Trend CruiserGT for CADCHF

- 专家

- Ramesh Selvarajoo

- 版本: 2.0

- 更新: 15 一月 2018

- 激活: 5

Trend CruiserGT (for CAD/CHF)

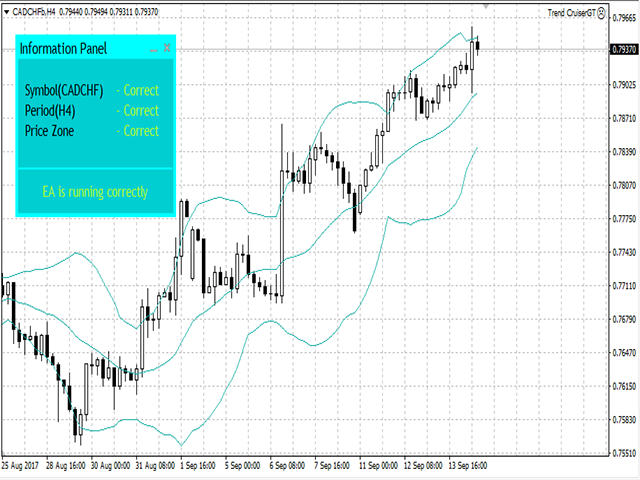

- It is a swing trading system that trades on CAD/CHF currency pair on 4-hrly chart.

- The EA is custom designed to take advantage of the start of rising Canadian dollar in 2017, after seeing over 7 year period of downtrend against the Swiss Franc (CHF).

- The design of the EA have taken consideration of fundamental analysis over last several quarters for the CAD and CHF counterparts, and analyzing the multi-year chart pattern of this pair.

- The strategy will take full advantage of the rising strength of the CAD/CHF that is expected to last through 2020.

How it works

- Trend CruiserGT trades only the buys (long-only trades) and scans for the uptrend movement using a series of Bollinger Bands for entry and exits.

- Relative Strength Index indicator entries increase frequency of trades slightly.

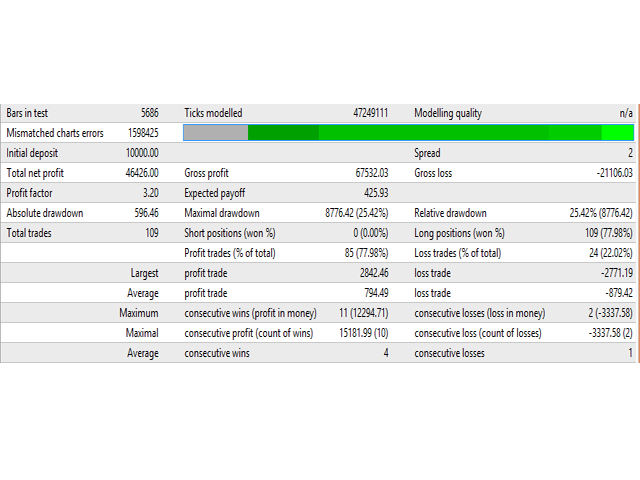

- The strength of the EA is the simplicity. It trades on 4-hourly chart and the trades can last for 1 to 3 days on average. It places 3-5 high probability trades per month.

- The author has built and developed the strategy using 10/20/30 Rule he has created.

- The 10/20/30 Rule is a powerful technique to build trading strategies that produce winning results. The coding of the Trend CruiserGT is created by Dennis Nikolopoulos who has many years experience in developing and testing systems that are bug free and error prone.

What is the strength

- This is a risk-averse strategy

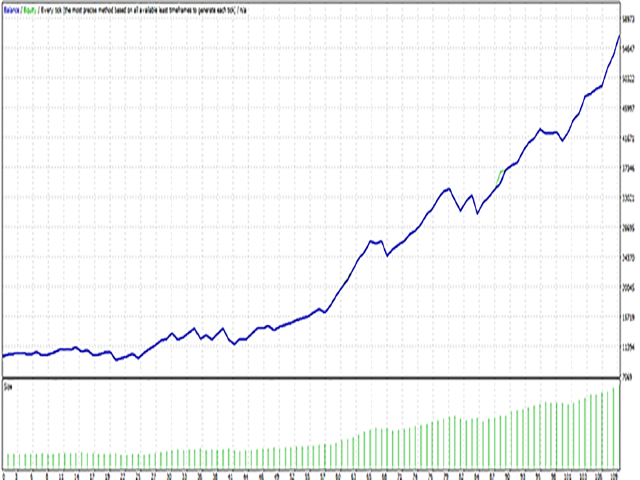

- The strategy is also tuned to produce nice returns with lower risk which is crucial but extremely rare to find. Also, the strategy has been tested and verified with robust backtesting and forward testing using the author's unique 10/20/30 Rule™ and have the edge of many systems out there.

Recommendation

- This is not scalping, so the EA will work very well with all regulated forex brokers.

- This is a plug & play system, so no new parameters setting will be needed. It is better to let the system run with default settings for optimum performance.

Money management

- There are 3 levels; Conservative, Smart and Aggressive, of money management rules for different types of traders.

- Default is at "Smart" for people who are focused to keep very low drawdown and maximize gain. Aggressive setting has still maintain a relatively low drawdown, and have a more growth potential.

Parameter settings

- The system has been optimized to run best with the default parameter settings and users are not required to change them.

- Money management selection is recommended to be selected per the user's risk preference.

- The strategy places the stop-loss level according to price action and there is a universal stop loss (percentage) that is set to 4% to protect against flash crash or sudden drop in price for whatever reason.

- There are 3 Bollinger Band settings which are optimized and doesn't need to change.

Parameters

- Maximum number of Orders. Set to 3 (default). This is to have the maximum trade orders opened at any time.

- Stop-Loss (Percentage). All orders have stop-loss. This is an extra layer of stop-loss for sudden price drop on rare events. Set at 4% of the open price.

- Money Management Rules. 3 settings according to risk appetite: Conservative (3% risk), Smart (4.4%) and Aggressive (5.8%)

- Bollinger Band Blue. 20p, 1.9dev settings for Entry order and Stop-loss trigger - no changes required

- Bollinger Band Green. 18p, 2.8dev settings for Take-profit setting - no changes required

- Bollinger Band Red. 22p, 2.3dev, shift -2 settings for Take-profit setting. Green and Red Bollinger Band must intersect to set take-profit- no changes required

- RSI Strategy Period = 28 - period interval for RSI calculation - no changes required

- RSI Strategy Level = 36 - trigger level - no changes required

- Enable Panel - True is visible, False is green panel on screen is removed

- Enable Rule 1 - True (optimized take profit level)

- Enable Rule 2 SL - True enable optimized Stop-loss rule