Raff and Bollinger

- 专家

- Vadim Zotov

- 版本: 1.4

- 更新: 20 四月 2022

- 激活: 10

The robot is intended for trading on a real account. Two channels are being constructed: Hilbert Raff and John Bollinger. The external Raff channel allows you to determine the direction of the global trend. Inside it, in the Bollinger channel, trade is conducted on a trend. Provision is made for disabling martingale and money management, transactions are protected by stop-loss.

Features of the trading strategy

The robot calculates two channels. The external channel is calculated by the method of Hilbert Raff, inside it is built the channel of John Bollinger. These channels respectively reflect global and local trends. The most effective and safe is trade with the coincidence of directions of identified trends. Entry to the market and profit-taking are made near the borders of the internal channel. Positions open only in the direction of the trend defined by the external channel. Thus, most of the positions are closed at a profit. Loss positions are averaged by additional transactions, which are calculated so that their aggregate is also closed at a profit. As the deposit grows due to money management, the volume of transactions increases to reconcile available funds, profitability and risk. Testing and application of the robot is shown in the video.

Results

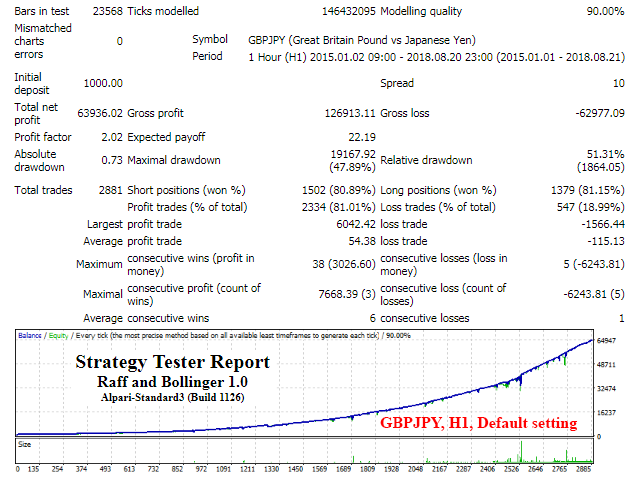

During testing for the period from January 2015 to August 2018 on a pair GBPJPY and hour timeframe with an initial capital of $1000 and with default settings, the robot received a profit of $63936.

Recommendations for use

For the work of the robot, no indicators are required, all the necessary algorithms are contained in a single robot file. To control the work of the robot, you can use the additional indicator Raff Channel indicator, which displays the Raff channel and also the standard indicator Bollinger Bands, which is included in the terminal. Indicators can be set on one graph together with the robot. Indicator parameters should be set as the corresponding input parameters of the robot.

By switching the Open counter positions parameter, you can enable or disable the setting of counter positions when the entry criteria in the opposite direction are met. Allowing counter positions increases the total number of trading cycles and reduces drawdowns due to locking.

The robot is easily optimized for work on other currency pairs and timeframes.

Options

General parameters

- Language - robot message language (Eng, Rus);

- Magic - magic number for orders;

- Open counter positions - to open opposing positions (Yes, No);

- Period Bollinger bands - the period of the internal Bollinger channel;

- Deviation Bollinger bands - deviation of internal channel Bollinger Bands;

- Number of bars - number of bars for calculating the external Raff channel;

- Coefficient of the channel width - Ruff channel width factor;

- Entry criteria - distance to the trend line (in% of the width of the channel) to enter the transaction / exit from the transaction;

- Gradient criteria - gradient of the inclination of the internal channel, at which it is permitted to conclude deals;

- Offset for determining Gradient criteria - offset for gradient calculation;

- Distance to safety levels - distance to safety levels, points.

Parameters of averaging positions

- Use martingale - use martingale (Yes, No);

- Step of averaging positions - averaging step, points;

- Lot increase coefficient - coefficient of increase in the lot;

- Maximum number of steps for averaging positions - the maximum number of steps of averaging (if all is exceeded);

- Coefficient of stop - the stop ratio (the fraction of the averaging step, 0.1 ... 1);

- Specified profit with averaging - given averaging profit, $ by 0.01 lot.

Additional parameters

- Clearance - clearance above characteristic points (points);

- Use money management - use of money management (Yes, No).

- Initial lot - начальный лот.

The robot can be used on 5- and 4-digit quotes. The number of digits in quotes is defined automatically. All parameters specified in points should always be set for 5-digit quotes (set by default).

I do like the products from this Autor very much. They are worth the price and even, if you are not trading a BIG account, you can afford it. They make steady winnings day by day and if used wisely, you are able to get back the cost and grow your account. I will buy more from this autor, as soon as I will have earned the money. :-) Thanks for making EAs even "small people" can afford to use ... :-)