Muhammad Syamil Bin Abdullah / 个人资料

- 信息

|

10+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

0

信号

|

0

订阅者

|

I'm self-taught trader started trading since 2007. Trading in major currency pairs, gold and some US indices.

I am using RoboForex as main broker for all my trade.

I am using RoboForex as main broker for all my trade.

Muhammad Syamil Bin Abdullah

Bank Negara Malaysia Friday said it is taking steps to ensure that the ringgit isn't priced "excessively and out of sync."

The comments came as the U.S. dollar surged to its highest point since late January against the ringgit in the spot market.

"Recent offshore market activities have brought on significant volatility and undue adverse influence on ringgit prices," Bank Negara Malaysia Assistant Governor Adnan Zaylani said in a statement. "With the surge in volatility, the ringgit foreign exchange market has become prone to extreme movements."

The U.S. dollar is trading at MYR4.38, up from its previous close of MYR4.27. The surge came as investors unwound bets on developing countries amid expectations that interest rates will continue to rise in the U.S.

"Dollar strength continues to run wild against most currencies," Maybank said in a note. "Expectation of expansionary fiscal policies spurs expectation that inflation could come faster than expected and this could potentially lead to greater impetus for Fed to raise rates."

Mr. Zaylani said the ringgit is a noninternationalized currency and its prices should be fully determined by onshore financial market transactions that are driven only by the fundamentals and genuine trade and investment activities in Malaysia.

The central bank said it will provide necessary liquidity in the foreign exchange market and it is in "close engagement" with all market participants.

The comments came as the U.S. dollar surged to its highest point since late January against the ringgit in the spot market.

"Recent offshore market activities have brought on significant volatility and undue adverse influence on ringgit prices," Bank Negara Malaysia Assistant Governor Adnan Zaylani said in a statement. "With the surge in volatility, the ringgit foreign exchange market has become prone to extreme movements."

The U.S. dollar is trading at MYR4.38, up from its previous close of MYR4.27. The surge came as investors unwound bets on developing countries amid expectations that interest rates will continue to rise in the U.S.

"Dollar strength continues to run wild against most currencies," Maybank said in a note. "Expectation of expansionary fiscal policies spurs expectation that inflation could come faster than expected and this could potentially lead to greater impetus for Fed to raise rates."

Mr. Zaylani said the ringgit is a noninternationalized currency and its prices should be fully determined by onshore financial market transactions that are driven only by the fundamentals and genuine trade and investment activities in Malaysia.

The central bank said it will provide necessary liquidity in the foreign exchange market and it is in "close engagement" with all market participants.

Muhammad Syamil Bin Abdullah

On a longer time forecast view, the DAX index futures weekly chart still in a bearish market mode, as we can see the example here shows a bearish Gartley pattern, 25 value point of pattern.

Muhammad Syamil Bin Abdullah

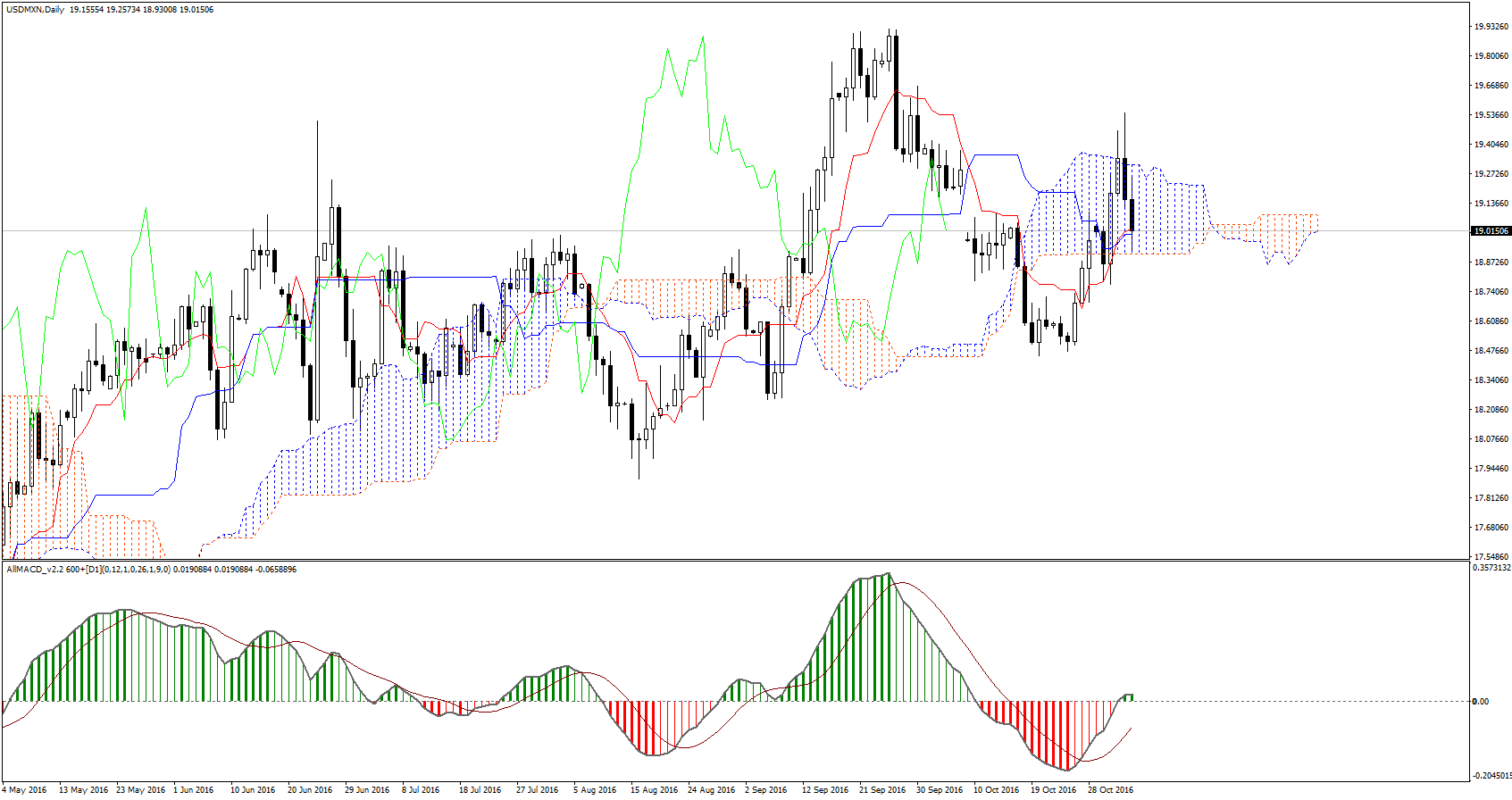

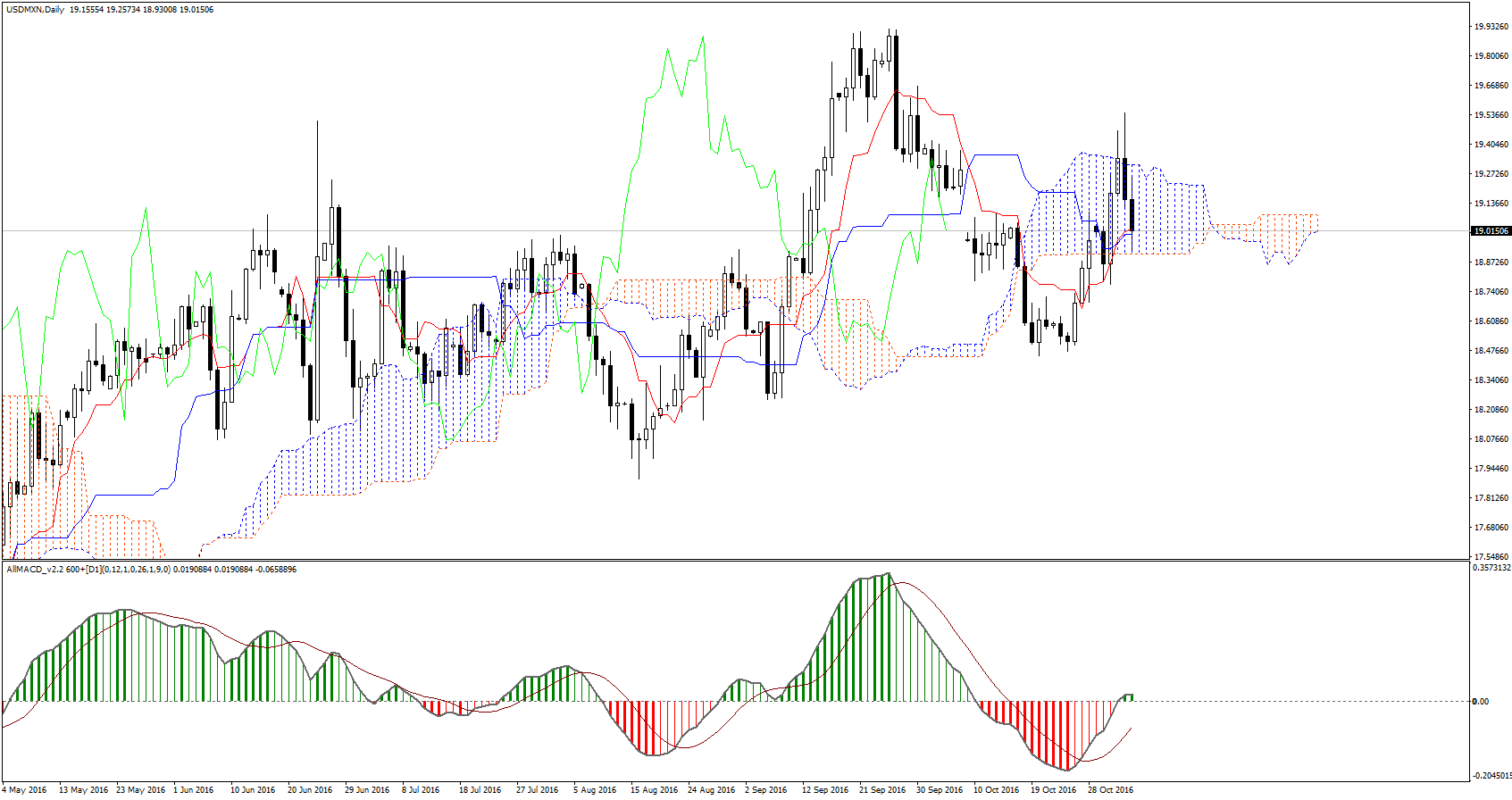

USDMXN will be more volatile during U.S election, from daily chart we can see this pair is inside ichimoku cloud which signalling non-trading zone.

Muhammad Syamil Bin Abdullah

This is indeed a good news.

MetaQuotes

Forexware delivers MetaTrader 5 Gateway to CQG

The MetaTrader 5 multi-asset platform continues expanding its trading features: the gateway to CQG platform goes live following the recent release of the gateway to Interactive Brokers . The application developed by Forexware provides direct

Muhammad Syamil Bin Abdullah

Traders must take note from their respective broker about leverage and margin requirements for opening position, as U.S election is near from 7th - 11th Nov the financial market will face uncertainty many brokers will raise their margin and lower leverage to avoid risk.

: