Gap Professional MT5

- 专家

- Vadim Zotov

- 版本: 1.4

- 更新: 24 四月 2022

- 激活: 10

Features of the trading strategy

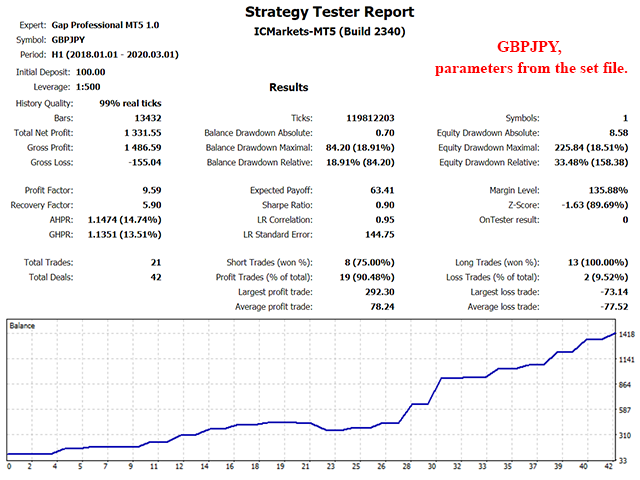

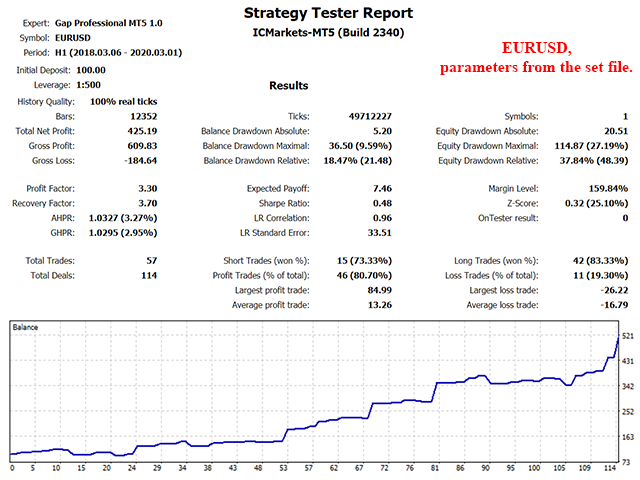

In the graphs of the movement of currency pairs, gaps are often formed. Usually they occur after days off or holidays. This is due to a change in some fundamental factors of the markets during the absence of trading. Therefore, immediately after the opening of the market, one can observe large jumps in prices (gaps). Gaps can also occur on regular trading days when important news comes out, and this triggers a sharp increase in volatility. An important regularity is clearly manifested in such market segments - after the occurrence of a gap, the price tends to return to its original value. This phenomenon is called gap closure. The gap close partially or completely, the probability of this is quite high, which allows you to get a stable profit on such movements.

The robot uses these market properties. It is equipped with all types of protections and interlocks, allowing stable operation in adverse conditions of a real account. The robot recognizes the occurrence of a gap, measures its magnitude, and by the nature of the further behavior of the price decides to enter the market in the direction of closing the gap. Moreover, for each position, the robot calculates individual goals, depending on the conditions prevailing in the market.

A distinctive feature is the ability to use the tick criterion for analyzing price movements. It allows you to accurately determine the beginning of the movement towards the close of the gap, it is practically inertialess, which allows you to almost completely use the price movement to get profit.

The robot accompanies the position. For this, various types of trailing are provided, which can significantly reduce trading risks. Automatic money management adapts transactions lot to the accumulated volumes and allows reinvesting the funds received. All this makes the robot work as safe and efficient as possible.

Gaps are relatively rare, so the robot does not open positions often. But transactions are very accurate and open with increased volume, providing high trading efficiency.

Options

- Comment — comments on the settings (any text);

- Magic — magic number for positions;

- Language — message language of the robot (Eng / Rus);

- Trading days — allowed trading days (Only monday / All days);

- Max spread when opening — maximum spread at which position opening is allowed (points, if 0 - do not control the spread);

- Size of the gap — minimum gap size, more than which it is allowed to open deals (points);

- Coefficient of the take profit — gap share used for profit (0.2-1.0);

- Tick criterion — tick criterion (number of ticks in the direction of closing the gap, 0 - do not use the criterion);

- Lot selection — lot management method (Automatic money management / Fixed lot);

- Lot for 1000 units of free margin — lot per 1000 units of available funds of the base currency (for automatic money management);

- Fixed lot — fixed lot for work without money management;

- Stop loss — initial stop loss (points);

- Type of trailing — type of trailing (No trailing / Simple trailing / By extremes of candles);

- Start trailing — when to start trailing (Immediately / Only when no loss);

- Trailing step — stop loss move step during trailing (points).

Recommendations for use

The robot can be used to trade on any accounts. Preferred accounts with 5-digit quotes, low spread and high speed. The leverage of the account is preferably not less than 1:500.

The best results are obtained on GBPJPY.

Optimization over time is not required if market parameters do not change. However, when switching to other brokers, especially with an increase in the spread, optimization may be necessary.

New set-files will be posted here on the Comments page.

If optimization is needed, I will tell the buyer details of it in a personal message.

If you have questions, write me a private message. I am pleased to help on any issue.

用户没有留下任何评级信息