Morning Evening Star

- 指标

- Alexey Topounov

- 版本: 1.3

- 更新: 4 九月 2017

- 激活: 7

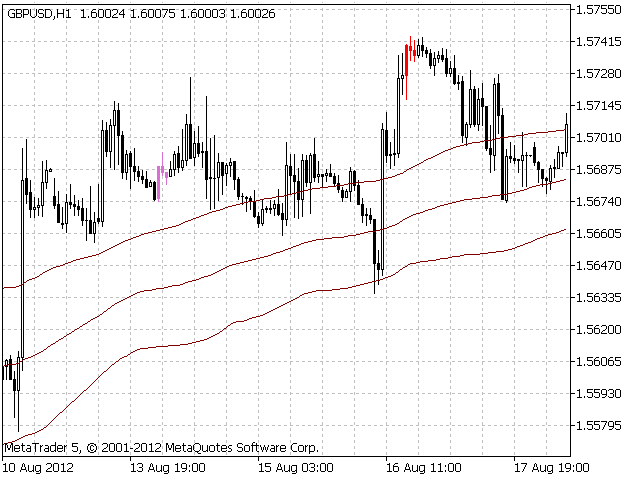

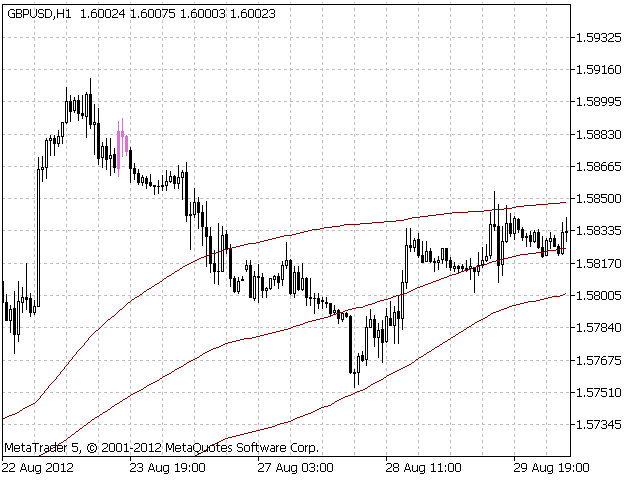

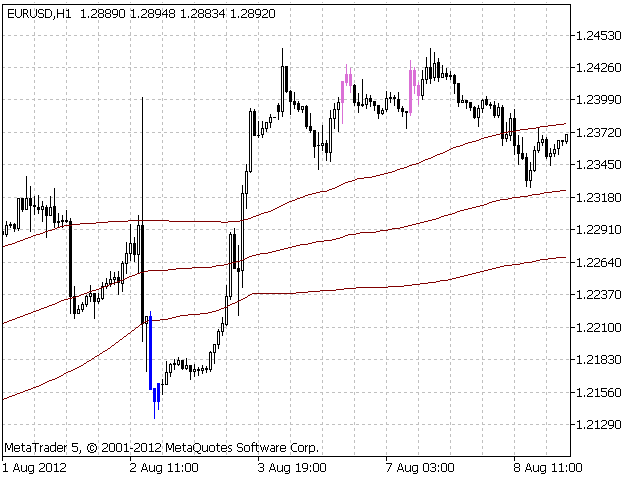

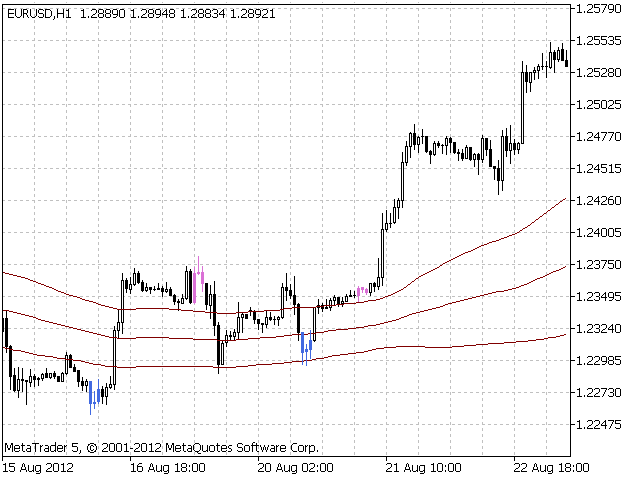

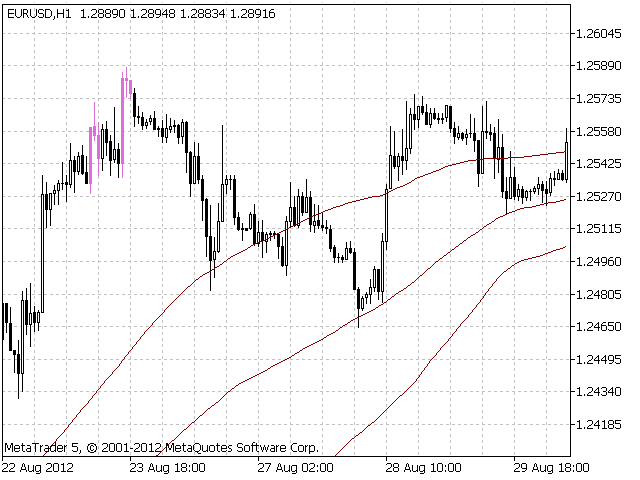

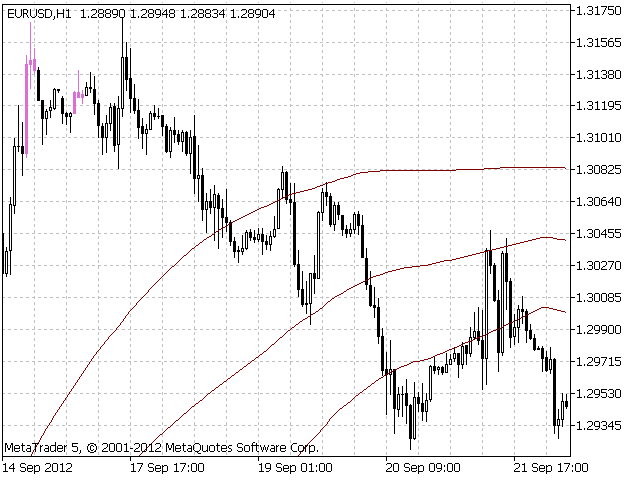

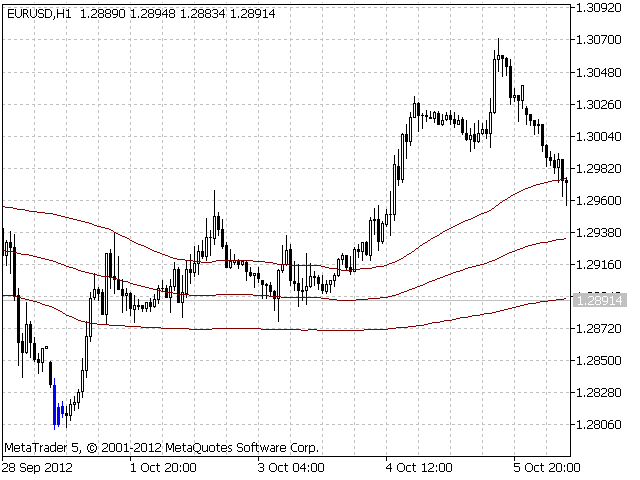

The indicator displays the "Morning star" and "Evening star" patterns on a chart.

The Evening star is displayed in red or rose. The Morning star is displayed in blue or light blue.

Input Parameters:

- Max Bars – number of bars calculated on the chart.

- Make Signal Alert – use alerts.

- Send Push Notification - send notification to a mobile terminal

- Type of rules pattern – type of the model of pattern determination (Hard – with the control of length of shadows of the second bar). If Soft is selected then patterns that do not meet the maximum shadow length condition will be displayed in light colors (rose or light blue).

- Smart Filter Enabled – filter that considers the probability of reverse.

- Sensitivity Smart Filter – sensitivity of the "Smart Filter" (0 ÷ 1). 1 – maximum sensitivity. 0 – minimum sensitivity (there will be less signals).

- Ratio of body length (first bar) – coefficient of the minimal length of body of the first bar.

- Ratio of body length (second bar) – coefficient of the maximal length of body of the second bar.

- Ratio of length of shadows (second bar) – coefficient of the maximal length of shadows of the second bar.

- Ratio of body length (third bar) – coefficient of the minimal length of body of the third bar.

- Short-Term Trend Filter – settings of the short-term trend filter.

- MA Filter Enabled – use the short-term trend filter based on MA.

- MA Method – method of averaging of MA.

- MA Period – period of MA.

- MA Price Type – type of price used.

- Set Bollinger Bands Filter – setting of the filter based on the Bollinger Bands indicator.

- Enabled Filter – use the filter based on the Bollinger Bands indicator.

- Entry BBands period – period of Bollinger Bands.

- Entry BBands deviation – deviation of Bollinger Bands.

- Range Check – number of bars to be checked.

Recommendations on usage:

Enter the market by pending orders placed:

- on the Low level of the third bar minus several points for the Evening star.

- on the High level of the third bar plus several points for the Morning star.

SL is placed on the local extremum level plus several points.

A signal formed on Friday 3-4 hours before the end of a trade session should be better skipped.

If there is an open position when a signal appears, it is recommended not to reverse, but continue trailing the open position.