SyntheticIndices

- 指标

- Stanislav Korotky

- 版本: 2.0

- 激活: 5

The indicator compares quotes of a given symbol and a synthetic quote calculated from two specified referential symbols. The indicator is useful for checking Forex symbol behavior via corresponding stock indices and detecting their convergence/divergence which can forecast future price movements.

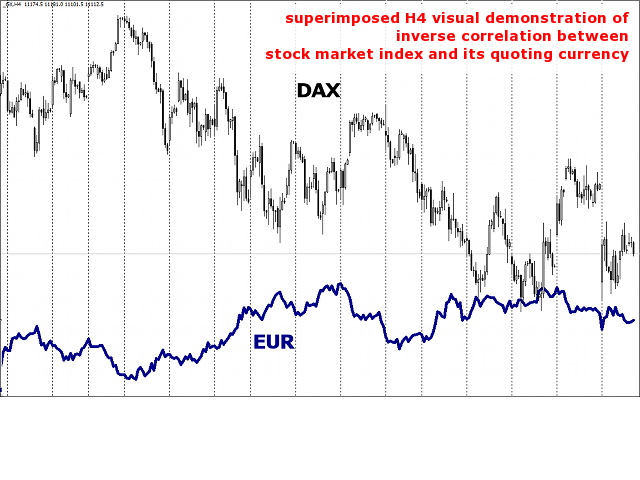

The main idea is that all stock indices are quoted in particular currencies and therefore demonstrate correlation with Forex pairs where these currencies are used. When market makers decide to "buy" one or another stock index, they sell currency the index is quoted in. For example the S&P500 upward trend is usually confirmed by the USD downward trend. And likewise, USD usually grows when S&P500 and other American indices fall (people may be said to go into cash). This is illustrated in the first chart below with DAX and EUR superposition (note that this is EUR, not EURUSD or any other pair which contains EUR).

The indicator calculates synthetic rate between two stock indices and compares it with a real symbol rate. For example, in case of EURUSD one can choose DAX vs S&P500, or CAC40 vs Dow Jones for analysis. S&P500 represents S&P500/USD in Forex terms, an DAX is the DAX/EUR pair. Thus, ratio of these two indices forms an alternative rate of EUR/USD. The indicator shows this synthetic as such (the ScalingPeriod parameter is set to 0, see below) or as values normalized respectively to the specified moving average (ScalingPeriod exceeds 0). But the most important thing is that these normalized values of a standard Forex symbol and its synthetic analysis are displayed side by side demonstrating convergence and divergence phases.

The indicator works well with such strategies as pairs trading and hedging: trade the Forex pair in the direction of the synthetic, and optionally trade indices in the opposite direction.

Parameters

- SymbolList - the list of symbols to analyze, represented as triplets: "ReferenceA1/ReferenceA2=RealSymbolA;ReferenceB1/ReferenceB2=RealSymbolB;..." etc.; triplets are separated by ";", maximal number of triplets - 5; in every triplet, ReferenceX1 is an index name, corresponding to the second currency (quotation) of the RealSymbolX, and ReferenceX2 is an index name, corresponding to the first currency (base) of the RealSymbolX; for example, for EURUSD analysis one may specify "S&P500/DAX=EURUSD", or "NQ/FDAX=EURUSD", or "DJI/STOXX50=EURUSD"; examples of settings for major currencies are provided on the Comments tab;

- Smoothing - a period of moving average applied on the synthetic curve for smoothing (default - 5);

- ScalingPeriod - moving average period for relative normalization, default value is 21; 0 means cross-rate without normalization - it's applicable if only one reference pair is given, for example, SymbolList="NQ/FDAX";

- ScalingMethod - moving average mode, default value is MODE_EMA;

- ScalingPrice - moving average price, default value is PRICE_CLOSE;

- RangingPeriod - period for calculation of average range of all visible lines (shown as gray dotted lines);

If indices are not specified, the indicator outputs hints for major Forex currencies into the log.

Tickers for market indices specified in inputs must be available in Market Watch. The indicator works solely with standard quotes from your broker and does not request any external services.