Juan Carlos Barradas Ramirez / 个人资料

- 信息

|

1 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

3

信号

|

0

订阅者

|

https://jcarlosbarradasrz1.wixsite.com/jcb-edge-fund

The portfolio is well diversified, and because the goal is to stop the losses quickly and let the winnings run as long as they pay, you will see a more steady equity than balance. The metric that matters most is equity over balance

This week main long GE and ADP. The portfolio will be mixed this week between longs and shorts

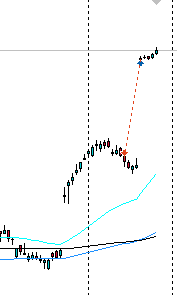

The portfolio went from 80% short to almost 100% long, thanks to its strategy. 44% return YTD. Main long NVDA

80% of the positions are short as this week the S&P 500 continued its drawdown. The best trade is General Electric shorted around 112, current price: 106.238. Worst trade Marsh McLennan bought around 189, current price 184.725. The best profit is twice the worst trade thanks to the size lot in each trade. This week, the portfolio ended in profit, with a YTD around 36% positive

Difficult week for the S&P500. My US Equity Trading ended up with 57% of all positions being short, and 43% of all positions being long. Some improvements to the strategy have been made. Let's see what happen. One of the shorts is GOOG. https://charts.mql5.com/37/703/goog-nas-d1-raw-trading-ltd.png

The week started being positive, but several trades hit the stop loss at the end of the week, some on profit, some on loss... The portfolio is still 95% long. I'll keep protecting the capital and stick to the strategy

I'll stick to the strategy regardless of the current events

This week was of high volatility, as the S&P 500 made a pause in the bear trend. The portfolio made a switch from short to long ending 77% of all position being long. The strategy has been succesfull in detecting the market trend, and in terms of risk management, I have stopped the losses and let the wining trades run. This week ended with an all time Equity high

At the end of this week, 52% of the total value of the portfolio is short with financials and consumer staples as main shorts. Main longs is information technology and industrials. The S&P 500 didn't send a clear signal of going long or short, at least for me. I'm sticking to the strategy, that's why I have mixed positions which helps to risk management. This week was for realizing some profits. Some times I'll be withdrawing and depositing some funds at the end of each month

This past week S&P 500 continue falling and the strategy signaled one should be short, so the account shows that conviction in several traded stocks with few longs. Some of these longs will hit my strategy's Stop Loss level. Always stop the losses, and let the winnings run. I will not always be right, but in the end the winnings will always overcome the loses, as the account shows it in its stats