Neural network NGZ

- 专家

- Andriy Sydoruk

- 版本: 1.0

- 激活: 5

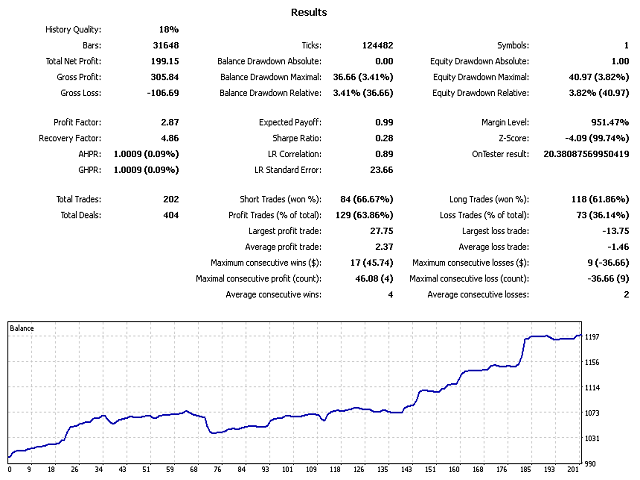

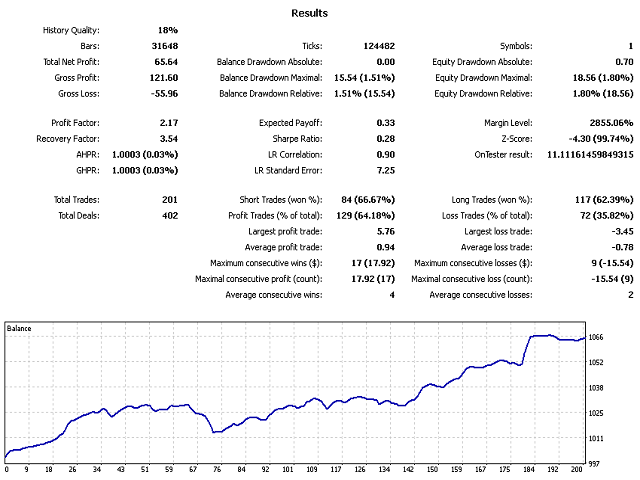

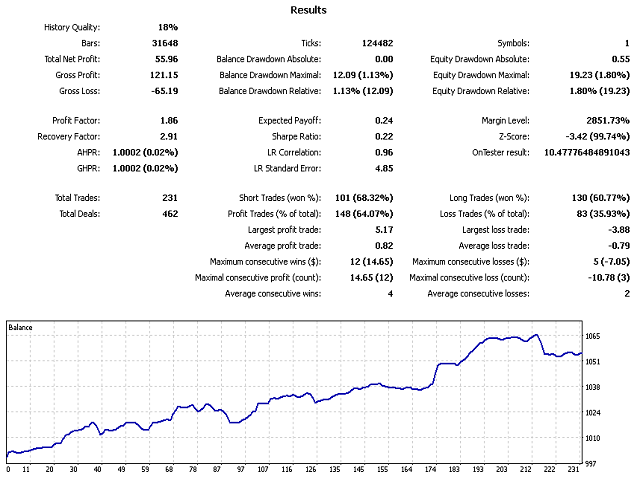

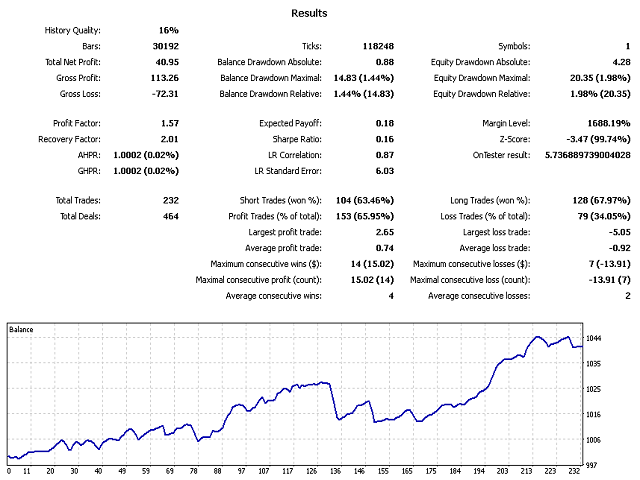

Neural network NGZ is a progressive, adaptive modern forex bot. This is a very complex development, which in its structure uses both neural network learning and genetic algorithms, as well as advanced indicators that are used as a variation of the projections of the price function, and with the help of actively normalized data work in conjunction with the entire structure of the bot code. Despite everything, the bot needs to be optimized for 30/30 days, for example.

How to work with a bot?

The chosen currency pair used (not all give positive results, you need to select). Also, the bot works great in a multicurrency mode, for which it is enough just to put it on several charts (before optimizing all the options). We work on the M1 timeframe. The default risk deposit is $ 1000. If you are a particularly economical user and want to take risks, then you can start with $ 100, but this is at your own risk.

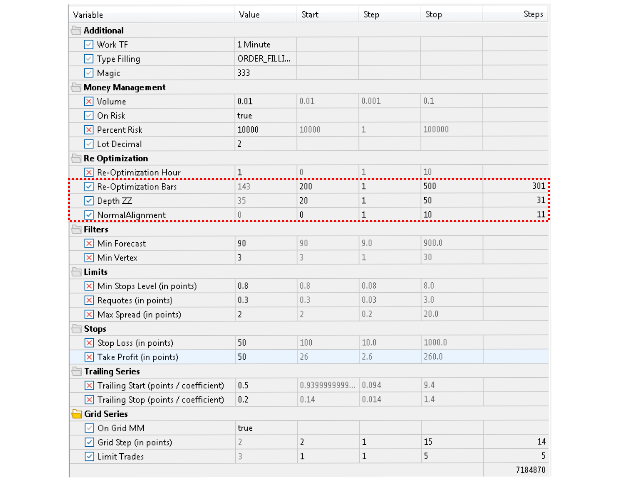

Just do not drive it out throughout history - it makes no sense. Optimize a month and a month to work. Optimization is quite simple, an example of optimization will be in the discussion section for the product, as well as in the screenshots for the product.

How does a bot work?

The bot works in cycles. Which are set in the settings for the first parameter Re-Optimization Hour, which forces the bot to prepare the neural network every specified number of hours. Re-Optimization Bars is the number of bars on which the neural network will train. Note the number of hogs is not large, but the network is often retrained. Each cycle, the bot stops working for some time to conduct this training. Sample inputs are required for the neural network. The samples are formed by the iZigZag indicator, limited by the Depth ZZ parameter, this parameter sets the minimum grid for the peaks, that is, so that the peaks are not too frequent. After the vertices are found, it is necessary to teach the neural network to work on training data based on the price. The input data is formed as follows. The algorithm has in its structure several different types of indicators that optimize using an internal genetic algorithm, after which a vector of input data is formed to be fed to the input of the neural network synchronously with the previously found vertices. Also at this stage, the indicator values are analyzed and the data normalization limits are formed. Thus, at the end of the cycle, a trained neural network is ready, indicators are configured and limits for normalization are fixed. All data is stored in files. That is, if you turn off the terminal and then turn on all the information will be pulled from the files. During operation, the bot scans the configured indicators to form an input vector for the neural network, normalizing it according to the normalization limits. It remains only to wait for a response from the neural network. The neural network can only generate a buy or sell signal, and the next bot algorithm already accompanies a series of orders. A series of orders is limited in the settings. Also in the settings you can set take profit and stop loss, as well as trailing start and trailing stop. There are additional important settings as well. Everything is simple and intuitive. What is not clear, ask.