版本 1.11

2023.07.03

"GA Moving Average" - Intelligent Moving Average Expert Advisor

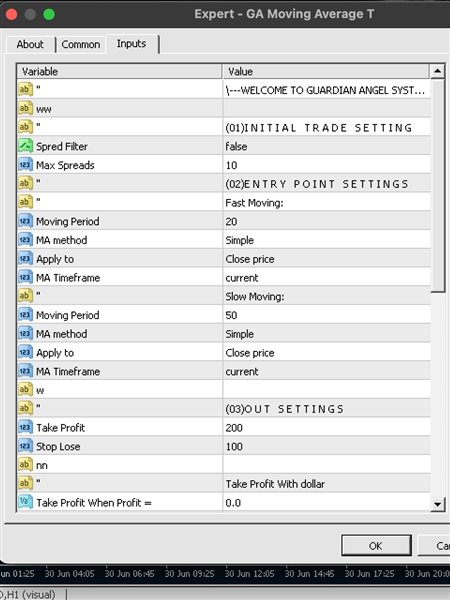

(01) Initial Trade Settings: Customize your initial trade settings to start your trading journey. By using the spread filter option, you can ensure optimal trade execution. Set the maximum spread limit up to 10 pips to protect your strategy from unfavorable market conditions.

(02) Entry Point Settings: Precisely configure your entry points. Configure the fast and slow moving averages to capture market momentum. Choose from multiple moving average methods and applied price options, with flexibility in selecting the timeframe for each moving average.

(03) Exit Settings: Control your profit targets and risk management. Set desired take profit (TP) and stop loss (SL) levels, ensuring potential profits while reducing potential losses. Fine-tune your strategy to align with your risk tolerance.

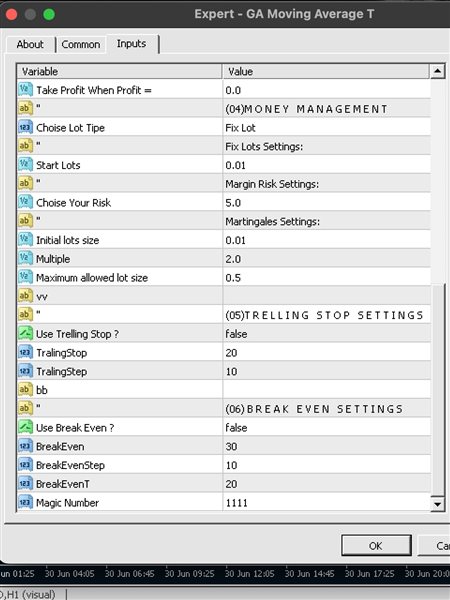

(04) Money Management: Implement effective money management techniques to maximize returns. Choose between fixed lot sizes or adjust the position size based on the defined risk percentage. Set your risk threshold and let the expert advisor automatically calculate the appropriate lot size.

(05) Trailing Stop Settings: Enhance your trade management with the trailing stop feature. Activate the trailing stop function to secure profits when the market moves in your favor. Define the distance and step to customize your exit strategy for optimal results.

(06) Break Even Settings: Boost your gains with the break-even feature. Activate the break-even function to move the stop loss to the entry point once a specific profit level is reached. Set the distance and step to secure profits while minimizing risks.

"GA Moving Average" combines intelligent entry points, effective money management, trailing stop functionality, and break-even protection. With customizable settings and robust features, it empowers traders to navigate the markets with confidence and achieve desired trading goals. Enjoy the power of automated applications and step-by-step trading with GA Moving Average.

- -------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- -----------

"GA Moving Average" is an Expert Advisor (EA) designed to automate trading based on a moving average crossover strategy. With its customizable settings, this EA empowers traders to create their ideal strategy by tailoring various parameters to match their trading preferences.

The core concept of the "GA Moving Average" EA revolves around the utilization of moving average indicators to identify potential trade opportunities. By analyzing the interaction between different moving averages, the EA aims to generate signals for buying and selling in the market.

Key Features and Customization Options:

1. Moving Average Parameters: Traders can define the specific moving average periods (short-term and long-term) to suit their trading style and preferences. This allows for flexibility in adapting to different market conditions and timeframes.

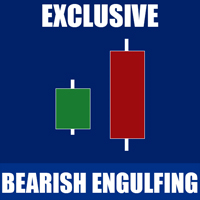

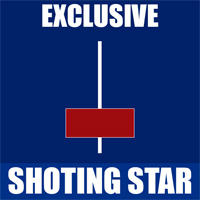

2. Crossover Signal Generation: The EA monitors the crossover of the short-term and long-term moving averages. When the short-term moving average crosses above the long-term moving average, a bullish signal is generated, indicating a potential buy opportunity. Conversely, when the short-term moving average crosses below the long-term moving average, a bearish signal is generated for potential selling opportunities.

3. Risk Management: The EA incorporates risk management features, enabling traders to control their exposure in the market. Users can specify parameters such as lot size, stop loss, and take profit levels to manage risk and protect their trading capital.

4. Customizable Settings: The "GA Moving Average" EA provides an array of adjustable parameters to fine-tune the strategy. Traders can experiment with different settings, such as signal sensitivity, confirmation criteria, and trade filters, to optimize performance and adapt to market conditions.

5. Backtesting and Optimization: The EA supports historical data analysis through backtesting and optimization. Traders can evaluate the effectiveness of their strategy by testing it against past market conditions and optimizing parameters to enhance performance.

Note: It is important to thoroughly test and validate any strategy or EA before deploying it in live trading. Additionally, monitoring the EA's performance and making necessary adjustments is crucial to adapt to changing market dynamics.

用户没有留下任何评级信息