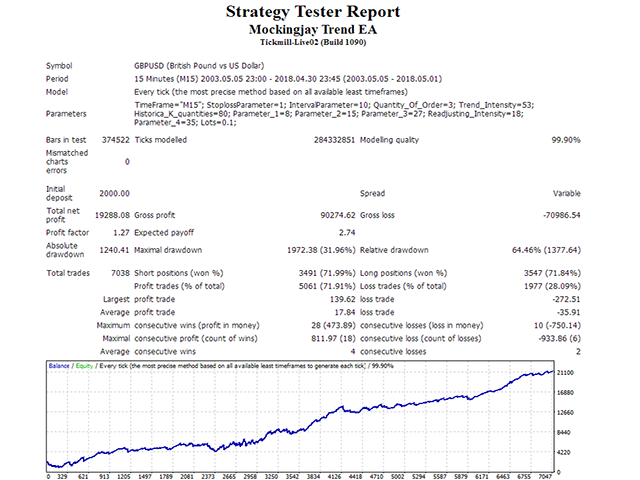

Mockingjay Trend EA

The central strategy of the EA is based on the Elliott Wave Theory. When the second wave is a correction, you can open order in the direction of a trendline and use the fluctuations of the third wave to take profit. Stop loss will be set at the highest or the lowest price in the past. Each order has a stop loss.

The EA is not Martingale, so the risk is controllable.

Parameters

- StoplossParameter: Actual stop loss = Theoretical stop loss multiplied by the stop loss factor, and the value range is 0-1. For example, if the coefficient is set as 0.7, then the stop loss distance that should have been 10 points is now actually 7 points.

- IntervalParameter: The shortest distance between the two orders.

- Quantity_Of_Order: The maximum number of open orders on the current currency in the value range of 1, 2, 3.

- Trend_Intensity: Judge the strength of the current trend.

- Historical_K_quantities: The historical value range of the trend judgment.

- Parameter_1: Determine the number of k-lines for opening orders.

- Parameter_2: Determine the time for opening orders. When the price reaches the time selected by the strategy, orders will be opened.

- Parameter_3: The parameters used to determine the timing of the correction.

- Readjusting_Intensity: The parameters used to determine the strength of the correction. The larger the value, the greater the correction effort.

- Parameter_4: Profit Adjustment Module.

- Lots: Fixed lot.

Pairs and timeframes

The EA can only be used on GBPUSD (M15), XAUUSD (M15) and USDJPY (M15). It cannot be used on other pairs like XAGUSD.

Recommendations

It is recommended to use an ECN broker with a low spread and VPS.

Small spread significantly increases the EA's efficiency.

用户没有留下任何评级信息