Bit Buddy AI

- 专家

- Michael Prescott Burney

- 版本: 1.97

- 激活: 20

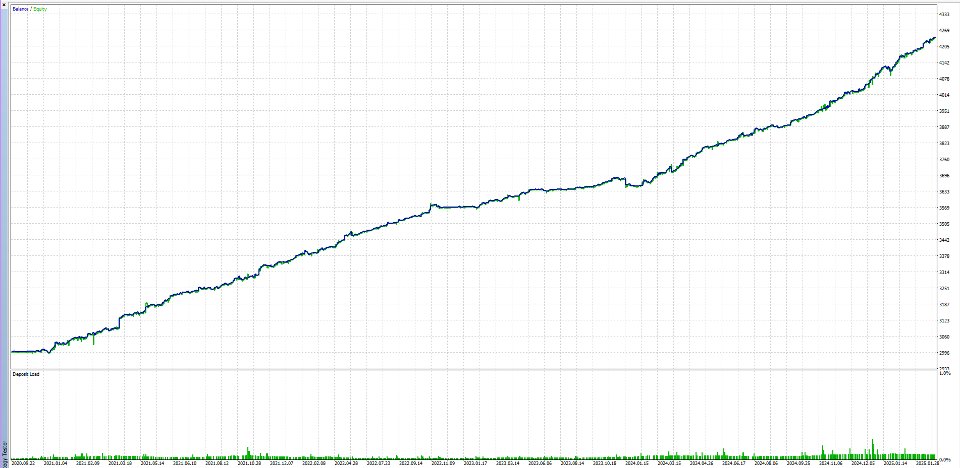

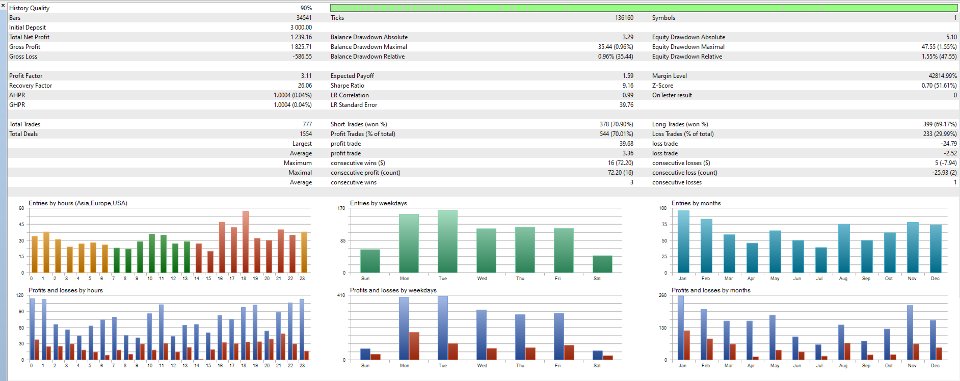

Bit Buddy AI is an expert advisor (EA) designed for trading BTCUSD on the H1 timeframe, utilizing high-frequency trading strategies and intelligent trade execution. It supports both dynamic and fixed lot sizing, incorporating trailing stops, break-even mechanisms, and take-profit strategies for structured risk management.

Capable of managing up to 100 open positions, Bit Buddy AI can execute both long and short trades or be configured for sell-only strategies. Built-in protection features include a maximum spread filter, equity safeguards, daily loss limits, ATR-based stop-loss placement, and time-based exits for trade management. Profit-locking mechanisms help manage risk and optimize trade closures.

Optimized for market engagement between 15:00 and 23:00 UTC, Bit Buddy AI is designed for automated BTCUSD trading, providing traders with structured execution and risk control tools.