CandleMaster Pro

- 专家

- Ilia Stavrov

- 版本: 2.63

- 更新: 4 三月 2025

- 激活: 11

CandleMaster PRO

Professional Next-Generation Trading Expert Advisor

CandleMaster Pro is a unique solution in the field of automated trading. Using advanced neural network technologies, the advisor identifies Japanese candlestick patterns with high accuracy and combines market entry control with integrated technical indicators. This trading expert advisor embodies years of successful trading experience transformed into a precise mathematical algorithm.

One of the key advantages of this expert advisor is trading in the direction of the expected market movement. In cases where the entry was untimely, the advisor builds a grid of Limit orders, with the ability to fine-tune for any timeframe and trading pair.

Key advantages:

1. Comprehensive Market Analysis

- Deep analysis of candlestick patterns considering their structure and relationships

- Integration of technical indicators for signal confirmation

- Multi-level false signal filtration system

- Adaptive approach to market condition analysis

2. Professional Risk Management System

- Intelligent order grid construction with dynamic step

- Progressive position volume increase with adjustable multiplier

- Common Take Profit for the entire grid with automatic adjustment

- Control of maximum drawdown in deposit currency

- Automatic closure of all positions when specified conditions are met

3. Unique Pattern Recognition System

- Precise identification of 10 classic candlestick patterns

- Flexible pattern parameter settings

- Consideration of candle body sizes and shadows

- Analysis of relative candle positions

- Trend verification before pattern formation

4. Intelligent Signal Filtration

- Use of stochastic oscillator for entry point confirmation

- Application of moving average for trend determination

- Combined analysis of multiple technical indicators

- Market volatility consideration in decision making

Expert Advisor Operation Features:

1. Market Entry Algorithm

- Candlestick pattern identification according to set parameters

- Verification of confirming signals from technical indicators

- Market condition analysis (spreas, volatility)

- Calculation of optimal entry points taking into account the minimum distance, with the ability to adjust the entry point offset

- Market entry via Buy/Sell Stop order in the direction of expected market movement

- Activation of Limit order grid if price moves against trader's position

2. Position Management

- Dynamic order grid construction after first stop order activation

- Automatic volume calculation for each grid level

- Constant monitoring of overall grid status

- Timely adjustment of Take Profit and Stop Loss

- Virtual break-even setting function

- Possibility of dynamic parameter changes for grid management during active trading cycle

3. Security System

- Free margin control before opening each position

- Verification of sufficient funds for entire grid construction

- Maximum drawdown limitation

- Protection against connection failures and technical issues

Optimal Operating Conditions:

- Recommended timeframes: M15 to D1

- Major currency pairs

- Minimum recommended deposit: from 200 base currency units

- Optimal operating time: main trading sessions

Usage Benefits:

- Fully automated trading

- No need for constant market monitoring

- Flexible adjustment to any trading style

- Professional risk management

- Detailed documentation and operation logging

Unique Technical Solutions:

- Optimized code for fast operation execution

- Minimal CPU load

- Resilience to network delays

- Automatic recovery after failures

- Protection against random price fluctuations

CandleMaster Pro v2.56 is the result of years of work and testing various trading strategies. The advisor combines the reliability of classic technical analysis with modern algorithmic trading methods. Thanks to its wide range of settings, it can be adapted to any trading style and market conditions.

Special attention is paid to trading safety: all operations undergo multi-stage verification before execution, and the built-in risk management system protects against excessive losses. The advisor is perfect for both beginning traders wanting to automate their trading and professionals seeking to optimize their trading operations.

Configurable Parameters of CandleMaster Pro v2.56:

1. Basic Trading Parameters:

- SetName - Set name. Allows specifying the set name for easier operation.

- TradeBuy = (true) - Allow buy trading

- TradeSell = (true) - Allow sell trading

Note: if trading in either direction is prohibited during active trading, the advisor will normally complete the trading cycle, then apply the changes. If both parameters are disabled, the advisor doesn't trade until next enable. Can be used as a "soft" trading prohibition without removing the advisor from the chart.

- MaxSpread – The maximum spread is set in old points. It is taken into account only when trying to open the first order of the cycle.

- MaxPriceAdjustment – Maximum price adjustment (0 – disabled). If an adjustment is required due to high volatility, the entry price can be adjusted within the specified values.

- ForceCloseEnabled = false – Force trading cycle completion. If enabled, immediately completes trading cycle: removes all active orders at current price, removes all Limit orders.

- LotSize (0.01) - Base trading volume

- Timeframe (PERIOD_H4) - Analysis timeframe selection

- MagicNumber (123456) - Magic number for order identification

- TradeComment ("CandleTrade") - Trade comment

Trade comment includes order sequence number, where first Buy/Sell Stop order is counted as zero. First grid order is considered the first Limit order.

- MaxCandleLife (3) - Pending orders lifetime in candles

2. Grid Order Parameters:

- GridOrderCount (3) - Number of limit orders in grid

- GridMultiplier (1.5) - Volume multiplier for limit orders

- StartMultiplierFromOrder (2) - From which grid order to apply multiplier (1 - immediately)

First grid order is considered the first Limit order.

- MaxLotMultiplier (0) - Maximum volume multiplier (0 - no limits)

How many times the base lot volume can be increased for the next grid order. Example: Base volume = 0.01, maximum multiplier = 13, then maximum volume with which advisor will set limit order = 0.01*13 = 0.13 lot. Upon reaching this limit, all subsequent limit orders will be set with 0.13 lot volume.

- GridStep (5.0) - Grid step in old points

- GridTP (0.0) - Grid take-profit in old points

If "0" - advisor closes orders at breakeven. Take-profit values can be changed during active trading cycle, also can set GridTP = 0 during active trading cycle if need to close all orders at weighted average entry price and exit market as soon as possible.

- GridSL (0.0) - Grid stop-loss in old points

Stop-loss is always set from last possible order in grid, i.e., last order price according to GridOrderCount + specified stop-loss value. If "0" - no stop-loss

- MaxLossInCurrency (0.0) - Maximum drawdown in deposit currency (0 - disabled)

When drawdown reaches MaxLossInCurrency value, advisor completes trading cycle, removes all active and limit orders.

- StopAfterMaxLoss = false – Stop trading advisor after reaching MaxLossInCurrency. Advisor doesn't trade until restart.

- VirtualBEPercent = 0 – Virtual breakeven activation after price passes specified percentage of distance to TP (0 – disabled)

Author's note: constant use of virtual breakeven function will likely lead to reduced profits, but this function can be very useful in cases where user considers entry extremely good, for example, selling at historical highs. In such case, there might be desire to multiply take-profit, but to secure position, additionally can enable virtual breakeven. Practical example: Advisor entered at 5-year maximum for sell, you expect significant price correction downward. Your GridTP = 20, but you believe you can safely get 100 points profit. For this, change GridTP = 100, VirtualBEPercent = say 50. Then, if price passes 50% to new take-profit, virtual breakeven activates. But for cases if price from example, after activating virtual breakeven, starts rising again, and you want to earn, specify in VirtualBEPoints = for example 20 (your initial take-profit), thus, after virtual breakeven activation, you either get your standard 20 points profit, or price drops sufficiently and you get multiple times more profit.

- VirtualBEPoints = 0 – Add old points to breakeven level (0 – "pure" breakeven)

3. Pattern Parameters:

- UseBullishEngulfing (true) - Use "Bullish Engulfing" pattern

- UseBearishEngulfing (true) - Use "Bearish Engulfing" pattern

- MinBodySizeEngulfing (1.0) - Minimum body size of first candle for engulfing patterns

- UseHammer (true) - Use "Hammer" pattern

- HammerLowerShadowMultiplier (2.0) - Multiplier for hammer's lower shadow

- HammerUpperShadowMaxPercentage (25.0) - Maximum percentage of upper shadow for hammer

- UseInvertedHammer (true) - Use "Inverted Hammer" pattern

- InvertedHammerUpperShadowMultiplier (2.0) - Multiplier for inverted hammer's upper shadow

- InvertedHammerLowerShadowMaxPercentage (25.0) - Maximum percentage of lower shadow for inverted hammer

- UseDarkCloudCover (true) - Use "Dark Cloud Cover" pattern

- MinBodySizeDarkCloud (1.0) - Minimum body size of first candle for "Dark Cloud Cover"

- UsePiercingPattern (true) - Use "Piercing Pattern"

- MinBodySizePiercing (1.0) - Minimum body size of first candle for "Piercing Pattern"

- UseMorningStar (true) - Use "Morning Star" pattern

- UseEveningStar (true) - Use "Evening Star" pattern

- MinBodySizeStarPatterns (1.0) - Minimum body size of first candle for star patterns

- UseHaramiCross (true) - Use "Harami Cross" pattern

- MinBodyLengthPrev (0.1) - Minimum body length of previous candle

- MaxBodyLengthPrev (1.0) - Maximum body length of previous candle

- MinBodyLengthCurrent (0.0) - Minimum body length of current candle (doji)

- MaxBodyLengthCurrent (0.1) - Maximum body length of current candle (doji)

- UseHangingMan (true) - Use "Hanging Man" pattern

- HangingManLowerShadowMultiplier (2.0) - Multiplier for hanging man's lower shadow

- HangingManUpperShadowMaxPercentage (25.0) - Maximum percentage of upper shadow for hanging man

4. Stochastic Parameters:

- UseStochasticControl (true) - Enable entry control using stochastic

- KPeriod (14) - %K period

- DPeriod (3) - %D period

- Slowing (3) - Slowing

- MA_Method (MODE_SMA) - Moving average method

- BullishStochasticLevel (20.0) - Stochastic level for bullish signals

For buy signal, price must be below Stochastic level

- BearishStochasticLevel (80.0) - Stochastic level for bearish signals

For sell signal, price must be above Stochastic level

5. Moving Average Parameters:

- UseMAControl (true) - Enable entry control by moving average

- MAPeriod (14) - Moving average period

- MAApplyToPrice (PRICE_CLOSE) - Apply MA to price

- MATimeframe (PERIOD_H4) - Timeframe for MA calculation

- MACheckMode - MA check mode. Check "By candle body", check "By entire candle"

MA entry control performs check: for Bullish signals - signal candle must be below MA level, for Bearish signals - signal candle must be above MA level.

6. New Year Trading Restrictions

- DaysBeforeNewYear = 0 – Trading prohibition for specified number of days before New Year (0 – disabled). If value is greater than zero, complete trading prohibition is enabled for specified number of days. If there's active trading cycle – advisor will normally manage it until completion.

- DaysAfterNewYear = 0 – Trading prohibition after New Year for specified number of days (0-disabled).

Each parameter is carefully selected to ensure maximum flexibility in adjusting the advisor to individual trading preferences and market conditions. Values in parentheses are examples that can be changed by user depending on trading strategy.

For Hammer, InvertedHammer, HangingMan patterns – shadow multiplier and maximum shadow percentage are checked relative to candle body.

Additional Comments:

1. Limit order grid is built only after Buy/Sell Stop order activation.

2. During active trading cycle (with open orders) it's possible to change certain risk management parameters:

GridOrderCount - number of orders in grid (can increase or decrease)

GridTP - grid take-profit

GridSL - grid stop-loss

GridStep - grid step

VirtualBEPercent – virtual breakeven

VirtualBEPoints – virtual breakeven adjustment

When changing these parameters:

- When increasing GridOrderCount - new orders will be added

- When decreasing GridOrderCount - excess orders will be removed, starting from last

- When changing GridTP or GridSL - corresponding levels will update for all orders

- When changing GridStep - order prices will be recalculated and updated

- When enabling VirtualBEPercent – virtual breakeven will be set.

3. Manual closure of any active order leads to immediate trading cycle completion and removal of all existing orders.

4. Advisor works tick by tick, however, it's recommended to install advisor on chart with Timeframe set in advisor settings. It's not recommended to switch TF of window where advisor is installed, if larger or smaller tf needed – should open second chart window.

5. All values are set in old points. Through decimal point can precisely set new points, up to 5th and 3rd digit. Example: GridTP = 10 – means 10 old points or 100 new points, 10.7 = 10.7 old points or 107 new points etc.

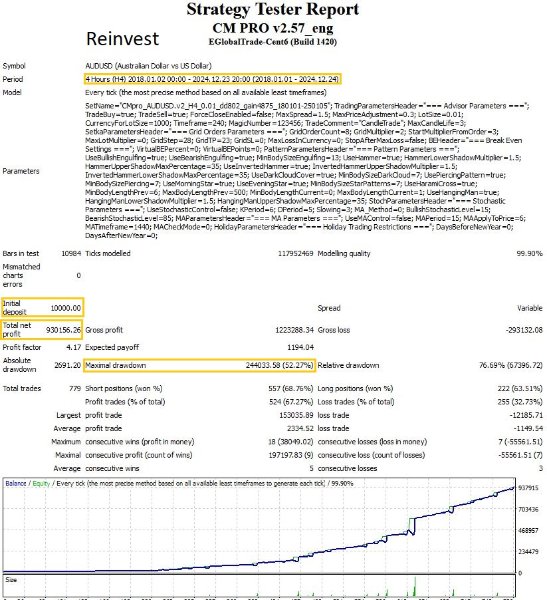

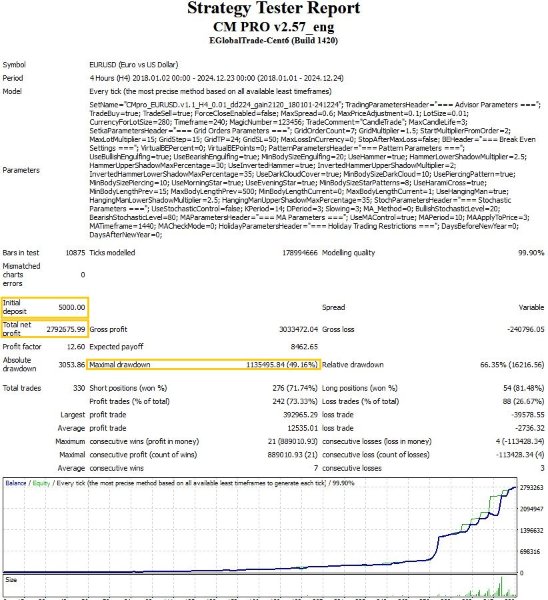

Before using CandleMaster Pro advisor, it's recommended to test it on history, on your account. Even though author conducts comprehensive testing on quotes with 99.99% modeling quality - different brokers and account types may have different trade execution, spread, and even candles.

Проверить мои достижения: .