QuantifierEA MT5 for a variety of statistic

- 实用工具

- Christoph Nickels

- 版本: 1.5

- 激活: 20

Because of the variety of strategies that traders and investors have developed over time, quantified, statistics-based strategies over time stand out.

Statistical strategies are not based on technical analysis or similar patterns, as some might expect, but on the approach of using recurring patterns in the market, caused, for example, by liquidity effects, on the basis of a period-based entry and exit.

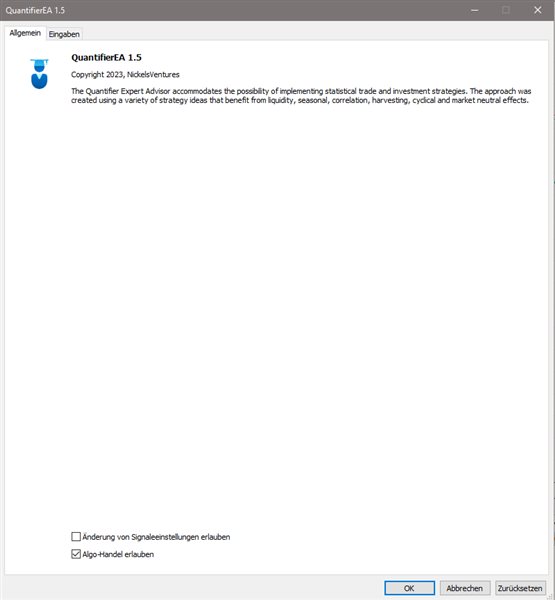

The Quantifier Expert Advisor therefore offers the possibility to implement exactly these said statistical trading and investment strategies, regardless of the chosen instrument. The solution approach was developed using a variety of strategy ideas that benefit from liquidity, seasonal, correlation, harvest, cyclical and market neutral effects.

You receive:

- a solution designed by institutional traders

- the Expert Advisor in .ex5 format

- the door to infinite possibilities of time-based trading

- the possibility of application on any tradable instrument

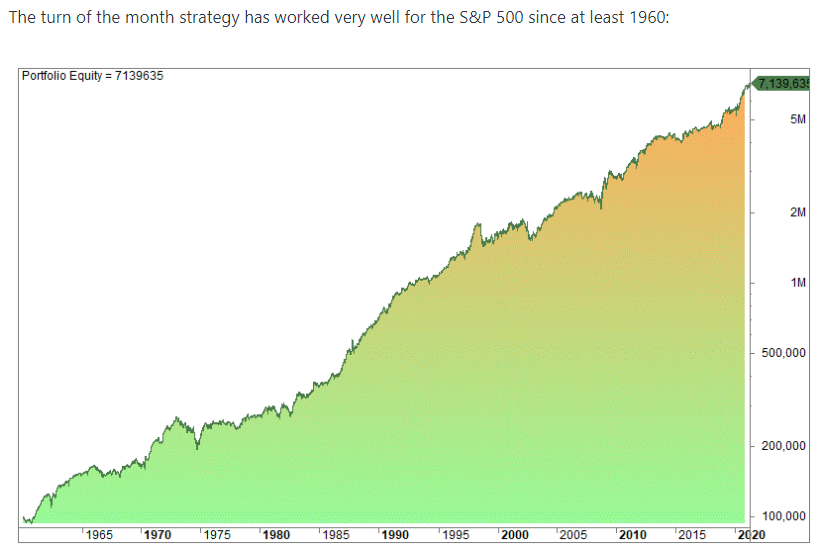

Many well-known strategies, such as the end-of-month effect (https://www.quantifiedstrategies.com/turn-of-the-month-trading-strategy/) , are documented in detail with backtesting on the quantifiedstrategies.com homepage .

Furthermore, tools such as Seasonax.com or stockmarketonline.com offer the possibility of identifying and applying an almost infinite number of strategies based on all instruments that can be traded on the Metatrader 5.

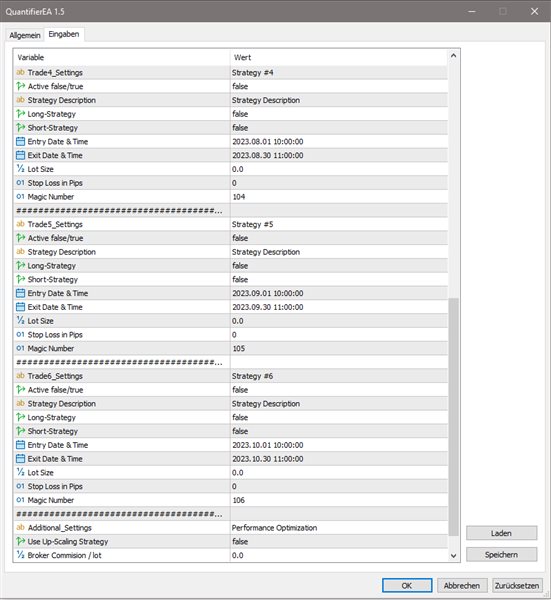

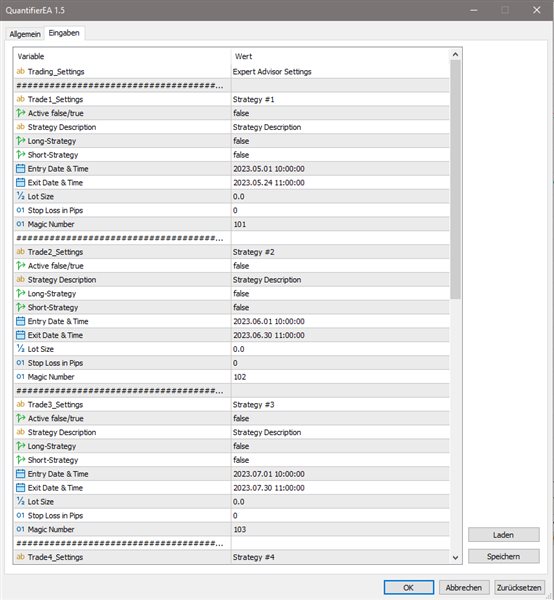

The QuantifierEA therefore offers you the optimal basis for applying six independent strategies for a selected instrument.

This means that the Expert Advisor can implement six strategies per applied chart window or instrument. This is based on the magic number logic, which ALWAYS has to be defined uniquely for the whole account, otherwise the relationship between the entry and exit periods can be influenced or disturbed.

In addition, the Expert Advisor contains a scaling logic that allows you to optimize your profits for the respective period on the basis of classic price-action logic.

As soon as the first of your positions is in positive territory and after a correction, a bullish or bearish candle with momentum exits - according to Wyckoff - an identical position is opened, just not from the exit day.

All paths and doors to statistical trading are now open to you. Take your chance and follow the path of the large institutional (hedge) fund managers.