RSI with Bollinger Bands

- 指标

- Aristeidis Gitas

- 版本: 1.1

- 更新: 18 二月 2025

- 激活: 15

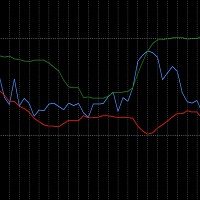

The RSI_BBands is a custom indicator designed to combine the Relative Strength Index (RSI) and Bollinger Bands (BB) for enhanced market analysis. It calculates the RSI using a specified period (default 14) and overlays Bollinger Bands around the RSI values, with adjustable parameters for the Bollinger Bands period and deviation.

Check more HERE

Key Features:

- RSI Calculation: The RSI is calculated based on price changes, with higher values indicating overbought conditions and lower values indicating oversold conditions.

- Bollinger Bands: The Bollinger Bands consist of three lines:

- Upper Band: Set to the mean RSI value plus the deviation multiplied by the standard deviation.

- Lower Band: Set to the mean RSI value minus the deviation multiplied by the standard deviation.

- Indicator Visualization: The indicator is drawn in a separate window, with the following visual elements:

- RSI Line (DodgerBlue): Represents the RSI values.

- Upper Band (Green): The upper boundary of the Bollinger Bands.

- Lower Band (Red): The lower boundary of the Bollinger Bands.

- Middle Band (Orange): The central line of the Bollinger Bands.

Parameters:

- RSI Period ( InpPeriodRSI ): Defines the period for calculating the RSI.

- Bollinger Bands Period ( BB_Period ): Specifies the period for the Bollinger Bands.

- Bollinger Bands Deviation ( BB_Deviation ): Determines the distance of the upper and lower Bollinger Bands from the mean RSI value.

Use Case:

This indicator is useful for traders who wish to analyze the RSI in relation to volatility and overbought/oversold conditions, with the added perspective of Bollinger Bands. It can provide signals based on price movements in relation to the RSI’s upper and lower boundaries, aiding in decision-making for market entries and exits.