KT Currency Strength and Correlation MT5

- 指标

- KEENBASE SOFTWARE SOLUTIONS

- 版本: 1.2

- 更新: 19 二月 2020

- 激活: 5

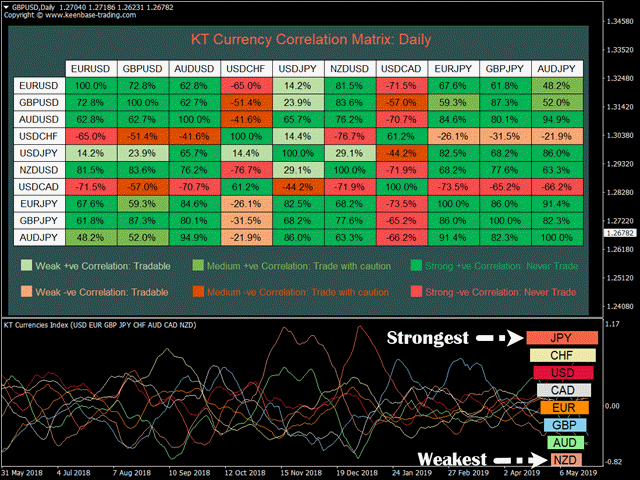

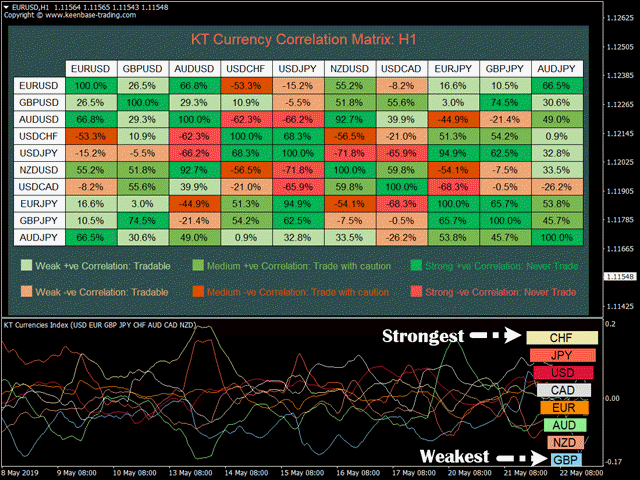

If you trade Forex, having detailed information about the currency strength and currency pairs correlation can take your trading to new heights. The correlation will help to cut your risk in half, and strength analysis will help to maximize the profits.

This indicator provides a hybrid approach for selecting the most appropriate currency pairs using the strength analysis and currency pairs correlation.

How to use the Currency Strength Analysis

Suppose your trading strategy provides a buying opportunity on AUD/JPY and using the KT Currency strength analysis you find that the JPY is going stronger than AUD. It is likely that the trade will end in a loss. When you have this indicator, you'll able to avoid such losses easily.

How to use the Currency Pair Correlation

As these pairs are strongly correlated, trading them together will only double your risk. If you get a loss on NZD/USD, it is very likely that the trade on GBP/JPY will also end as a loss.

Features

- Quickly find the strongest and weakest currency to verify the trade opportunity generated by your trading strategy.

- Cut your risk by half or even one-third by avoid trading the strongly correlated currency pairs.

- Receive alerts when a currency become the strongest or weakest among the currency basket.

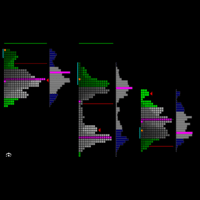

- Analyze the strength report using a currency pyramid which arranges them in order of strongest to weakest currency.

Currency Strength Analysis in Detail

- Choosing the Best Currency Pair

Suppose your trading strategy provides a buying opportunity GBP/JPY and EUR/JPY. As both of the pairs are strongly positively correlated, trading them both would only double the risk.

Using the currency strength pyramid, you can find out which is the strongest currency out of GBP and EUR. If GBP is stronger than EUR, you should choose the GBP/JPY, or if EUR is stronger than GBP, you should pick the EUR/JPY.

- Avoiding the Flat Market

Suppose your trading strategy provides a buying opportunity on AUD/JPY. You find the Australian Dollar and Japanese Yen arranged adjacently in the currency strength pyramid.

It reflects a situation in which both of the currencies are either strongest or weakest at the same time. Having both the tendencies together will end up as a sideways market.

Currency Pairs Correlation in Detail

Generally speaking, correlation is a statistical method to measure the relationship between two trading assets. Currency Correlation shows an extent to which two currency pairs move in the same, opposite, or random within a particular period.

- A correlation of +1 is known as the perfect positive correlation. It means that the two currency pairs will move in the same direction 100% of the time, such as EUR/USD and GBP/USD.

- A correlation of -1 is known as the perfect negative correlation. It means that the two currency pairs will move in the opposite direction 100% of the time, such as EUR/USD and USD/CHF.

- A correlation of 0 means the relationship between two currency pairs is random. Their price movement is not related to each other.

- Positive Correlation Strength

- Weak Positive Correlation (10% to 40%) = Tradable

- Medium Positive Correlation (40% to 60%) = Trade with caution

- Strong Positive Correlation (60% to 100%) = Never Trade

- Negative Correlation Strength

- Weak Negative Correlation (-10% to -40%) = Tradable

- Medium Negative Correlation (-40% to -60%) = Trade with caution

- Strong Negative Correlation (-60% to -100%) = Never Trade

This is a great tool. Welldone