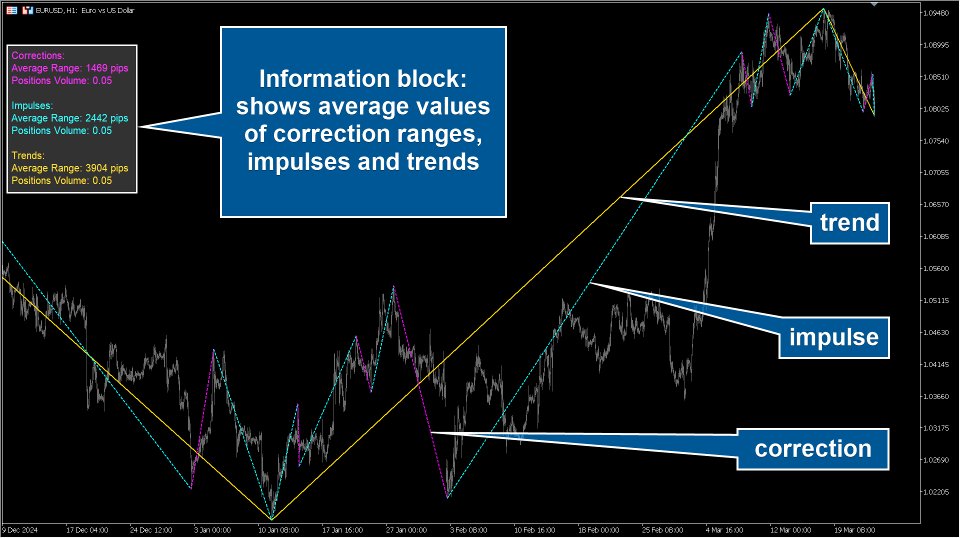

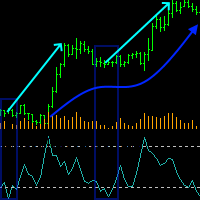

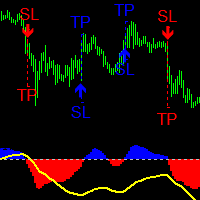

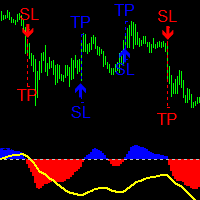

Trend Risk Analyzer intelligently identifies trends, impulses, and corrections, calculating optimal trade volumes and safe levels for stop-loss and take-profit. Increase your accuracy, reduce risks, and boost your trading profits!

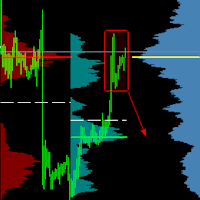

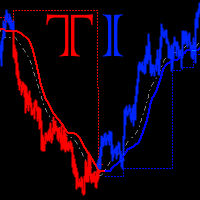

The key feature of Trend Risk Analyzer is its capability to calculate the average range of each market element, enabling traders to set justified stop-loss and take-profit levels. Additionally, it dynamically adjusts trading volume based on current volatility, significantly enhancing your risk management efficiency.

Benefits:

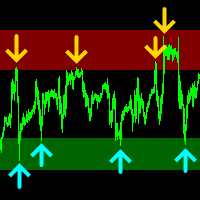

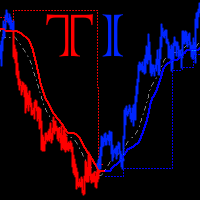

- Automatically identifies trends (gold lines), impulses (aqua lines), and corrections (magenta lines)

- Calculates average range values for each type of market movement

- Adjusts optimal trade volumes dynamically based on real-time market volatility

- Provides clear visual guidance for setting effective stop-loss and take-profit levels

Use cases:

- Open positions with volumes precisely adjusted to current market risk

- Set logical take-profit and stop-loss levels backed by statistical market analysis

- Enhance risk management capabilities for both beginners and seasoned traders

Perfectly suitable for all traders seeking consistent trading results!

Input Parameters:

| === RATES HISTORY CALCULATIONS === | Settings for historical bar calculations. |

| Calculate History From Bar Shift | Bar shift number from the current bar, from which historical calculations start. |

| Calculate History From Bar DateTime | Date and time of the bar from which historical calculations begin. |