PZ Latency Arbitrage EA MT5

- 实用工具

- PZ TRADING SLU

- 版本: 4.3

- 更新: 17 三月 2022

- 激活: 20

Trade like a time traveler thanks to latency arbitrage

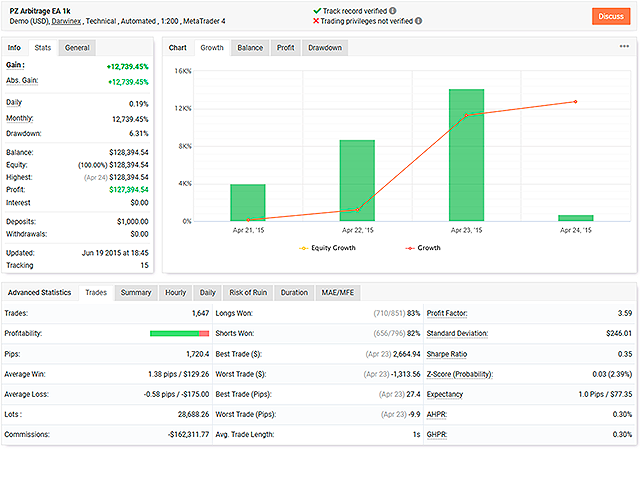

Everyone knows that the best way to make money in the markets is by knowing the future. Have you ever wished to know the future price of something in advance? Even if it were just a few days, hours, or minutes ahead? What if it were possible to know it but with less than a second of advance notice? That's precisely what the PZ Latency Arbitrage EA robot does.

PZ Latency Arbitrage EA is your personal time machine: but it can only travel into the past by less than a second. The robot is like Biff Tannen in the movie Back to the Future. It connects to multiple brokers simultaneously and listens. It listens carefully and pays close attention to prices and server times. And occasionally, every now and then, it's able to know the future with less than a second's notice. Sometimes a broker's server slows down for whatever reason. It lags behind in time. And then, and only then, the robot trades knowing the future price with less than a second's notice. The trades last less than a second, and brokers despise this strategy.

Latency arbitrage is a trading strategy that allows traders to make instant profits by acting fast on opportunities presented by pricing inefficiencies between two or more brokers: it entails trading against a lagging broker knowing the future price in advance, received from other price feed, fractions of a second earlier. These inefficiencies can be caused by liquidity providers or network issues on the broker's side. Under ideal trading conditions, latency arbitrage is a zero-risk strategy that requires no analysis or indicators.

[ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- 100% self hosted

- It is very easy to use

- No installer, config files or DLLS used

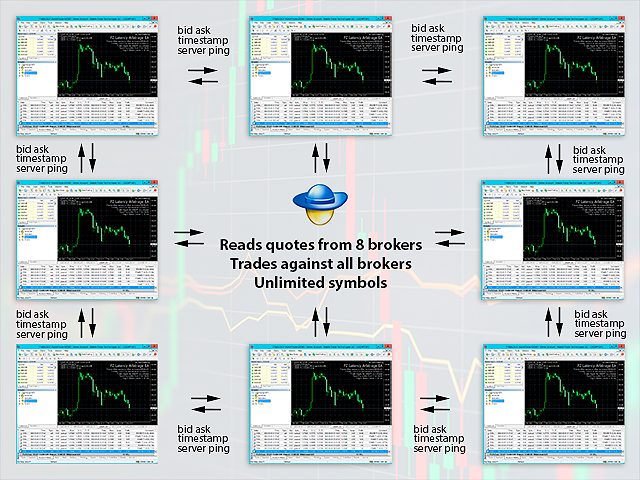

- Trade against up to 8 brokers simultaneously

- Trade unlimited symbols or instruments

- Adapts and considers the ping to the broker server

- Adapts to spread, commissions, stoplevel and freezelevel

- Trades can be closed on time expiration

- Supports unconventional symbol names

- It can place SL and TP orders for safety

- Flexible risk management

- NFA-FIFO Compliant

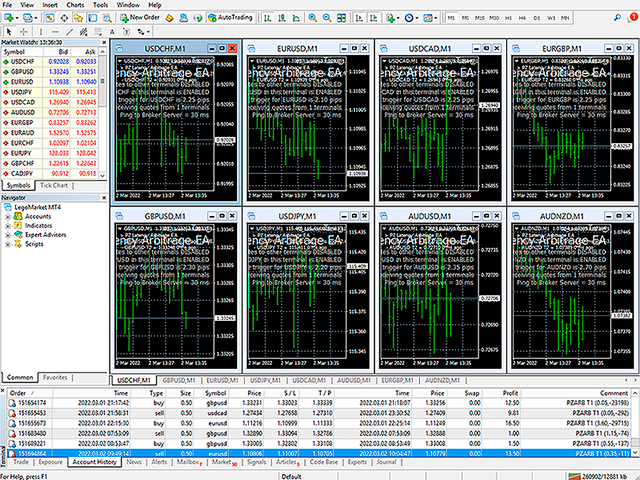

Originally developed in 2014 and released in 2015, the Latency Arbitrage EA has been recoded to use named files instead of memory channels, and can connect up to 8 Metatrader Terminals with dual behavior: it can read the price feed from eight brokers and trade against them all if the opportunity arises. It should be executed on a VPS in many Metatader terminals simultaneously, and in as many symbols as the trader wishes to trade.

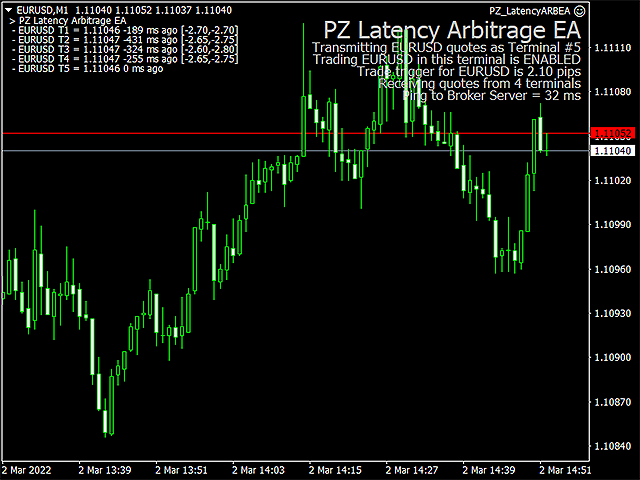

- The price feed of each broker is adjusted to the broker server ping

- The EA won't trade if the network ping or spread and commissions make the trade unfeasible

- The EA trades with a specified slippage of one pip and requotes are to be expected

- The trading logic as been coded to avoid retries and delays

- The EA won't trade if any trading restriction is in place

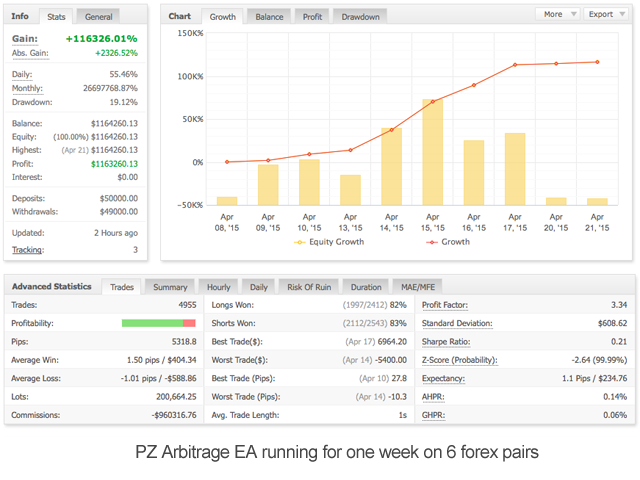

Trading frequency will fluctuate depending on the network latency, spreads and commissions. It can go from many trades a day to no trades at all, if the EA considers the trading conditions not desirable. Increase the trading frequency by connecting many different brokers in a VPS.

How to get started

- Load the EA on EURUSD in Broker A. Choose "Terminal 1" in inputs.

- Load the EA on EURUSD in Broker B. Choose "Terminal 2" in inputs.

- Load the EA on EURUSD in up to 8 brokers with a different terminal input value.

That's it! The EA will trade pricing inneficiencies whenever they arise on any terminal.

Repeat this process in as many symbols as desired.

Input Parameters

- Terminal: Assign a different terminal number to each broker. From 1 to 8.

- Behavior: Choose how this instance of the EA behaves.

- Quote and Trade: Provides price feed for other terminals and can trade as well.

- Quote Only: Only provides price feed for other terminals. (Fast Broker)

- Trade Only: Only can trade and does not provide a price feed. (Slow Broker) - Manual Symbol: Type the symbol name if the chart has an unconventional name

- Expiration: Choose the trade expiration time or disable the feature

- Stop Loss: Enter the precautionary stop-loss for all trades

- Take Profit: Enter the precautionary take-profit for all trades

- Trade Trigger: Amount of pips to capture on each trade. A higher value will produce less trades.

- Money Management: Choose if the EA must auto-calculate lotsizes or use a fixed lotsize.

- Risk per Trade: Percentage of the free margin to be risked on each trade if "auto-calculated" is chosen above.

- Fixed Lotsize: Trade size for all trades if "fixed lotsize" is chosen in the above parameter.

- Label Color: This is the color of the informative text labels in the chart.

- Manual Pip Value: Use this parameter to override the pip value for this chart, if needed.

- Custom Comment: Enter your custom comment for trades.

- Slippage: Maximum slippage for the order

The price of this robot might increase next week!

We've introduced dynamic pricing for this indicator to reflect its true market value. With each sale, the price increases by $1, rewarding early buyers. If no sales occur within a week, the price resets to the original rate, with prices updated every Monday. This model lets the market decide the product's value, but there’s always a chance to grab your desired tools at a cheaper price if you prefer to wait.

Actually, I am waiting to receive from the SELLER the most reliable brokers for this EA. Hope I will not be disappointed.