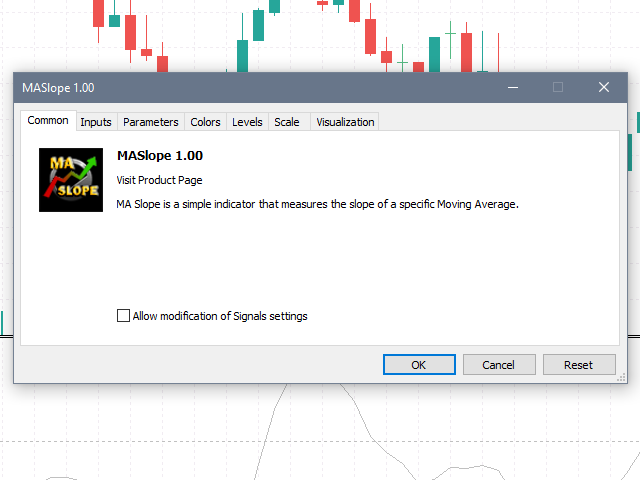

MA Slope

- 指标

- Serge Villasica

- 版本: 1.0

- 激活: 5

MA Slope is a simple indicator that measures the slope of a specific Moving Average.

We usually say that the price is in an uptrend when it is above the moving average, or it is in a downtrend when it is below the moving average. However, this information is inadequate since most of the time the market is in range. During range-bound markets, price moves back and forth around the Moving Average giving a lot of false signals.

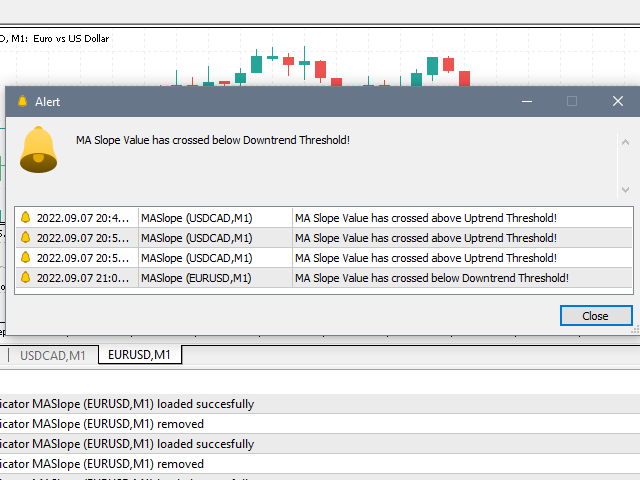

MA Slope helps identify and validate trends as it directly measures the steepness of the moving average. The user can also set levels and alerts so that they can determine when a specific value of MA Slope is being met.

MA Slope also helps filter out false signals obtained from other indicators since this roughly distinguishes trending from range-bound market conditions.

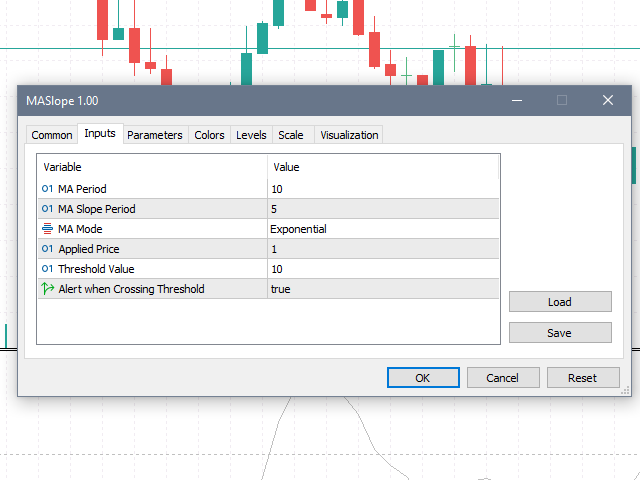

The parameters are as follows:

- MA Period - The Period of the Moving Average that you want to measure the slope of

- MA Slope Period - The Calculation Period of the MA Slope, the larger the period, the smoother the MA Slope

- MA Mode - Type of MA (e.g. EMA, SMA, etc)

- Applied Price - Type of price for MA Period

- Threshold Value - User-defined Value that determines if the price is in Uptrend, Downtrend or in Range. (For example: a value of 5 would be the threshold values would be 5 and -5, A value of 6 would indicate that the price is in an uptrend)

- Alert when Crossing Threshold - Enable alerts when MA Slope value crosses Uptrend or Downtrend Thresholds