KT Dynamic Price Oscillator MT4

- 指标

- KEENBASE SOFTWARE SOLUTIONS

- 版本: 1.0

- 激活: 10

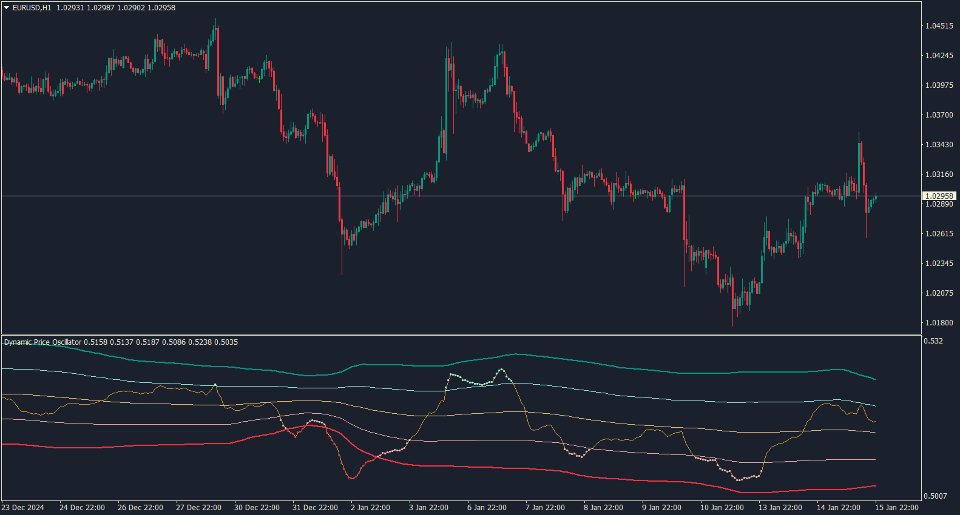

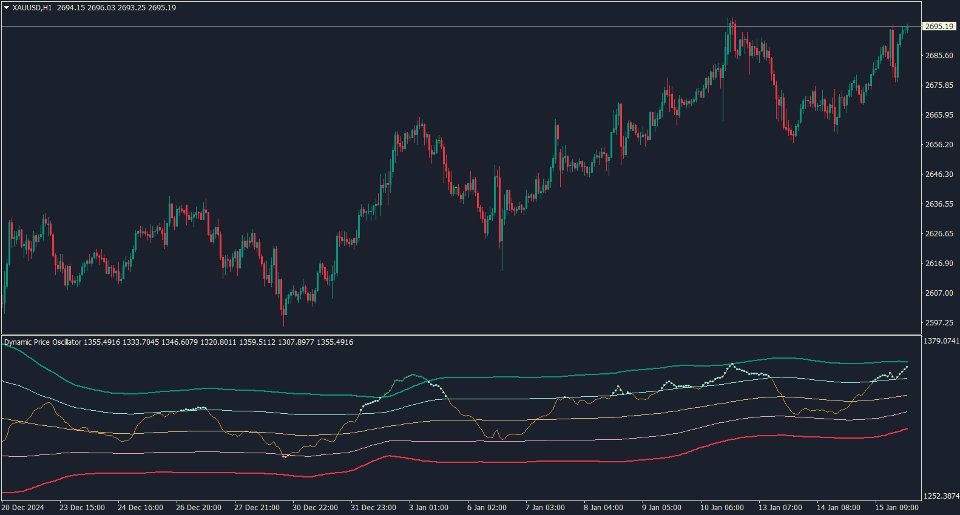

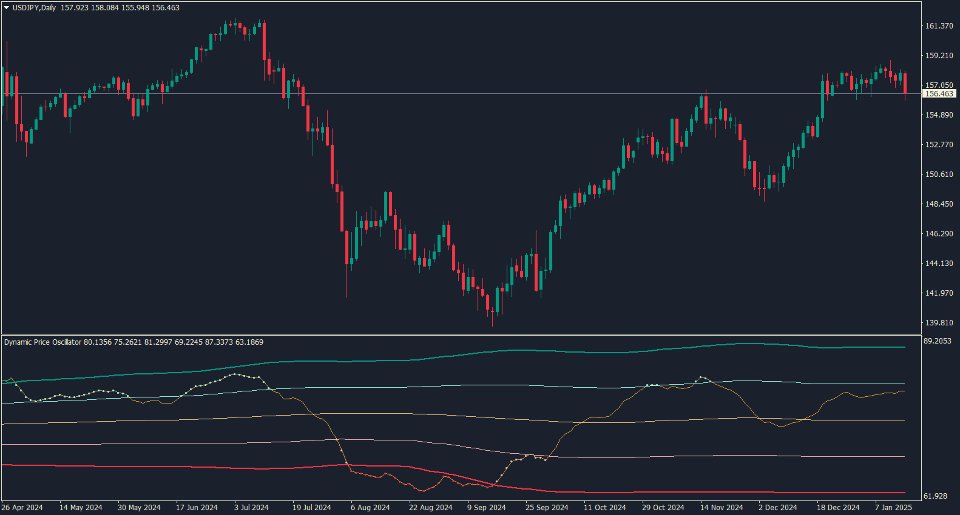

The KT Dynamic Price Oscillator (DPO) offers a specialized approach to analyzing the trend, momentum, and volatility of financial instruments. It excels at identifying trend continuations, overbought or oversold conditions, and potential reversal points with precision.

It is specifically designed to assist traders in identifying short-term price cycles and potential reversals by effectively filtering out long-term trends.

How to use the DPO

- Trend Confirmation: The DPO acts as a reliable confirmation tool for existing trends. Traders can use it to verify bullish or bearish trends by observing whether the oscillator stays above or below its mean line.

- Overbought and Oversold Detection: By applying Bollinger Bands directly to the oscillator, the DPO uniquely identifies overbought and oversold conditions.

- Volatility Insights and Breakout Signals: A sudden expansion in the bands often signals a breakout from consolidation, providing traders with opportunities to enter trades in the breakout's direction.

- Momentum Detection: Momentum traders can leverage the DPO to identify when market momentum is accelerating.

- Ideal for Mean Reversion Strategies: When the oscillator touches or crosses the Bollinger Bands, it highlights a deviation from the typical price range.

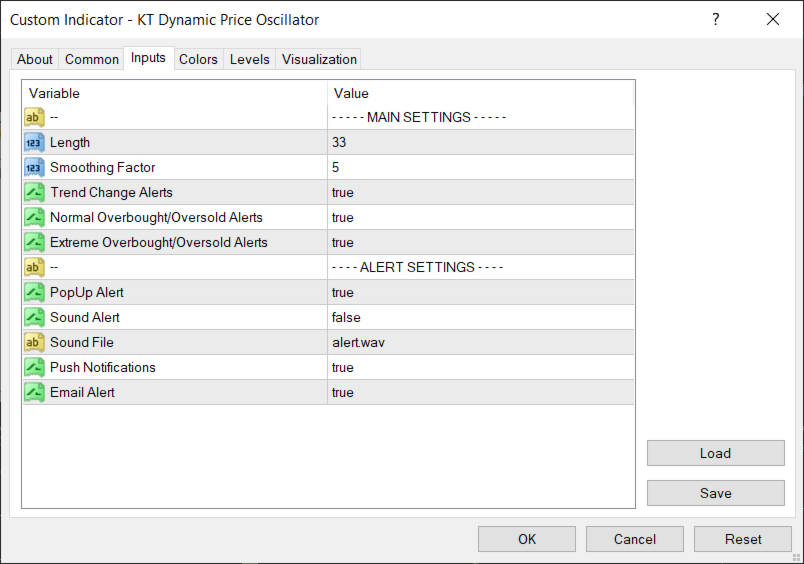

Inputs

- Length: The Length parameter defines the lookback period for the oscillator and Bollinger Bands, balancing sensitivity and signal frequency.

- Smoothing Factor: The Smoothing Factor adjusts the level of noise reduction in the oscillator. Higher smoothing provides clearer trend identification at the expense of signal timeliness, whereas lower smoothing increases responsiveness, making it ideal for short-term trading but with a greater risk of false signals.

Conclusion

It provides a unique perspective on market cycles by filtering out long-term trends. Its cross-platform compatibility, extensive customization options, and focus on identifying price cycles make it a versatile tool for traders of all experience levels.

However, it is best used in conjunction with other indicators, particularly in volatile market conditions, to ensure well-rounded analysis and decision-making.