WildCycleEA

- 专家

- Hajime Tsuro

- 版本: 1.37

- 激活: 5

Unveiling WILD CYCLE EA: A Strategy for Dynamic Market Trends

Adaptive Trading in Motion

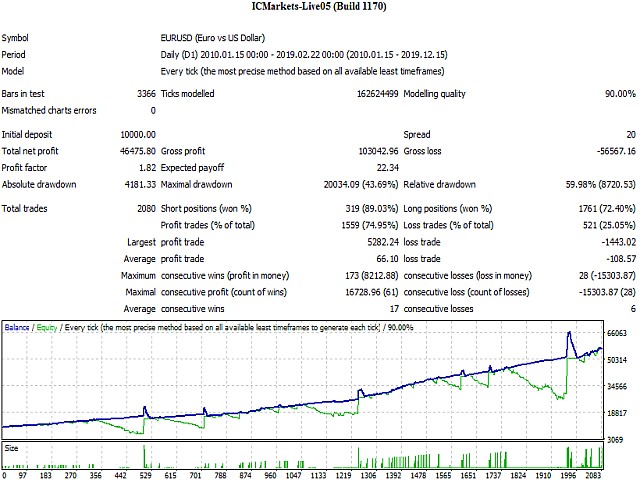

Embarking on the trading landscape from June 2021, the WILD CYCLE EA presents an evolutionary approach to market-trend following. Pioneering a relentless pursuit of profit, this EA deftly adapts to shifting market dynamics.

Navigating the Core Strategy

At its heart lies a fundamental approach—initiating positions in the direction of positive SWAP, such as the EURUSD SHORT. These positions are meticulously calculated based on the account balance, ensuring alignment with trading capacity. This is just the foundation; the WILD CYCLE EA introduces a suite of functions that encapsulate its prowess.

Essential Functions

- Multiplied Base Positions: Multiply openings of Positive SWAP Base Positions, calculated by "lot per size" and points gaps from current price. This dynamic approach mitigates the need to wait for an opportune moment, allowing for diversified entry sequences.

- Virtual Trailing: Leverage the average price of all active Base Positions for informed trailing.

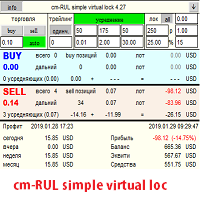

- Assist Positions: In times of contrary market tendencies, initiate assist positions, converging seamlessly into the virtual trailing strategy.

- Counter Positions: Introduce hedge positions (Counter Positions) with a lot size strategically designed not to impact the account balance—always smaller than Base Positions.

- Trailing for Counter Positions: Customize trailing for Counter Positions, choosing between standard or virtual modes.

- Automated Lot Calculation: Embrace automated lot size calculation for an optimal trading experience.

- Strategic Closure: Facilitate closure of all positions once Base Positions reach predefined target points.

- Continuous Expansion: Initiate additional positive SWAP direction positions using accumulated funds until the next "close all" instance.

Risk Management through Account Balance Integration

The WILD CYCLE EA's bedrock is trading with a lot size aligned with your account balance—prioritizing risk reduction. While leverage of 1:200 is permissible, utilizing it at 1:5 or 1:1 is advisable. Why? This strategy diverges from scalping or day trading, instead favoring a prolonged approach that spans weeks to months. To maximize efficacy, adopt this EA for positive SWAP direction trading, with SWAP-free accounts offering an added advantage.

Ensuring Resilience

With a prudent approach of 0.01 lot size per $1000, the impact of tumultuous market events is mitigated. Be it Brexit, the Greece Crisis, geopolitical shifts, or major economic events, this strategic safeguard assures account resilience. Furthermore, the unique hedge strategy offers a shield against drastic movements—over time, market tendencies often revert to their previous positions.

Systematic Trading with Internal Sophistication

It's akin to manual trading, albeit amplified by the sophistication of internal functions within the WILD CYCLE EA. Akin to having a vigilant trader at your side, this EA operates seamlessly, requiring no constant monitoring.

Guiding Recommendations

- VPS: Consider a Virtual Private Server for seamless operation.

- Balanced Lot Size: Opt for a balanced lot size, like 0.01 per $1000.

- Positive SWAP Direction: Align with Base Positions or select SWAP-free accounts.

- Time Frame: The strategy transcends time frames, with D1 signal operation.

Configuring with Precision

The parameters below empower customization:

- Base Positions Magic Number

- Counter Positions Magic Number

- Base Positions Direction: Choose between SHORT, LONG, or AUTO.

- UseTradeRange: Default "False"

- TradeRangeSHORT_From/Until: Set SHORT positions range if "True" for UseTradeRange.

- TradeRangeLONG_From/Until: Set LONG positions range if "True" for UseTradeRange.

- Max Positions for Base: Default 3

- Max Positions for Counters: Default 6

- Risk Setting: Opt for Low, Standard, Medium, or High.

- Lot per size (Base position)

- Max Spread

- Trade Spread

- SL (Stop Loss)

- TP (Take Profit)

- Start Virtual Trailing Stop: Enter in Points.

- Virtual Trailing Distance: Set in Points.

- Use Trailing for Counters: Choose True/False.

- Trailing Distance for Counters: Specify in Points.

- Use Virtual Trailing for Counters: Opt for True/False.

- Start Virtual Trailing Stop: Define in Points.

- Virtual Trailing Distance: Specify in Points.

- Base Buffer from Current Price: Specify in Points.

- Counter Buffer from Current Price: Specify in Points.

- Trade Stop Function after Reaching Close All: Default "False".

- Execute Immediate Close All & Trade Stop: Default "False".

As you navigate these parameters, you navigate the evolving market trends with precision and strategy—enabling an approach that's both dynamic and well-informed.