Orion Dynamic Range Breakout

- 专家

- Joao Paulo Botelho Silva

- 版本: 1.1

- 更新: 24 五月 2023

- 激活: 5

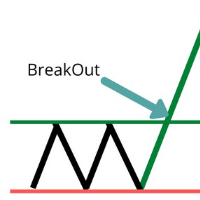

Orion Dynamic Range Breakout allows the trader to use one of the most robust trading strategies of all times, the Opening Range Breakout, which can be adapted to work in many different Symbols. Also, it allows the user to use many variations of breakout ranges and risk/profit parameters.

Theoretical Basis

Range Breakouts are widely used by a lot of big names in the trading industry. They were popularized by the hedge fund manager Toby Crabel, which made a lot of success using the strategy in futures markets (see the book Trading Short Term Price Patterns and Opening Range Breakout - August 1990).

How it works?

The user defines the start and end of the range area which will be used to place buy/sell stop orders to enter the breakout.

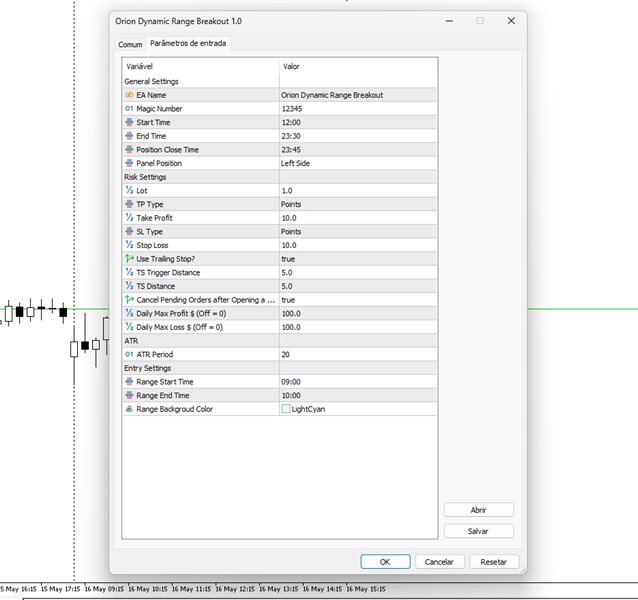

General Settings

The user can define:

1- EA Name;

2- Magic Number;

3- Start Time (Time to start trading;

4- End Time (Time to stop trading);

5- Position Close Time (Time to close open positions and orders);

6- Panel Position;

Risk Parameters

1- Lot;

2- TP Type (Type of distance of the Take-profit: Points, ATR Multiple, Range);

3- Take Profit (TP distance or multiplier);

4- SL Type (Type of distance of the Stop Loss: Points, ATR Multiple, Range);

5- Stop Loss (SL distance or multiplier);

6- Use Trailing Stop;

7- TS Trigger Distance (Distance in Points to activate TS);

8- TS Distance (Distance of TS of the highest/lowest price);

9- Cancel Pending Orders after Opening a Position;

10- Daily Max Profit $;

11- Daily Max Loss $;

ATR Settings

1- ATR Period (If user selects TP or SL in ATR);

Entry Settings

1- Range Start Time (Time to start calculating the breakout range);

2- Range End Time (Time to finish calculating the breakout range) ;

3- Range Background Color

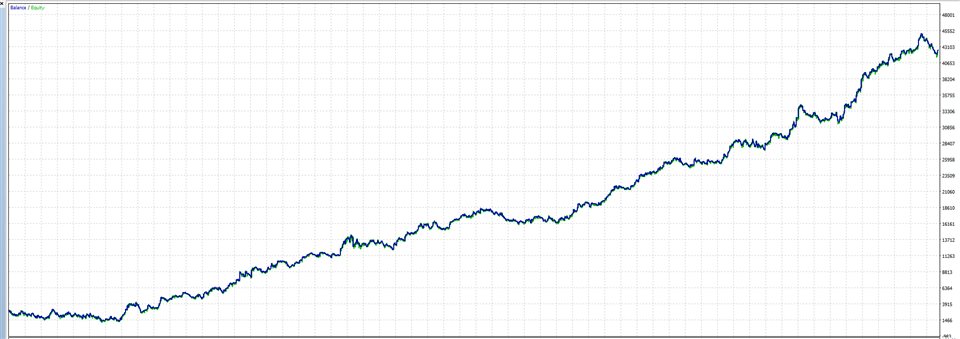

Results

We believe in robust trading strategies that have survived the test of time. Range Breakout strategies are undoubtedly one of them.

Robust strategies are the ones that are conversible to many symbols without the need of countless indicators or "secret formulas" = ).

*Check the images to see a robust and working configuration for the strategy using the USDJPY with H1 charts.