Orion Flexible Mean Reversion

- 专家

- Joao Paulo Botelho Silva

- 版本: 1.0

- 激活: 5

The Orion Flexible Mean Reversion EA allows traders to develop numerous mean reversion strategies. The EA incorporates various indicators for developing robust entry and exit strategies that can be adapted to function in various time frames and markets.

Theoretical Basis

Mean reversion strategies aim to enter in the opposite direction of exhaustion movements, seeking a price reversal. They are excellent ways for traders to diversify their portfolios building high winning rates strategies.

How It Works

The user defines the indicator that will generate entry signals, choosing from Keltner Channels, Bollinger Bands, Envelopes, or Donchian Channels.

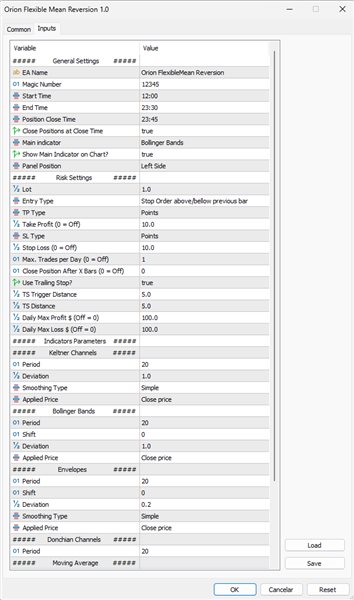

General Settings

- EA Name

- Magic Number

- Start Time (Time to start trading)

- End Time (Time to stop trading)

- Position Close Time (Time to close open trades and pending orders)

- Close Position at Close Time (Close trades at closing time)

- Main Indicator (Indicator to be used for generating entry signals)

- Show Main Indicator on Chart?

- Panel Position (EA panel position on the screen)

Risk Settings

- Lot

- Entry Type

2.1. Stop Order above/below previous bar

2.2. At Market if bar close above/below band

2.3. Close Out, Close In

2.4. Entry at Touch of Band - TP Type (Take Profit Type: Points, Percentage, Opposite Band, Middle Band, Moving Average, ATR Multiple)

- Take Profit (TP distance or multiplier)

- SL Type (Stop Loss Type: Points, Percentage, ATR Multiple)

- Stop Loss (SL distance or multiplier)

- Use Trailing Stop

- TS Trigger Distance (Distance in points to activate TS)

- TS Distance (TS distance)

- Daily Max Profit $

- Daily Max Loss $

Indicators Parameters

Keltner Channels

- Period

- Deviation

- Smoothing Type

- Applied Price

Bollinger Bands

- Period

- Shift

- Deviation

- Applied Price

Envelopes

- Period

- Shift

- Deviation

- Smoothing Type

- Applied Price

Donchian Channels

- Period

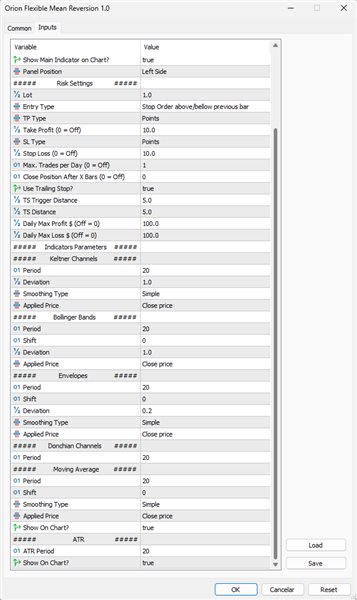

Moving Average

- Period

- Shift

- Smoothing Type

- Applied Price

- Show On Chart?

ATR Settings

ATR Period (ATR period if user chooses TP or SL in ATR)

Show On Chart?

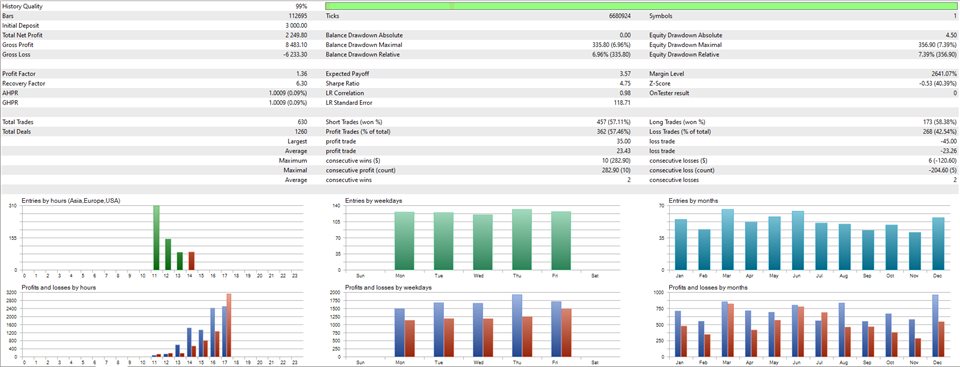

Results

We believe in robust trading strategies that can withstand different market scenarios. Mean reversion strategies are undoubtedly excellent ways to achieve portfolio diversification.

Robust strategies are those that can be adapted to various assets without the need for countless variables or false "secret formulas" =).

*See the images for an example of a robust strategy configuration on EURUSD using M15 charts.