Average Daily Range Marker

- 指标

- Stoyan Roev

- 版本: 1.0

- 激活: 5

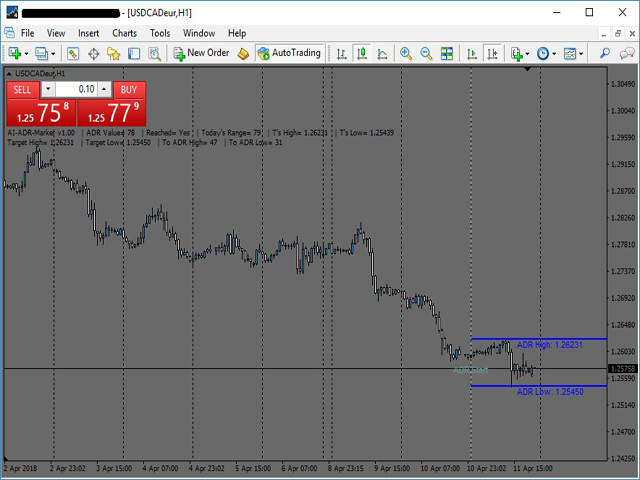

- The Average Daily Range shows the dynamic levels of average pip range on a pair measured based on the daily Highs and Lows over a certain periods.

- You can use the ADR to visualize potential price action outside the average daily move. When ADR is above average, it means that the daily volatility is higher than usual.

- The ADR can be helpful in setting targets for positions. If the ADR shows you that a pair has an average daily range of 80 pips, then it might be wise to tighten up your target in this range.

- ADR Marker is also useful for trading intraday reversals. If a currency pair reaches the top of a daily range, then it could be due for a reversal, and you could capture a potential retracement.

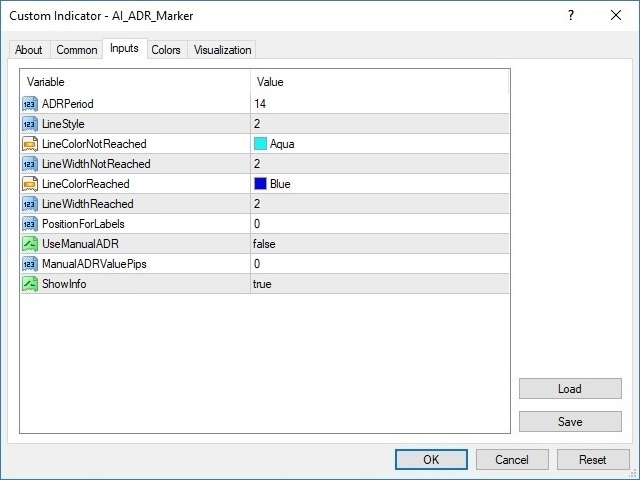

Indicator parameters

- ADRPeriod - calculating the period of average daily range in days (default 14)

- LineStyle - style of the displayed lines (default 2)

- LineColorNotReached - the color of the lines when ADR are not reached (default Aqua)

- LineWidthNotReached - width of the lines when ADR are not reached (default 2)

- LineColorReached - the color of the lines when ADR are reached (default Blue)

- LineWidthReached - width of the lines when ADR are reached (default 2)

- PositionForLabels - position of the price value labels under the lines (default 0)

- UseManualADR - option for usage of manual ADR value(default false)

- ManualADRValuePips - input your ADR value in pips (default 0)

- ShowInfo - display the information text (default true)

How to configure the indicator

- The indicator is provided with option for manual input of ADR, which allows you to use your own ADR value in pips.

- If you want to give a try with different settings you can open Indicator list, choose AI_ADR_Marker and click on "Inputs" tab.

On all my charts very handy detail.