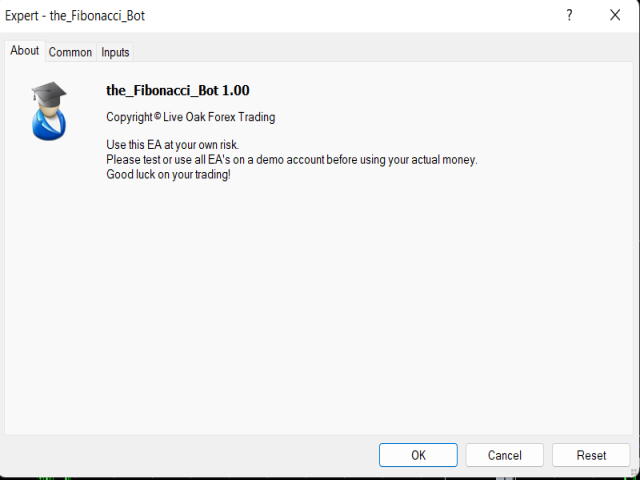

The Fibonacci Bot

- 专家

- Jason Edward Todt

- 版本: 1.0

- 激活: 5

The Fibonacci Bot uses Moving Averages working in combination with Boilinger Bands and MACD filters built in. The strategy is based on utilizing trend direction changes and

optimizing order size. Whenever a trend direction change takes place, this EA would balance positive profits from the current trend orders with the negative loss orders and

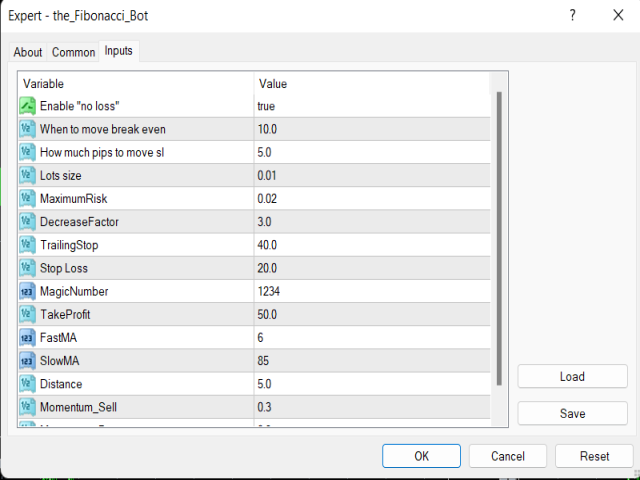

close all of the orders with the configurable profit in pips. This EA has flexible settings allowing you to modify: orders, lot sizes, order frequency, closing profit,

Trailing Stop, Stop Loss, Magic Number, Take Profit, Moving Averages, Move-to-break-even and Momentum indicators.

It uses the concept of Fibonacci retracements as a signal to generate trades. This strategy makes the assumption that Fibonacci levels are areas of support and resistance.

While these support and resistance areas are not always respected by price, they are still considered as points of interest where traders can look for trade opportunities.

With this concept in mind, The Fibonacci Bot is designed for trading the pullbacks of newly established trends.

The momentum indicator is applied to confirm the signal given by the moving average crossover. Momentum values are obtained from the three previous candles. If any of them has a value that is less than 0.3, that confirms the trade signal. This gives the idea that the market is not yet exhausted, meaning it still has enough steam to move forward in whatever direction it intends to go.

The Fibonacci Expert Advisor offers the user a few options to secure profitable trades by breaking even or trailing the stop. These two options are enabled by default. If an open trade gains at least 30 pips, its stop loss is moved to the entry price for a risk-free trade. Later if the trade gains more pips, the trailing stop function comes in. Trailing stop maintains a distance between market price and trade stop loss of 40 pips. At some point, price will hit either the adjusted stop loss or take profit of 50 pips. In both cases the trade ends up a winner.

Anyone interested to know the robot’s true potential must consider implementing the robot in a demo account, running parallel tests in various trading instruments to determine which markets would give it more winning chances.