GG ATR Trailing Stop

- 指标

- Pham Quoc Gia

- 版本: 1.0

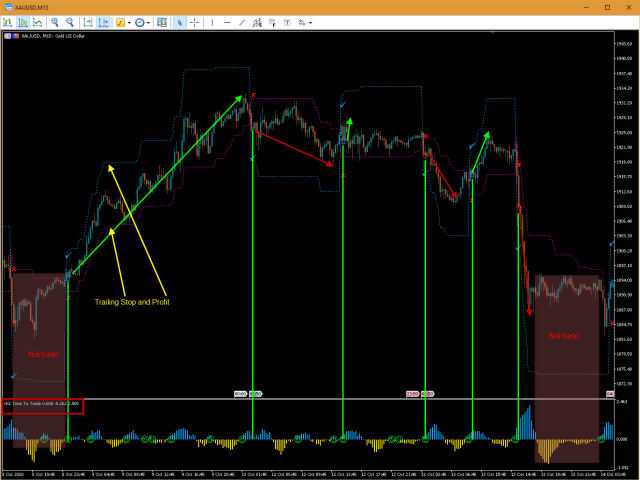

Time your Entry and Exits with Average True Range (ATR) Trailing Stops

ATR Trailing Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries.

The indicator will help make your calculation of stop loss easier as it will be visually aiding you in choosing where to put your stoploss level on the chart by calculating the current value of ATR indicator.

For those who are unfamiliar with ATR, it is a useful indicator to calculate stoploss for trend following strategy. If volatility is high, ATR stoploss level will be wider to ensure that your stoploss is reasonably wide enough to stay with the trend; and when volatility is low, ATR stoploss level will be contracted narrower to ensure that you won't be caught in a sudden trend reversal or big pullback.

With this indicator:

- Helps you to identify your stop loss or take profit points according to visual indicators. You have to adjust it manually.

- Helps you to find entry and exit points when combined with other indicators (for example, GG Time to Trade see the picture below).

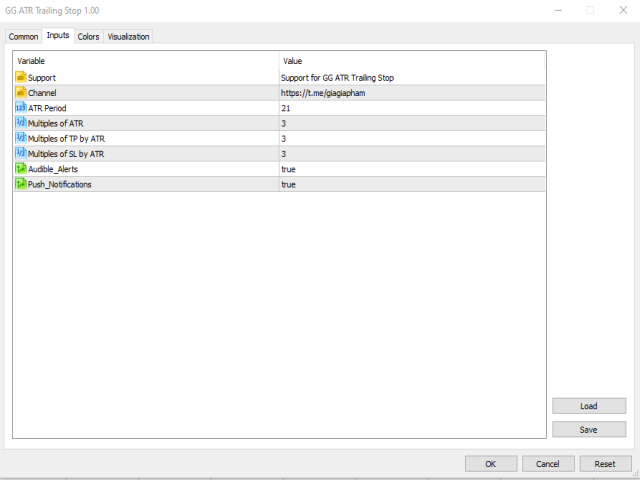

Parameter:

- ATR Period // Period of the ATR

- Multiples of ATR //Multiples are applied for trailing stops

- Multiples of TP by ATR //Multiples are applied for Take Profit

- Multiples of SL by ATR //Multiples are applied for Stop Loss (normally by )

Typical ATR time periods used vary between 5 and 21 days. Wilder originally suggested using 7 days, short-term traders use 5, and longer term traders 21 days. Multiples between 2.5 and 3.5 x ATR are normally applied for trailing stops, with lower multiples more prone to whipsaws.

The default is set as 3 x 21-Day ATR.

Feedback for improvement is appreciated. If you feel good and effective, please share with your friends and review the product. Thanks for your attention.

Great tool for making it’s SL measurble, I definitely appreciate it!!