MerkaDivergence

A trading system based on divergences is one that uses divergences between technical indicators and market prices to identify potential trading opportunities. Here's how this type of trading system operates:

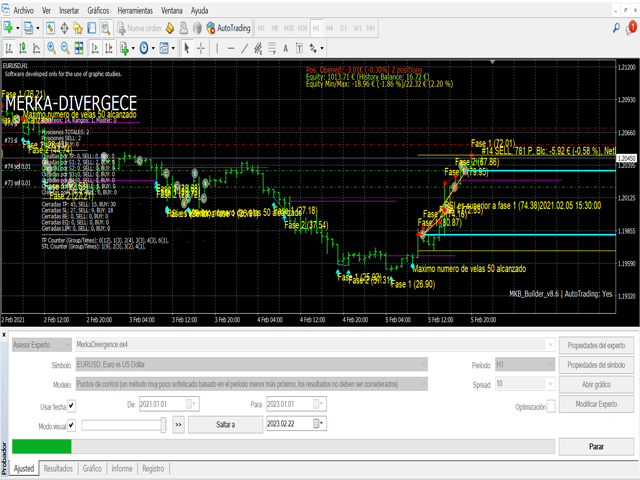

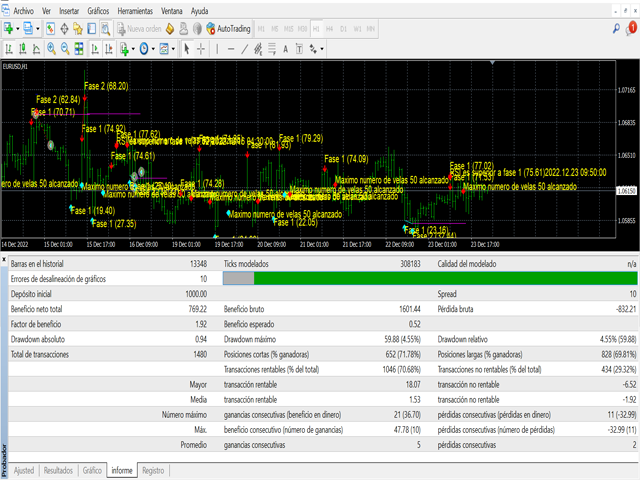

Divergence identification: The divergence-based trading system seeks to identify divergences between technical indicators and market prices. A divergence occurs when the market price and a technical indicator move in different directions, which can indicate a possible trend reversal.

Signal confirmation: Once a divergence has been identified, the trading system must confirm the signal before entering a trade. Signal confirmation may include analyzing other technical indicators, price patterns, or fundamental analysis.

Trade entry: When the signal is confirmed, the trading system can enter a trade. The direction of the trade will depend on the type of divergence identified. For example, if a bullish divergence is identified, the trading system may enter a long position.

Setting stop loss: As with any trading system, the divergence-based system must establish a stop loss level to limit losses in case the trade doesn't go as expected. The stop loss level can be set at a strategic point to minimize the trade's risk.

Setting profit targets: The divergence-based system must establish profit targets to close the trade at the right time. These profit targets may be based on identifying resistance or support levels, or other factors.

Overall, a trading system based on divergences uses divergences between technical indicators and market prices to identify potential trading opportunities. Like any trading system, the success of a divergence-based system depends largely on the accuracy in identifying divergences and managing risk and profit targets appropriately.