RaptorFPS

- 专家

- Andriy Sydoruk

- 版本: 6.1

- 更新: 28 七月 2024

- 激活: 5

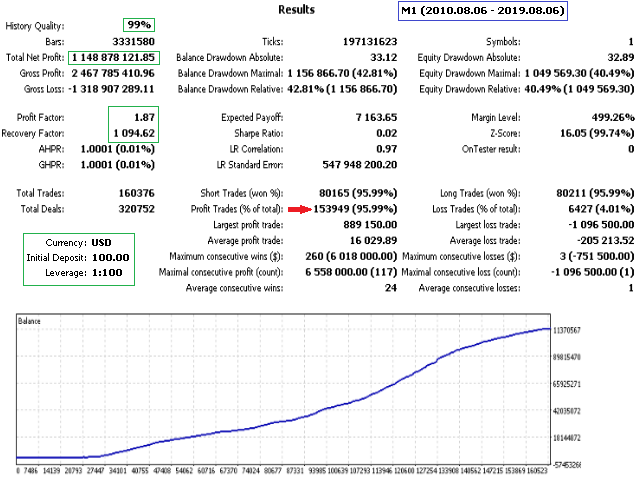

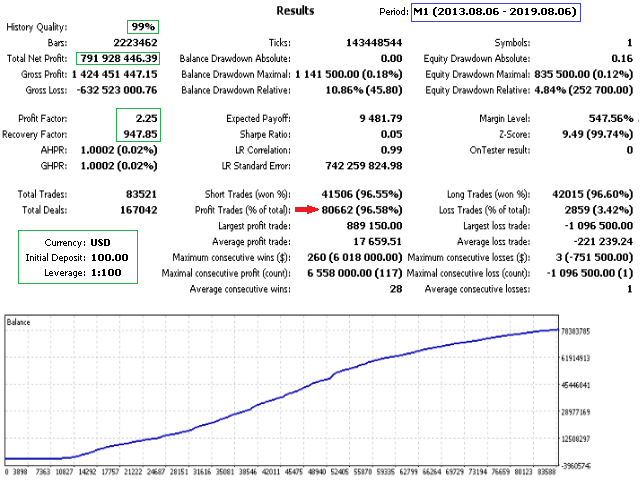

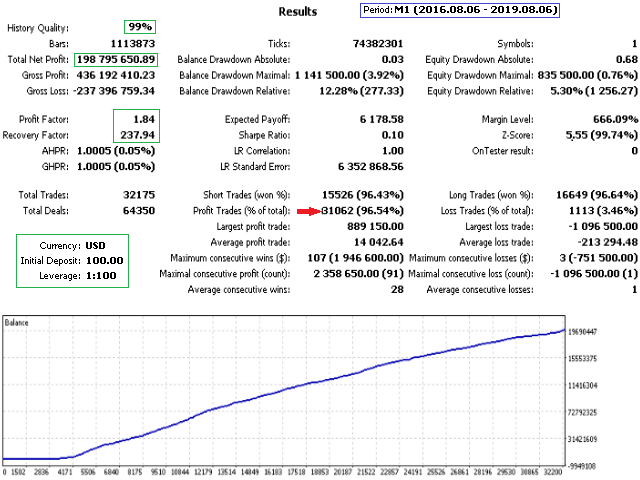

The Expert Advisor works with ticks on both netting and hedging account types. The internal algorithm uses a tick (not a bar) as a unit for analysis. The product works with 5-digit quotes. Requotes are critical. A broker with the minimum execution delay is required. This bot is a development project CoreFPS.

Make sure to set parameters: HourLimit = -1 and MinLimit = -1.

The Expert Advisor does not use history stored in the database. It downloads history data online creating its own database stored in the

internal memory. After the restart, the database is deleted and should be downloaded again. The size of the internal database is managed

by

CountTick parameter specifying how many ticks should be written to the database to start working. The mentioned database is used for the

long-term analysis. Information from the long-term database designed for the stack is used for the short-term analysis and market entry.

In other words, the EA uses the most current selection of ticks from the stack managed by the information received from the long-term

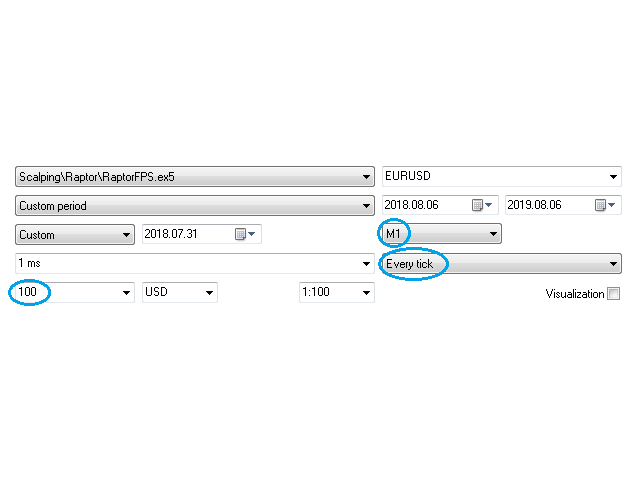

database. Optimization is recommended for good results in the tester's real tick mode.

After downloading the specified volume of data, the EA starts its operation consisting of two stages. During the first stage, downloaded ticks are analyzed by the specified volume ( CountTick) with the periodicity set by ReOptimization parameter. The Expert Advisor selects the best parameters it would have worked with if it had operated at that period. In other words, the best result is selected using the exhaustive search method. Since there are no much parameters to select from, this method is reasonable. Three internal parameters are selected for the search:

- Adjusting the stack size from 1 to CountSteck.

- Checking for enter (direct or inverted).

- Adjusting sensitivity of a single tick, where 1.0 is a barrier reaction for the barrier's internal optimization: minimum (MinPips), change step ( StepPips) and maximum (MaxPips).

The internal optimizer follows the mentioned principle and selects the settings that yielded the best results entering the market and working there till the instruction on the new internal reoptimization ( ReOptimization) is received. During the first configuration of the tick history, the EA does not enter the market till the database is filled. During the next reoptimization cycle, there are no delays, since the database is updated online and is always relevant.

During the second stage, the EA enters the market using the internal optimizer's settings and the stack data. TP and SL are used to secure the position, though they may be especially important with some settings.

Settings

- TypeFilling - sets order filling type.

- Magic - sets the magic number.

- Lot - sets lot size for market entry (the priority uis higher than that of Risk).

- Risk - lot calculation depending on the deposit.

- Spread - spread limit (no entries above this).

- TP - Take Profit.

- SL - Stop Loss.

- CountSteck - the depth of the tick stack (maximum is 9).

- Pips - tick impulse value.

- LimitOrder - limit in the number of orders (if you increase the number twice, you should also reduce risk by 2 times).

- MinClose - minimum profit to close by a signal (% of deposit).

- OnChanel - trading in a channel or following the trend. Example (trend): if the impulse is buy, a buy order is opened. Channel: if the impulse is buy, a sell order is opened.

- DrawDown - maximum allowable drawdown, which being reached orders are closed (% of deposit).

- HourLimit - limit trading in specified hour. Set to -1 (disables limit).

- MinLimit - limiting trading in the specified minutes of the specified hour. Set to -1 (disables limit).

用户没有留下任何评级信息