RSI Overbought Sniper PRO

- 专家

- Mustapha Lazar

- 版本: 1.0

- 激活: 5

描述

由 J. Welles Wilder 开发的相对强弱指数 (RSI) 是一种动量振荡器,用于衡量价格变动的速度和变化。 RSI 在 0 和 100 之间波动。传统上,RSI 在高于 70 时被认为是超买,在低于 30 时被认为是超卖。可以通过寻找分歧和失败波动来生成信号。 RSI 也可用于识别总体趋势。

这个 EA 的工作原理

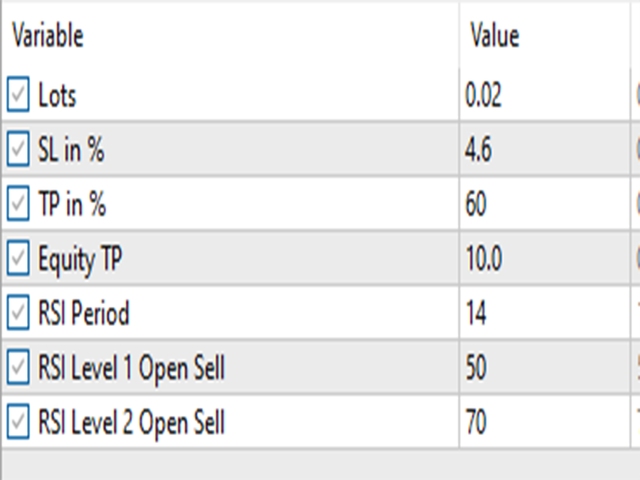

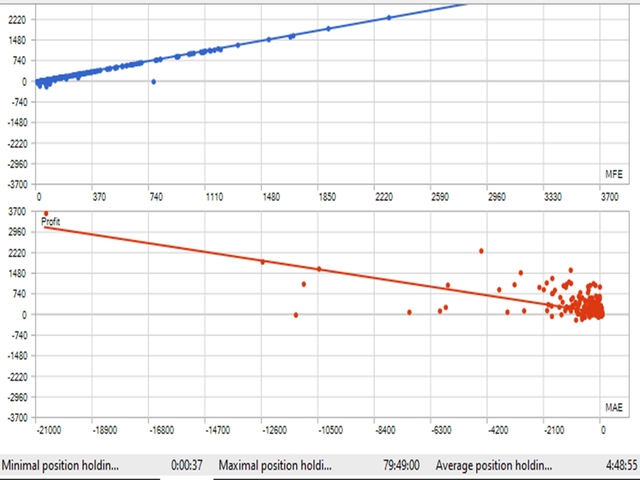

当 RSI 高于 70 时被认为是超买,但 EA 使用的不仅仅是这个值来检测和验证它是否是一个值得下单的超买。

Description

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend.

How this EA works

RSI is considered overbought when above 70 but the EA is using more than that to detect and validate whether it is an overbought that deserves to take an order for it.