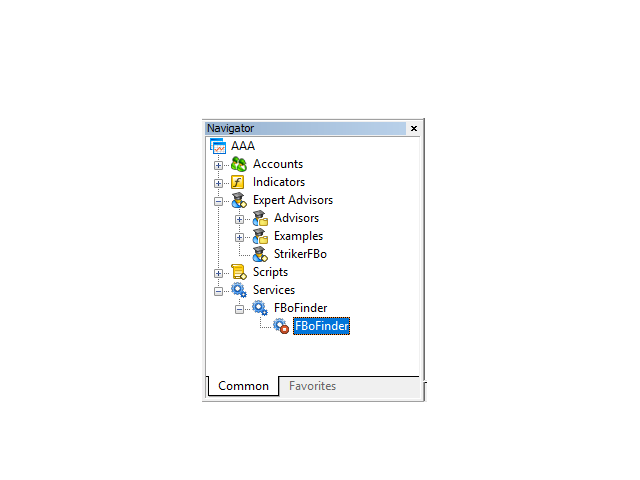

FBoFinder

- 实用工具

- Andrii Voliuvach

- 版本: 1.2

- 更新: 13 三月 2021

- 激活: 5

For those who trade false breakouts (FBo) levels.

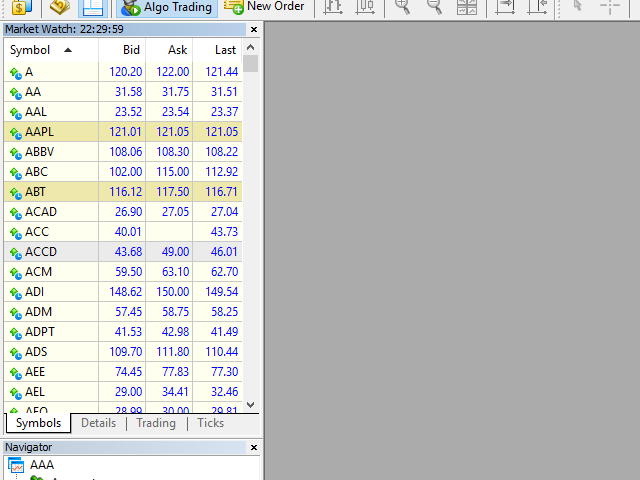

The False Breakout Finder (FBoFinder) service was written primarily for trading stocks and their CFDs on daily charts.

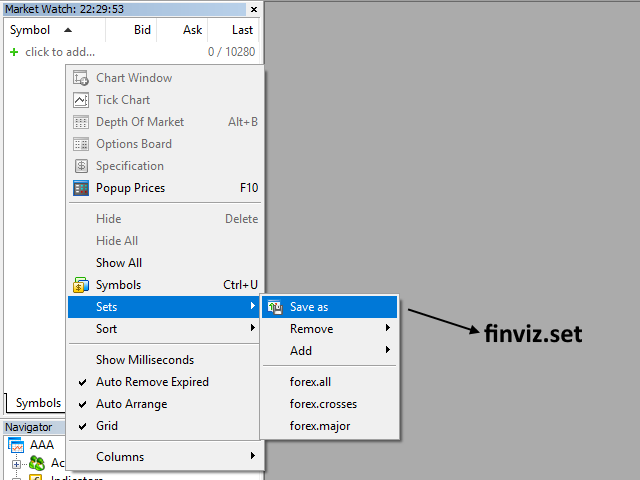

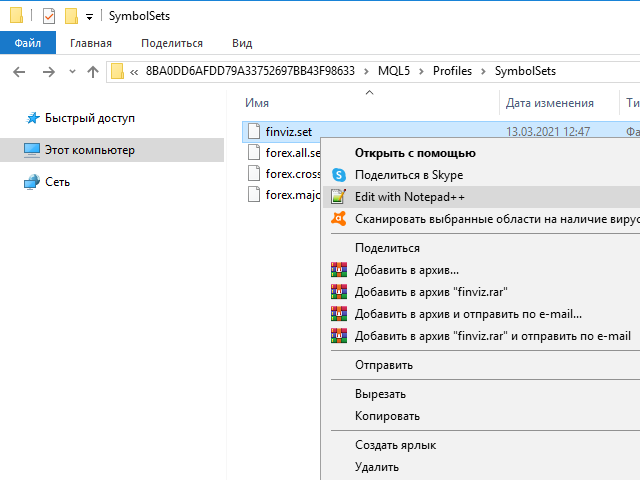

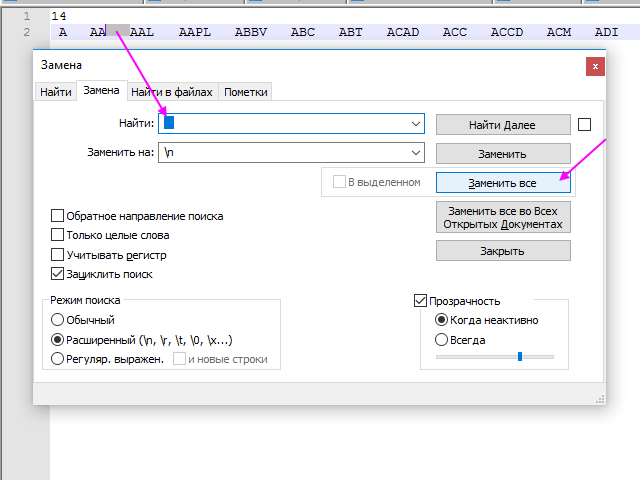

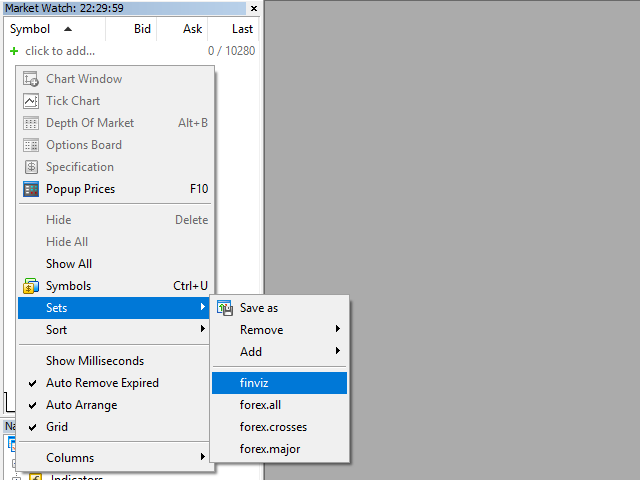

It will search for you for various false breakouts of extremes on hundreds and thousands of instruments from the Watchlist, which will save you in the long run many hours of daily routine selection of securities before the market opens. In the process of enumerating instruments, securities with a ban on trading are ignored. If a security is allowed to trade only long, then it will not look for patterns of false breakouts for short. The same is true for LongOnly securities. When an instrument that has an FBo model is found, its chart is opened, a price level line is drawn and a trading expert (StrikerFBo) is placed, which can be downloaded separately from the page. You can use the service without an expert. And all that is required of a trader is to review the selection results and throw away those securities that, in his opinion, are not suitable. On the remaining shares, the EA will wait for the market to open. Also, the Expert Advisor can be used independently without the FBoFinder service.

FBoFinder has settings, both its own and those that are passed to the expert (StrikerFBo). The same settings are provided by the StrikerFBo Expert Advisor itself. If necessary, they can be reconfigured for a specific selected paper.

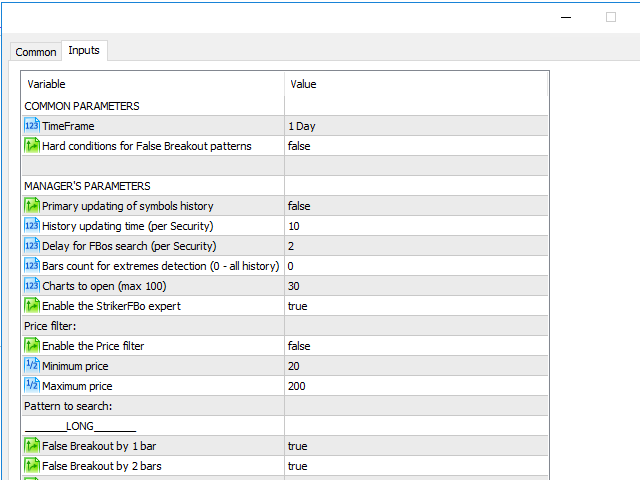

Common parameters:

- TimeFrame - all available timeframes for trading, D1 by default.

- Hard conditions for False Breakout patterns - hard conditions for testing false breakout patterns. (Version 1.1).

Service parameters:

- Bars count for extremes detection (0 - all history) – the number of history bars to search for extremes (the highest High and the lowest Low). If you specify 0, then the entire history of the instrument will be analyzed.

- Charts to open – the number of charts to open. The maximum that the terminal supports is 100 opened charts. With a large number of open charts, the terminal slows down.

- Enable the StrikerFBo expert – Allow the service to schedule the StrikerFBo expert. If the expert is absent, then the error will not occur.

- Enable the Price filter – enable the filter based on the securities price. If false, the entire Watchlist will be processed.

- Minimum price – the minimum price to search.

- Maximum price – the maximum price to search.

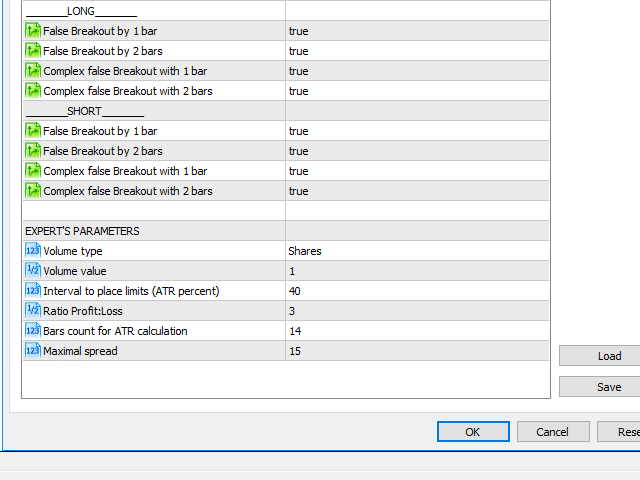

The following parameters enable or disable the search for false breakout patterns:

- False Breakout by 1 bar – FBo by one bar

- False Breakout by 2 bars – FBo by two bars

- Complex false Breakout with 1 bar – complex FBo with 1 bar behind the level

- Complex false Breakout with 2 bars – complex FBo with 2 bars behind the level

Expert parameters:

- Volume type

- Shares - specify the number of securities for trading in the field below.

- Volume Coefficient (2.5 x 20 leverage = 50 shares) - this parameter forms the volume based on the leverage provided by the broker per share. The smaller the leverage, the more funds are used to buy securities. The specified ratio will make it possible to balance the allocated funds for trading. But the difference in volume between the 20th and 4th arms will be significant (with c = 2.5, 50 and 10 securities will turn out, respectively, since the difference is 5 times). Specify the coefficient in the field below.

- Risk,% - the percentage of risk on the deposit. Percentage of the size of the deposit that the trader is willing to donate to Stop Loss. The Expert Advisor sets Stop Loss for the breakout bar. Specify the risk percentage in the field below.

- Volume value - the value of the volume type selected above.

- Interval to place limits (ATR percent) - offset from the level for placing a limit order. If the instrument opens in the middle of this interval, then the deal will be executed at the market.

- Ratio Profit: Loss - the ratio for Take Profit in relation to Stop Loss (3 to 1 or 4 to 1, etc.). The field contains one number (3, 3.5, 4 or your own version).

- Bars count for ATR calculation - the number of bars to calculate the ATR (average price movement).

- Maximal spread - the maximum spread size for placing a limit order (or for entering a position).