PythonLSTM

- 专家

- Yevhen Chystiukhin

- 版本: 3.2

- 更新: 3 四月 2024

- 激活: 5

This multi-currency Expert Advisor uses 28 currency pairs. For forecasts, the EA uses recurrent neural networks of the LSTM type, models trained in the python language environment, and imported into the EA using a new function in mql5 to load ONNX models

Finally it happened, mql5 developers have recently introduced the ability to load ONNX models in the mql5 language. And this format supports most modern libraries for training neural networks, and this now opens up an unlimited number of possibilities for using artificial intelligence in trading.

Hurry up to be the first to use this powerful tool in trading, because soon neural network advisors will be out of competition, now neural networks and artificial intelligence are developing by leaps and bounds.

How is this Expert Advisor better than the rest on neural networks in the mql5 market? - Previously, it was generally not possible to use neural networks directly in the mql5 language, and all other Expert Advisors are mainly made on self-made neural networks, which cannot compete with neural networks trained using modern machine learning libraries that have been developed and improved over many years. years and developed by a huge number of developers.

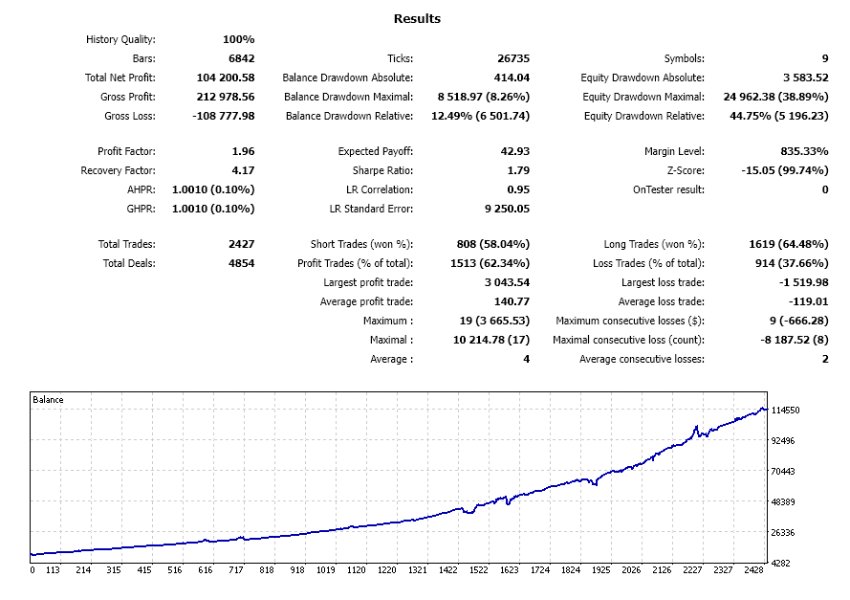

The profitability of currency pairs can be viewed in the strategy tester after the test in the "Journal" tab, and disable unprofitable pairs as needed in the adviser settings, or select the most profitable, the Active option. Before the test, set Active = True for all pairs and after the test, turn off the unprofitable pairs Active = False, and you can start trading.

By default, the most profitable 9 pairs out of 28 are selected

The EA was trained from 2016 to 2023, it is necessary to test in the strategy tester from 2022 for Model2 = True, from this period the EA did not know anything about the history during training

- Before testing, it is advisable to select the EUR USD currency pair and the H1 hour period

- In the strategy tester, set the "Open prices only " trading mode, this will not greatly affect the testing results, but will noticeably speed up the process.

- Also, for quick testing, you can turn off the visualization of the strategy tester.

- At the end of testing, in the log tab, you can view information on the profitability and maximum drawdown of each pair separately

- UseSameLotSizeForAllPairs - the ability to select the lot size for each pair separately, true by default, one lot size for all specified by the parameter above

- UseMaxAllTakeProfitProcent - enables the global take profit as a percentage of the current profit specified in the MaxAllTakeProfitProcent parameter, after its execution all current orders are closed. Test only on all ticks or 1 minute OHLC

- UseMaxStopLossProcent - turns on the global stop loss as a percentage of the current profit specified in the MaxAllStopLossProcent parameter, after its execution, all current orders are closed. Test only on all ticks or 1 minute OHLC

- IsDynamicLot - enable automatic formation of the lot size depending on the balance or free margin

- is_koef_for_each - if true, then the lot size is formed from the balance for each currency pair separately, if false, then from the total balance or free margin

- koef - coefficient for forming the lot size, the larger, the greater the risks

- from - formation of the lot size depending on the balance or free margin

- CountOfGrid - the number of pending orders in the grid

- CountGridBars - the number of last bars in history from which the lowest and highest prices are found to calculate the interval between orders for the grid: MaxPrice and MinPrice

- GridKoef - the distance between pending orders in the grid is calculated using the formula (MaxPrice - MinPrice)/ GridKoef

- GridKoefBegin, GridKoefEnd - distribution of coefficients for multiplying the price of a pending order in the grid