Claws and Horns / 个人资料

Claws and Horns

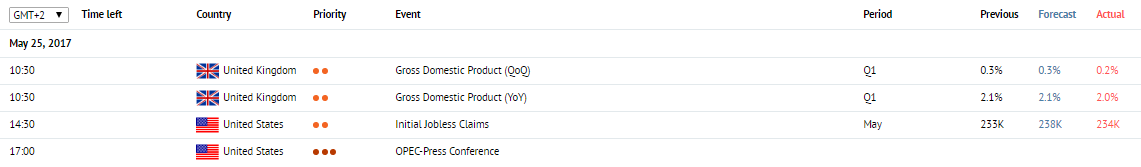

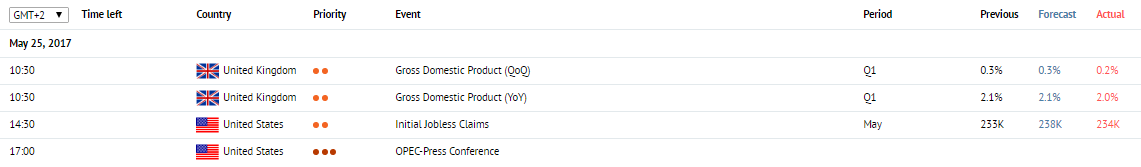

News of the day. 25.05.2017

Gross Domestic Product. UK, 10:30 (GMT+2)

The data on the UK Gross Domestic Product is due at 10:30 (GMT+2). The indicator is expected to remain unchanged at the level of 2.1% in Q1. The indicator shows market value of all final goods and services produced in the UK and describes the rate of economic growth or fall. High results strengthen GBP, and low ones on the contrary weaken the pound.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The data on initial jobless claims in the USA is due at 14:30 (GMT+2). The value is expected to grow to 238K a week against 232K in the previous week. The value indicates the number of new jobless claims. The index is published every Thursday and shows the value of nonfarm payrolls indicator. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Gross Domestic Product. UK, 10:30 (GMT+2)

The data on the UK Gross Domestic Product is due at 10:30 (GMT+2). The indicator is expected to remain unchanged at the level of 2.1% in Q1. The indicator shows market value of all final goods and services produced in the UK and describes the rate of economic growth or fall. High results strengthen GBP, and low ones on the contrary weaken the pound.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The data on initial jobless claims in the USA is due at 14:30 (GMT+2). The value is expected to grow to 238K a week against 232K in the previous week. The value indicates the number of new jobless claims. The index is published every Thursday and shows the value of nonfarm payrolls indicator. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Claws and Horns

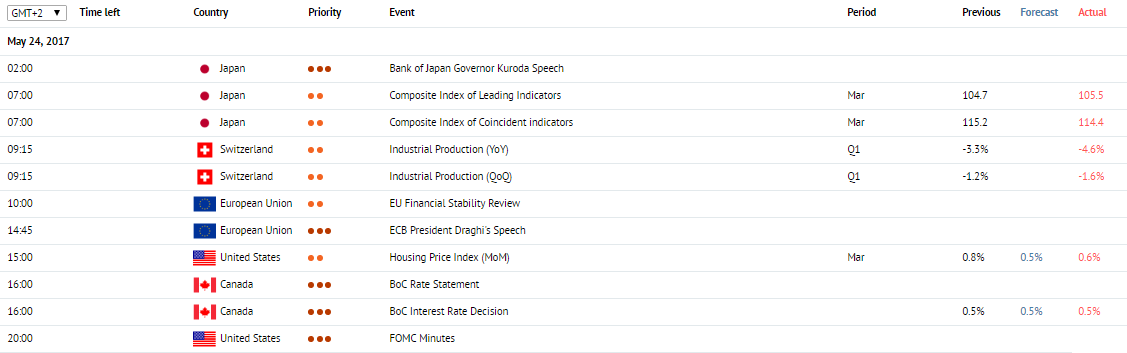

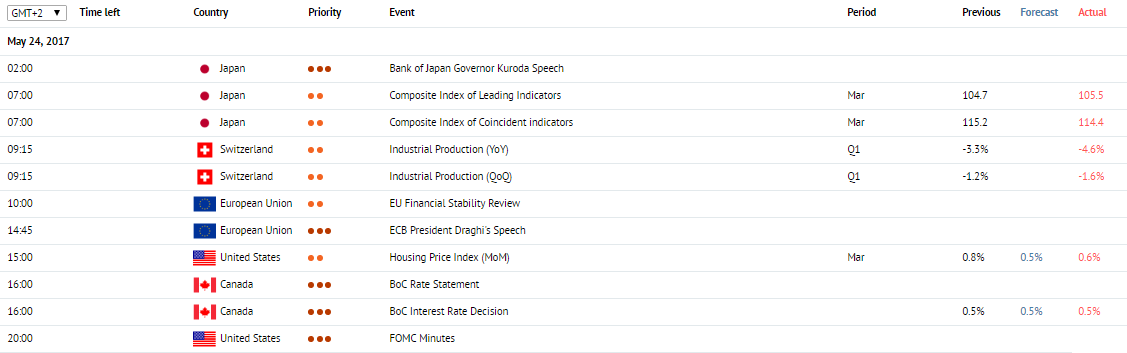

News of the day. 24.05.2017

Trading Balance. New Zealand, 00:45 (GMT+2)

The data on the trading balance of New Zealand is due at 00:45 (GMT+2). The indicator shows the difference between the import and export of goods and services in monetary equivalent. A positive value means the proficiency of balance and strengthens NZD, and a negative one – the deficiency of the balance and weakens the national currency.

Statement by the Head of the Bank of Japan Kuroda. Japan, 02:00 (GMT+2)

The head of the Bank of Japan Kuroda is to make a statement at 02:00 (GMT+2). He is holding a press conference about monetary policy issues.

Industrial Output. Switzerland, 09:15 (GMT+2)

The data on the industrial output in Switzerland is due at 09:15 (GMT+2). The indicator monitors the volumes of production in the industrial sector of the country. The growth of the indicator is a positive factor for the Swiss economy and strengthens CHF.

Statement by ECB Head Draghi. EU, 14:45 (GMT+2)

The head of ECB Mario Draghi is to make comments on the current economic situation in the region at 14:45 (GMT+2). Positive comments may lead to the strengthening of EUR, and negative ones weaken it.

Decision of the Bank of Canada on the Interest Rate. Canada, 16:00 (GMT+2)

The decision of the Bank of Canada on the interest rate will be published at 16:00 (GMT+2). The indicator is expected to remain unchanged on the level of 0.5%. The Bank of Canada makes decisions on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens CAD, and if the rate is kept on the previous level or lower, CAD falls.

Follow-Up Statement by the Bank of Canada. Canada, 16:00 (GMT+2)

After announcing the decision on the interest rate the Bank of Canada will publish comments on made decisions regarding the interest rate and monetary policy.

Minutes of the Meeting of FOMC Open Markets Committee. USA, 20:00 (GMT+2)

MoM of FOMC Open Markets Committee is to be published at 20:00 (GMT+2). In the document the Committee gives its assessment of the economic situation is the USA and determines further monetary policy.

Trading Balance. New Zealand, 00:45 (GMT+2)

The data on the trading balance of New Zealand is due at 00:45 (GMT+2). The indicator shows the difference between the import and export of goods and services in monetary equivalent. A positive value means the proficiency of balance and strengthens NZD, and a negative one – the deficiency of the balance and weakens the national currency.

Statement by the Head of the Bank of Japan Kuroda. Japan, 02:00 (GMT+2)

The head of the Bank of Japan Kuroda is to make a statement at 02:00 (GMT+2). He is holding a press conference about monetary policy issues.

Industrial Output. Switzerland, 09:15 (GMT+2)

The data on the industrial output in Switzerland is due at 09:15 (GMT+2). The indicator monitors the volumes of production in the industrial sector of the country. The growth of the indicator is a positive factor for the Swiss economy and strengthens CHF.

Statement by ECB Head Draghi. EU, 14:45 (GMT+2)

The head of ECB Mario Draghi is to make comments on the current economic situation in the region at 14:45 (GMT+2). Positive comments may lead to the strengthening of EUR, and negative ones weaken it.

Decision of the Bank of Canada on the Interest Rate. Canada, 16:00 (GMT+2)

The decision of the Bank of Canada on the interest rate will be published at 16:00 (GMT+2). The indicator is expected to remain unchanged on the level of 0.5%. The Bank of Canada makes decisions on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens CAD, and if the rate is kept on the previous level or lower, CAD falls.

Follow-Up Statement by the Bank of Canada. Canada, 16:00 (GMT+2)

After announcing the decision on the interest rate the Bank of Canada will publish comments on made decisions regarding the interest rate and monetary policy.

Minutes of the Meeting of FOMC Open Markets Committee. USA, 20:00 (GMT+2)

MoM of FOMC Open Markets Committee is to be published at 20:00 (GMT+2). In the document the Committee gives its assessment of the economic situation is the USA and determines further monetary policy.

Claws and Horns

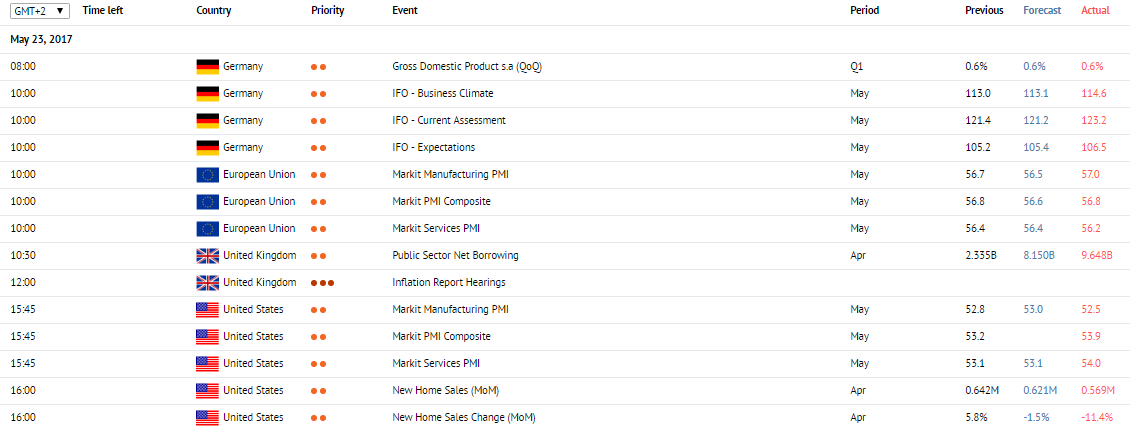

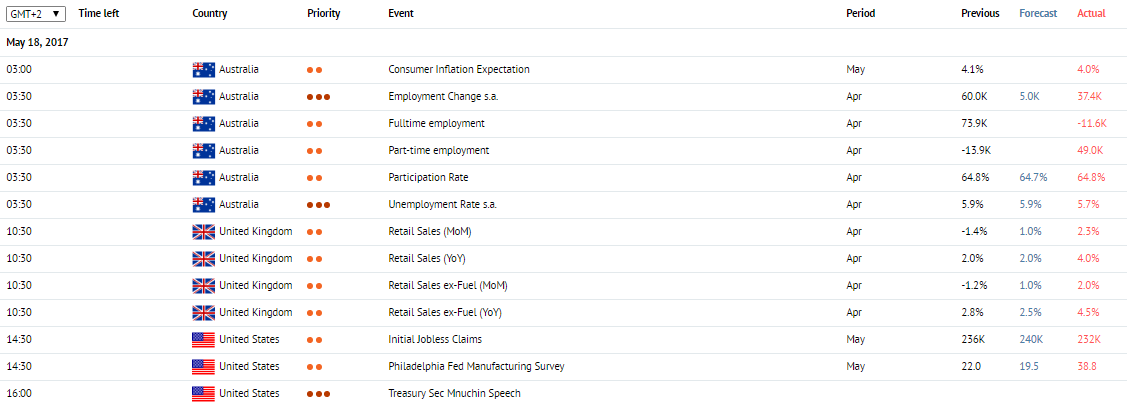

News of the day. 23.05.2017

Gross Domestic Product. Germany, 08:00 (GMT+2)

The Gross Domestic Product is due at 08:00 (GMT+2) in Germany. The index is expected to stay on the same level of 0.6% in the first quarter. It represents the value of all goods and services created in the country during the year. A high reading strengthens the EUR. A low reading weakens the EUR.

IFO - Expectations. Germany, 10:00 (GMT+2)

The IFO -Expectations index is due at 10:00 (GMT+2) in Germany. The index is expected to grow to 105.8 points in May from 105.2 points in the previous month. It is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses and their forecasts for the next 6 months. The forecast can assume that things will improve, stay the same or get worse. Positive forecasts from the majority of participants are perceived as a positive signal and strengthen the EUR. Negative forecasts weaken the EUR.

Markit Services PMI. EU, 10:00 (GMT+2)

Markit Services PMI is due at 10:00 (GMT+2) in the EU. The index is expected to grow to 56.5 points in May from 56.4 points in the previous month. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Inflation Report Hearings. United Kingdom, 12:00 (GMT+2)

Inflation Report Hearings are due at 12:00 (GMT+2) in the UK. The Governor of the Bank of England and members of the Monetary Policy Committee speak in the Parliament regarding current economic conditions and future prospects for the economy.

Markit Services PMI. USA, 15:45 (GMT+2)

Markit Services PMI is due at 15:45 (GMT+2) in the USD. The index is expected to lower to 53.0 points in May from 53.1 points in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Markit Manufacturing PMI. USA, 15:45 (GMT+2)

Markit Manufacturing PMI is due at 15:45 (GMT+2) in the USA. The index is expected to grow to 53.0 points in May from 52.8 points in the previous month. The index represents current economic conditions in the manufacturing sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Gross Domestic Product. Germany, 08:00 (GMT+2)

The Gross Domestic Product is due at 08:00 (GMT+2) in Germany. The index is expected to stay on the same level of 0.6% in the first quarter. It represents the value of all goods and services created in the country during the year. A high reading strengthens the EUR. A low reading weakens the EUR.

IFO - Expectations. Germany, 10:00 (GMT+2)

The IFO -Expectations index is due at 10:00 (GMT+2) in Germany. The index is expected to grow to 105.8 points in May from 105.2 points in the previous month. It is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses and their forecasts for the next 6 months. The forecast can assume that things will improve, stay the same or get worse. Positive forecasts from the majority of participants are perceived as a positive signal and strengthen the EUR. Negative forecasts weaken the EUR.

Markit Services PMI. EU, 10:00 (GMT+2)

Markit Services PMI is due at 10:00 (GMT+2) in the EU. The index is expected to grow to 56.5 points in May from 56.4 points in the previous month. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Inflation Report Hearings. United Kingdom, 12:00 (GMT+2)

Inflation Report Hearings are due at 12:00 (GMT+2) in the UK. The Governor of the Bank of England and members of the Monetary Policy Committee speak in the Parliament regarding current economic conditions and future prospects for the economy.

Markit Services PMI. USA, 15:45 (GMT+2)

Markit Services PMI is due at 15:45 (GMT+2) in the USD. The index is expected to lower to 53.0 points in May from 53.1 points in the previous month. The index is based on surveys of executives of the companies operating in the services sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Markit Manufacturing PMI. USA, 15:45 (GMT+2)

Markit Manufacturing PMI is due at 15:45 (GMT+2) in the USA. The index is expected to grow to 53.0 points in May from 52.8 points in the previous month. The index represents current economic conditions in the manufacturing sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Claws and Horns

News of the day. 22.05.2017

Merchandise Trade Balance Total. Japan, 01:50 (GMT+2)

The Merchandise Trade Balance Total data are due at 01:50 (GMT+2) in Japan. The indicator represents the difference between the value of exports and imports. Positive values occur when exports exceed imports and imply the balance is in surplus. Negative values imply the balance is in deficit indicating imports exceed exports. A high reading strengthens the JPY. A low reading weakens the JPY.

Chicago Fed National Activity Index. USA, 14:30 (GMT+2)

Chicago Fed National Activity Index is due at 14:30 (GMT+2) in the USA. It is the indicator of economic activity in the states of Indiana, Michigan and Illinois. Positive values strengthen the USD, as negative ones press the USD.

Merchandise Trade Balance Total. Japan, 01:50 (GMT+2)

The Merchandise Trade Balance Total data are due at 01:50 (GMT+2) in Japan. The indicator represents the difference between the value of exports and imports. Positive values occur when exports exceed imports and imply the balance is in surplus. Negative values imply the balance is in deficit indicating imports exceed exports. A high reading strengthens the JPY. A low reading weakens the JPY.

Chicago Fed National Activity Index. USA, 14:30 (GMT+2)

Chicago Fed National Activity Index is due at 14:30 (GMT+2) in the USA. It is the indicator of economic activity in the states of Indiana, Michigan and Illinois. Positive values strengthen the USD, as negative ones press the USD.

Claws and Horns

News of the day. 19.05.2017

Producer Price Index. Germany, 08:00 (GMT+2)

The Producer Price Index is due at 08:00 (GMT+2) in Germany. The YoY index is expected to grow to 3.2% in April from 3.1% in the previous month, as the MoM index will grow to 0.2% in April from 0.0% in the previous month. It represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Consumer Price Index. Canada, 14:30 (GMT+2)

The Consumer Price Index is due at 14:30 (GMT+2) in Canada. The index is expected to grow to 0.5% in April from 0.2% in the previous month. It represents the change in the price for the basket of goods and services. High values can lead to an increase in interest rates. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Consumer Confidence. EU, 16:00 (GMT+2)

The Consumer Confidence index is due at 16:00 (GMT+2) in the European Union. The index is expected to be at the level of -3.0 points in May from -3.6 points in the previous month. The indicator reflects how optimistic or pessimistic consumers are regarding current economic activity. A high result represents an optimistic mood and can support the EUR. A result below the forecast pressures the EUR.

Producer Price Index. Germany, 08:00 (GMT+2)

The Producer Price Index is due at 08:00 (GMT+2) in Germany. The YoY index is expected to grow to 3.2% in April from 3.1% in the previous month, as the MoM index will grow to 0.2% in April from 0.0% in the previous month. It represents the wholesale prices change from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Consumer Price Index. Canada, 14:30 (GMT+2)

The Consumer Price Index is due at 14:30 (GMT+2) in Canada. The index is expected to grow to 0.5% in April from 0.2% in the previous month. It represents the change in the price for the basket of goods and services. High values can lead to an increase in interest rates. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Consumer Confidence. EU, 16:00 (GMT+2)

The Consumer Confidence index is due at 16:00 (GMT+2) in the European Union. The index is expected to be at the level of -3.0 points in May from -3.6 points in the previous month. The indicator reflects how optimistic or pessimistic consumers are regarding current economic activity. A high result represents an optimistic mood and can support the EUR. A result below the forecast pressures the EUR.

Claws and Horns

Meet CLAWS&HORNS at the IFX EXPO 2017 AT BOOTH 33 in Limassol, Cyprus!

Claws&Horns is excited to announce that we are attending the iFXEXPO in Limassol for the third year running, at the Palais des Sports - Spyros Kyprianou Stadium, on the 23rd-25th of May 2017!

Claws&Horns Analytical portal was successfully launched in 2014. The service enables brokers to provide their Clients with a complete analytical solution, where Clients can access everything in one place, enhancing their overall trading experience and encouraging them to become more and more active.

The analytical services provided include an economic calendar, technical, fundamental, and wave analyses, weekly video reviews, highly accurate signals and live analysts to answers all of your Clients questions. The service is directly integrated into the MT4/5 trading platforms, and can also be used in the personal Clients area. Additionally, we've made the service available on mobile app for your Clients who trade 'on the go', covering all bases and ensuring complete accessibility.

With no limits on the number of users, and exceptionally competitive packages, we are certain that Claws&Horns analytical service is the solution that you’ve been searching for!

We look forward to seeing you at BOOTH 33 for a full presentation. Let us show you how to save your time, money, and effort!

If you would like to pre-book a presentation slot, please email us at info@clawshorns.com or phone on + 357 25 722 357

We look forward to seeing you there!

Claws&Horns is excited to announce that we are attending the iFXEXPO in Limassol for the third year running, at the Palais des Sports - Spyros Kyprianou Stadium, on the 23rd-25th of May 2017!

Claws&Horns Analytical portal was successfully launched in 2014. The service enables brokers to provide their Clients with a complete analytical solution, where Clients can access everything in one place, enhancing their overall trading experience and encouraging them to become more and more active.

The analytical services provided include an economic calendar, technical, fundamental, and wave analyses, weekly video reviews, highly accurate signals and live analysts to answers all of your Clients questions. The service is directly integrated into the MT4/5 trading platforms, and can also be used in the personal Clients area. Additionally, we've made the service available on mobile app for your Clients who trade 'on the go', covering all bases and ensuring complete accessibility.

With no limits on the number of users, and exceptionally competitive packages, we are certain that Claws&Horns analytical service is the solution that you’ve been searching for!

We look forward to seeing you at BOOTH 33 for a full presentation. Let us show you how to save your time, money, and effort!

If you would like to pre-book a presentation slot, please email us at info@clawshorns.com or phone on + 357 25 722 357

We look forward to seeing you there!

分享社交网络 · 1

Claws and Horns

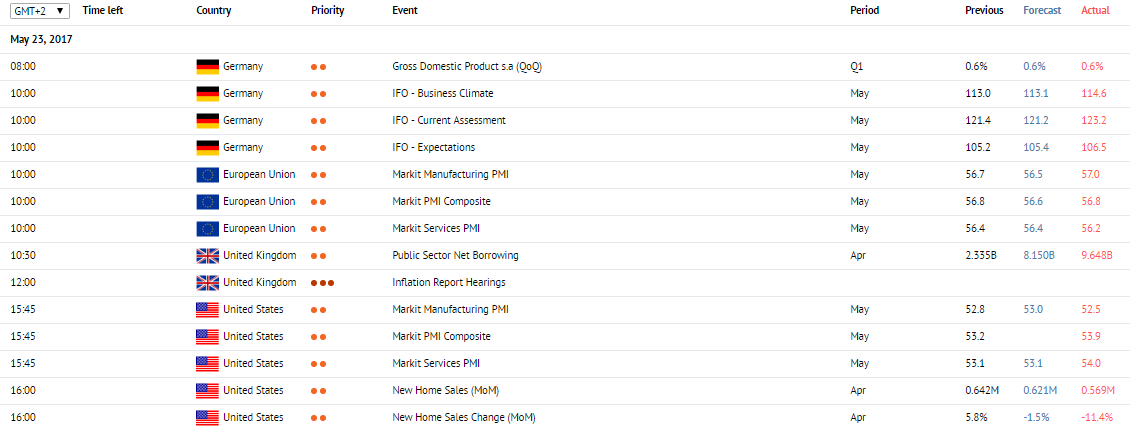

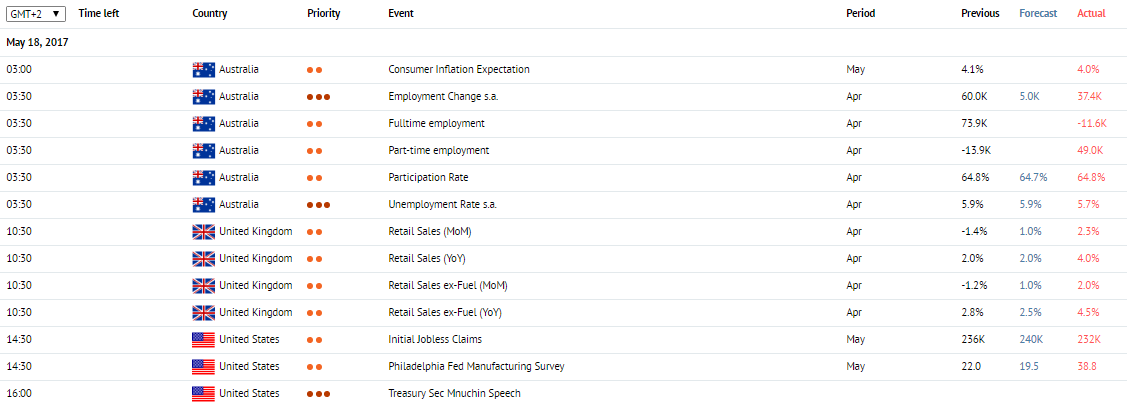

News of the day. 18.05.2017

Employment Change s.a. Australia, 03:30 (GMT+2)

The Employment Change s.a. is due at 03:30 (GMT+2) in Australia. The index is expected to lower to 5K in April from 60.9K in the previous month. The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

Unemployment Rate s.a. Australia, 03:30 (GMT+2)

The Unemployment Rate s.a. is due at 03:30 (GMT+2) in Australia. The index is expected to stay on the same level of 5.9% in April. The data on unemployment rate represents a percentage of the total labour force that is currently unemployed. A growth in the indicator is considered a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

Retail Sales. United Kingdom, 11:30 (GMT+2)

The Retail Sales data are due at 11:30 (GMT+2) in the UK. The YoY index is expected to grow to 2.0% in April from 1.7% in the previous month. The MoM index is expected to grow to 1.0% in April from -1.8% in the previous month. The index represents the total value of all receipts from retail shops in the country and characterizes the level of consumer expenditure and demand. Growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims data are due at 14:30 (GMT+2) in the USA. The index is expected to grow to 240K this week from 236K in the previous week. It represents the number of new unemployment claims. It is published weekly on Thursdays and allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Employment Change s.a. Australia, 03:30 (GMT+2)

The Employment Change s.a. is due at 03:30 (GMT+2) in Australia. The index is expected to lower to 5K in April from 60.9K in the previous month. The Employment Change released by the Australian Bureau of Statistics is a measure of the change in the number of employed people in Australia. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive (or bullish) for the AUD, while a low reading is seen as negative (or bearish).

Unemployment Rate s.a. Australia, 03:30 (GMT+2)

The Unemployment Rate s.a. is due at 03:30 (GMT+2) in Australia. The index is expected to stay on the same level of 5.9% in April. The data on unemployment rate represents a percentage of the total labour force that is currently unemployed. A growth in the indicator is considered a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

Retail Sales. United Kingdom, 11:30 (GMT+2)

The Retail Sales data are due at 11:30 (GMT+2) in the UK. The YoY index is expected to grow to 2.0% in April from 1.7% in the previous month. The MoM index is expected to grow to 1.0% in April from -1.8% in the previous month. The index represents the total value of all receipts from retail shops in the country and characterizes the level of consumer expenditure and demand. Growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims data are due at 14:30 (GMT+2) in the USA. The index is expected to grow to 240K this week from 236K in the previous week. It represents the number of new unemployment claims. It is published weekly on Thursdays and allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Claws and Horns

News of the day. 17.05.2017

Industrial Production. Japan, 06:30 (GMT+2)

The Industrial Production is due at 06:30 (GMT+2) in Japan. The index is expected to stay on the same level of - 2.1% in March. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Claimant Count Change. United Kingdom, 10:30 (GMT+2)

The Claimant Count Change is due at 10:30 (GMT+2) in the UK. The index is expected to lower to 7.5K in April from 25.5K in the previous month. It represents the number of unemployed in the UK. A high reading weakens the GBP. A low reading strengthens the GBP.

ILO Unemployment Rate. United Kingdom, 10:30 (GMT+2)

The ILO Unemployment Rate is due at 10:30 (GMT+2) in the UK. The index is expected to stay on the same level of 4.7%. It is one of the main indicators of unemployment in the UK. It represents a percentage of the total labour force of the country that is currently unemployed. A growth in the index weakens the GBP. A fall in the index strengthens the GBP.

Consumer Price Index. European Union, 11:00 (GMT+2)

The Consumer Price Index is due at 11:00 (GMT+2) in the EU. The index is expected to stay on the same level of 1.9% in April. It is the key indicator of inflation in the Eurozone and represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Industrial Production. Japan, 06:30 (GMT+2)

The Industrial Production is due at 06:30 (GMT+2) in Japan. The index is expected to stay on the same level of - 2.1% in March. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Claimant Count Change. United Kingdom, 10:30 (GMT+2)

The Claimant Count Change is due at 10:30 (GMT+2) in the UK. The index is expected to lower to 7.5K in April from 25.5K in the previous month. It represents the number of unemployed in the UK. A high reading weakens the GBP. A low reading strengthens the GBP.

ILO Unemployment Rate. United Kingdom, 10:30 (GMT+2)

The ILO Unemployment Rate is due at 10:30 (GMT+2) in the UK. The index is expected to stay on the same level of 4.7%. It is one of the main indicators of unemployment in the UK. It represents a percentage of the total labour force of the country that is currently unemployed. A growth in the index weakens the GBP. A fall in the index strengthens the GBP.

Consumer Price Index. European Union, 11:00 (GMT+2)

The Consumer Price Index is due at 11:00 (GMT+2) in the EU. The index is expected to stay on the same level of 1.9% in April. It is the key indicator of inflation in the Eurozone and represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Claws and Horns

News of the day. 16.05.2017

Minutes of the Meeting of Reserve Bank of Australia. Australia, 03:30 (GMT+2)

Minutes of the Meeting of Reserve Bank of Australia is due at 03:30 (GMT+2). The document is published two weeks after making a decision on the interest rate. The minutes contains information about the votes of certain Committee members and comments on made decisions.

Consumer Price Index. UK, 10:30 (GMT+2)

The British Consumer Price Index is due at 10:30 (GMT+2). The indicator is expected to grow to 2.6% YoY in April from 2.3% a month earlier. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

ZEW Institute Business Circles Climate Index. Germany, 11:00 (GMT+2)

ZEW Institute Business Circles Climate Index is due at 11:00 (GMT+2). The indicator is expected to grow to 22.0 points in May from 19.5 points a month earlier. The indicator is calculated by the Economic Studies Center (ZEW) on the basis of poll o the leading European financial expert that assess the current economic situation in Europe. A positive result indicates that the experts are optimistic about the economy and strengthen EUR. Values below the expected level show that the economy is assessed in pessimistic terms and weaken euro.

Gross Domestic Product. EU, 11:00 (GMT+2)

The data on the EU GDP are due at 11:00 (GMT+2). The indicator is expected to remain unchanged at the level of 1.7% in Q1. The indicator shows market value of all final goods and services produced in Germany in a year. Higher results induce euro rate increase, and low ones weaken EUR.

Housing Construction in Progress. USA, 14:30 (GMT+2)

The data on housing construction in progress from the USA are due at 14:30 (GMT+2). The indicator is expected to grow to 1.260 mln in monthly terms in April from 1.215 mln a month earlier. The indicators shows the number of new foundations. High reasults strengthen USD, and low ones weaken it.

Industrial Output. USA, 15:15 (GMT+2)

The data on the US industrial output is due at 15:15 (GMT+2). The indicator is expected to fall to 0.3% in April from 0.5% a month earlier. It reflects the level of the US industrial output and shows the state of national economy. The growth of the indicator strenghtens the national currency. Its fall leads to the weakening of USD.

Minutes of the Meeting of Reserve Bank of Australia. Australia, 03:30 (GMT+2)

Minutes of the Meeting of Reserve Bank of Australia is due at 03:30 (GMT+2). The document is published two weeks after making a decision on the interest rate. The minutes contains information about the votes of certain Committee members and comments on made decisions.

Consumer Price Index. UK, 10:30 (GMT+2)

The British Consumer Price Index is due at 10:30 (GMT+2). The indicator is expected to grow to 2.6% YoY in April from 2.3% a month earlier. Consumer Price Index is one of the key indicators that characterizes the level of inflation and demonstrates the changes in commodity and service prices. A high value of the indicator strengthens GBP, and a low one weakens it.

ZEW Institute Business Circles Climate Index. Germany, 11:00 (GMT+2)

ZEW Institute Business Circles Climate Index is due at 11:00 (GMT+2). The indicator is expected to grow to 22.0 points in May from 19.5 points a month earlier. The indicator is calculated by the Economic Studies Center (ZEW) on the basis of poll o the leading European financial expert that assess the current economic situation in Europe. A positive result indicates that the experts are optimistic about the economy and strengthen EUR. Values below the expected level show that the economy is assessed in pessimistic terms and weaken euro.

Gross Domestic Product. EU, 11:00 (GMT+2)

The data on the EU GDP are due at 11:00 (GMT+2). The indicator is expected to remain unchanged at the level of 1.7% in Q1. The indicator shows market value of all final goods and services produced in Germany in a year. Higher results induce euro rate increase, and low ones weaken EUR.

Housing Construction in Progress. USA, 14:30 (GMT+2)

The data on housing construction in progress from the USA are due at 14:30 (GMT+2). The indicator is expected to grow to 1.260 mln in monthly terms in April from 1.215 mln a month earlier. The indicators shows the number of new foundations. High reasults strengthen USD, and low ones weaken it.

Industrial Output. USA, 15:15 (GMT+2)

The data on the US industrial output is due at 15:15 (GMT+2). The indicator is expected to fall to 0.3% in April from 0.5% a month earlier. It reflects the level of the US industrial output and shows the state of national economy. The growth of the indicator strenghtens the national currency. Its fall leads to the weakening of USD.

Claws and Horns

News of the day. 15.05.2017

Home Loans. Australia, 03:30 (GMT+2)

The March Home Loans data are due at 03:30 (GMT+2) in Australia. The data on home loans represents the number of recently extended home loans. It is one of the key indicators of the property market. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Industrial Production. China, 04:00 (GMT+2)

Industrial Production index is due at 04:00 (GMT+2) in China. The YoY index is expected to lower to 7.1% in March from 7.6% in the previous month. It represents the change in industrial output in China. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the index supports the CNY. A fall in the index pressures the CNY.

Home Loans. Australia, 03:30 (GMT+2)

The March Home Loans data are due at 03:30 (GMT+2) in Australia. The data on home loans represents the number of recently extended home loans. It is one of the key indicators of the property market. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Industrial Production. China, 04:00 (GMT+2)

Industrial Production index is due at 04:00 (GMT+2) in China. The YoY index is expected to lower to 7.1% in March from 7.6% in the previous month. It represents the change in industrial output in China. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the index supports the CNY. A fall in the index pressures the CNY.

Claws and Horns

News of the day. 12.05.2017

Gross Domestic Product. Germany, 08:00 (GMT+2)

The data on German GDP are due at 08:00 (GMT+2). The indicator is expected to increase up to 0.7% in Q1 from 0.4% for the previous period. It shows the value of all goods and services produced in Germany within a year. High results lead to the growth of EUR, and low ones to its fall.

Consumer Price Index. Germany, 08:00 (GMT+2)

German Consumer Prices Index is due at 08:00 (GMT+2). The indicator is expected to remain unchanged on the level of 0% in April. The index shows the changes in household commodity and service prices and is considered the main inflation indicator. The growth of the indicator strengthens EUR, and its fall weakens the currency.

Industrial Output. EU, 11:00 (GMT+2)

The data on EU industrial output are due at 11:00 (GMT+2). The indicator is expected to grow to 2.3% in March against 1.2% a month earlier. In monthly terms the indicator is expected to grow to 0.3% in March from -0.3% in February. The indicator shows changes in industrial output volume and is one of the most important indexes of inflation. High results strengthen EUR, and low ones weaken it.

Retail Sales. USA, 14:30 (GMT+2)

The data on the US retail sales are due at 14:30 (GMT+2). The indicator is expected to grow to 0.6% in April from -0.2% a month earlier. This indicator reflects consumer spending and represents the change in the volume of retail sales. The growth of the indicator is a positive factor for the US economy and strengthens the rate of USD, and the fall weakens it.

Consumer Price Index. USA, 14:30 (GMT+2)

The data on the US consumer price index are due at 14:30 (GMT+2). The indicator is expected to grow to 0.2% in April from -0.3% a month earlier. It is the key indicator of inflation in the country and represents the change in the value of the basket of goods and services. Positive results strengthen USD, and negative ones weaken it.

Gross Domestic Product. Germany, 08:00 (GMT+2)

The data on German GDP are due at 08:00 (GMT+2). The indicator is expected to increase up to 0.7% in Q1 from 0.4% for the previous period. It shows the value of all goods and services produced in Germany within a year. High results lead to the growth of EUR, and low ones to its fall.

Consumer Price Index. Germany, 08:00 (GMT+2)

German Consumer Prices Index is due at 08:00 (GMT+2). The indicator is expected to remain unchanged on the level of 0% in April. The index shows the changes in household commodity and service prices and is considered the main inflation indicator. The growth of the indicator strengthens EUR, and its fall weakens the currency.

Industrial Output. EU, 11:00 (GMT+2)

The data on EU industrial output are due at 11:00 (GMT+2). The indicator is expected to grow to 2.3% in March against 1.2% a month earlier. In monthly terms the indicator is expected to grow to 0.3% in March from -0.3% in February. The indicator shows changes in industrial output volume and is one of the most important indexes of inflation. High results strengthen EUR, and low ones weaken it.

Retail Sales. USA, 14:30 (GMT+2)

The data on the US retail sales are due at 14:30 (GMT+2). The indicator is expected to grow to 0.6% in April from -0.2% a month earlier. This indicator reflects consumer spending and represents the change in the volume of retail sales. The growth of the indicator is a positive factor for the US economy and strengthens the rate of USD, and the fall weakens it.

Consumer Price Index. USA, 14:30 (GMT+2)

The data on the US consumer price index are due at 14:30 (GMT+2). The indicator is expected to grow to 0.2% in April from -0.3% a month earlier. It is the key indicator of inflation in the country and represents the change in the value of the basket of goods and services. Positive results strengthen USD, and negative ones weaken it.

Claws and Horns

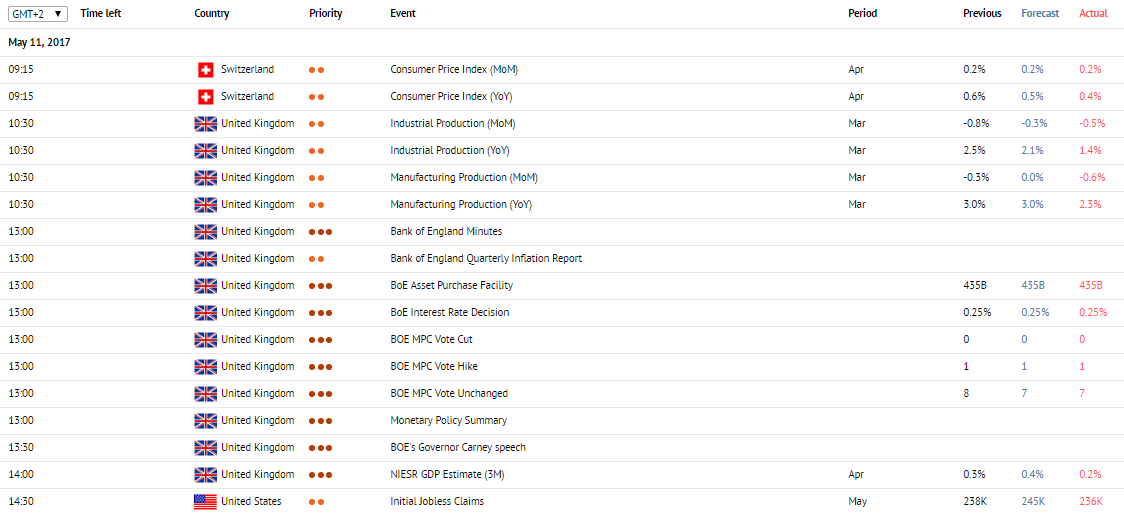

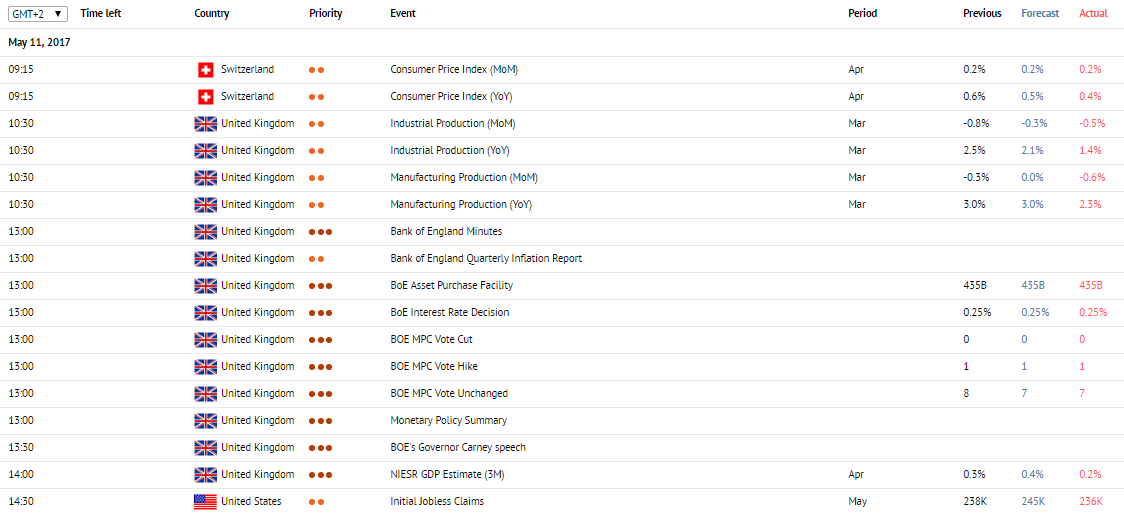

News of the day. 11.05.2017

Consumer Price Index. Switzerland, 09:15 (GMT+2)

The Consumer Price Index is due at 09:15 (GMT+2). The index is expected to lower to 0.5% in April from 0.6% in the previous month. The index represents changes in prices of goods and services for household consumption. The data is considered as the key indicator of inflation. A growth in the index strengthens the CHF, while a fall weakens the CHF.

Industrial Production. United Kingdom, 10:30 (GMT+2)

The Industrial Production index is due at 10:30 (GMT+2). The MoM index is expected to be -0.2% in March against -0.7% in the previous month. The YoY index is expected to lower to 3.1% in March from 3.3% in the previous month. It represents industrial output in the UK. It is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

BoE Interest Rate Decision. United Kingdom, 13:00 (GMT+2)

The BoE Interest Rate Decision is due at 13:00 (GMT+2). The index is expected to stay on the same level of 0.25%. Depending on the current economic situation and the level of inflation, the Bank of England makes its decision on the interest rate. The rate increase strengthens the GBP. If rate remains unchanged or get cut, the GBP weakens.

Bank of England Minutes. United Kingdom, 13:00 (GMT+2)

The Bank of England Minutes is published after the interest rate decision is made and contains commentaries about the decision.

NIESR GDP Estimate. United Kingdom, 14:00 (GMT+2)

The NIESR GDP Estimate publication is due at 14:00 (GMT+2). The report is published by the National Institute for Economic and Social Research. It tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the GBP. A low reading weakens the GBP.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims data are due at 14:30 (GMT+2).The index is expected to grow to 245K WoW from 238K in the previous week. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Producer Price Index. USA, 14:30 (GMT+2)

The Producer Price Index is due at 14:30 (GMT+2). It is expected to grow by 0.2% in April from -0.1% in the previous month. Represents the wholesale prices change from producers. A high reading strengthens the USD. A low reading weakens the USD.

Consumer Price Index. Switzerland, 09:15 (GMT+2)

The Consumer Price Index is due at 09:15 (GMT+2). The index is expected to lower to 0.5% in April from 0.6% in the previous month. The index represents changes in prices of goods and services for household consumption. The data is considered as the key indicator of inflation. A growth in the index strengthens the CHF, while a fall weakens the CHF.

Industrial Production. United Kingdom, 10:30 (GMT+2)

The Industrial Production index is due at 10:30 (GMT+2). The MoM index is expected to be -0.2% in March against -0.7% in the previous month. The YoY index is expected to lower to 3.1% in March from 3.3% in the previous month. It represents industrial output in the UK. It is one of the major indicators of the state of the national economy. The index includes manufacturing, mining and utilities. A growth in the index supports the GBP. A fall in the index pressures the GBP.

BoE Interest Rate Decision. United Kingdom, 13:00 (GMT+2)

The BoE Interest Rate Decision is due at 13:00 (GMT+2). The index is expected to stay on the same level of 0.25%. Depending on the current economic situation and the level of inflation, the Bank of England makes its decision on the interest rate. The rate increase strengthens the GBP. If rate remains unchanged or get cut, the GBP weakens.

Bank of England Minutes. United Kingdom, 13:00 (GMT+2)

The Bank of England Minutes is published after the interest rate decision is made and contains commentaries about the decision.

NIESR GDP Estimate. United Kingdom, 14:00 (GMT+2)

The NIESR GDP Estimate publication is due at 14:00 (GMT+2). The report is published by the National Institute for Economic and Social Research. It tracks the UK economy growth for the last three months. The report has the potential to influence monetary policy in the country. A high reading strengthens the GBP. A low reading weakens the GBP.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims data are due at 14:30 (GMT+2).The index is expected to grow to 245K WoW from 238K in the previous week. Represents the number of new unemployment claims. It is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Producer Price Index. USA, 14:30 (GMT+2)

The Producer Price Index is due at 14:30 (GMT+2). It is expected to grow by 0.2% in April from -0.1% in the previous month. Represents the wholesale prices change from producers. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 10.05.2017

Retail Sales with the Use of Electronic Payment Cards. New Zealand, 00:45 (GMT+2)

The data on retail sales with the use of electronic payment cards are due at 00:45 (GMT+2). The indicator specifies the number of purchases made with the use of credit and debit cards and shows the state of the retail sector. High values of the indicator are a positive factor for NZF, and low ones are negative.

Consumer Price Index. China, 03:30 (GMT+2)

Chinese consumer price index is due at 03:30 (GMT+2). The indicator is expected to rise to 1.1% in April from 0.9% a month earlier on YoY basis. The index shows the changes in household commodity and service prices and is considered the main inflation indicator. Moderate growth of the indicator is a positive factor for CNY and low ones are negative.

Statement by ECB Head Draghi. EU, 13:00 (GMT+2)

The statement by ECB head Mario Draghi is due at 13:00 (GMT+2). Draghi will make comments on the current economic situation at the EU. Positive comments may lead to the strengthening of EUR and negative ones weaken it.

Decision of the Reserve Bank of New Zealand on the Interest Rate. New Zealand, 23:00 (GMT+2)

The decision of RBNZ on the interest rate is due at 23:00 (GMT+2). The indicator is expected to remain unchanged on the level of 1.75%. RBNZ makes a decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens NZD. If the rate remains on the same level or drops the rate of the national currency decreases.

Retail Sales with the Use of Electronic Payment Cards. New Zealand, 00:45 (GMT+2)

The data on retail sales with the use of electronic payment cards are due at 00:45 (GMT+2). The indicator specifies the number of purchases made with the use of credit and debit cards and shows the state of the retail sector. High values of the indicator are a positive factor for NZF, and low ones are negative.

Consumer Price Index. China, 03:30 (GMT+2)

Chinese consumer price index is due at 03:30 (GMT+2). The indicator is expected to rise to 1.1% in April from 0.9% a month earlier on YoY basis. The index shows the changes in household commodity and service prices and is considered the main inflation indicator. Moderate growth of the indicator is a positive factor for CNY and low ones are negative.

Statement by ECB Head Draghi. EU, 13:00 (GMT+2)

The statement by ECB head Mario Draghi is due at 13:00 (GMT+2). Draghi will make comments on the current economic situation at the EU. Positive comments may lead to the strengthening of EUR and negative ones weaken it.

Decision of the Reserve Bank of New Zealand on the Interest Rate. New Zealand, 23:00 (GMT+2)

The decision of RBNZ on the interest rate is due at 23:00 (GMT+2). The indicator is expected to remain unchanged on the level of 1.75%. RBNZ makes a decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens NZD. If the rate remains on the same level or drops the rate of the national currency decreases.

Claws and Horns

News of the day. 08.05.2017

Housing Starts s.a. Canada, 14:15 (GMT+2)

The Housing Starts s.a index is due at 14:15 (GMT+2). It is published by Canada Mortgage and Housing Corporation. It represents the number of housing starts for single-family homes. Construction volumes are closely linked to the population income, thus a growth in the index indicates economy growth. A high reading strengthens the CAD. A low reading weakens the CAD.

Labor Market Conditions Index. USA, 16:00 (GMT+2)

The Labor Market Conditions Index is due at 16:00 (GMT+2). It is calculated by Fed economists. It is made up of 19 different indicators describing the labor market. The index is one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

BoC Review. Canada, 16:30 (GMT+2)

The BoC Review is due at 16:30 (GMT+2), which represents the current state of Canada economy. The indicator is based on the report of hundreds of the administrators of the commercial enterprises. The optimistic mood makes a positive impact on the CAD, as the pessimistic views are negative for the CAD.

Housing Starts s.a. Canada, 14:15 (GMT+2)

The Housing Starts s.a index is due at 14:15 (GMT+2). It is published by Canada Mortgage and Housing Corporation. It represents the number of housing starts for single-family homes. Construction volumes are closely linked to the population income, thus a growth in the index indicates economy growth. A high reading strengthens the CAD. A low reading weakens the CAD.

Labor Market Conditions Index. USA, 16:00 (GMT+2)

The Labor Market Conditions Index is due at 16:00 (GMT+2). It is calculated by Fed economists. It is made up of 19 different indicators describing the labor market. The index is one of the major indicators of the US economic growth. A high reading strengthens the USD. A low reading weakens the USD.

BoC Review. Canada, 16:30 (GMT+2)

The BoC Review is due at 16:30 (GMT+2), which represents the current state of Canada economy. The indicator is based on the report of hundreds of the administrators of the commercial enterprises. The optimistic mood makes a positive impact on the CAD, as the pessimistic views are negative for the CAD.

Claws and Horns

News of the day. 05.05.2017

RBA Monetary Policy Statement. Australia, 02:30 (GMT+2)

The RBA Monetary Policy Statement is due at 02:30 (GMT+2). A statement on monetary policy, released by the Reserve Bank of Australia, contains an overview of current economic conditions as well as factors which have lead to certain monetary policy stance adopted by the central bank. Commentaries have an impact on future interest rate decision.

Nonfarm Payrolls. USA, 14:30 (GMT+2)

The Nonfarm Payrolls data are due at 14:30 (GMT+2). The index is expected to grow to 180K in April from 98K in the previous month. It is one of the main indicators of employment in the US. It represents the number of employed in non-agricultural sectors. Has a high impact on the market. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

Unemployment Rate. USA, 14:30 (GMT+2)

The Unemployment Rate publication is due at 14:30 (GMT+2).The index is expected to grow to 4.6% in April from 4.5% in the previous month. It is one of the key macroeconomic indicators. It represents the share of unemployment in the total labour force. The growth of the indicator weakens USD, and its reduction strengthens US dollar.

Net Change in Employment. Canada, 14:30 (GMT+2)

The Net Change in Employment publication is due at 14:30 (GMT+2). The index is expected to lower to 10K in April from 19.4K in the previous month. It represents the change in the number of employed. A growth in the index indicates economic growth and strengthens the CAD. A fall in the index weakens the CAD.

Average Hourly Earnings. USA, 14:30 (GMT+2)

The Average Hourly Earnings data are due at 14:30 (GMT+2).The index is expected to grow to 0.3% in April from 0.2% in the previous month. It is the indicator of the cost of labour. It represents the change in hourly wages. A high reading strengthens the USD. A low reading weakens the USD.

Fed's Yellen Speech. USA, 19:30 (GMT+2)

Fed's Yellen Speech is due at 19:30 (GMT+2). She can comment upon the current economical situation and monetary policy in the USA.

RBA Monetary Policy Statement. Australia, 02:30 (GMT+2)

The RBA Monetary Policy Statement is due at 02:30 (GMT+2). A statement on monetary policy, released by the Reserve Bank of Australia, contains an overview of current economic conditions as well as factors which have lead to certain monetary policy stance adopted by the central bank. Commentaries have an impact on future interest rate decision.

Nonfarm Payrolls. USA, 14:30 (GMT+2)

The Nonfarm Payrolls data are due at 14:30 (GMT+2). The index is expected to grow to 180K in April from 98K in the previous month. It is one of the main indicators of employment in the US. It represents the number of employed in non-agricultural sectors. Has a high impact on the market. A high reading represents employment growth and strengthens the USD. A low reading weakens the USD.

Unemployment Rate. USA, 14:30 (GMT+2)

The Unemployment Rate publication is due at 14:30 (GMT+2).The index is expected to grow to 4.6% in April from 4.5% in the previous month. It is one of the key macroeconomic indicators. It represents the share of unemployment in the total labour force. The growth of the indicator weakens USD, and its reduction strengthens US dollar.

Net Change in Employment. Canada, 14:30 (GMT+2)

The Net Change in Employment publication is due at 14:30 (GMT+2). The index is expected to lower to 10K in April from 19.4K in the previous month. It represents the change in the number of employed. A growth in the index indicates economic growth and strengthens the CAD. A fall in the index weakens the CAD.

Average Hourly Earnings. USA, 14:30 (GMT+2)

The Average Hourly Earnings data are due at 14:30 (GMT+2).The index is expected to grow to 0.3% in April from 0.2% in the previous month. It is the indicator of the cost of labour. It represents the change in hourly wages. A high reading strengthens the USD. A low reading weakens the USD.

Fed's Yellen Speech. USA, 19:30 (GMT+2)

Fed's Yellen Speech is due at 19:30 (GMT+2). She can comment upon the current economical situation and monetary policy in the USA.

Claws and Horns

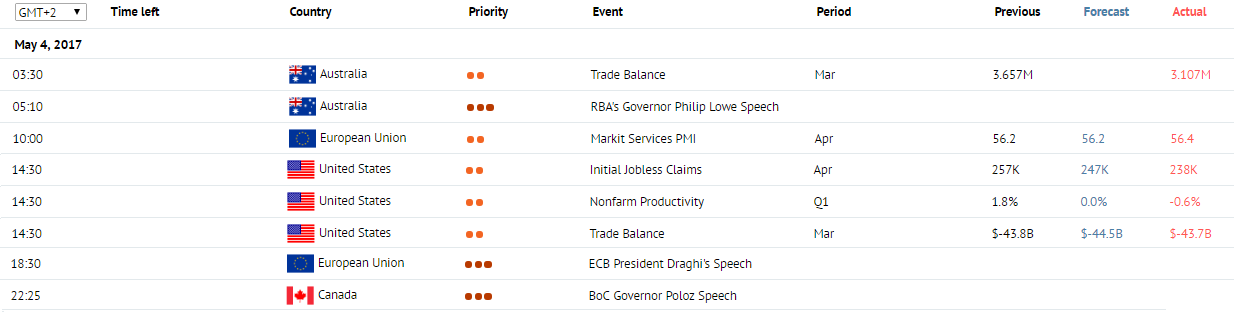

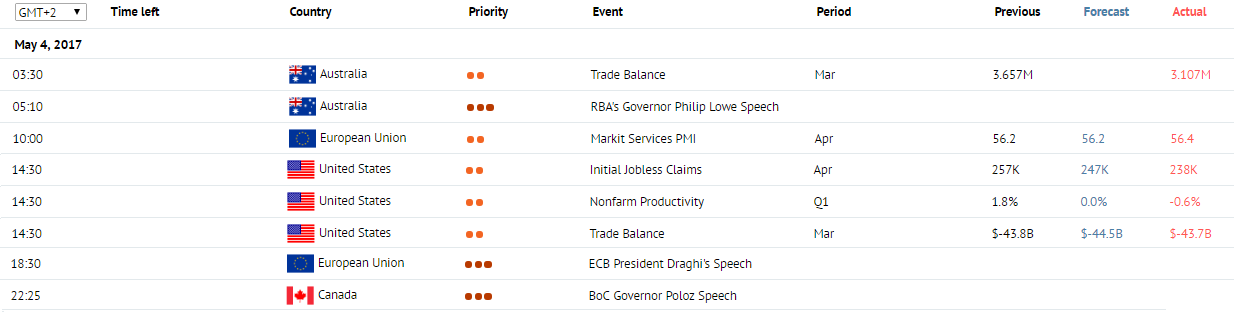

News of the day. 04.05.2017

Trade Balance. Australia, 03:30 (GMT+2)

The Trade Balance data are due at 03:30 (GMT+2) in Australia. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

RBA's Governor Philip Lowe Speech. Australia, 05:10 (GMT+2)

The RBA's Governor Philip Lowe Speech is due at 05:10 (GMT+2). Lowe will comment upon the current economical state of the Australia.

Markit Services PMI. EU, 10:00 (GMT+2)

The Markit Services PMI is due at 10:00 (GMT+2). The index is expected to stay on the same level of 56.2 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Consumer Credit. United Kingdom, 10:30 (GMT+2)

The Consumer Credit publication is due at 10:30 (GMT+2). The index is expected to lower to 1.200 billion GBP in March from 1.144 billion in the previous month. It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Mortgage Approvals. United Kingdom, 10:30 (GMT+2)

The Mortgage Approvals data are due at 10:30 (GMT+2). It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims is due at 14:30 (GMT+2). The index is expected to lower to 246K WoW from 257K in the previous week. It represents the number of new unemployment claims and is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

ECB President Draghi's Speech. EU, 18:32 (GMT+2)

The ECB President Draghi's Speech is due at 18:32 (GMT+2). Mario Draghi gives commentaries on current economic conditions in the Eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

BoC Governor Poloz Speech. Canada, 22:25 (GMT+2)

The BoC Governor Poloz Speech is due at 22:25 (GMT+2). Steven Poloz is the Governor of the Bank of Canada and the Chairman of the Board of Directors of the Bank since June 2013. He is giving commentaries regarding current economic conditions in the country and monetary policy. Depending on the tone of his speech, his comments can either strengthen or weaken the CAD.

Trade Balance. Australia, 03:30 (GMT+2)

The Trade Balance data are due at 03:30 (GMT+2) in Australia. The data on trade balance represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the AUD. Negative values indicate the balance deficit and weaken the AUD.

RBA's Governor Philip Lowe Speech. Australia, 05:10 (GMT+2)

The RBA's Governor Philip Lowe Speech is due at 05:10 (GMT+2). Lowe will comment upon the current economical state of the Australia.

Markit Services PMI. EU, 10:00 (GMT+2)

The Markit Services PMI is due at 10:00 (GMT+2). The index is expected to stay on the same level of 56.2 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Consumer Credit. United Kingdom, 10:30 (GMT+2)

The Consumer Credit publication is due at 10:30 (GMT+2). The index is expected to lower to 1.200 billion GBP in March from 1.144 billion in the previous month. It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Mortgage Approvals. United Kingdom, 10:30 (GMT+2)

The Mortgage Approvals data are due at 10:30 (GMT+2). It represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money thus showing confidence in the economy. A high reading strengthens the GBP. A low reading weakens the GBP. Fact: a too high reading could indicate credit overconsumption, when consumers take more credit than they actually need.

Initial Jobless Claims. USA, 14:30 (GMT+2)

The Initial Jobless Claims is due at 14:30 (GMT+2). The index is expected to lower to 246K WoW from 257K in the previous week. It represents the number of new unemployment claims and is published weekly on Thursdays. Allows approximating what nonfarm payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

ECB President Draghi's Speech. EU, 18:32 (GMT+2)

The ECB President Draghi's Speech is due at 18:32 (GMT+2). Mario Draghi gives commentaries on current economic conditions in the Eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

BoC Governor Poloz Speech. Canada, 22:25 (GMT+2)

The BoC Governor Poloz Speech is due at 22:25 (GMT+2). Steven Poloz is the Governor of the Bank of Canada and the Chairman of the Board of Directors of the Bank since June 2013. He is giving commentaries regarding current economic conditions in the country and monetary policy. Depending on the tone of his speech, his comments can either strengthen or weaken the CAD.

Claws and Horns

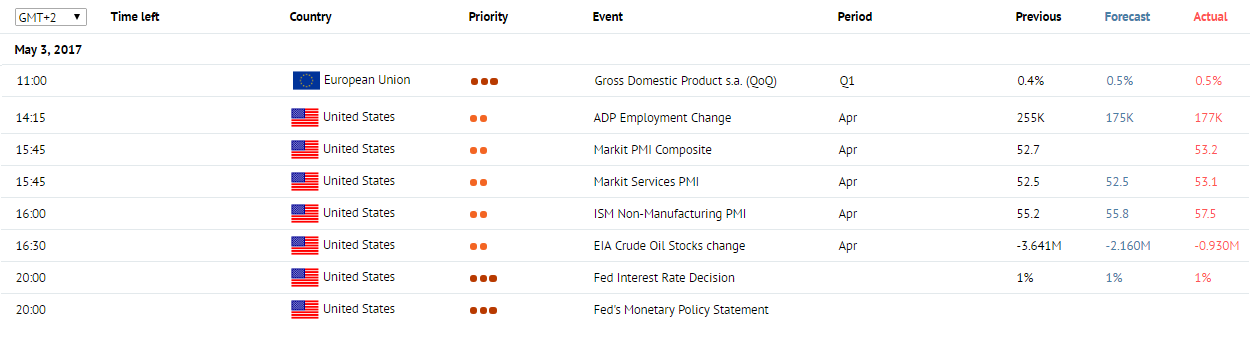

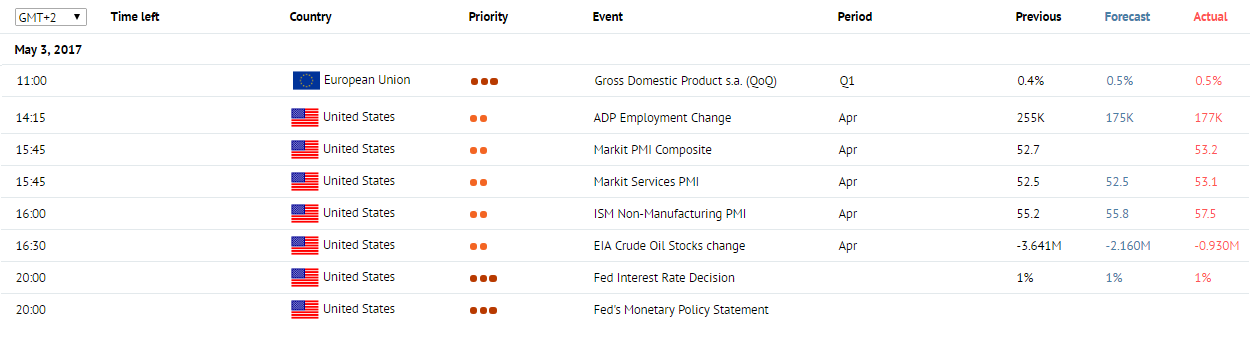

News of the day. 03.05.2017

Gross Domestic Product. EU, 11:00 (GMT+2)

The data on Gross Domestic Product in EU is due at 11:00 (GMT+2). The indicator is expected to grow to 0.5% in Q1 from 0.4% in the previous quarter. The indicator shows market value of all final goods and services produced in euro zone within the period. Higher values strengthen EUR, lower values weaken it.

ADP Employment Change Report. USA, 14:15 (GMT+2)

The employment change report is due at 14:15 (GMT+2). The indicator is expected to make up 180K in April against 263K a month earlier. The index shows the level of employment in nonfarming sectors and is formed on the basis of the data received from about 500 thousand US legal entities. High values have a positive impact on USD. Low values or those below forecast have negative influence on US dollar.

Markit Services PMI. USA, 15:45 (GMT+2)

Markit Services PMI in the USa for April is due at 15:45 (GMT+2). The indicator is expected to remain unchanged on the level of 52.5 points. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing USD rate.

FOMC decision on interest rate. USA, 20:00 (GMT+2)

FOMC's decision of the interest rate is due today at 20:00 (GMT+2). The indicator is expected to remain unchanged on the level of 1%. This indicator is very important for the economy and influences interest rate levels of commercial banks and exchange rate of US dollar. Interest rate hike influences US national currency in a positive way. Lower interest rate leads to the reduction of USD rate.

FOMC comment on fiscal policy. USA, 20:00 (GMT+2)

After making a decision on the interest rate FOMC gives its comments on the fiscal policy. Positive comments strengthen USD, and negative ones weaken it.

Gross Domestic Product. EU, 11:00 (GMT+2)

The data on Gross Domestic Product in EU is due at 11:00 (GMT+2). The indicator is expected to grow to 0.5% in Q1 from 0.4% in the previous quarter. The indicator shows market value of all final goods and services produced in euro zone within the period. Higher values strengthen EUR, lower values weaken it.

ADP Employment Change Report. USA, 14:15 (GMT+2)

The employment change report is due at 14:15 (GMT+2). The indicator is expected to make up 180K in April against 263K a month earlier. The index shows the level of employment in nonfarming sectors and is formed on the basis of the data received from about 500 thousand US legal entities. High values have a positive impact on USD. Low values or those below forecast have negative influence on US dollar.

Markit Services PMI. USA, 15:45 (GMT+2)

Markit Services PMI in the USa for April is due at 15:45 (GMT+2). The indicator is expected to remain unchanged on the level of 52.5 points. The index is built upon polls of managers working in services sector to estimate current economic situation in this sector. Values above 50 are perceived as a positive signal and strengthen USD. Values below 50 are perceived as a negative signal and call for decreasing USD rate.

FOMC decision on interest rate. USA, 20:00 (GMT+2)

FOMC's decision of the interest rate is due today at 20:00 (GMT+2). The indicator is expected to remain unchanged on the level of 1%. This indicator is very important for the economy and influences interest rate levels of commercial banks and exchange rate of US dollar. Interest rate hike influences US national currency in a positive way. Lower interest rate leads to the reduction of USD rate.

FOMC comment on fiscal policy. USA, 20:00 (GMT+2)

After making a decision on the interest rate FOMC gives its comments on the fiscal policy. Positive comments strengthen USD, and negative ones weaken it.

Claws and Horns

News of the day. 02.05.2017

BoJ Monetary Policy Meeting Minutes. Japan, 1:50 am (GMT+2)

The BoJ Monetary Policy Meeting Minutes is due at 1:50 am (GMT+2). The Minutes contain an analysis of economic conditions in the country and the evaluation of their future prospects.

RBA Interest Rate Decision. Australia, 6:30 am (GMT+2)

The RBA Interest Rate Decision is due at 6:30 am (GMT+2). The rate is expected to remain unchanged at 1.5%.

Considering current economic conditions and the pace of inflation, the regulator makes its decision on interest rates. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

Markit Manufacturing PMI. EU, 10:00 am (GMT+2)

The Markit Manufacturing PMI is due at 10:00 am (GMT+2). In April, the index is expected to remain unchanged at 56.8 points. The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. UK, 10:30 am (GMT+2)

The Markit Manufacturing PMI is due at 10:30 am (GMT+2). In April, the index is expected to decline from 54.2 to 54.0 points. The index evaluates the state of the manufacturing sector. Is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived as positive and strengthens the GBP. A reading below 50 is perceived as negative and weakens the GBP.

Unemployment Rate. EU, 11:00 am (GMT+2)

Data on the Unemployment Rate is due at 11:00 am (GMT+2). In March, the index is expected to fall from 9.5% to 9.4%. The index measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

BoJ Monetary Policy Meeting Minutes. Japan, 1:50 am (GMT+2)

The BoJ Monetary Policy Meeting Minutes is due at 1:50 am (GMT+2). The Minutes contain an analysis of economic conditions in the country and the evaluation of their future prospects.

RBA Interest Rate Decision. Australia, 6:30 am (GMT+2)

The RBA Interest Rate Decision is due at 6:30 am (GMT+2). The rate is expected to remain unchanged at 1.5%.

Considering current economic conditions and the pace of inflation, the regulator makes its decision on interest rates. An increase in interest rates strengthens the AUD. If interest rates remain unchanged or get cut, the AUD weakens.

Markit Manufacturing PMI. EU, 10:00 am (GMT+2)

The Markit Manufacturing PMI is due at 10:00 am (GMT+2). In April, the index is expected to remain unchanged at 56.8 points. The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 point represents favorable state of the sector and can strengthen the EUR. A result below 50 points, on the contrary, is seen as a negative signal and can weaken the EUR.

Markit Manufacturing PMI. UK, 10:30 am (GMT+2)

The Markit Manufacturing PMI is due at 10:30 am (GMT+2). In April, the index is expected to decline from 54.2 to 54.0 points. The index evaluates the state of the manufacturing sector. Is based on surveys of executives of the biggest manufacturing companies. A reading above 50 is perceived as positive and strengthens the GBP. A reading below 50 is perceived as negative and weakens the GBP.

Unemployment Rate. EU, 11:00 am (GMT+2)

Data on the Unemployment Rate is due at 11:00 am (GMT+2). In March, the index is expected to fall from 9.5% to 9.4%. The index measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result can pressure the EUR, while a low one, on the contrary, can strengthen the EUR.

Claws and Horns

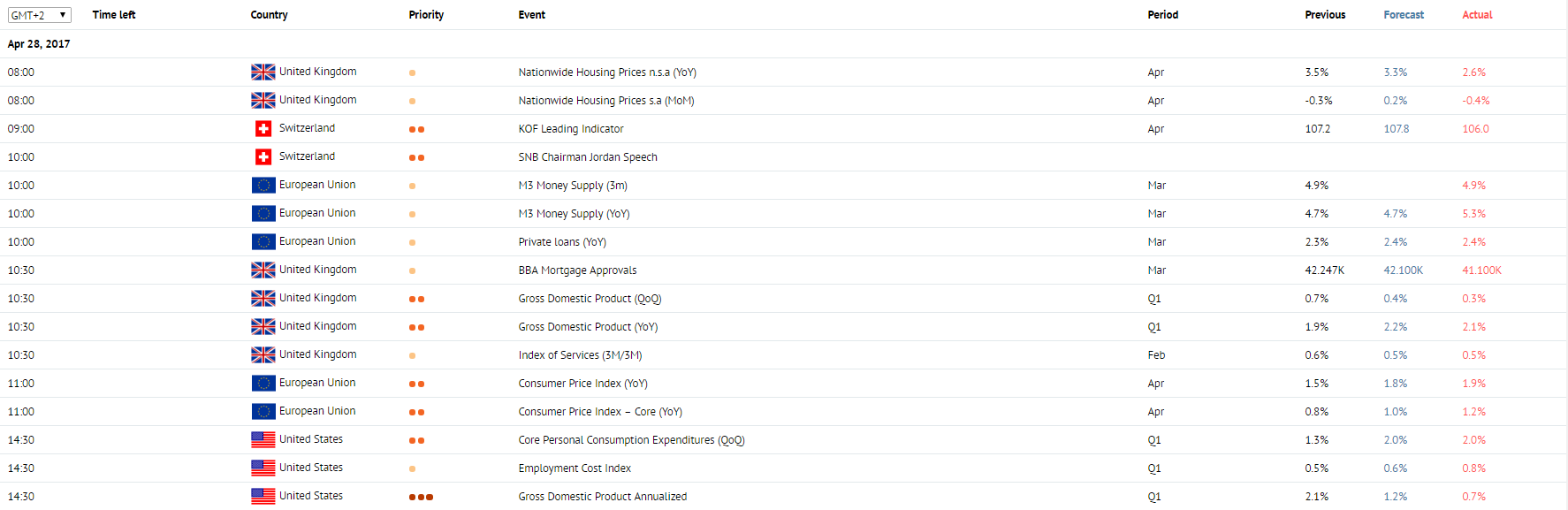

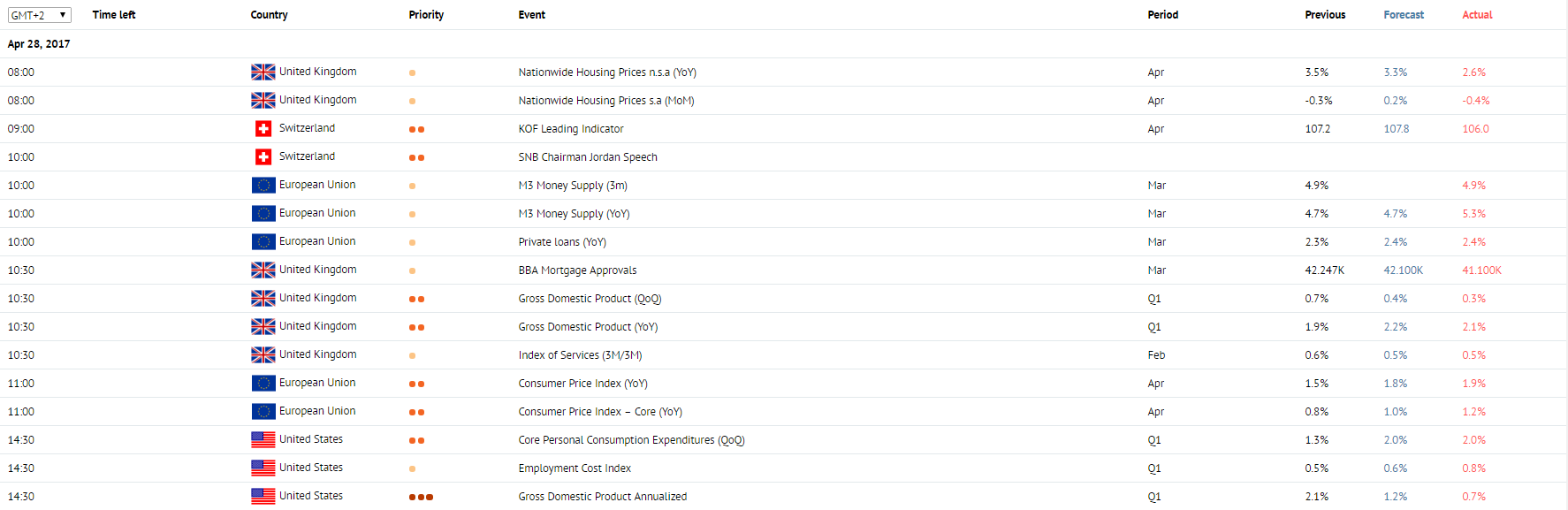

News of the day. 28.04.2017

Statement by the Head of Swiss National Bank Jordan. Switzerland, 10:00 (GMT+2)

The head of Swiss National Bank Thomas Jordan will make comments on the current economic situation and fiscal policy at 10:00 (GMT+2). Depending on the tone and nature of his statements, they may cause volatility of the Swiss franc.

Gross Domestic Product. UK, 10:30 (GMT+2)

British GDP data for Q1 is due at 10:30 (GMT+2). The indicator is expected to fall from 0.7% to 0.4% within the reporting period. The indicator shows market value of all final goods and services produced in the UK and describes the rate of economic growth or fall. High results strengthen GBP, and low ones on the contrary weaken the pound.

Consumer Price Index. EU, 11:00 (GMT+2)

The data on EU Consumer Price Index is due at 11:00 (GMT+2). The indicator is expected to grow to 1.8% in April from 1.5% a month earlier on YoY basis. This is the main indicator of inflation in the EU. The indicator shows the changes in price of the basic market basket. Its growth leads to the increase of EUR rate. The fall of the indicator weakens euro.

Annual GDP data. USA, 14:30 (GMT+2)

US annual GDP data are due at 14:30 (GMT+2). The indicator is expected to reduce to 1.3% in Q1 from 2.1% in the previous period. It shows market value of all final goods and services produced in the USA and describes the rate of economic growth or fall. High results strengthten USD and low ones weaken it.

Statement by the Head of Swiss National Bank Jordan. Switzerland, 10:00 (GMT+2)

The head of Swiss National Bank Thomas Jordan will make comments on the current economic situation and fiscal policy at 10:00 (GMT+2). Depending on the tone and nature of his statements, they may cause volatility of the Swiss franc.

Gross Domestic Product. UK, 10:30 (GMT+2)

British GDP data for Q1 is due at 10:30 (GMT+2). The indicator is expected to fall from 0.7% to 0.4% within the reporting period. The indicator shows market value of all final goods and services produced in the UK and describes the rate of economic growth or fall. High results strengthen GBP, and low ones on the contrary weaken the pound.

Consumer Price Index. EU, 11:00 (GMT+2)

The data on EU Consumer Price Index is due at 11:00 (GMT+2). The indicator is expected to grow to 1.8% in April from 1.5% a month earlier on YoY basis. This is the main indicator of inflation in the EU. The indicator shows the changes in price of the basic market basket. Its growth leads to the increase of EUR rate. The fall of the indicator weakens euro.

Annual GDP data. USA, 14:30 (GMT+2)

US annual GDP data are due at 14:30 (GMT+2). The indicator is expected to reduce to 1.3% in Q1 from 2.1% in the previous period. It shows market value of all final goods and services produced in the USA and describes the rate of economic growth or fall. High results strengthten USD and low ones weaken it.

Claws and Horns

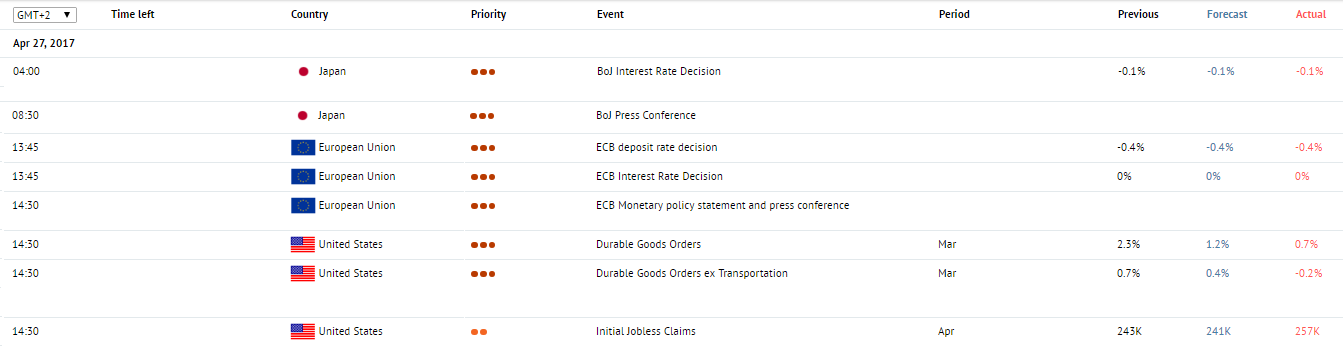

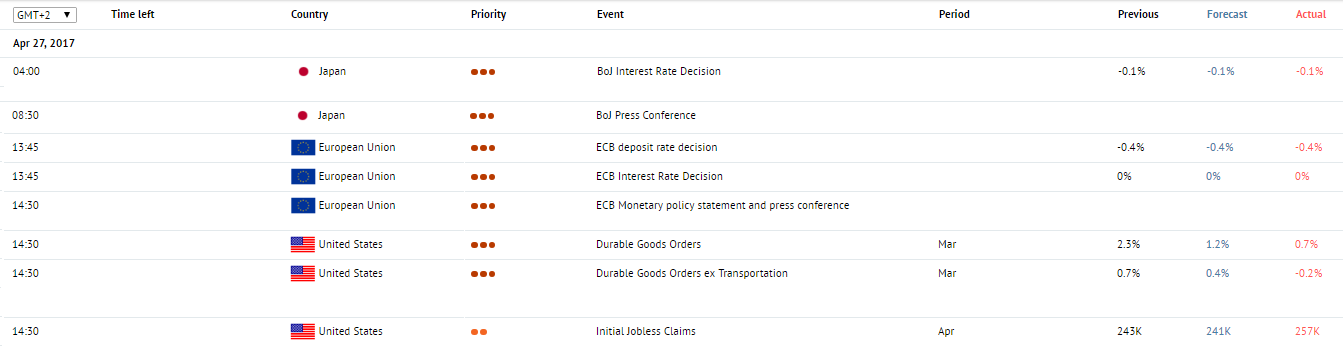

News of the day. 27.04.2017

Decision of the Bank of Japan on the Interest Rate Japan, 04:00 (GMT+2)

The decision of the Bank of Japan on the Interest Rate will be published at 04:00 (GMT+2). The indicator is expected to remain unchanged on the level of -0.1%. The Bank of Japan makes a decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens JPY. If the rate remains on the previous level of falls, the rate of the national currency decreases.

Decision of ECB on the Interest Rate. EU, 13:45 (GMT+2)

The decision of ECB on the interest rate is due at 13:45 (GMT+2). The indicator is expected to remain unchanged on the level of 0%. ECB makes a decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens EUR. If the price remains on the previous level of drops, the rate decreases.

Decision of ECB on Deposit Rate. EU, 13:45 (GMT+2)

Decision of ECB on the deposit rate will be published at 13:45 (GMT+2). The indicator is expected to remain unchanged on the level of -0.4%. A deposit rate is an interest rate under which commercial banks deposit their funds on the accounts of the Central Bank.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The indicator is expected to reduce to 241 thousand a week from 244 thousand a week earlier. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays, and gives a perspective of the NonFarm Payrolls indicator. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Demand for Durable Goods. USA, 14:30 (GMT+2)

Data on demand for durable goods are due at 14:30 (GMT+2). The indicator is expected to fall to 1.2% in March from 1.8% a month earlier. The index demonstrates changes in the prices for durable goods including vehicles that have been in use for over 3 years. The growth of demand is viewed as a positive signal for the economy, and its decline indicates slower economic growth rate. High values strengthen USD.

Press Conference and Comments of ECB on Fiscal Policy. EU, 14:30 (GMT+2)

ECB press conference on fiscal policy is due at 14:30 (GMT+2). After announcing a decision on the interest rate the head of ECB makes comments on it and answers questions about the current economic situation in the EU.

Decision of the Bank of Japan on the Interest Rate Japan, 04:00 (GMT+2)

The decision of the Bank of Japan on the Interest Rate will be published at 04:00 (GMT+2). The indicator is expected to remain unchanged on the level of -0.1%. The Bank of Japan makes a decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens JPY. If the rate remains on the previous level of falls, the rate of the national currency decreases.

Decision of ECB on the Interest Rate. EU, 13:45 (GMT+2)

The decision of ECB on the interest rate is due at 13:45 (GMT+2). The indicator is expected to remain unchanged on the level of 0%. ECB makes a decision on the interest rate based on the current economic situation and the level of inflation. The growth of the indicator strengthens EUR. If the price remains on the previous level of drops, the rate decreases.

Decision of ECB on Deposit Rate. EU, 13:45 (GMT+2)

Decision of ECB on the deposit rate will be published at 13:45 (GMT+2). The indicator is expected to remain unchanged on the level of -0.4%. A deposit rate is an interest rate under which commercial banks deposit their funds on the accounts of the Central Bank.

Initial Jobless Claims. USA, 14:30 (GMT+2)

Initial Jobless Claims are due at 14:30 (GMT+2). The indicator is expected to reduce to 241 thousand a week from 244 thousand a week earlier. This indicator shows the amount of new initial jobless claims, is published weekly on Thursdays, and gives a perspective of the NonFarm Payrolls indicator. Decreasing the amount of the claims influences the USA dollar in a positive way. Increased amount of claims, on the contrary, is considered to be a negative factor.

Demand for Durable Goods. USA, 14:30 (GMT+2)

Data on demand for durable goods are due at 14:30 (GMT+2). The indicator is expected to fall to 1.2% in March from 1.8% a month earlier. The index demonstrates changes in the prices for durable goods including vehicles that have been in use for over 3 years. The growth of demand is viewed as a positive signal for the economy, and its decline indicates slower economic growth rate. High values strengthen USD.

Press Conference and Comments of ECB on Fiscal Policy. EU, 14:30 (GMT+2)

ECB press conference on fiscal policy is due at 14:30 (GMT+2). After announcing a decision on the interest rate the head of ECB makes comments on it and answers questions about the current economic situation in the EU.

: