Your Personal Assistant

- 实用工具

- Igor Semyonov

- 版本: 1.71

- 更新: 8 四月 2020

- 激活: 7

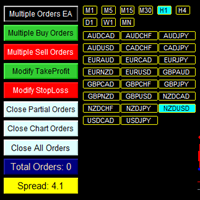

Your Personal Assistant is an Expert Advisor for semi-automatic Forex trading. It is designed for trades who trade manually or prefer semi-automatic trading.

Suitable for trading currencies, metals and CFD.

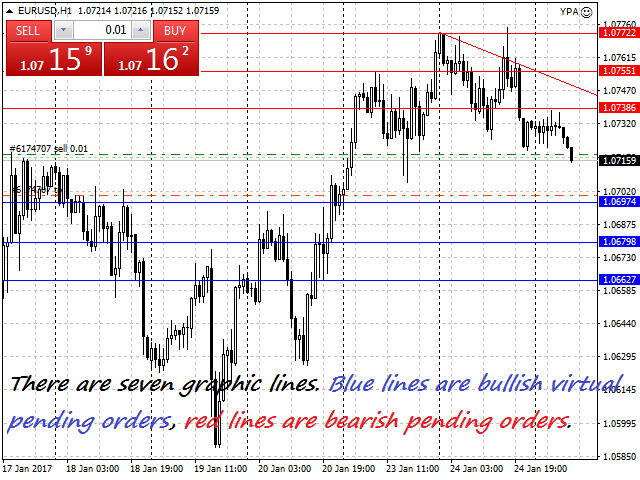

The EA helps the trader in managing the open positions, as well as open deals using virtual pending orders based on graphical horizontal and/or trend lines. Thus, positions can be opened by the following method, including their joint use:

- Market orders (positions are opened by the trader)

- Pending orders (orders are placed by the trader)

- Virtual orders in the form of graphic lines (lines are placed by the trader)

The graphic lines must have the corresponding names for the EA to be able to identify them among any other graphical objects.

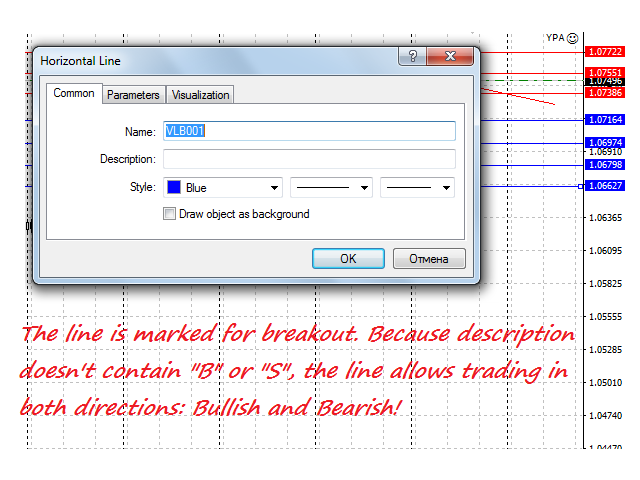

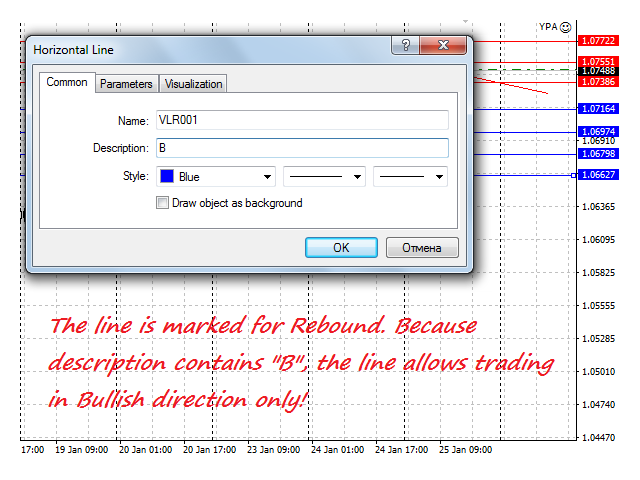

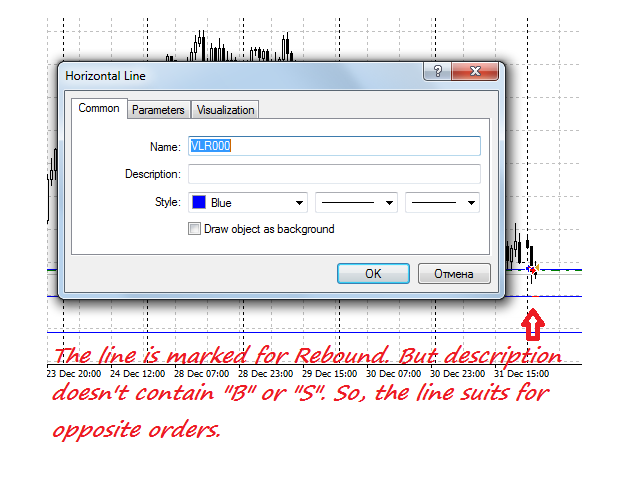

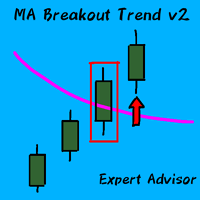

Deals can be opened using the graphic lines in the direction of the breakout, rebound, buy or sell. Combined use is also possible, for example, certain lines for breakout (buy and sell), others for rebound (buy and sell), or breakout and buy, etc. Identification of the deal type is performed based on the line name and its description. Name of the graphic line in the input parameters must have three characters. Name of the graphic line on the chart must begin with the three characters from the input parameters.

Graphic lines for buying must have one B letter in description, which means Buy. Accordingly, for selling - one S letter. An empty string in the description of the graphical line or other characters indicate that the line can be used both for buying and for selling (see screenshots).

In general, the EA is able to perform the following functions:

- Open deals using graphic lines

- Calculation of lot when opening deals

- Management of the real TakeProfit level

- Management of the virtual StopLoss level

- Use of the averaging and/or hedging strategy

- Fixing profit or loss

- Output of the report to the Experts journal

- E-mail notification about disconnection from the trading server, opening and closing orders

The list of the input parameters is provided fully, descriptions - selectively.

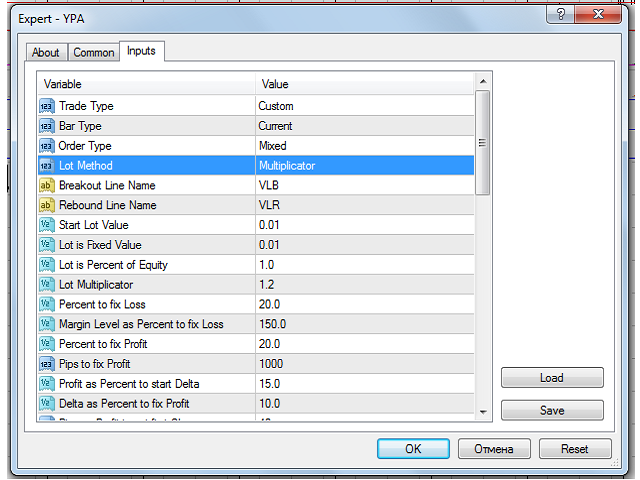

Input parameters

- Trade Type:

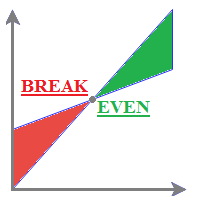

- Breakout

- Rebound

- Custom

- Bar Type:

- Current

- Previous

- Order Type:

- Buy

- Sell

- Mixed

- Lot Method:

- Fixed

- Percent

- Multiplier

- Breakout Line Name

- Rebound Line Name

- Start Lot Value

- Lot is Fixed Value

- Lot is Percent of Equity

- Lot Multiplier

- Percent to fix Loss

- Margin Level as Percent to fix Loss

- Percent to fix Profit

- Pips to fix Profit

- Profit as Percent to start Delta - Profit in % for calculation of the Delta deviation

- Delta as Percent to fix Profit - Delta in % for fixing profit

- Pips as Profit to set first SL - Profit in points for the first SL

- Pips as Profit to set second SL - Profit in points to move SL to the second stage

- Pips as Profit for Trailing Virtual SL - Profit in points to activate trailing stop

- Loss Pips to Set Initial TakeProfit - Loss in points to set the initial TP

- Initial TakeProfit

- TakeProfit for Averaging or Hedging

- Average Spread for Hedging

- Slippage

- Use Percent to fix Loss

- Use Margin Level as Percent to fix Loss

- Use Percent to fix Profit

- Use Pips to fix Profit

- Use Percent as Delta to fix Profit

- Use Marubozu Pattern - Use Marubozu for fixing profit

- Use Morning Star Hammer Hanging Man - Use the patterns for fixing profit

- Use Profit above Breakeven - Use the SL above breakeven (point 17)

- Use Virtual Trailing StopLoss

- Use Initial TakeProfit

- Use Trailing TakeProfit

- Use Averaging

- Use Hedging

- Use Virtual SL during TP Management

- Use Virtual SL for Averaging - Use SL when averaging

- Use Virtual SL for Hedging - Use SL when hedging

- Delete Line

- Connection Control

- Send Mail

- Language of Messages

- Print Report

- StopLoss Sell Color

- StopLoss Buy Color

Using the virtual SL at points 39 and 40 allows to protect the profit in case the orders are not closed at the real TP and SL levels.

Usage

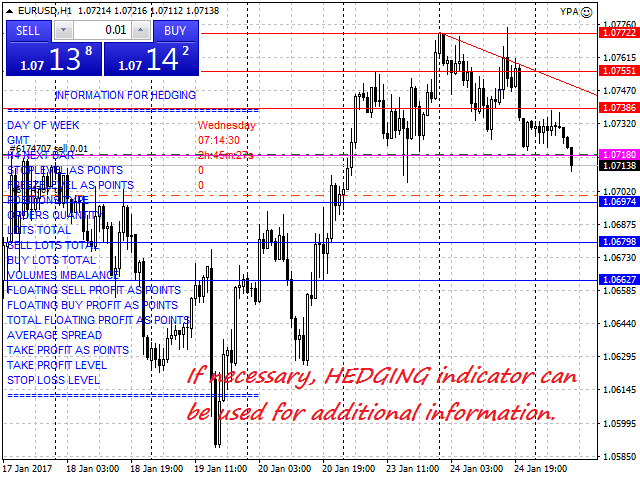

The averaging and hedging strategies use the same algorithms as the Averaging Script, Hedging Script products. The Averaging and Hedging indicators may be used for visualization.

It is possible to switch from averaging strategy to hedging, but not backwards.

The EA is intended for trading only one financial instrument.