Hiroment

- 专家

- Ivan Simonika

- 版本: 1.0

- 激活: 5

The Hiroment bot is suitable for everyone who was looking for a universal scalpel but cannot stop at a specific product because they notice flaws in all of them or a lack of understanding of the trading strategy. For those who are included in this category of searchers, there is good news - this bot is for you! The description below will provide only essential information, and nothing more.

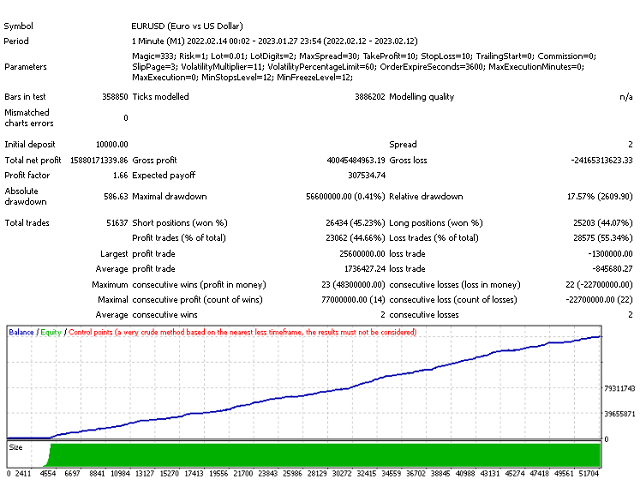

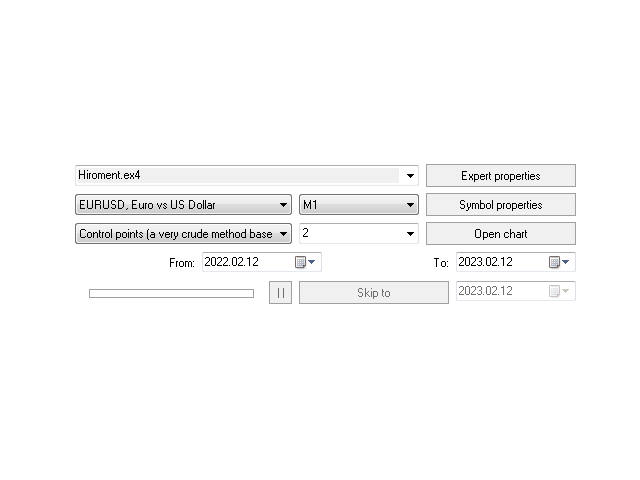

An example of how to conduct testing, see the screenshot!

Testing recommendations.

It is necessary to test the bot on all ticks. We select a special broker with a specially low spread, and it is he who is suitable for work, but not average, which is only suitable for testing trend bots! That is, testing on real ticks (with an average historical spread) is not suitable for this development in any way! For real tick fanatics, an optimization file will be provided with which you can optimize on real ticks and work on the principle of optimize 90% and work 10% of the time, as mentioned above for environments unfavorable for the bot.

About the principle of the bot.

This bot is a scalpel-type expert, which means, first of all, high performance. In order to ensure high performance, a simple and effective principle of entering the market was chosen.

The Expert Advisor forms a channel on the selected timeframe. When the purchase price breaks below this channel (that is, when the price is in a favorable place for us), a pending order to buy is placed. A sell order is placed similarly when the channel is broken in the other direction. When generating a signal, the level of the spread, both instant and average for the last 30 ticks, is taken into account, so the entry is made only at the time of the minimum spread! The next important point is the analysis of market volatility and signal matching in accordance with acceptable volatility values. Pending orders are possible two at the same time, one for buying the other for selling, and the bot always opens only one order in one direction, that is, there is no accumulation of orders and no grids or martingale. One order in one direction with short stops. After a pending order is placed (or two orders in different directions), the EA is able to trail this order, that is, if the sell level drops below the middle of the channel, the EA will trail the pending order so that when the latter is triggered, there will be better conditions for the strategy. That is, there is a very effective trailing of pending orders. If the price rises significantly above the channel, then the pending order will be deleted according to the strategy and new favorable conditions will be expected. Let's consider the situation, when the order moves from the pending to the market one. After the transition of the order to such a state, the Expert Advisor can trail its stops when the price moves in the direction of the profitability of the order. And all that can be further is the stop loss or take profit triggering. After that, a new order is expected, and so on in a circle. Therefore, the strategy is simple, but thoughtful and effective in terms of technical implementation and taking into account all possible points for the correct operation of the scalpel-type bot. Another important point is that the bot is able to respond to various emergency situations that arise in the market. The bot has excellent lot control depending on the deposit, if trading with automated money management is activated. Also, the bot correctly sets waiting timings, requotes, repeated attempts to place an order or close it if necessary, and so on.

Happy trading!