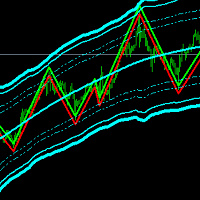

Algotrading EA

- 专家

- Ravshan Chuliev

- 版本: 1.0

- 激活: 10

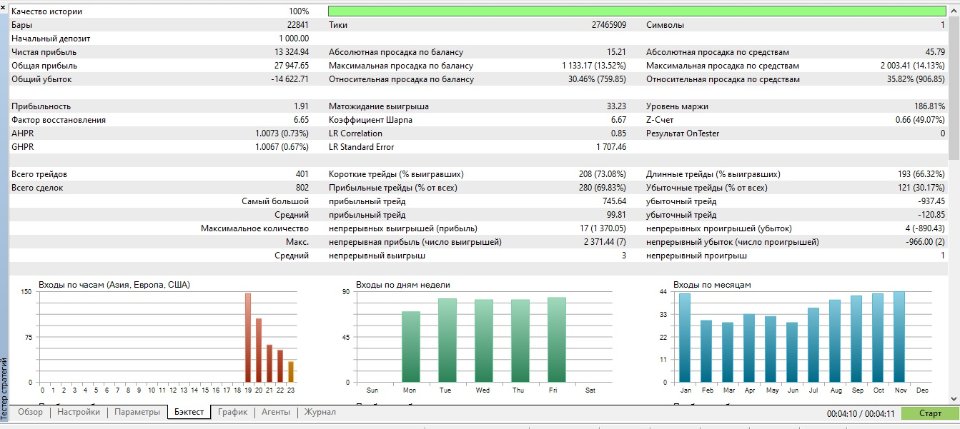

- Configurable Settings – Developed with user flexibility in mind. Allows adjusting lot size, risk parameters, and trading settings to match individual trading strategies.

- Risk Management Approach – Implements an algorithmic method to manage trading risks. Attempts to optimize lot size based on account balance, but users should understand that no risk management is foolproof.

- Spread Monitoring – Designed to track market conditions and potentially pause trading during unfavorable spread conditions. Not a guarantee of profit protection.

- Automated Position Management – Provides automated trade closure options based on predefined profit or loss thresholds. Aims to reduce emotional decision-making, but requires careful initial configuration.

- Flexible Time Settings – Enables users to define specific trading time windows, allowing potential focus on more active market periods.

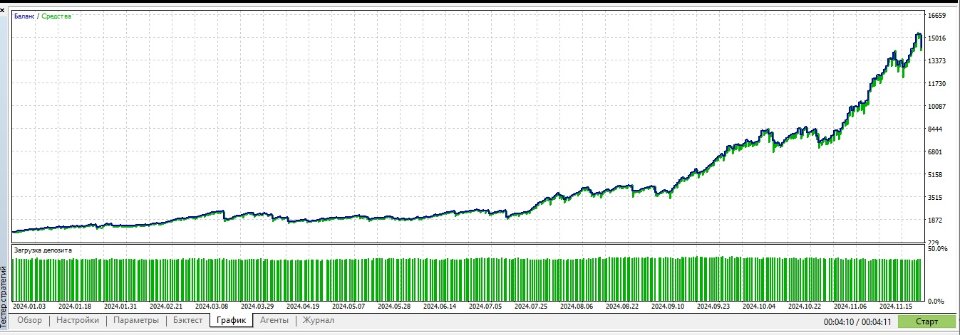

Technical Specifications:

- Supported Broker: IC Markets

- Trading Platform: MetaTrader 5 (MT5)

- Trading Instruments: Selected Forex pairs (AUDNZD, NZDCAD, GBPAUD, GBPCAD)

- Configurable Parameters:

- Lot size

- Maximum acceptable spread

- Risk percentage

- Trading time intervals

- Development Language: MQL5

Intended User Profile:

- Less Experienced Traders – Offers a structured approach to automated trading with a user-friendly interface

- Advanced Traders – Provides customization options for integrating personal trading strategies

Key Recommendations:

- Thoroughly test in a demo account

- Understand that past performance doesn't guarantee future results

- Regularly monitor and adjust settings

- Be prepared for potential trading losses