TradeLeader B3 Bovespa Scanner

- 实用工具

- Cid Ougaske

- 版本: 2.1

- 激活: 5

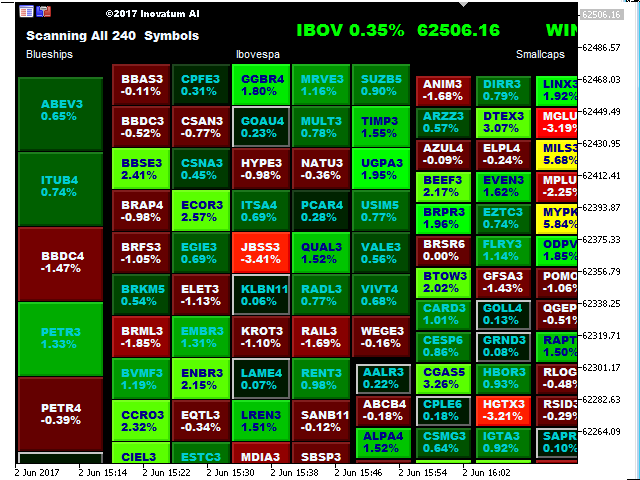

TradeLeader B3/Bovespa Scanner is an indicator that allows you to observe the entire market heat map in a single chart.

More images in high definition in https://www.mql5.com/pt/users/ougaske/blog

- Track all the assets of the stock market separated by liquidity groups.

- Customize the alert level for opportunities.

- Display in real time the Ibovespa, minicontracts of Index and Dollar or any other instrument that you wish to highlight.

- Click on the desired asset and a chart will open for better analysis and commercialization.

We use this panel daily, which allows us to observe trends and opportunities that the native Market Watch does not show.

It is very simple to use and automatically loads the necessary assets into your MetaTrader (of course, your broker must provide these quotes).

You can even customize the groups that will appear on the panel, even include Forex and international assets, indexes, etc that you wish.

As a convenience, the indicator already comes with all assets reported by B3/Bovespa this month (May/2017) in alphabetical order and in groups for liquidity.

However, you can modify them at will, and in the future change any portfolio/asset to your liking.

For example, compare the Ibovespa, S & P, DownJones, Dollar, etc. in the panel. Just have your brokerage give you quotes.

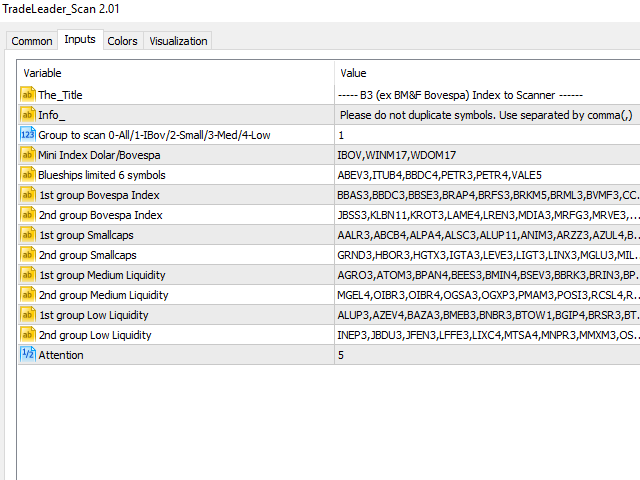

Main Parameters

- Groups for scan: 0 - all assets / 1 - only the assets of the index Ibovespa / 2 - smallcaps / 3 - medium liquidity assets / 4 - assets with low liquidity.

- Mini Index / Index: Choose up to three assets to highlight in the panel.

- BlueShips (6 assets): Assets that move the Ibovespa index, but you can change them if you wish.

- 1st Group assets Ibovespa: Assets that participate in the Ibovespa.

- 2nd Group assets Ibovespa: Assets that participate in the Ibovespa.

- 1st Group SmallCaps assets: Good liquid assets, but not participating in Ibovespa. They provide good deals.

- 2nd group SmallCaps assets: Good liquid assets, but not participating in Ibovespa. They provide good deals.

- 1st Group assets Average Liquidity: Medium liquidity assets, but not participating in Ibovespa. They provide good business.

- 2nd Group assets Average Liquidity: Medium liquid assets, but not participating in Ibovespa. They provide good deals.

- 1st Group assets Liquidity Low: Low liquidity assets. Provide good deals if analyzed in a judicious way, of course, with more risk.

- 2nd Group assets Liquidity Low: Assets with low liquidity. Provide good deals if analyzed in a judicious way, of course, with more risk.

- Attention: Percentage value you want to be alerted, in highlighted yellow, on the heat map.

Note:

- If you want to include any assets, separate them by commas.

- Do not duplicate assets. This will cause a black icon to appear on the screen as a doubling warning. Just access the product properties and remove the duplicate item.

- By choosing to show all the assets, you understand that you must have RAM available for this. In our tests, the indicator consumed 200 MB (comparative, MetaTrader consumes 100 MB on average).

- The first time the indicator will take a few minutes to load the history. It will depend on the time of how many assets you chose and your Internet.

Thank you for your interest! I am available for suggestions.