EuroBlade

- 专家

- Yuto Tokuhara

- 版本: 0.3

- 更新: 2 十一月 2024

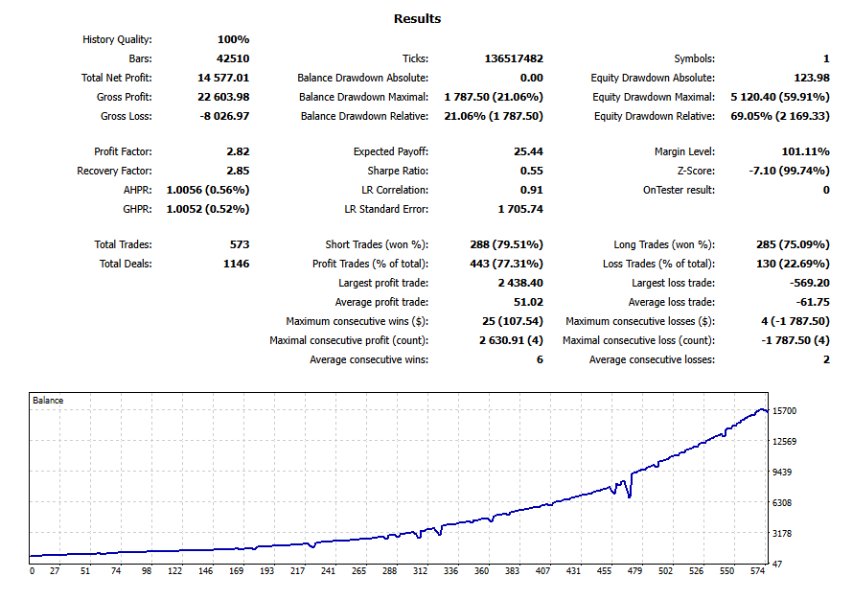

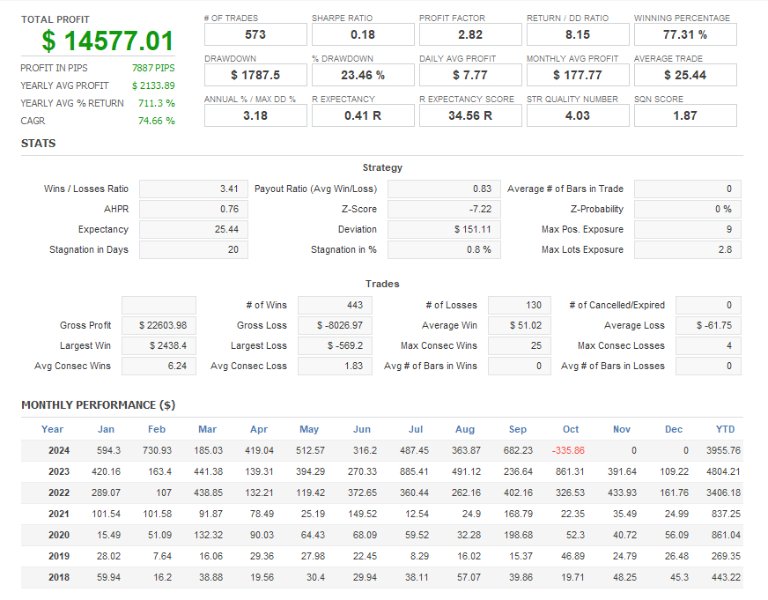

The martingale method is a risky trading technique, but EuroBlade hedges the risk by holding both the sell and buy positions at the same time.

In addition, because of the long-term leg of the trade, the trend can be caught and profits can be earned consistently.

This Expert Advisor allows for compound interest, and the back test is the result of compounding.

Since I utilize the martingale method, news events and fund management must be done by the customer.

The recommended method of operation is to withdraw the initial margin once the funds have doubled.

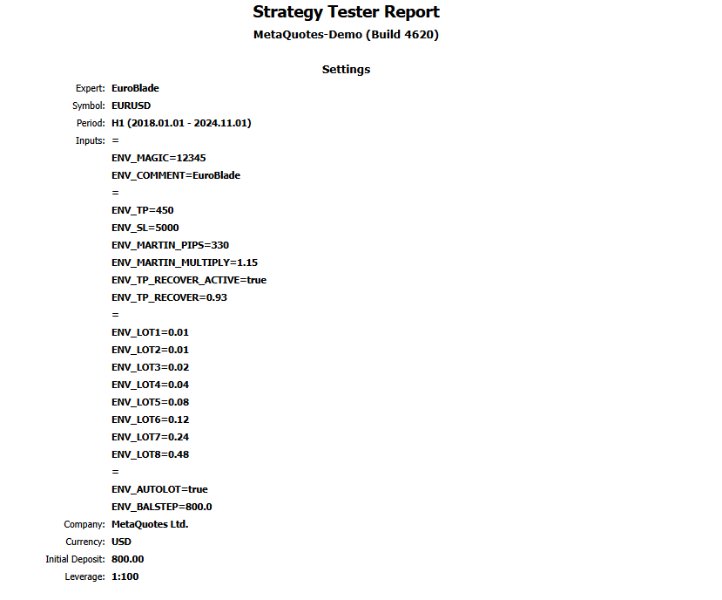

EuroBlade are tuned by default, but if you wish to further refine your settings, you can do so by setting the following items.

Take Profit Points

You can set the number of points until position to tp.

While holding multiple positions, the profit will be set at the number of points from the average price.

While a larger number can be expected to increase profits, it can also be a risk when you have multiple positions.

Stop Loss Points

The number of points to loss.

Basically, you do not need to touch it, but you can set the number of points to stop loss.

The stop loss line is fixed regardless of the number of positions held.

Martingale Points

This is the number of points at which the martingale begins.

For example, in the case of 200points, a second position will be held if it reverses 20 pips from the initial position.

The wider you spread the position, the more risk you hedge, but this can cause a decrease in the time to gain, the amount of gain, and the number of transactions.

Martingale Points Multiply

It is a constant that multiplies the number of martingale points by the number of positions held.

For example, if the martingale point is 100 points at 1.2, the second position is 120 points from the first position, and the third position is 140 points.

Setting the value to 1.0 allows you to martingale at equal intervals, but is not recommended due to the high risk involved.

TP Recovery Mode

This setting enables or disables the TakeProfit narrowing mechanism based on the number of positions.

TP Recovery Multiply

A constant that narrows the TakeProfit range based on the number of positions.

Narrows the width of TakeProfit according to the number of positions, in the form of a power.

For example, if the TakeProfit is set to 0.5, the TakeProfit will be reduced by half for each additional position.

By reducing this setting, the risk is reduced, but so is the profit.

Lot Settings

The setting of the lot to be held in martingale.

The default setting is recommended, but can be changed.

Auto Lot Adjust

The setting is to automatically calculate the lot size according to the margin or not.

Adjust Balance Step

This is the setting for how much margin each lot is to be raised.

Initially, the minimum margin is $800, but by increasing the setting, you can reduce the risk of margin increases.

Conversely, decreasing the setting will result in a riskier operation.

For example, if the setting is $800, the lot will be doubled when it reaches $1,600.

If you have any questions, please message me.

Also, if you have any other requests for something like this, please contact us and we will create it.

Sorry if my English is difficult to understand since I live in Japan.