Conundrum

- 专家

- Igor Ryabchikov

- 版本: 2.7

- 更新: 9 六月 2020

- 激活: 7

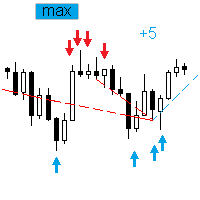

Conundrum is a fully automated EA trading breakouts after pullbacks.

The EA analyzes small breaks of soil and resistance in the H1 temporality with a high percentage of success.

It is the ideal system for a winning strategy in the medium / long term.

It does NOT use dangerous trading systems like martingale, grid, coverage, etc. All operations always have Stop Loss and Take Profit, one order in one direction at a time.

After pending order enters the market, the EA watches the conditions closely and use different techniques to maximise the profit and minimise potential losses - multiple strategies are employed to manage exit.

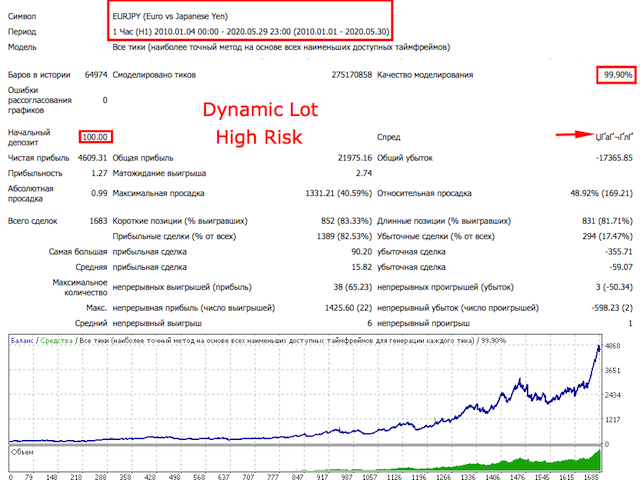

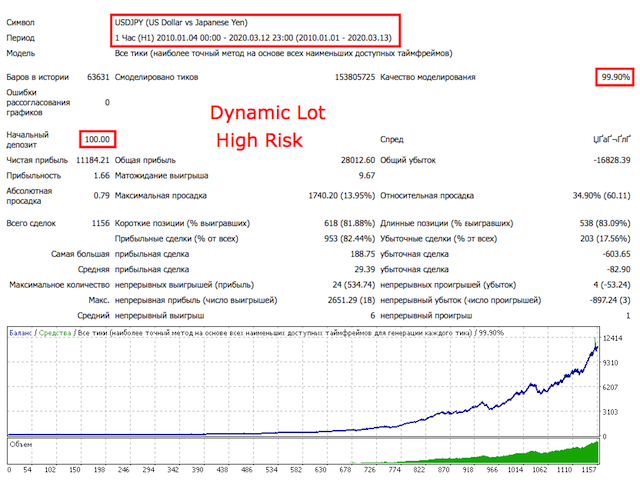

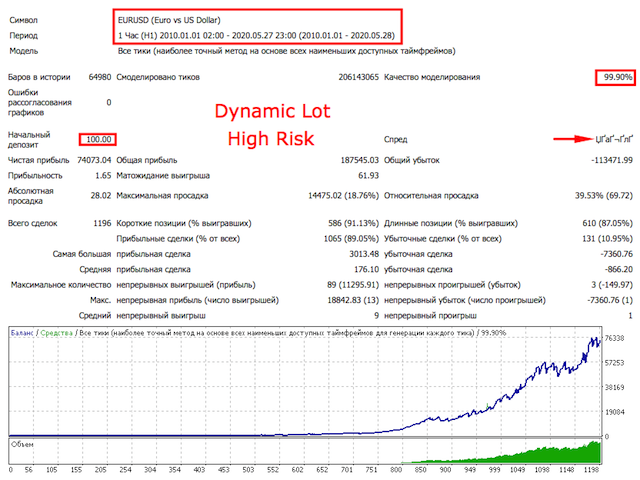

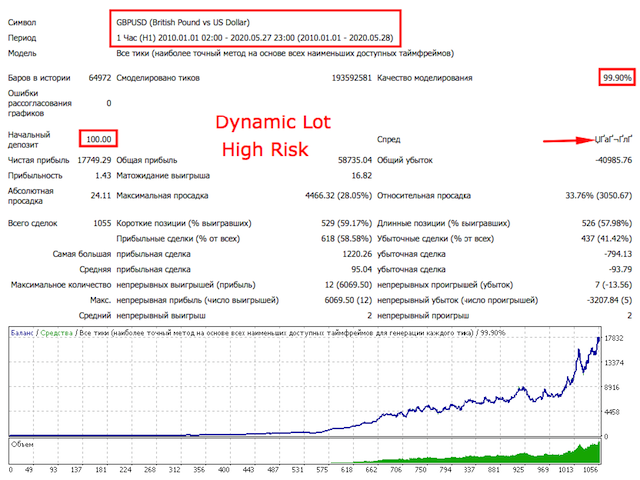

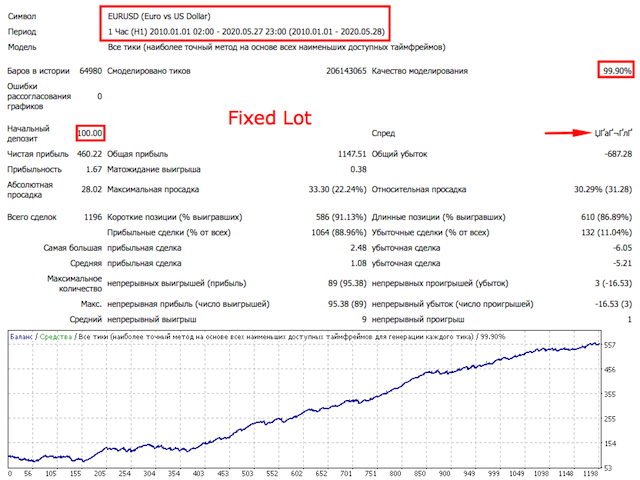

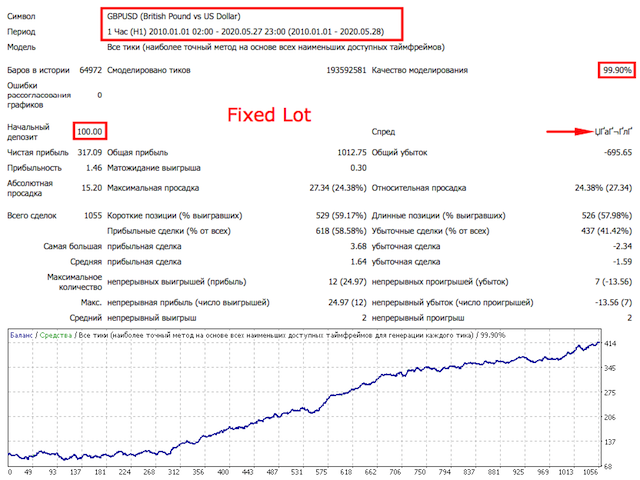

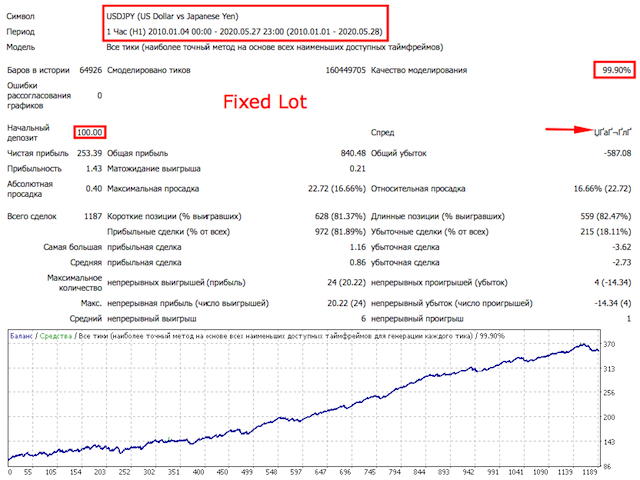

Symbols: EURUSD, GBPUSD, USDJPY, EURJPY (experimental: USDCHF)

Timeframe: H1

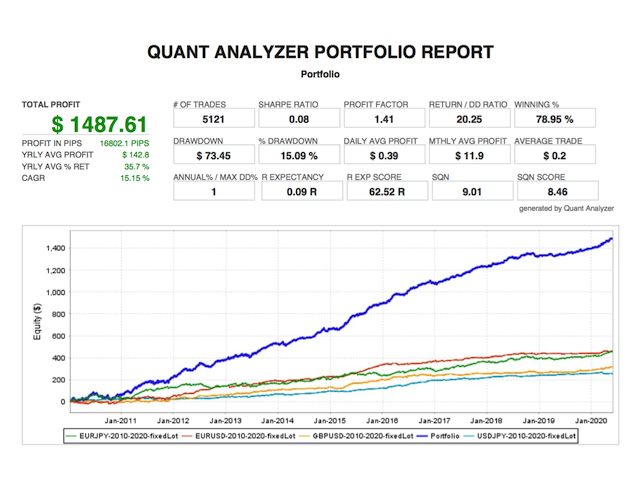

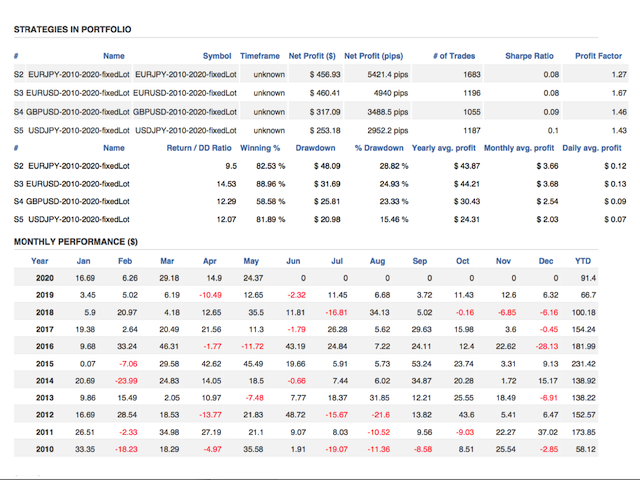

Recommended Money Management: 0.01 lot per 200USD of balance. This MM will return about 5% monthly (average over portfolio of 4 pairs since 2010) with maximal DD or 23% (last observed in 2012).

EA was thoroughly tested on real tick historical data (99.9%). All tests were carried out with 4$/lot commission and 100ms slippage modelling.

The strategy has proven to be reliable on a long back test period - all results in the screenshot section were obtained on a period from Jan 2010.

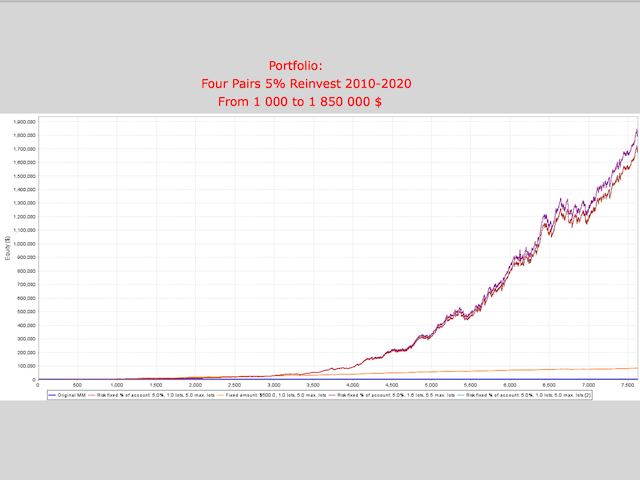

A portfolio of 4 currency pairs with 5% of account balance risk in each trade, 5 lots max volume yields 110% annual return with 15% maximal drawdown

Please note that individual dynamic lot tests were done with higher risk for demonstration purpose.

Proper optimisation methodology was applied to every optimisation done for the settings: only a limited historical period or 1 year was used for optimisation, subsequently verified by back- and forward test on a full 10 years period. No periods were excluded from testing: EA is not vulnerable to news and other high volatility events.

That allows us to believe the backtest results accurately reflect the average performance of the strategy.

Live performance here: https://www.mql5.com/ru/signals/764443

Important:

- Past performance does not guarantee future results

- Regular losses are part of the strategy, gains build up cumulatively on a medium/long term

- Auto settings recommended

- VPS with low latency recommended to improve the efficiency of exit management

- Every trade has StopLoss and TakeProfit. EA may chose to close the trade before it reached the level, or move TP or SL closer

- No grid, no martingale, no toxic strategies

- All settings in "pips" are 4-digit scale. Example: EURUSD 1pip = 0.0001. EA supports both 4- and 5-digit brokers

PARAMETERS:

General Settings

- Magic number: Magic, can be the same across pairs

- Order comment: comment that EA will use for the order

Money Management

- MM strategy: Fixed lot or or dynamic proportionate to Balance, Equity or Free Margin

- Base lots size: If a fixed lot strategy chosen, that will be the volume of every deal. Otherwise this is a base for dynamic allocation

- Account currency per base lots size (when MM is on): Balance/Equity/Free margin amount per Lot in case of "MM strategy" isn't "Fixed lot"

- Maximum lot (0 - use broker limit): limit for the maximum lot size

- Recovery multiplier (1 - recovery off): Multiply lot after loss until recovered. For some pairs like EURJPY it's acceptable to use factors of 1.6-2.0. Not recommended, use at your own risk

- AutoSettings: Use pre-defined settings for the currency pair. If you chose the pair that is not in the list, EURUSD settings will be used

Exit Parameters

- Optimistic take profit, pips: Take profit for every order

- Maximum Stop Loss, pips: Maximum stop loss for every order. EA may use closer stop

Trailing Stop

- Start trailing, pips (0 - off): When order reaches this profit (in pips), it will start trailing stop loss

- Trailing stop, pips: Trailing stop distance (maximum retrace from the current profit level allowed)

- Trailing step, pips: Steps to move trailing stop

Time Settings

- Start Hour: an hour when new pending order is allowed (broker time)

- End Hour: an hour when new pending order is not allowed (broker time)

用户没有留下任何评级信息