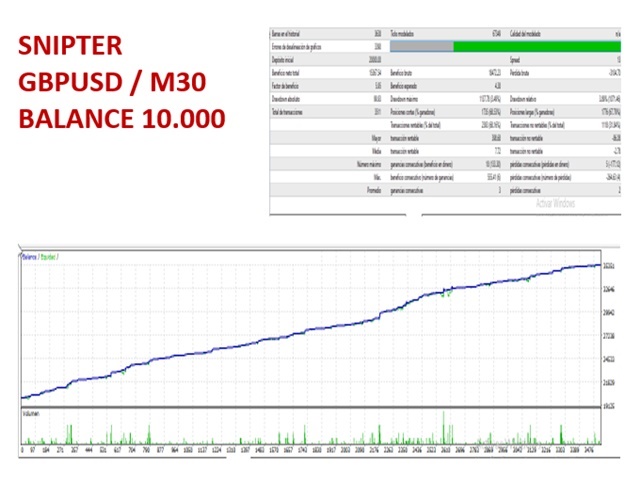

Gea Snipter GBPUSD mt5

- 实用工具

- Mauricio Valbuena

- 版本: 1.0

- 激活: 5

Here is a powerful trading tool that will allow you to trade manually or automatically in any market, but is especially useful in markets with high volatility and liquidity.

This system has two EAs (Expert Advisors): one for Buy and one for Sell, which work independently. The operation is based on the hedging strategy and the increase in lots based on the Fibonacci sequence, which will allow you to always add the two previous lots: 1, 2, 3, 5, 8, 13...

You decide how you want to trade: you can start the cycles manually or automatically, depending on the strategy you are using. In manual mode, you can control the buttons on the screen, while in automatic mode, the bot will make its inputs based on divergences, which can be controlled by a single parameter: the indicator periods.

And that's not all, the expert has three totally independent and adjustable closing systems according to your needs, which will allow you to operate with greater security and confidence in the financial market.

Do not miss the opportunity to improve your trading operations. Find out how this expert can help you trade more efficiently and profitably in the financial market!"

Features

-

This expert has separate bots for Buy and Sell, which can be adjusted in the system parameters.

-

// Automatic trading Buy

-

// Automatic trading Sell

-

The hedge has both a lot multiplier and a trade distance multiplier to reduce risk.

-

// Lots

-

// Distance between trades pips (0 = off)

-

// Grid multiplier (1 = off)

-

// Maximum number of trades

-

It has closing buttons that will allow you to easily exit the market at any time you want.

-

It has a lines button that will allow you to control the bot in a more efficient and personalized way. Find out how this expert can help you improve your trading operations and reduce risk in the financial market!

-

Also, these buttons not only allow you to exit the market easily, but also allow you to use the bot in the strategy tester. With this feature, you will be able to automate your trading strategy and let the expert trade for you, without having to worry about anything else!

-

This expert is not only versatile in terms of the markets you can trade, but also has different time frames that can be analyzed simultaneously. In this way, you will be able to obtain a complete and detailed vision of the financial market and make more informed and accurate trading decisions.

-

This expert not only allows you to control the maximum number of orders and the maximum volume allowed, but also limits the daily risk and the risk per trade. In addition, he has a maximum stop loss for all orders, which allows you to manage and limit the risk of your trading operations effectively. With these risk control features, you will be able to operate with greater peace of mind and confidence in the financial market.

-

This system not only offers you different risk control options, but also has three different closing systems that allow you to alternate and optimize your trading results. The system automatically adjusts to your specific trading needs and goals.

-

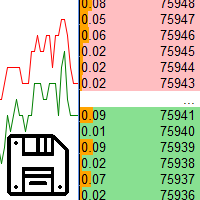

It has a very complete risk control panel that will allow you to manage your trading operations more effectively. This control panel will show you important statistics such as your daily, weekly and monthly earnings, maximum risk and maximum drawdown, among other relevant data. With this information, you will be able to make more informed decisions and better control your risks in the financial market.

Parameters

// Contact: to inform contact details

// Automatic trading Buy: Activate automatic Buy system

// Automatic trading Sell: Activate automatic Sell system

// Start time: Trading start time

// End time: Trading end time

// Maximum spread: Maximum spread allowed

// Lots: Set the volume for cycle start

// Active Autolots: Enable automatic volume calculation on balance - true / false

// Autolots % : percentage of balance to invest %

// Active hedge: Activate the coverage system more than one operation simultaneously true false

// Multiply on loss: Volume increase multiplier when the price is at a loss

// Multiply on profit: Volume increase multiplier when the price is at a profit

// Distance between trades pips (0 = off): Set the minimum price distance between each trade

// Grid multiplier (1 = off): multiplier to increase the minimum price distance between each trade

// Activate alternate orders: activate embedded orders buy - sell - buy ........

// Timeframe Range: timeframe for range filter

// Periods Range: parameters for range filter

// Timeframes Bars: signal interval timeframe

// Timeframes Levels: levels timeframe

// Periods levels: Levels periods

// Multiply_Atr: Atr multiplier

// Sens: Offset levels

END OF TREND CLOSURE

// Past candles count: N candles

// Min pips range between_candles: pips between candles

// Trend_Quality (between 1 and 9): slope trend

// Start N orders: number of orders to activate

// closing profit: profit between pair of orders

// Activate impulse system: Activate impulse system true false

input string _4 = "T R A D I N G D A Y S";

input bool Monday = true; configuration of trading days

input bool Tuesday = true; configuration of trading days

input bool Wednesday = true; configuration of trading days

input bool Thursday = true; configuration of trading days

input bool Friday = false; configuration of trading days

input bool Saturday = false; configuration of trading days

input bool Sunday = false; configuration of trading days

"xxxxxxxxxxxxxxxxxx"; // RISK MANAGEMENT

// maximun loss daily (0 = off): maximum risk of the day, and is given in the trading currency

/ N days to reset: number of days to reset the system

// Minimum funds: minimum funds allowed to deactivate the bot

// Fixed Stop loss: stop loss

// Maximum number of trades: Set the maximum allowed number of trades

// Volume upper limit: Maximum volume allowed

// Active End stop: Activate fixed closing time

// End stop trades: fixed closing time ej 20:00

// Slippage: difference between the expected price of an operation and the real price at which the operation is executed

// Magic Number: magic number