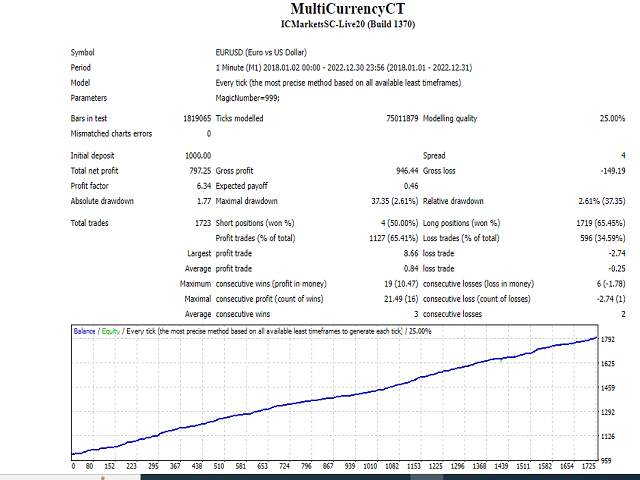

MultiCurrencyCT

- 专家

- Gianfranco Tanzi

- 版本: 1.1

- 更新: 30 一月 2023

Below you will find the explanation of the complete version of MultiCurrencyCTX not yet published.

MultiCurrencyCTX

Strategy Explanation up to version 1.331

MultiCurrencyCTX is an Expert Advisor based on ADX indicator and on the DXY index of the US dollar which allows to identify the strength of the US dollar and therefore carry out Buy or Sell operations on the currencies correlated to it.

The EA uses the following currencies for its trading activity:

EURUSD - GBPUSD – USDJPY – USDCAD - USDCHF

The correlation of the DXY index with the first two currencies is inverse, ie when the index is positive SELL positions are opened. When the index is negative, BUY positions are opened.

The correlation with the other currencies is direct ie when the index is positive BUY positions are open while when the index is negative SELL positions are open.

The entry signal is made by the ADX indicator. It detects the side of the trade to open.

In addition the EA checks which is the position of DXY_Index.

If the DXY_Index is significantly positive, it means that USD is strong or quite strong and consequently are allowed only entry signals to open a Buy trade for USDJPY or USDCAD or USDCHF or a Sell Trade for GBPUSD or EURUSD.

On the contrary, if DXY_Index is significantly negative it means that the USD is weak or quite weak and consequently are allowed only entry signal to open a Sell trade for USDJPY or USDCAD or USDCHF or a Buy trade for GBPUSD or EURUSD.

Trades are opened with a Take Profit fixed by the user. In addition, user can set a amount of BreakEven points.

Instead to fix an amount of Stop Loss, the EA, when an open trade goes in loss over a certain amount (Trigger*TriggerMulti), opens one or more trades, using the same criteria to open normal trades.

The trades opened may have an amount of lots equal to the parameter Lots and with the same direction of the trade in loss or an amount of lots equal to the lots of the trade in loss multiplied by the parameter Multi and with the direction reversed.

To activate the opening of continued or reversal trades, as above stated, the parameter LotsChange must be set to true and the parameter Multi must be set with a value > 0 (default value = 2.5).

Operating in this way the EA tries to close all trades together (trade in loss and continued or reversal trades) with a profit equal to the Target value.

Once the trade is open, trades are managed and closed by the main following functions:

a) Trailing Take Profit

b) BreakEven

c) CloseAllOrders

Trailing Take Profit

This function reduces, the Take Profit applied to the order when opened, with the TralingStep value and the TrlMulti value. To use this function TakeProfit must be set with a good value.

BreakEven set the Stop Loss value over the opening price, with the BreakEvenPips just to create a gain and to cover commission fees.

CloseAllOrders

The function closes, all together one or more trades, when the profit of all trades is over or equal to the Target value.

How to tune the EA’s input parameters

The profit of each trade may be done by the value of the Target ( Lots * TargetPoints) or be determined by the TrailingProfit or by the BreakEven function. It depends on the values set in each parameter.

So to tune the EA, change smoothly the combined values of these parameters.

One more parameter that the user may change, to improve EA results, is the PlMn_Threshold set by default to 30.

If you increase this value, you reduce open trades. If you decrease the value, you increase open trades but with a lower level of reliability.

With the default settings the EA opens 100/120 trades per year for each pair. To increase the number of trades and, consequently, of earnings, user can set the parameter TradeOneBar to false and set the parameter MaxOpenOrders to 2.

So doing, the EA opens two trades for each bar. I suggest no more than 2 in MaxOpenOrders to avoid high drawdown or stop out. The value of parameter Multi may be set to 3.

With the parameter SwapCheck user can ask to the EA to open trades with earning swap only. To activate this, SWapCheck must be set to true.

All tests have done with an account balance of USD 1,000.00 with a leverage account 1:500.

No trading Time for News - IntraDay

The EA has three intraday time range that the user can set in order to avoid the opening of trades during the issues of breaking economic news.

The time to set is the GMT time. The EA adds or subtracts to the GMT time the ManualGMT_Offset representing hours in + or in – respect to the Broker time.

So user has to set the GMT_Offset with the sign + to add to GMT time or with the sign – to subtract to GMT time.

For example: the time of the broker ICMarketsSC has 3 hours more respect to GMT time.

Main default Settings vers 1.331

PlMn_Theshold, represents the minimum level to be reached by PLusADX or MinusADX to trigger the entry signal.

DailyChgDXY_Target, represents the minimum value to be reached by DXY_Index to trigger the entry signal (default 0).

TradeOneBar, if set to true allows the opening of one trade per bar only.

Lots, represents the amount of lots per each trade to open.

MaxOpenOrders, represents the max quantity of open orders ( default 5).

LotsChnge, if set to true, allows the opening of trades with the same sign of previous trade or reversed trades when an existing trade have a loss over the amount of Target*TargetMulti.

Multi, represents the multiplier used by the EA, when LotsChnge is set to true, to calculate the amount of lots of trades to be opened with the same sign or with reversed sign, to absorb the current loss.

BreakEvenPips, represents the quantity of points added to the opening price by the function BreakEven to set the Stop Loss.

TargetPoints, represents the quantity of points to be multiplied by the amount of Lots parameter to calculate the Target value.

TargetMulti, represents the multiplier of the Target.

SwapCheck , if set to true, EA opens trades with earning swap only.

UseNoTradingHours, if set to true, allows user to set 3 couple of time in order to stop trades opening during the time chosen ahead of economic news.