markets were braced for a big move today and a hawkish tilt to the dot plot projections, and as such reaction has been relatively limited so far," CIBC adds.

分享社交网络 · 3

Sarowar Jahan

USD: Overvaluation Worsens; GBP: A Recession Upson US - Credit Agricole

Credit Agricole CIB Research discusses the USD long-term fair-value and GBP near-term outlook.

"The recent USD broad rally has aggravated its overvaluation against the rest of G10 according to our latest G10 VALFeX model update based on the most recent quarterly data as of Q122. In particular, while the USD uptrend seemed to follow the currency’s improving real rate advantage against most of the G10 currencies, the FX gains contrasted with a loss of real yield advantage and relative productivity across the board," CACIB notes.

"A combination of weak economic data, returning Brexit fears and fragile global risk sentiment has sunk the GBP more recently and could keep it on the defensive in the very near term. Recent GDP data has suggested that the slowing UK economy has lost considerable momentum and may be on course to contract already in Q2 while the Johnson government proposed legislation yesterday that, if voted into law, will allow UK ministers to overturn the Northern Ireland (NI) protocol," CACIB adds.

Credit Agricole CIB Research discusses the USD long-term fair-value and GBP near-term outlook.

"The recent USD broad rally has aggravated its overvaluation against the rest of G10 according to our latest G10 VALFeX model update based on the most recent quarterly data as of Q122. In particular, while the USD uptrend seemed to follow the currency’s improving real rate advantage against most of the G10 currencies, the FX gains contrasted with a loss of real yield advantage and relative productivity across the board," CACIB notes.

"A combination of weak economic data, returning Brexit fears and fragile global risk sentiment has sunk the GBP more recently and could keep it on the defensive in the very near term. Recent GDP data has suggested that the slowing UK economy has lost considerable momentum and may be on course to contract already in Q2 while the Johnson government proposed legislation yesterday that, if voted into law, will allow UK ministers to overturn the Northern Ireland (NI) protocol," CACIB adds.

分享社交网络 · 1

Sarowar Jahan

USD/JPY: Trading The FOMC And BoJ - Nomura

Nomura Research discusses the USD reaction around this week's FOMC and BoJ policy meetings.

"The most important event for USD/JPY this week is the FOMC meeting on Wednesday. Although the market has priced in the possibility of a 50bp hike in September at 80-90%, the initial reaction is likely to be a stronger USD/JPY if the median 2022 dots is 2.875% and a weaker USD/JPY if it is 2.625%.

Actual JPY buying intervention is still unlikely, but the BOJ’s reaction this week is crucial for JPY. Although we do not expect the BOJ to change its policy at this week’s meeting after the BOJ shared concerns over rapid JPY weakness with the government in the statement, Governor Kuroda’s comments on FX may clearly change, potentially judging JPY weakness is no longer positive for Japan’s economy. Then, investors’ expectations for BOJ normalization may recover, which would likely strengthen JPY," Nomura notes.

"Recent price action has been disappointing for our bullish JPY view, but we still believe USD/JPY retracement is likely into H2 this year, maintaining USD/JPY short exposure via digi put options (125, expire on 5 September)," Nomura adds.

Nomura Research discusses the USD reaction around this week's FOMC and BoJ policy meetings.

"The most important event for USD/JPY this week is the FOMC meeting on Wednesday. Although the market has priced in the possibility of a 50bp hike in September at 80-90%, the initial reaction is likely to be a stronger USD/JPY if the median 2022 dots is 2.875% and a weaker USD/JPY if it is 2.625%.

Actual JPY buying intervention is still unlikely, but the BOJ’s reaction this week is crucial for JPY. Although we do not expect the BOJ to change its policy at this week’s meeting after the BOJ shared concerns over rapid JPY weakness with the government in the statement, Governor Kuroda’s comments on FX may clearly change, potentially judging JPY weakness is no longer positive for Japan’s economy. Then, investors’ expectations for BOJ normalization may recover, which would likely strengthen JPY," Nomura notes.

"Recent price action has been disappointing for our bullish JPY view, but we still believe USD/JPY retracement is likely into H2 this year, maintaining USD/JPY short exposure via digi put options (125, expire on 5 September)," Nomura adds.

分享社交网络 · 2

Sarowar Jahan

CAD: BoC May Deliver A Larger 75bps In July; USD/CAD To Drift Towards 1.20 Through Year-End - Credit Agricole

Credit Agricole CIB Research discusses CAD outlook and maintains a bullish bias through year-end.

"The CAD has been supported by the combination of (1) an extended rally in oil prices, as they were hardly impressed by the OPEC+ promise to ramp up production in the coming months; and (2) a more hawkish BoC in June as it stands ready to act more forcefully after back-to-back 50bp rate hikes. At this stage, the second driver may not offer much more of a boost to the CAD in the near term, unless the BoC is to step up its tightening with the delivery of a larger 75bp rise in July," CACIB notes.

"Ultimately, prospects of high energy prices for longer could be a more solid backbone for additional CAD gains further down the line, albeit coming more as a slow-burner support than an immediate boost. Our forecasts continue to look for USD/CAD to slowly drift towards 1.20 for the rest of the year, while a light domestic agenda is unlikely to provide any sort of catalyst next week," CACIB adds.

Credit Agricole CIB Research discusses CAD outlook and maintains a bullish bias through year-end.

"The CAD has been supported by the combination of (1) an extended rally in oil prices, as they were hardly impressed by the OPEC+ promise to ramp up production in the coming months; and (2) a more hawkish BoC in June as it stands ready to act more forcefully after back-to-back 50bp rate hikes. At this stage, the second driver may not offer much more of a boost to the CAD in the near term, unless the BoC is to step up its tightening with the delivery of a larger 75bp rise in July," CACIB notes.

"Ultimately, prospects of high energy prices for longer could be a more solid backbone for additional CAD gains further down the line, albeit coming more as a slow-burner support than an immediate boost. Our forecasts continue to look for USD/CAD to slowly drift towards 1.20 for the rest of the year, while a light domestic agenda is unlikely to provide any sort of catalyst next week," CACIB adds.

分享社交网络 · 2

: