Gold302b

- 专家

- Davide Martinazzo

- 版本: 1.0

- 激活: 5

Gold trade 3002 H1

PLEASE READ DESCRIPTION BEFORE BUY OR RENT EA

This EA is NOT the result of an optimization of historical data. In fact it is easy to achieve a “super” equity curve (as I call it “go to the space equity curve”) with parameters optimization and overfitting on historical data: it is always possible to find a set of parameters that over-optimize the historical data. But it is the PAST data. The point is to find a strategies that will work in the future. For these reasons my strategies have good result on backtest (they must be profitable of course on the past) but most important and crucial they are ROBUST.

I tested my EA on:

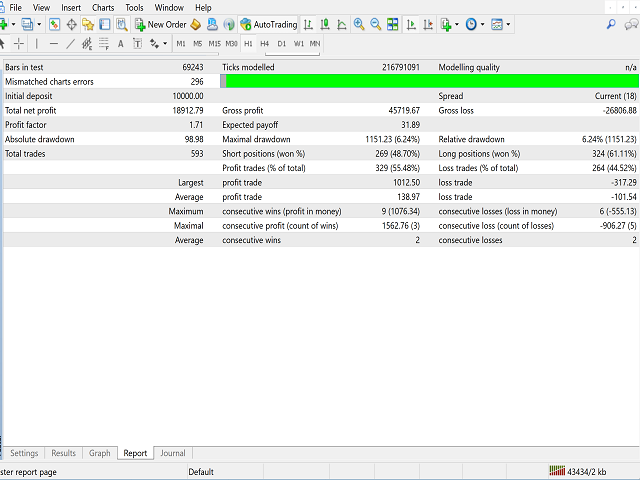

- from 2008 to 2019 data

- on long "Out of sample period" (about 5 years)

- on different timeframe (M15;M30;H1)

- with slippage test (simutate with higher level of slippage)

- with skip trades test (simulate that some trade skip with some probability)

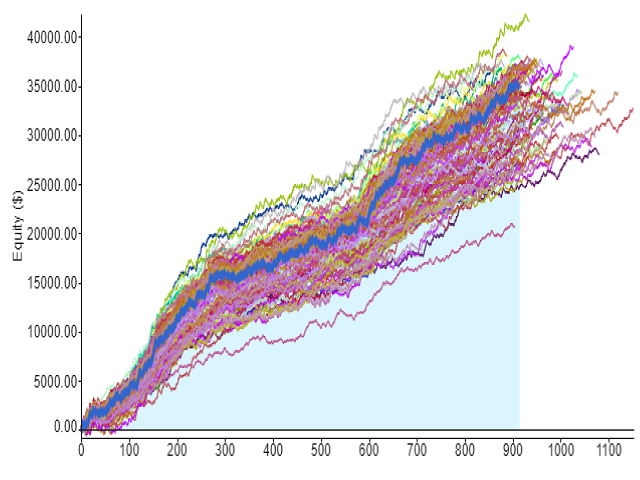

- with several robusteness test (several montecarlo tests with parameters variatios)

- with Walf forward matrix test

I could optimize parameters of EA to achieve better and better equity curve…but it is optimum for the past data and does not regard the future performance. Do not belive on EA with super linear and perfect equity curve: it is over-optimization (overfitting) on past data. DO NOT RELY to EAs with perfect and super linear equity curve: they are built with over-optimization (overfitting) on past data. They are built to maximixe the past! EA must be ROBUST

Please note that the best strategy to be profitable is to have a PORTFOLIO of 10-15 strategies: different strategies, different crosses, different timeframe, or all of them.

***********************

The strategy is a fully automated Expert Advisor on XAUUSD with no use of martingale, scalping etc. It is reccomended for medium-long term investing. It is very ROBUST (see details)

download INDICATORS here: https://drive.google.com/drive/folders/1joO3BTTqTmNIFUvqPH-PiKUgNwyXD06t?usp=sharing

It works with different timeframes:

- Gold: H1 (reccomended), m30, H4

Backtest data with high reliability from 2006 to 2019 (13 years)!!!

This EA can be used with different crosses, timeframe and with other my EAs to build a very stable and robust portfolio.

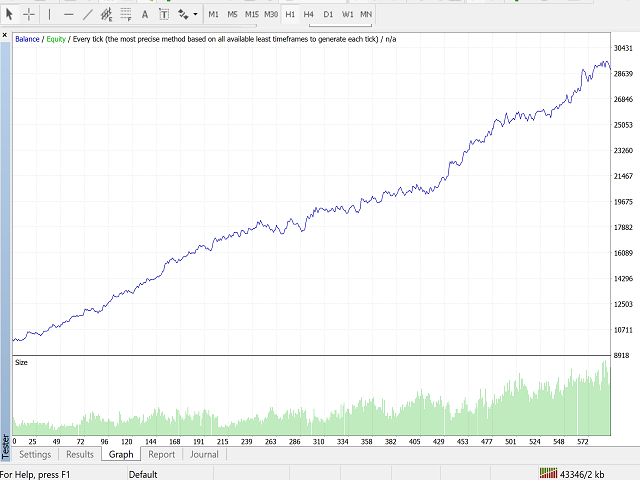

Very low DD as you can see from screenshot.

It passed ROBUSTNESS tests (montecarlo, Walk forward matrix, Slippage)

No leverage is required. If you use more EAs 1:30 is ok

You can use fixed amount (100$, 200$ or what you prefer) or money management (risk %) ---> You can set the Risk Percentage: suggested 1%-3% (max DD about 8-20%)

With fixed order amount (100 Euro) the backtest DD is low (see screenshot).

On EA you can SET several parameters and trading time

If you don’t have an ICMarkets account and you want use ICMarkets (you can use the broker you want!!!) you can use the following link in order to have reduced commissions (you will save 21% on commission) https://www.icmarkets.com/?camp=37877