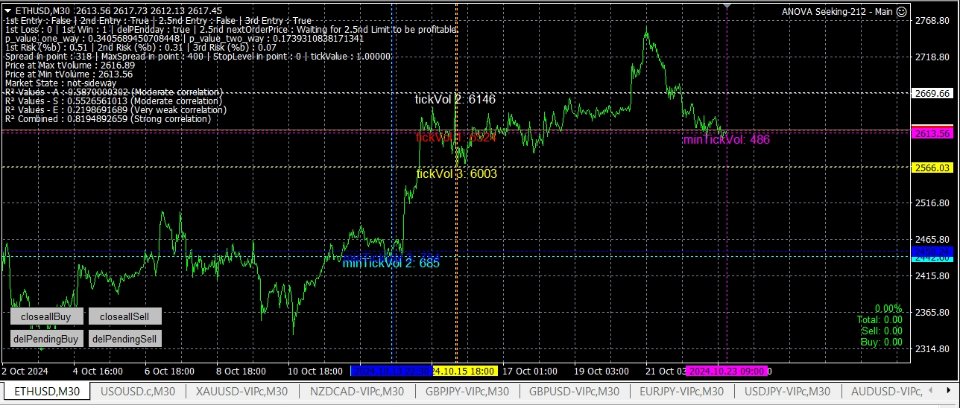

ANOVA Seeking

- 专家

- Mano Boonsok

- 版本: 1.1

- 更新: 25 十月 2024

- 激活: 5

**Multi-Strategy EA with Advanced Statistical Analysis (ANOVA & R-squared)**

**Core Statistical Framework:**

1. **ANOVA Analysis:**

- One-way ANOVA: For trend direction significance

- Two-way ANOVA: For market variable interactions

- P-value thresholds < 0.15 for trade validation

2. **R-squared Analysis:**

- ATR R² (Strong correlation ≥ 0.75)

- Standard Deviation R² (Moderate: 0.50-0.74)

- EMA R² (Weak: 0.25-0.49)

- Combined R² for overall market state

- Determines sideways vs trending markets

**Trading Strategies:**

**Strategy 1 (Magic: 124577)**

- Primary: ATR H4 with ANOVA validation

- Entry: Simultaneous Buy/Sell Stop orders

- Confirmation: P-value < 0.15 and R² analysis

- Risk: 0.51% per trade

- RRR: 1:1.95

- Advanced SL/TP using ATR

**Strategy 2 (Magic: 124578)**

- Primary: Volume Profile with R² confirmation

- Entry: Buy/Sell Limit orders

- Martingale on profit targets

- Risk: 0.31% per trade

- RRR: 1:2.44

- Max 6 orders limit

**Strategy 3 (Magic: 124579)**

- ATR H4 Martingale with statistical validation

- Counter-trend entries

- Risk: 0.07% per trade

- RRR: 1:3.33

- Max 5 Martingale orders

**Market State Analysis:**

1. **Sideways Market Detection:**

- R² < 0.6 for ATR/SD/EMA

- Combined R² < 0.25

- P-value significance testing

2. **Trend Confirmation:**

- Strong R² correlations (≥ 0.75)

- ANOVA significance levels

- Volume profile support

**Additional Features:**

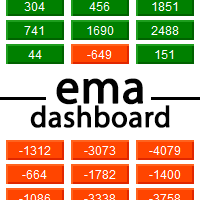

- Real-time statistical calculations

- Auto Break-Even system

- Order management controls

- Trading pause (03:00-07:00 Bangkok)

- P&L real-time display

**Risk Management Integration:**

- Strategy-specific risk allocation

- Statistical validation for entries

- Multi-layer protection system

- Advanced position sizing

This EA combines robust statistical analysis (ANOVA & R-squared) with practical trading strategies, offering a comprehensive approach to market analysis and trade execution.