Iranger

- 实用工具

- Gennadiy Stanilevych

- 版本: 1.0

Description The indicator based on Average True Range (ATR) is designed to accurately determine the possible range of price fluctuations on a selected timeframe. This tool is ideal for both beginner traders and experienced professionals looking to effectively plan their trades.

Key Features:

-

Displays possible price fluctuation levels on the chart, simplifying visual analysis.

-

Utilizes the power of the ATR algorithm to calculate precise volatility values.

-

Adapts to any timeframe, providing relevant data regardless of the trading style.

-

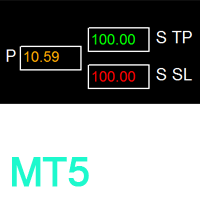

Useful for setting target profit levels (Take Profit) and stop-loss levels (Stop Loss).

-

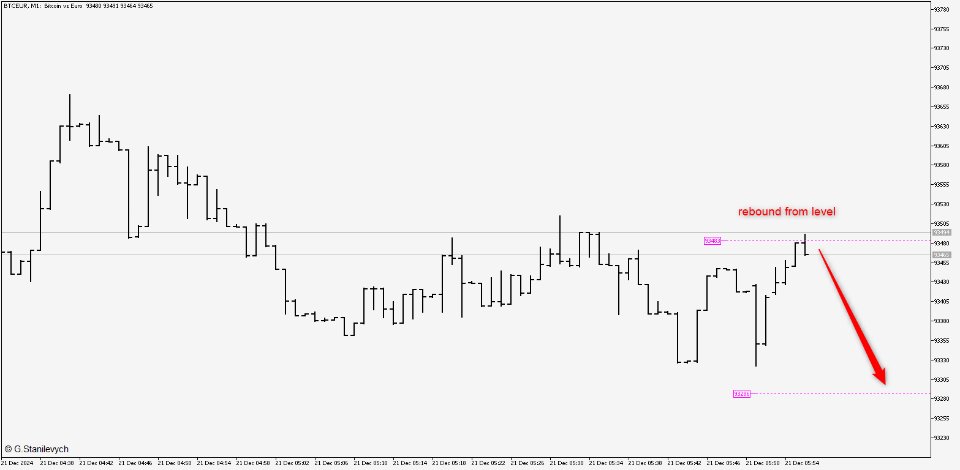

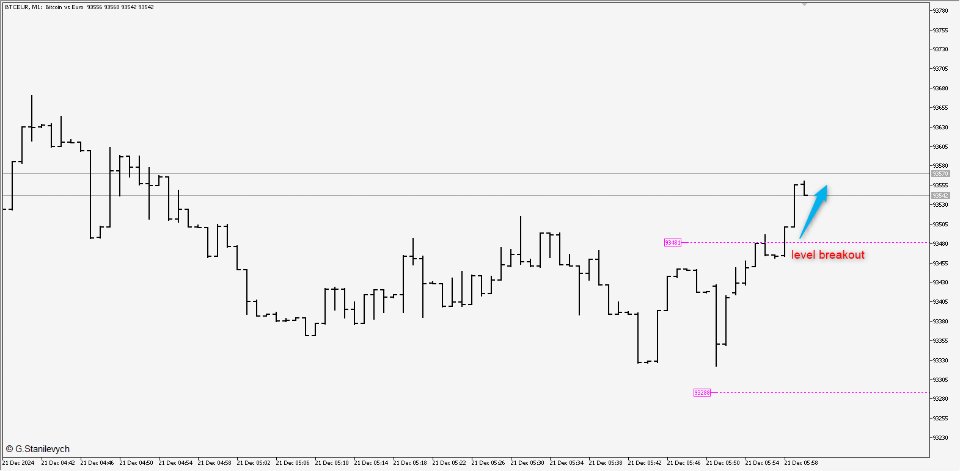

Indicates key levels that can be used for breakout or rebound trading.

Advantages:

-

Enables real-time assessment of asset volatility.

-

Reduces the risk of poor trade planning through objective data.

-

Helps adapt to current market conditions.

The indicator is suitable for intraday trading, scalping, and medium-term strategies. It will become an indispensable tool for those looking to increase their profitability through competent volatility analysis.

Settings:

ATRPeriod=100; /*ATR period*/

clrBuy=clrMagenta; /*Critical level for time frame*/

clrSel=clrMagenta; /*Critical level for time frame*/

LineStyle=STYLE_DOT;

LineWidth=1;

bMail=true;

bAlert=false;

bPush=true;

Usage Recommendations:

-

Apply the indicator to the chart of the desired asset.

-

Configure ATR parameters for optimal level display.

-

Use the indicated levels for trading:

-

On a breakout, when the price confidently moves beyond the range.

-

On a rebound, when the price shows a reversal from the boundary of the range.

-

The indicator helps identify key entry and exit points, simplifying trading decisions and risk management.