KT Trend Angle MT5

- 指标

- KEENBASE SOFTWARE SOLUTIONS

- 版本: 1.0

- 激活: 5

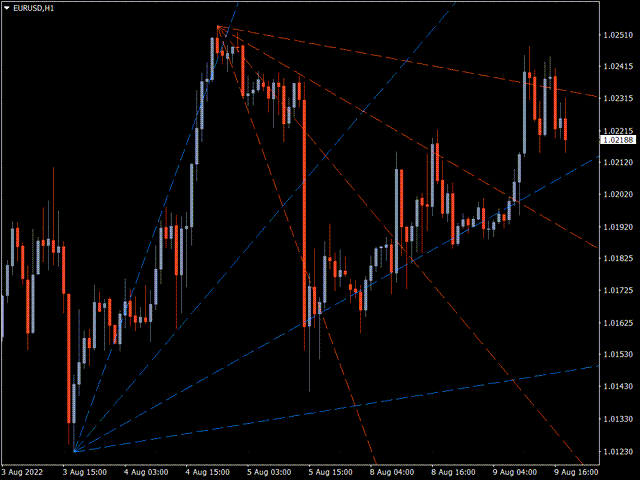

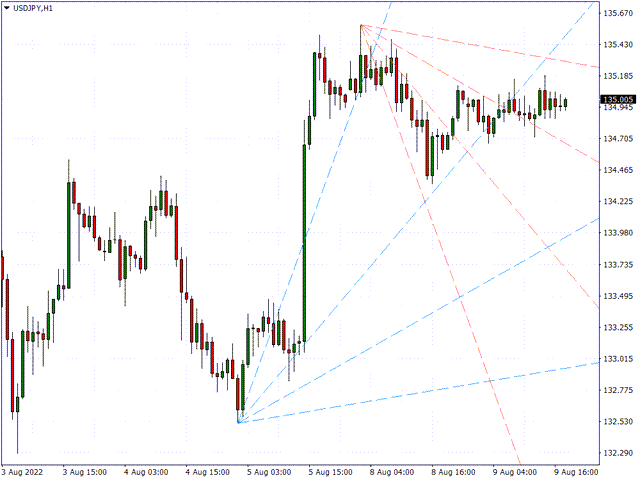

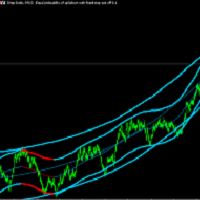

The KT Trend Angle helps to identify ranging and trending markets. The idea is to only enter a trade following the market trend if the slope is steep enough.

An angle is the ratio of the number of bars to the number of points:

- The bars mean the time offered by standard (M1, M5, etc.) and non-standard time frames.

- Points represent the unit of price measurement with an accuracy of 4 or 5 decimal places.

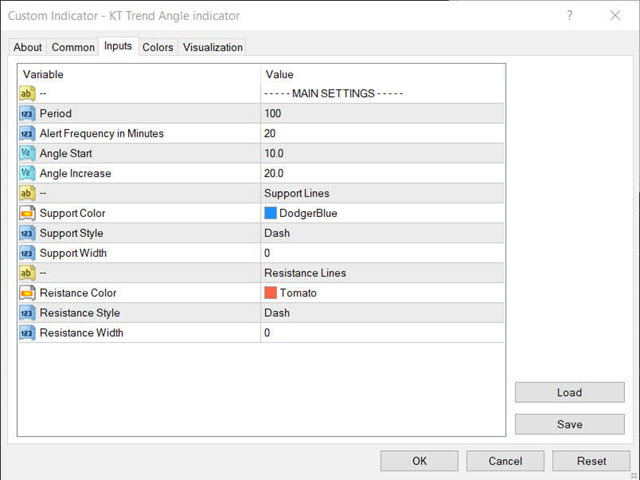

Input Parameters

- Period: An integer value to define the intensity of angled trendlines.

- Angle Start: The degree of angle of the first trendline.

- Angle Increases: The degree of angle to increment for consecutive trendlines.

- Support Color: The color and style of the bullish trendlines.

- Resistance Color: The color and style of the bearish trendlines.

Trend Angle Formula

SinFractal = 100*Sin(a) =100*b/c

Based on SinFractal calculation, we can manage to create a series of angled trendlines.

Trading Signals

- Buy Signal: A long order can be placed when the price moves and closes above the blue dodger trend line.

- Sell Signal: A short order can be placed when the price moves and closes below the red trend line.

- Buy Exit Signal: Close all buy orders if the price closes below the blue dodger trend line while a bullish trend continues.

- Sell Exit Signal: Close all sell orders if the price closes above the red trend line while a bearish trend is ongoing.