Evgeniy Scherbina / 个人资料

- 信息

|

12+ 年

经验

|

33

产品

|

595

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

Evgeniy Scherbina

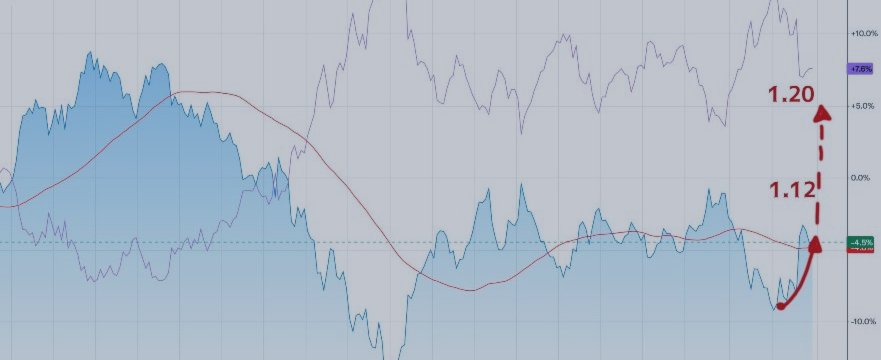

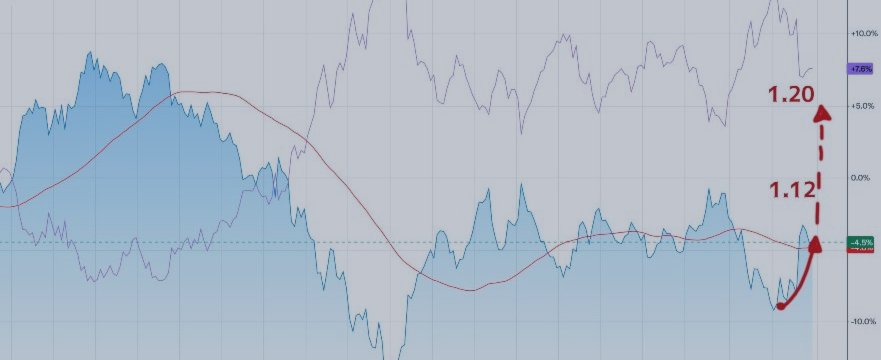

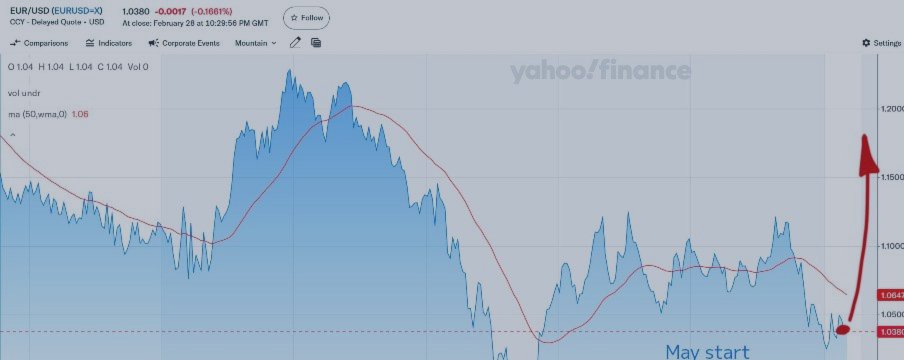

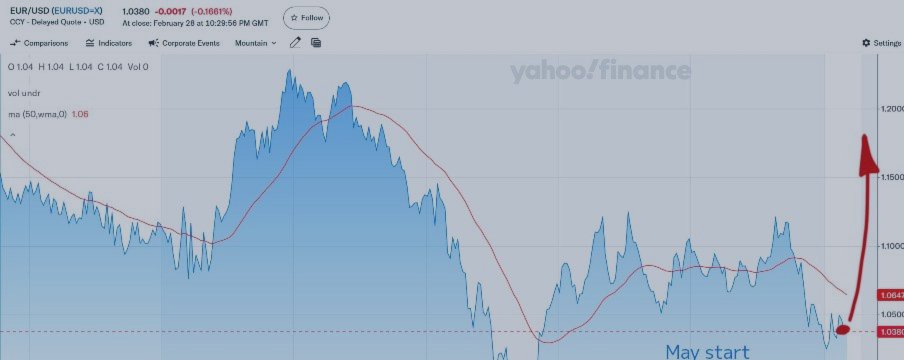

Hi everyone! Let’s update our forecasts for May. The broader "risk-on" trend is still in play, which means the USD is likely to keep weakening against other currencies. EurUsd: Last time , I called the April rally correctly — and EurUsd is still in a strong position, eyeing that big 1.20 target...

分享社交网络 · 2

120

Evgeniy Scherbina

Hi, everyone. A few words about this newest trend in machine learning - the Transformer!

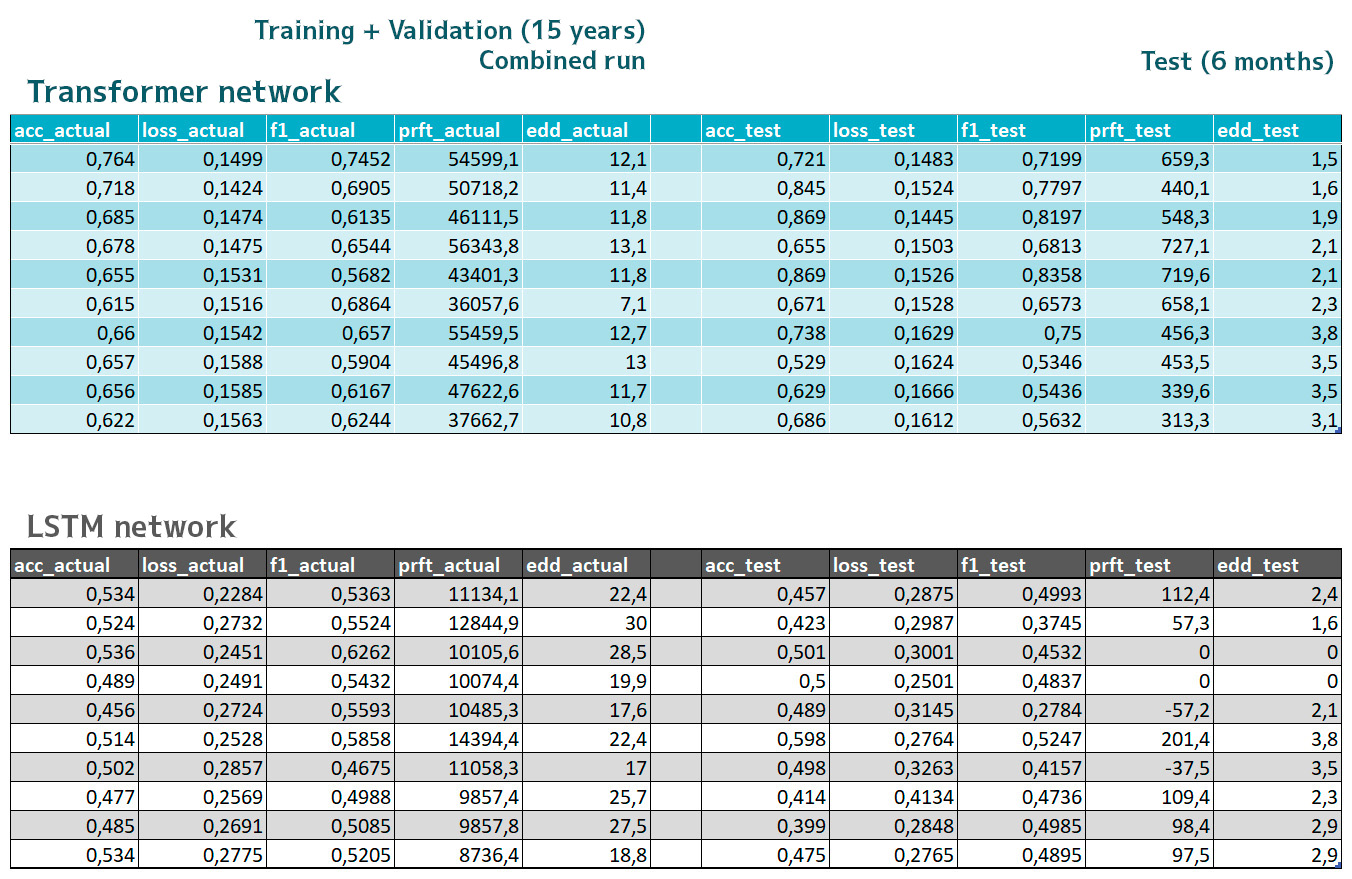

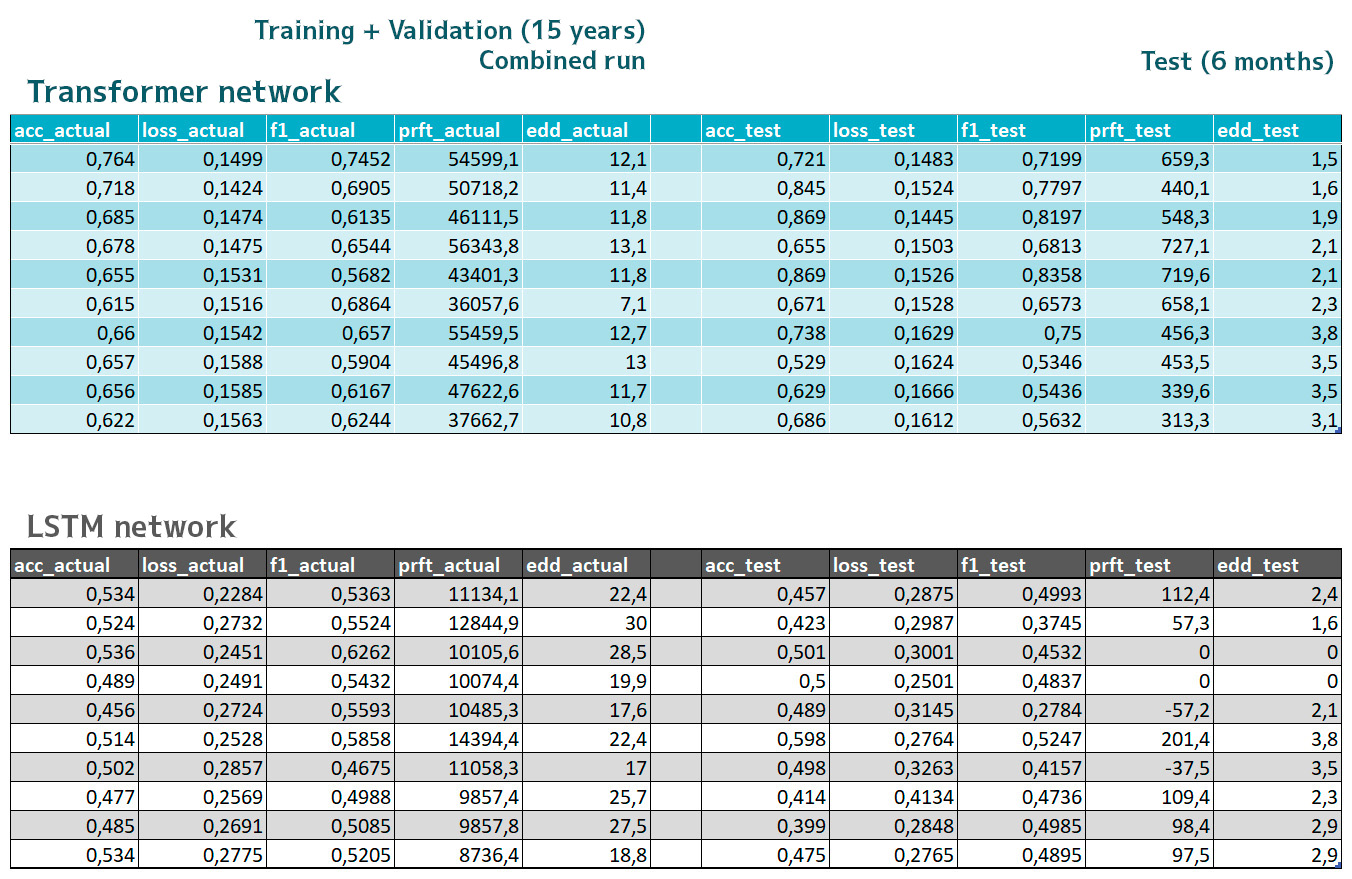

The Transformer architecture was first introduced by Google in 2017 for language translation tasks. Since then, this type of neural network has been widely adopted for building artificial intelligence systems, including ChatGPT. The key difference with the Transformer is that it encodes each input into a high-dimensional space (tens of thousands of dimensions), allowing it to capture complex relationships between all elements in the sequence. This approach sparked a revolution in machine learning, initially discussed only among experts, but later driving major advances as AI became more mainstream. As a result, Transformer models have increasingly replaced LSTMs in many fields, including financial market forecasting.

What impressed me the most is that the Transformer is able to continue learning even when the validation data differs from the training data. In my experience, LSTM networks often require the validation set to contain similar patterns to the training set in order to make further progress. When the validation examples are too different, LSTM training does not move at all. The Transformer, however, generalizes much better and continues to improve even on unfamiliar validation data. My tests show that the Transformer significantly outperforms LSTM in binary classification tasks.

The Transformer architecture was first introduced by Google in 2017 for language translation tasks. Since then, this type of neural network has been widely adopted for building artificial intelligence systems, including ChatGPT. The key difference with the Transformer is that it encodes each input into a high-dimensional space (tens of thousands of dimensions), allowing it to capture complex relationships between all elements in the sequence. This approach sparked a revolution in machine learning, initially discussed only among experts, but later driving major advances as AI became more mainstream. As a result, Transformer models have increasingly replaced LSTMs in many fields, including financial market forecasting.

What impressed me the most is that the Transformer is able to continue learning even when the validation data differs from the training data. In my experience, LSTM networks often require the validation set to contain similar patterns to the training set in order to make further progress. When the validation examples are too different, LSTM training does not move at all. The Transformer, however, generalizes much better and continues to improve even on unfamiliar validation data. My tests show that the Transformer significantly outperforms LSTM in binary classification tasks.

分享社交网络 · 3

Evgeniy Scherbina

Hi. I am updating my monthly assessment of the major trends on Forex. The overall trend can be described as "appeasement," which means Usd will be losing ground to other currencies in April. I was correct about an up move by EurUsd the previous time . It has not yet reached 1...

分享社交网络 · 3

167

Evgeniy Scherbina

What's up, guys! These are the latest improvement in the version 3.1 of LuminaFX:

1. A control of spread instead of "time open" and "time close" properties. Spreads tend to widen over midnight, and when spreads become usual again, trading resumes.

2. A new "Close all" function. It is now one property - "Close all profit (%)" - which triggers for all trades at any time when the value is reached. The historical chart may now look more straight-lined due to this. Trades can be reopened the next day, so after this function triggers, new trades will be opened only next week.

3. The "Max trades per signal" property changed, and now it count all trades for one symbol.

Plus some other minor impovements!

1. A control of spread instead of "time open" and "time close" properties. Spreads tend to widen over midnight, and when spreads become usual again, trading resumes.

2. A new "Close all" function. It is now one property - "Close all profit (%)" - which triggers for all trades at any time when the value is reached. The historical chart may now look more straight-lined due to this. Trades can be reopened the next day, so after this function triggers, new trades will be opened only next week.

3. The "Max trades per signal" property changed, and now it count all trades for one symbol.

Plus some other minor impovements!

分享社交网络 · 3

Evgeniy Scherbina

Hi. Gold broke the upper limit in 2024. And it still shows no sign of stopping. New threats of tariffs from Trump and a failed peace deal add more uncertainty and, hence, may push Gold up for the next few weeks. I don't think Gold will be rising forever, though...

分享社交网络 · 7

192

Evgeniy Scherbina

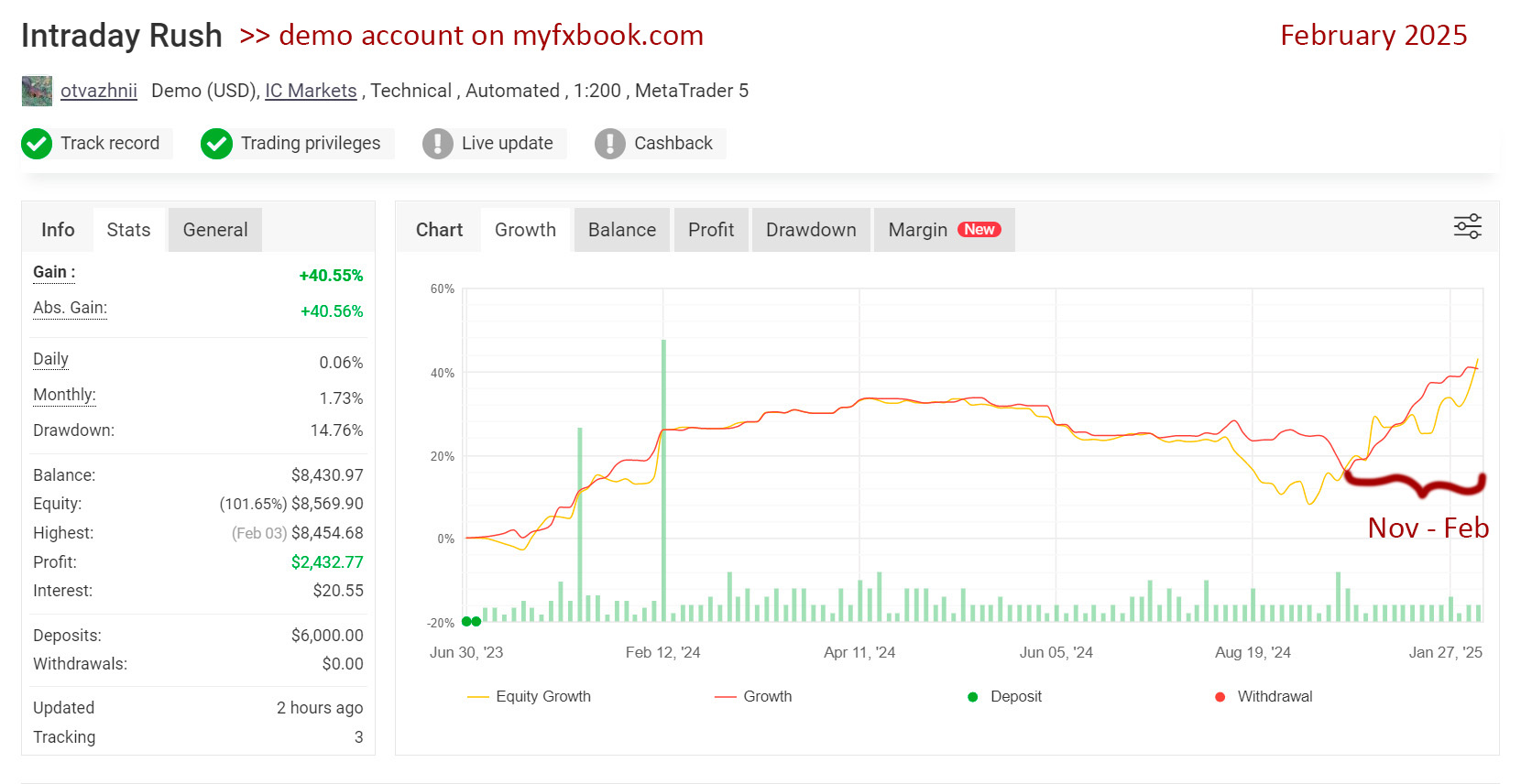

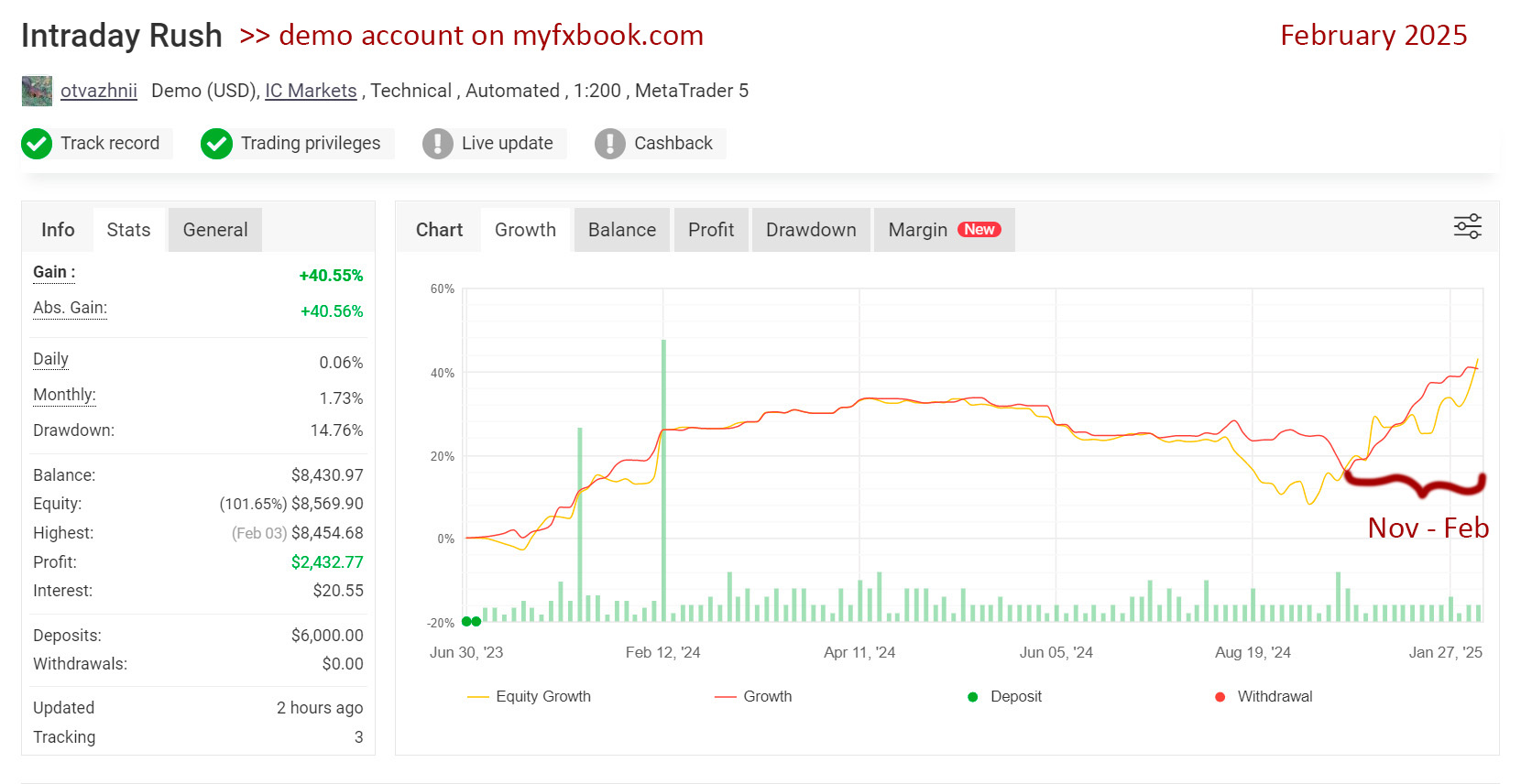

Hey, what's up guys! I guess this experiment with the H2 timeframe has been no good. It is tricky, but the bottom line is that it is not safe long-term. There may be periods where the H2 timeframe is extremely helpful and profitable. But then in other periods, it is just losing and losing.

The other good idea, in addition to the Daily timeframe with 1net, is to exploit the Daily timeframe with 2nets. As the picture below shows, the "Intraday Rush" EA has been pushing up in the last 4 months straightforwardly. It only exploits the 2nets approach. I have this approach implemented in both "QuantumPip" and "LuminaFX". However, considering all the changes I introduced in the last couple of months, the 2nets approach is currently off. So what I am going to do is re-activate the 2nets approach and it will again complement the 1net approach.

The other good idea, in addition to the Daily timeframe with 1net, is to exploit the Daily timeframe with 2nets. As the picture below shows, the "Intraday Rush" EA has been pushing up in the last 4 months straightforwardly. It only exploits the 2nets approach. I have this approach implemented in both "QuantumPip" and "LuminaFX". However, considering all the changes I introduced in the last couple of months, the 2nets approach is currently off. So what I am going to do is re-activate the 2nets approach and it will again complement the 1net approach.

分享社交网络 · 5

Evgeniy Scherbina

What's up, guys!

A few words regarding the approach I am using to define what is profitable and what is not. Below is a picture showing that a neural network struggled to make a profit for 2 months, and after that it found its trend up. What this means is that Forex trading is based on probabilities, and the reality is that a 51% forecast should be considered good. Although it may sound like a trick, it is not. I have tried to explain many times that if a strategy learns the history too well, it cannot make new correct decisions in new incorrect situations. So we have to accept that a strategy may be struggling for 1-2 months before it can make a profit.

My best approach so far in both free and paid EAs implements this concept. I have recently found a way to combine data of different symbols and to prolong the training for 200-300 epochs while improving the neural loss by tiny bits of 5-6 digits after the dot. This is outstanding. The neural network improves its knowledge about historical patterns without moving away from the dangerous border of the neural loss.

All of this does not mean there will never be another improvement. I am working and testing again and again. And I constantly keep my attentive eye on all the novelties in the machine learning area. So let's do it!

A few words regarding the approach I am using to define what is profitable and what is not. Below is a picture showing that a neural network struggled to make a profit for 2 months, and after that it found its trend up. What this means is that Forex trading is based on probabilities, and the reality is that a 51% forecast should be considered good. Although it may sound like a trick, it is not. I have tried to explain many times that if a strategy learns the history too well, it cannot make new correct decisions in new incorrect situations. So we have to accept that a strategy may be struggling for 1-2 months before it can make a profit.

My best approach so far in both free and paid EAs implements this concept. I have recently found a way to combine data of different symbols and to prolong the training for 200-300 epochs while improving the neural loss by tiny bits of 5-6 digits after the dot. This is outstanding. The neural network improves its knowledge about historical patterns without moving away from the dangerous border of the neural loss.

All of this does not mean there will never be another improvement. I am working and testing again and again. And I constantly keep my attentive eye on all the novelties in the machine learning area. So let's do it!

分享社交网络 · 7

Evgeniy Scherbina

What’s up, guys! I have found another way to incorporate the H2 timeframe into my strategies. I removed the H2 previously, because it loses badly in a trending market. Now I think it should be Ok if the H2 timeframe only activates when the D1 timeframe is in the period of uncertainty. Like EURUSD right now, it is neither buy nor sell. But it is still fluctuating swiftly, and it is the H2 timeframe that should be able to make a profit on this non-trending volatility. I am going to add the H2 strategy to both QuantumPip and LuminaFX very soon. Stay tuned!

分享社交网络 · 5

Evgeniy Scherbina

Hi! In this post, I tried to analyze the market leaders in depth. And I explored more than the usual top 10. I went deeper to unconver as many as 50 experts from the list of best-selling experts! My goal was not to mock all the strategies selling in the market top...

分享社交网络 · 9

1634

9

Evgeniy Scherbina

Only until January 10th! The prices are reduced!

Atari - new price 185 USD (down from 385 USD)

QuantumPip and QuantumPip MT4 - new price 185 USD (down from 385 USD)

LuminaFX - new price 165 USD (down from 285 USD)

And, of course, you can rent these products for 6 months at even lower prices! Check them out!

Atari - new price 185 USD (down from 385 USD)

QuantumPip and QuantumPip MT4 - new price 185 USD (down from 385 USD)

LuminaFX - new price 165 USD (down from 285 USD)

And, of course, you can rent these products for 6 months at even lower prices! Check them out!

分享社交网络 · 2

Evgeniy Scherbina

What's up, guys!

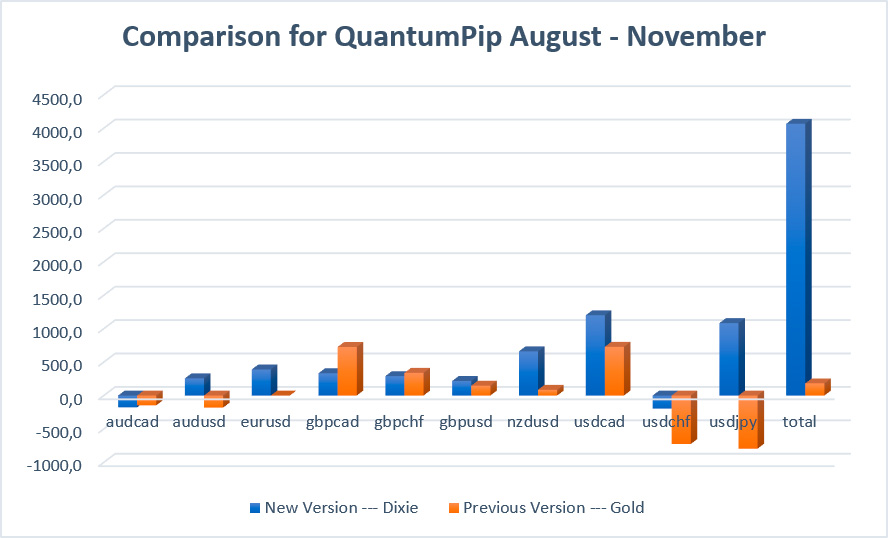

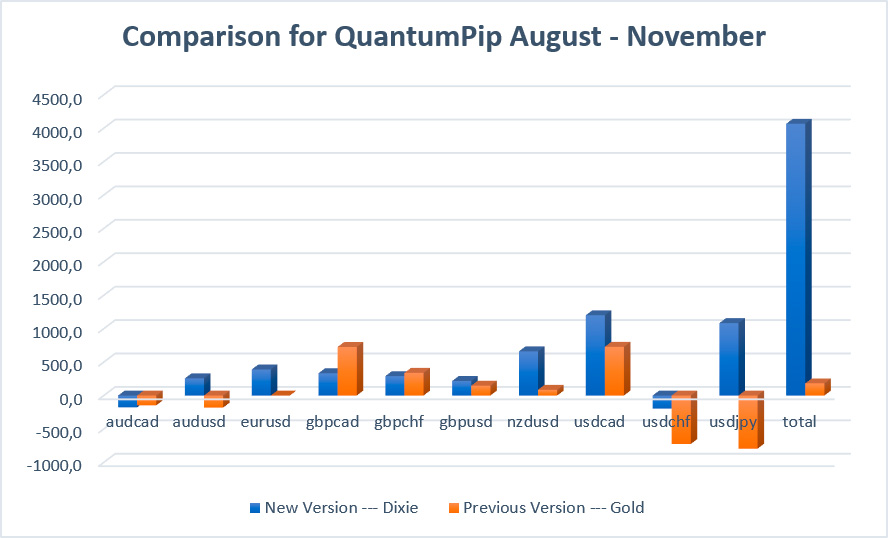

I have been working hard to update the QuantumPip expert and make it more adaptive to the quickly changing market environment. In my previous tests, Gold has had the upper hand as a solid supporting symbol. But frankly, there is not much correlation between currency symbols and Gold if we look at the last 6 months. This is what accounted for a low or even negative (in certain configurations) profitability in the second half of 2024. Vice versa, "Dixie", as a supporting symbol, has a strong link with the currency symbols because this indicator is their balanced sum by nature.

Last time I promised to add a separate neural network for closing trades and remove the "2nets" network. It appears this task would require more tests. Right now, I have found a more reliable approach to train the networks by manipulating dropouts and recurrent dropouts in neural layers, which have been recently reconfigured by the team of TensorFlow.

Nothing should stand still. The new version of QuantumPip will prioritize using the "Dixie" indicator as a supporting symbol instead of Gold. It is going to use a more versatile system of weighted prices, Standard Deviation, and a few other indicators as inputs. This should be more reliable, more adaptive, and more profitable than anything we have had so far.

I have been working hard to update the QuantumPip expert and make it more adaptive to the quickly changing market environment. In my previous tests, Gold has had the upper hand as a solid supporting symbol. But frankly, there is not much correlation between currency symbols and Gold if we look at the last 6 months. This is what accounted for a low or even negative (in certain configurations) profitability in the second half of 2024. Vice versa, "Dixie", as a supporting symbol, has a strong link with the currency symbols because this indicator is their balanced sum by nature.

Last time I promised to add a separate neural network for closing trades and remove the "2nets" network. It appears this task would require more tests. Right now, I have found a more reliable approach to train the networks by manipulating dropouts and recurrent dropouts in neural layers, which have been recently reconfigured by the team of TensorFlow.

Nothing should stand still. The new version of QuantumPip will prioritize using the "Dixie" indicator as a supporting symbol instead of Gold. It is going to use a more versatile system of weighted prices, Standard Deviation, and a few other indicators as inputs. This should be more reliable, more adaptive, and more profitable than anything we have had so far.

分享社交网络 · 2

Evgeniy Scherbina

What's up guys!

I am working to publish a new update of QuantumPip next week.

1) I will end the "2nets" approach. All open trades will be treated as "1net" trades.

2) I will add a "2 steps" approach instead. 1st step to open trades, 2nd step to close trades - all trained as different neural networks. The new closing network will take into account the duration and profitability of open trades. Possibly, I will make it as a timeseries, too. This may have additional information on how a trade developed, in addition to indicator values.

I am going to publish comparative pictures soon.

You cannot test the current 2.4 version of QuantumPip beyond October 23rd, latest update, unless you have an active copy on your account. The active copy downloads fresh data from Yahoo Finance. Since experts cannot download data in historical testing, this is only limited to active copies. I will update it next week, so historical testing will move on, too.

I am working to publish a new update of QuantumPip next week.

1) I will end the "2nets" approach. All open trades will be treated as "1net" trades.

2) I will add a "2 steps" approach instead. 1st step to open trades, 2nd step to close trades - all trained as different neural networks. The new closing network will take into account the duration and profitability of open trades. Possibly, I will make it as a timeseries, too. This may have additional information on how a trade developed, in addition to indicator values.

I am going to publish comparative pictures soon.

You cannot test the current 2.4 version of QuantumPip beyond October 23rd, latest update, unless you have an active copy on your account. The active copy downloads fresh data from Yahoo Finance. Since experts cannot download data in historical testing, this is only limited to active copies. I will update it next week, so historical testing will move on, too.

分享社交网络 · 1

Evgeniy Scherbina

The US election is 2 days away. My final thoughts are: Gold will go down sharply as long as there is a clear result.

They want Trump because they think prices under Trump were lower. What? Was it not the direct result of a balanced economic approach under Obama for 8 years preceding Trump, that provided for a stable economic situation? And then it was the irrational, anti-economic measures under Trump (like exits from the Paris Agreement, Mercosur or whatever else), which inevitably brought about higher prices in the 4 years following Trump? Am I the only one so smart and out of the American race?

They want Harris because they do not want Trump. This is what they say. They advertize for Harris with ads showing men, not women. Do they advertize for Trump with women in the ads? No! Is it because most men in America can't stand a woman so powerful and so childfree and so unbound by the kitchen duties?

Gold will go down sharply once it is clear that either of the two has won. Gold will go up sharply if it is still not clearly by the end of Tuesday who has won. The uncertainty is not about who wins. The uncertainty is about whether it will be a clear victory.

My bet is Kamala will do what Hillary could not. Remember Hillary Clinton won by votes, but lost by electors. She almost did it. What's more, she might have lost because of the ill-advised approach where to campaign in the last few days. Or simply because they could not stand a woman as president.

Gold will go down sharply when Harris wins. Euro, Chf, Gbp, Jpy and others will appreciate sharply against Usd.

Alright. Are we set? I guess we are.

They want Trump because they think prices under Trump were lower. What? Was it not the direct result of a balanced economic approach under Obama for 8 years preceding Trump, that provided for a stable economic situation? And then it was the irrational, anti-economic measures under Trump (like exits from the Paris Agreement, Mercosur or whatever else), which inevitably brought about higher prices in the 4 years following Trump? Am I the only one so smart and out of the American race?

They want Harris because they do not want Trump. This is what they say. They advertize for Harris with ads showing men, not women. Do they advertize for Trump with women in the ads? No! Is it because most men in America can't stand a woman so powerful and so childfree and so unbound by the kitchen duties?

Gold will go down sharply once it is clear that either of the two has won. Gold will go up sharply if it is still not clearly by the end of Tuesday who has won. The uncertainty is not about who wins. The uncertainty is about whether it will be a clear victory.

My bet is Kamala will do what Hillary could not. Remember Hillary Clinton won by votes, but lost by electors. She almost did it. What's more, she might have lost because of the ill-advised approach where to campaign in the last few days. Or simply because they could not stand a woman as president.

Gold will go down sharply when Harris wins. Euro, Chf, Gbp, Jpy and others will appreciate sharply against Usd.

Alright. Are we set? I guess we are.

分享社交网络 · 3

Evgeniy Scherbina

What's up, guys! I can't stop laughing... analyzing and laughing again. So I am doing yet another assessment of the top 10 of the market. The previous assessment of October 2nd is here . NB: My assessment in this blog post may be totally wrong. I will recheck the top 10 after one month...

分享社交网络 · 4

3502

Evgeniy Scherbina

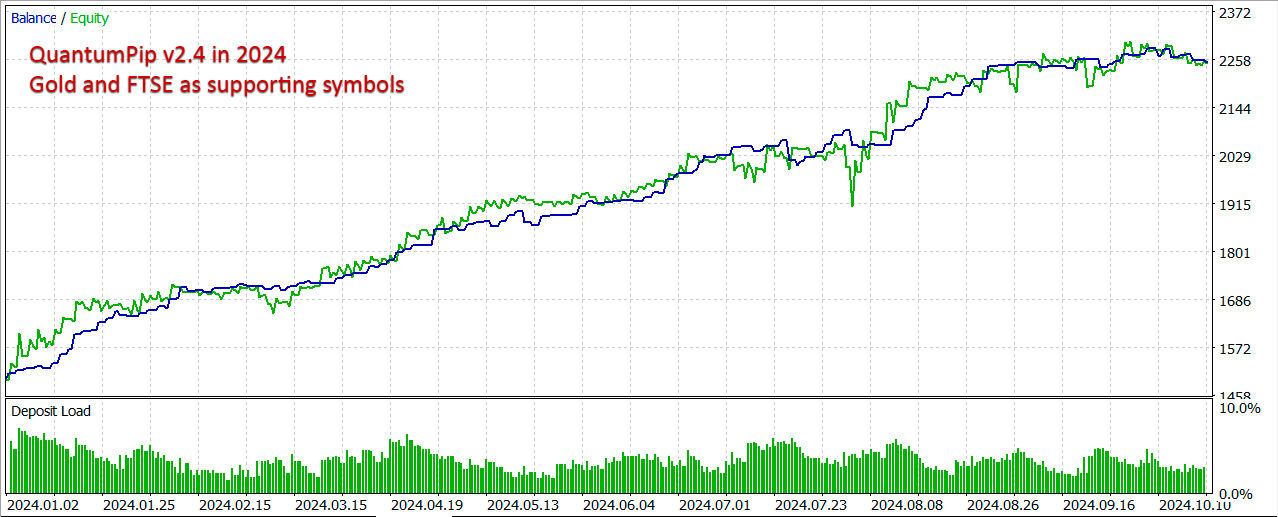

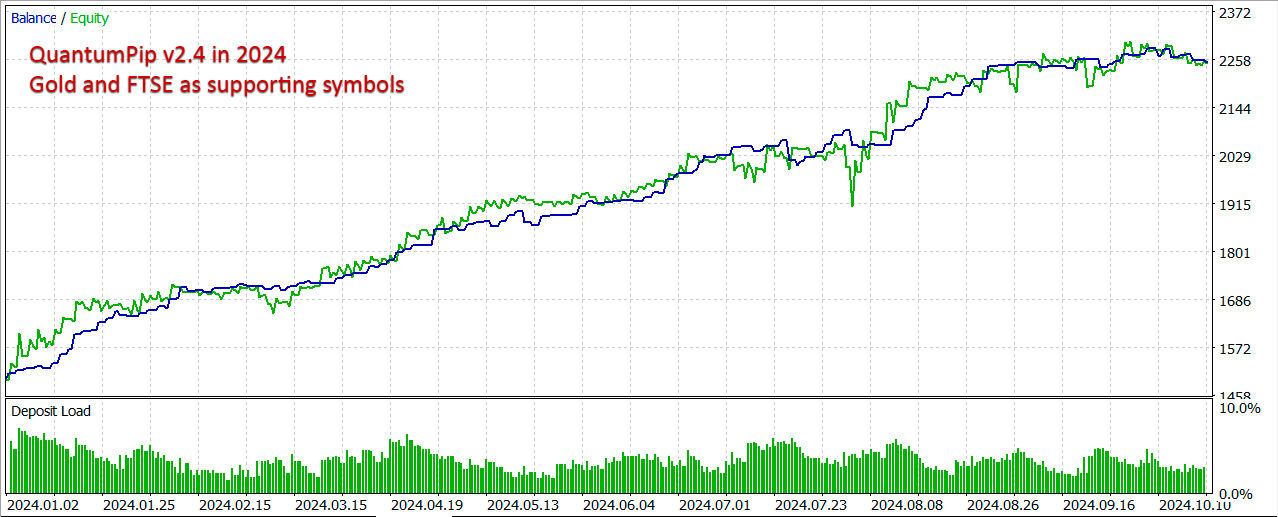

Hi, everyone. Finally, the version 2.4 with the 5 supporting symbols is there. I recommend _Gold, Oil or FTSE in any combination.

For those who will update from the previous versions, this version 2.4 will close the existing sells of USDJPY. So I recommend switching off USDJPY for some time (USDJPY=False).

We are now heading towards the US presidential election. Hence all the uncertainty. USD should let it go somewhat. The economies are going up. It is soon Christmas. And we've seen this before.

Again, a comment on the performance of the 2 latest versions of QuantumPip. As we can see in the picture of the progress in 2024, there may be a month or 2 months with no clear gain or even a loss. But it is eventually followed with an up movement.

QuantumPip is now currently to favor against USD. I think that it is correct. Except for USDJPY. USDJPY has seen very large moves this year. After the fog of the US election gets clearer, JPY will inevitably appreciate because, specifically for this purpose, they historically increased the exchange rate in Japan.

Cheers, if you have questions or suggestions, let me know! Profits will come our way!!

For those who will update from the previous versions, this version 2.4 will close the existing sells of USDJPY. So I recommend switching off USDJPY for some time (USDJPY=False).

We are now heading towards the US presidential election. Hence all the uncertainty. USD should let it go somewhat. The economies are going up. It is soon Christmas. And we've seen this before.

Again, a comment on the performance of the 2 latest versions of QuantumPip. As we can see in the picture of the progress in 2024, there may be a month or 2 months with no clear gain or even a loss. But it is eventually followed with an up movement.

QuantumPip is now currently to favor against USD. I think that it is correct. Except for USDJPY. USDJPY has seen very large moves this year. After the fog of the US election gets clearer, JPY will inevitably appreciate because, specifically for this purpose, they historically increased the exchange rate in Japan.

Cheers, if you have questions or suggestions, let me know! Profits will come our way!!

分享社交网络 · 2

Sergey Porphiryev

2024.10.23

JPY will inevitably appreciate - it is not about USDJPY, yeah? Its about exactly JPY?

* for clearly

* for clearly

Evgeniy Scherbina

What's up, guys! Below is my newest assessment of the top 10 of the market. The previous assessment of August 1st is here . As usual, I will compare what has changed since the previous assessment. I will indicate whether same or different authors have presented new products...

分享社交网络 · 4

2194

2

Evgeniy Scherbina

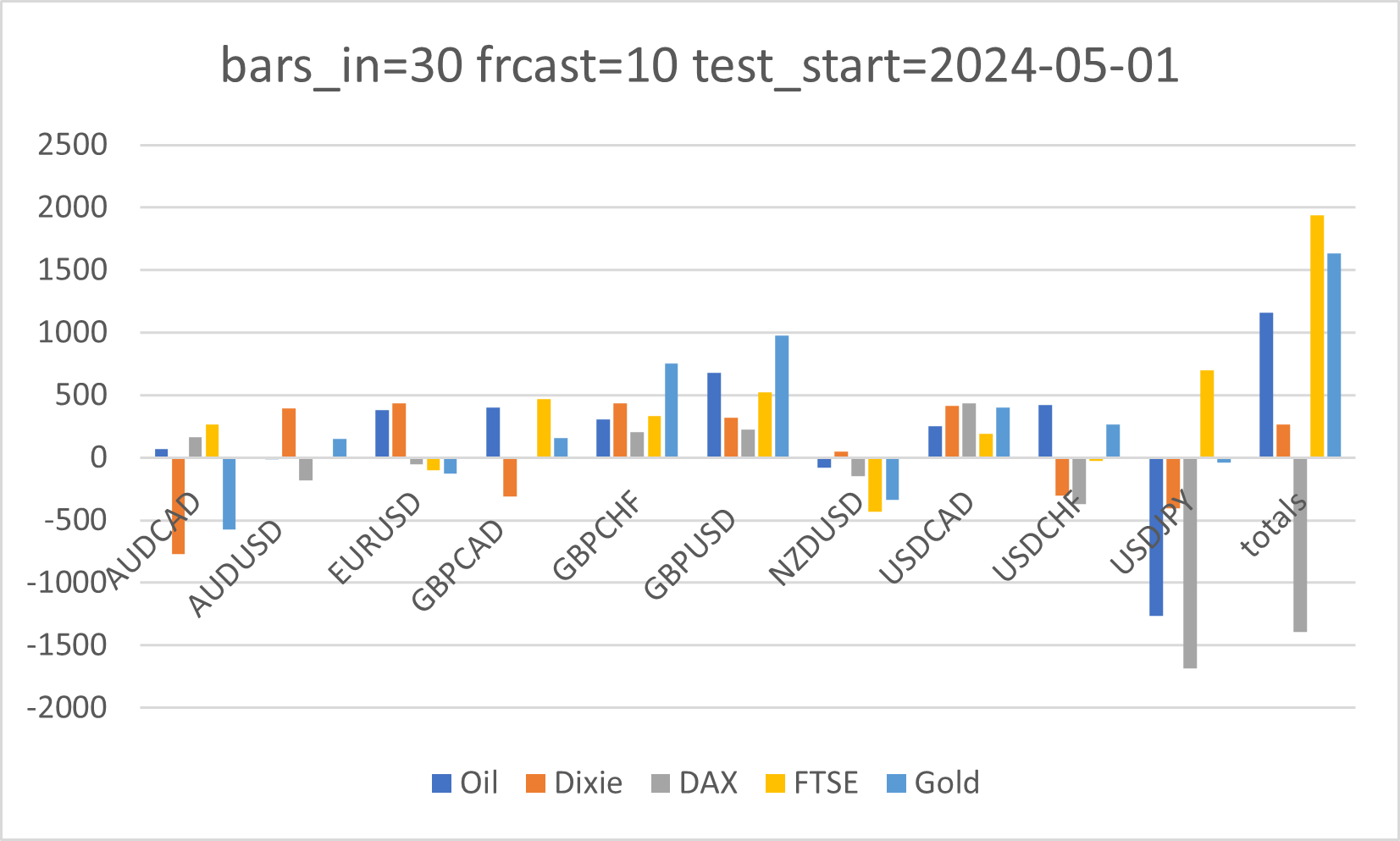

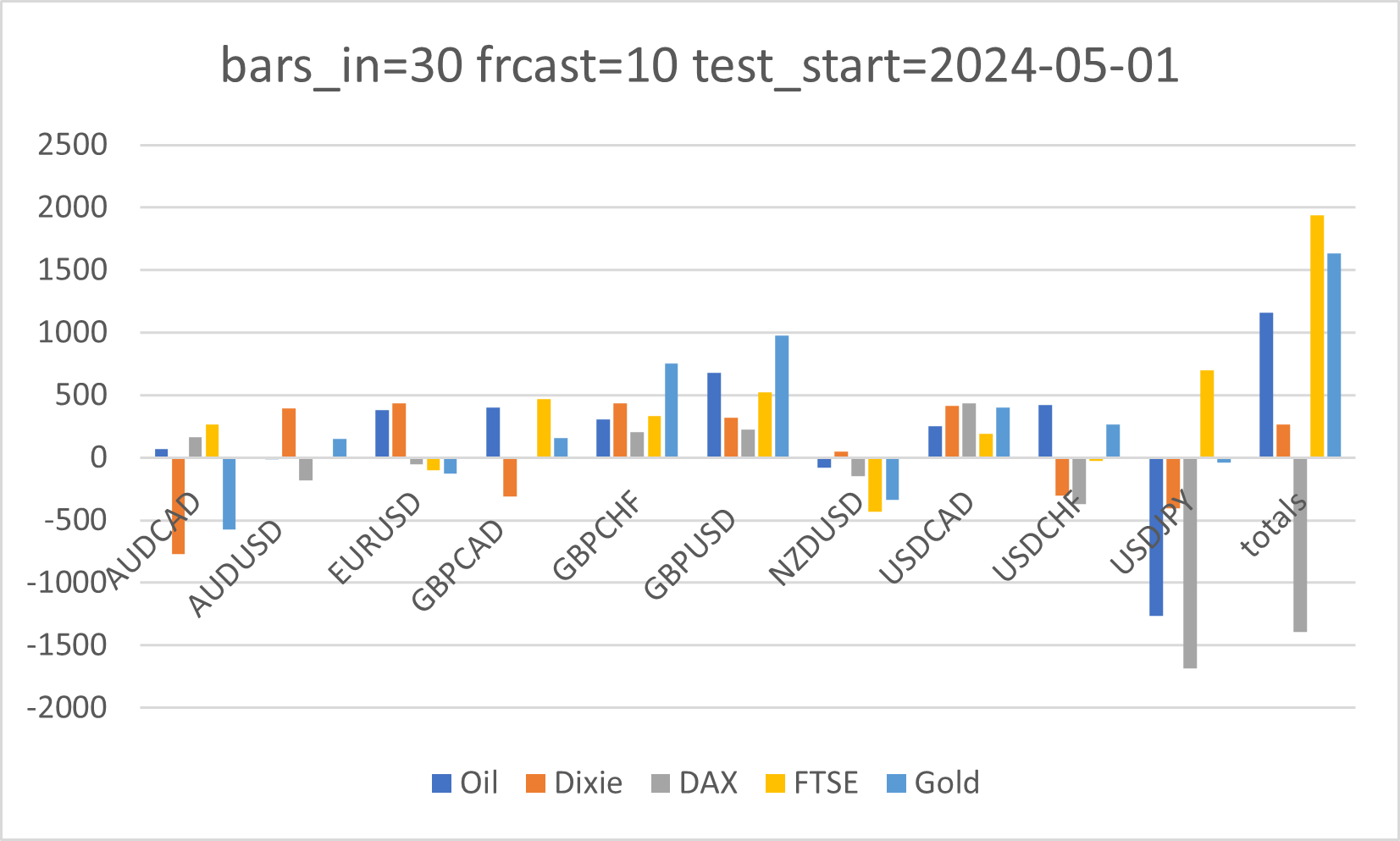

What's up, guys. I continued tests of my newest approach which includes only daily bars.

Below are why-are-you-doing-this charts. What these charts tell us, is that Gold is winning.

I am going to test 2 more options with all of this, namely for a shorter forecast and the one which is used in the current version of the expert "QuantumPip".

This is going to take one day more.

Another conclusion: Don't use all symbols if you want to maximize. For example, AUDCAD and NZDUSD cannot find their way at all.

And maybe adding stock indices or oil is not that interesting after all. But this is to conclude after 2 more pictures which are coming up.

Below are why-are-you-doing-this charts. What these charts tell us, is that Gold is winning.

I am going to test 2 more options with all of this, namely for a shorter forecast and the one which is used in the current version of the expert "QuantumPip".

This is going to take one day more.

Another conclusion: Don't use all symbols if you want to maximize. For example, AUDCAD and NZDUSD cannot find their way at all.

And maybe adding stock indices or oil is not that interesting after all. But this is to conclude after 2 more pictures which are coming up.

分享社交网络 · 2

Evgeniy Scherbina

Hi, everyone! I am going to update Gold Chaser now according to my newest approach. I have decided to update everything I have, starting with QuantumPip.

The new approach uses days and does not use weeks and months to analyze the market. So it should react much quicker to the changing environment. And help avoid long-running drawdowns. And of course it should trade more actively.

It has been mostly buy positions for Gold for many weeks. I guess it will (because it should) change with the new update this week.

I already had this picture before. I like it that much.

The new approach uses days and does not use weeks and months to analyze the market. So it should react much quicker to the changing environment. And help avoid long-running drawdowns. And of course it should trade more actively.

It has been mostly buy positions for Gold for many weeks. I guess it will (because it should) change with the new update this week.

I already had this picture before. I like it that much.

分享社交网络 · 4

Evgeniy Scherbina

Good morning, everyone. I have published the new version 2.3 of QuantumPip. Let's analyze how it works. We can see in the chart below that it has had "recessions" and "profits" in 2024. And this is the way it works! It can't be pushing up all the time. But it can handle different price fluctuations and make them profitable.

If you have many open trades and you do not want QP to close them all, you may want to change the magic. Remember: it should be a number different by 2 digits from the current number. It still uses 2 strategies, so it uses 2 magics: magic2 = magic1 + 1.

Earlier this year, I thought of adding different supporting symbols, like Oil, Stock indices and smth else. I think this idea can be implemented in QuantumPip version 2.4. I am testing it right now.

Come on! Let's grab all the profit as soon as it shows up!

If you have many open trades and you do not want QP to close them all, you may want to change the magic. Remember: it should be a number different by 2 digits from the current number. It still uses 2 strategies, so it uses 2 magics: magic2 = magic1 + 1.

Earlier this year, I thought of adding different supporting symbols, like Oil, Stock indices and smth else. I think this idea can be implemented in QuantumPip version 2.4. I am testing it right now.

Come on! Let's grab all the profit as soon as it shows up!

分享社交网络 · 2

Evgeniy Scherbina

What's up, guys! As I promised, I am going to publish a new version of QuantumPip. It will include my newest approach to training neural networks.

Below is the comparison picture. The current 2.2 version has not managed it well enough in the last month. The newest 2.3 version, that I am going to publish over the weekend, has a much better result with the Reliable risk. Of course, it is a test with the unknown, future data for the 2.3 version.

I have reduced the complexity of the networks. They say if a simple model performs as well or better as a complex model, you should use the simple model. This is what I am going to do.

Some uses have experienced bugs due to insufficient data. It will all be gone.

There will be one supporting symbol - XAUUSD.

It will be a choppier trading. So there will more trades and more signal changes. It is better because it should help avoid long-range traps as it has happened with USDJPY this summer.

Of course, it will work as usual with the existing trades. However, I guess most trades will be closed by the newer version. So you may want to change the magic. Also, the newer version will have a new comment "qpip" to replace the current comment "qp".

Below is the comparison picture. The current 2.2 version has not managed it well enough in the last month. The newest 2.3 version, that I am going to publish over the weekend, has a much better result with the Reliable risk. Of course, it is a test with the unknown, future data for the 2.3 version.

I have reduced the complexity of the networks. They say if a simple model performs as well or better as a complex model, you should use the simple model. This is what I am going to do.

Some uses have experienced bugs due to insufficient data. It will all be gone.

There will be one supporting symbol - XAUUSD.

It will be a choppier trading. So there will more trades and more signal changes. It is better because it should help avoid long-range traps as it has happened with USDJPY this summer.

Of course, it will work as usual with the existing trades. However, I guess most trades will be closed by the newer version. So you may want to change the magic. Also, the newer version will have a new comment "qpip" to replace the current comment "qp".

分享社交网络 · 1

: