CCI Multi Currency EA MT5

- 专家

- Biswarup Banerjee

- 版本: 5.0

- 更新: 24 十二月 2024

- 激活: 20

CCI Multi-Currency EA MT5

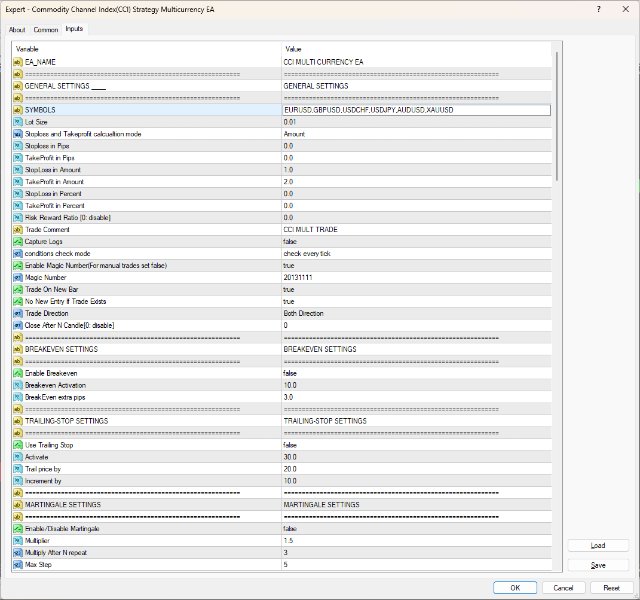

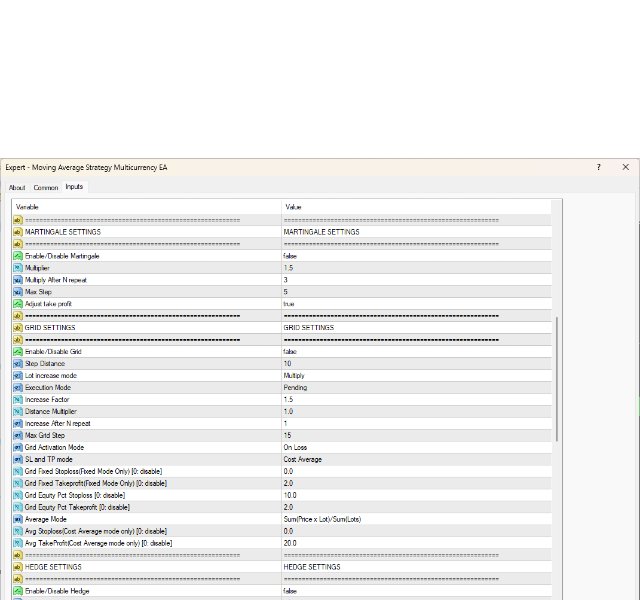

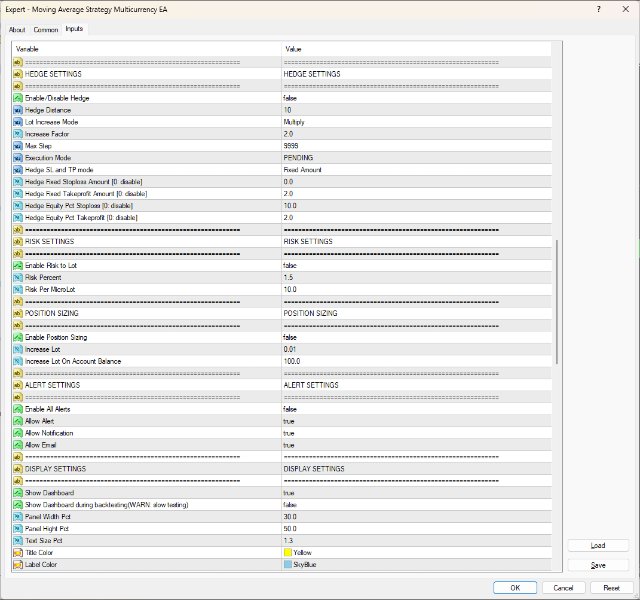

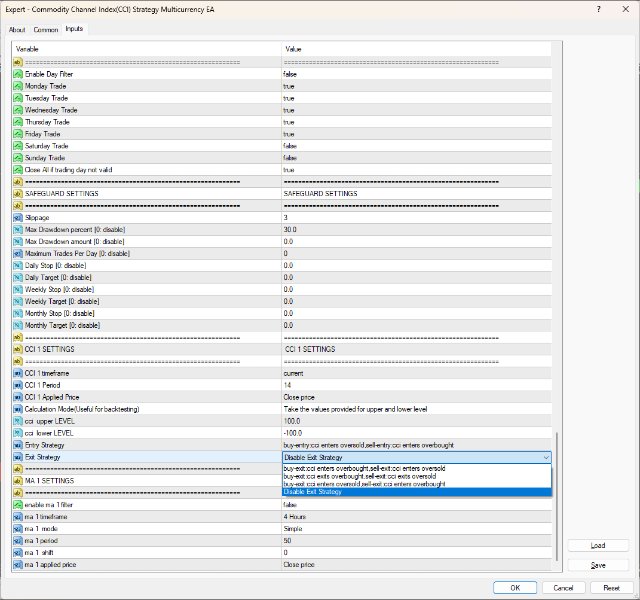

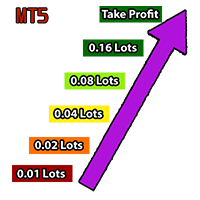

trades across multiple pairs based on the Commodity Channel Index (CCI) strategy. It features advanced trade management tools like grid recovery, hedging, and martingale strategies, along with group stop-loss and take-profit capabilities for portfolio-level control.

For detailed documentation General Settings/Input Guide | Indicator Settings, Backtest and Set files

You can download the MT4 version here

Key Features:

Implements a robust, backtested trading strategy.

Supports multiple timeframes and multi-currency trading.

Allows for customizable parameters like lot sizes, indicators, and entry/exit criteria.

Offers clear Stop-Loss and Take-Profit settings.

Includes trailing stops to secure profits.

Uses position sizing to manage overall risk.

Has drawdown protection and spread/slippage filters.

Provides multiple entry methods (breakouts, reversals, trend-following).

Offers flexible exit rules (indicator-based, time-based, or profit-based).

Executes trades quickly with minimal delay.

Uses efficient, non-lagging indicators.

Consumes low system resources.

Delivers on-screen pop-ups and audio alerts.

Sends email or push notifications.

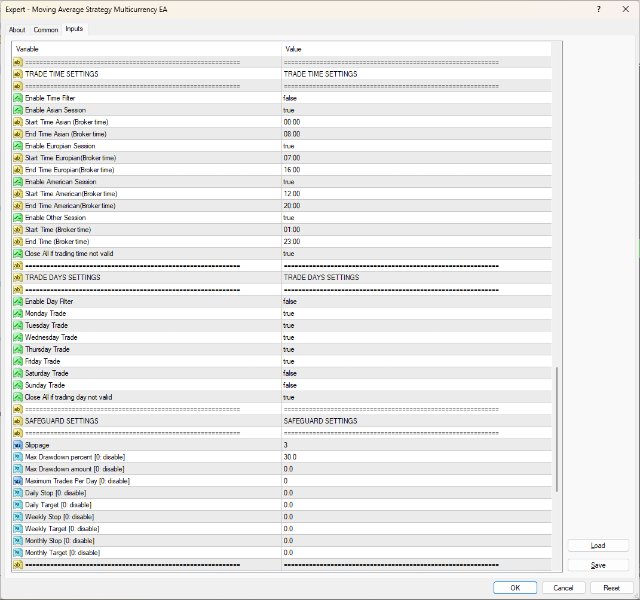

Adjustable input parameters and filters (time of day, sessions, day-of-week).

Modifiable indicator thresholds and conditions.

Adapts to various market conditions.

Supports historical data testing for performance validation.

Allows parameter optimization to find the best settings.

Displays a real-time dashboard of open trades, account equity, and system metrics.

Presents intuitive and well-organized input menus.

Offers clear documentation and user guides.

Incorporates slippage and spread controls.

Implements error-handling and logging.

Provides daily, weekly, and monthly trade summaries.

Tracks metrics like maximum drawdown, win rate, and profit factor.

Works seamlessly on MT4/MT5 platforms.

Receives regular updates and improvements.

Maintains reliable performance and stable operations over time.

Usage Recommendations:

Prior to deploying in live markets, thorough testing in a demo account is strongly advised. This ensures a comprehensive evaluation of the EA's performance, its alignment with your trading strategy, and an assessment of risk tolerance levels.

If you want to try the free trial version for 7 days, feel free to reach out to me via the profile section.